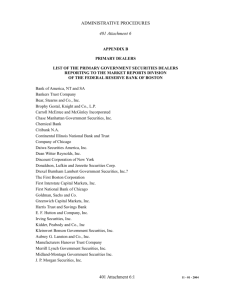

Fedwire Securities Service PFMI Disclosure

advertisement