Social Protection in the Philippines: Current State and Challenges

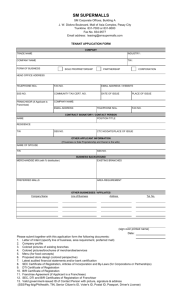

advertisement