Computer Accounting Technology

advertisement

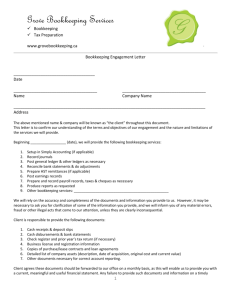

Computer Accounting Technology - A.A.S. Career Development The associates degree allows students to begin pursuing many different career pathways and specific occupations for their career development. Some career pathways and career occupations may require additional education, coursework, training, testing, certification, or licensure beyond the associates degree. Before making any career decisions, students should thoroughly research the employment requirements for the career pathways and specific career occupations. Career Pathways Examples of related career pathways may include: What Can I Do With This Major? (Accounting) Architecture and Engineering Occupations Career Cluster/Group Business and Financial Occupations Career Cluster/Group Career Occupations Examples of related career occupations that may require a high school degree, workforce development training, and/or certificate include: Customer Service Representatives Secretaries and Administrative Assistants Tellers Examples of related career occupations that may require an associates degree include: Bill and Account Collectors Bookkeeping, Accounting, and Auditing Clerks Insurance Underwriters Loan Officers Personal Financial Advisors Purchasing Managers, Buyers, and Agents Sales Managers Examples of related career occupations that may require a bachelors, masters, and/or doctorate degree include: Accountants and Auditors Actuaries Budget Analysts Financial Analysts Financial Managers Tax Examiners, Collectors, and Revenue Agents Transfer Transferring after graduation to a bachelor degree program may be possible by working early with a student success specialist (academic advisor) and the transfer college/university. Additionally, the University of the District of Columbia offers many opportunities for transferring to bachelor degree programs. Additionally, other colleges, universities, and training institutions offer transfer opportunities for students as well. Examples of related transfer bachelors degrees include: Bachelors Degree in Accounting Bachelors Degree in Business Bachelors Degree in Business Administration Bachelors Degree in Business Management Bachelors Degree in Economics Bachelors Degree in Finance Accounting Clerks and Technicians U.S. Bureau of Labor Statistics Bookkeeping, Accounting, and Auditing Clerks Summary Bookkeeping, accounting, and auditing clerks record financial transactions, update statements, and check them for accuracy. Quick Facts: Bookkeeping, Accounting, and Auditing Clerks 2010 Median Pay $34,030 per year $16.36 per hour Quick Facts: Bookkeeping, Accounting, and Auditing Clerks Entry-Level Education Work Experience in a Related Occupation On-the-job Training High school diploma or equivalent None Moderate-term on-the-job training Number of Jobs, 2010 1,898,300 Job Outlook, 2010-20 14% (About as fast as average) Employment Change, 2010-20 259,000 What Bookkeeping, Accounting, and Auditing Clerks Do Bookkeeping, accounting, and auditing clerks produce financial records for organizations. They record financial transactions, update statements, and check financial records for accuracy. Work Environment Bookkeeping, accounting, and auditing clerks are employed in many industries, including firms that provide accounting, tax preparation, bookkeeping, and payroll services; federal, state, and local governments; and schools. About 1 of 4 bookkeeping, accounting, and auditing clerks worked part time in 2010. How to Become a Bookkeeping, Accounting, or Auditing Clerk Most bookkeeping, accounting, and auditing clerks need a high school diploma, and they usually learn some of their skills on the job. They must have basic math and computer skills, including knowledge of spreadsheets and bookkeeping software. Pay The median annual wage of bookkeeping, accounting, and auditing clerks was $34,030 in May 2010. Job Outlook Employment of bookkeeping, accounting, and auditing clerks is expected to grow 14 percent from 2010 to 2020, as fast as the average of all occupations. As the number of organizations increases and financial regulations become stricter, there will be greater demand for these workers to maintain books and provide accounting services. Similar Occupations Compare the job duties, education, job growth, and pay of bookkeeping, accounting, and auditing clerks with similar occupations. O*NET O*NET provides comprehensive information on key characteristics of workers and occupations. Contacts for More Information Learn more about bookkeeping, accounting, and auditing clerks by contacting these additional resources. What Bookkeeping, Accounting, and Auditing Clerks Do As organizations continue to computerize their financial records, many bookkeeping, accounting, and auditing clerks need to use specialized accounting software, spreadsheets, and databases. Bookkeeping, accounting, and auditing clerks produce financial records for organizations. They record financial transactions, update statements, and check financial records for accuracy. Duties Bookkeeping, accounting, and auditing clerks typically do the following: Use bookkeeping software as well as online spreadsheets and databases Enter (post) financial transactions into the appropriate computer software Receive and record cash, checks, and vouchers Put costs (debits) as well as income (credits) into the software, assigning each to an appropriate account Produce reports, such as balance sheets (costs compared to income), income statements, and totals by account Check figures, postings, and reports for accuracy Reconcile or note and report any differences they find in the records The records that bookkeeping, accounting, and auditing clerks work with include expenditures (money spent), receipts (money that comes in), accounts payable (bills to be paid), accounts receivable (invoices, or what other people owe the organization), and profit and loss (a report that shows the organization's financial health). Workers in this occupation have a wide range of tasks. Some in this occupation are full-charge bookkeeping clerks who maintain an entire organization’s books. Others are accounting clerks who handle specific tasks. These clerks use basic mathematics (adding, subtracting) throughout the day. As organizations continue to computerize their financial records, many bookkeeping, accounting, and auditing clerks use specialized accounting software, spreadsheets, and databases. Most clerks now enter information from receipts or bills into computers, and the information is then stored electronically. They must be comfortable using computers to record and calculate data. The widespread use of computers also has enabled bookkeeping, accounting, and auditing clerks to take on additional responsibilities, such as payroll, billing, purchasing (buying), and keeping track of overdue bills. Many of these functions require clerks to communicate with clients. Bookkeeping clerks, also known as bookkeepers, often are responsible for some or all of an organization’s accounts, known as the general ledger. They record all transactions and post debits (costs) and credits (income). They also produce financial statements and other reports for supervisors and managers. Bookkeepers prepare bank deposits by compiling data from cashiers, verifying receipts, and sending cash, checks, or other forms of payment to the bank. In addition, they may handle payroll, make purchases, prepare invoices, and keep track of overdue accounts. Accounting clerks typically work for larger companies and have more specialized tasks. Their titles, such as accounts payable clerk or accounts receivable clerk, often reflect the type of accounting they do. Often, their responsibilities vary by level of experience. Entry-level accounting clerks may enter (post) details of transactions (including date, type, and amount), add up accounts, and determine interest charges. They also may monitor loans and accounts to ensure that payments are up to date. More advanced accounting clerks may add up and balance billing vouchers, ensure that account data is complete and accurate, and code documents according to an organization’s procedures. Auditing clerks check figures, postings, and documents to ensure that they are mathematically accurate and properly coded. They also correct or note errors for accountants or other workers to fix. Work Environment Bookkeeping, accounting, and auditing clerks may work longer hours to meet deadlines at the end of the fiscal year, during tax time, or when monthly or yearly accounting audits are performed. Bookkeeping, accounting, and auditing clerks held about 1.9 million jobs in 2010. They following industries employed the most bookkeeping, accounting, and auditing clerks in 2010: Professional, scientific, and technical services 11% Retail trade 9 Finance and insurance 7 Wholesale trade 7 Health care and social assistance 7 Bookkeeping, accounting, and auditing clerks work in offices. Work Schedules Many bookkeeping, accounting, and auditing clerks work full time. About 1 of 4 clerks worked part time in 2010. They may work longer hours to meet deadlines at the end of the fiscal year, during tax time, or when monthly or yearly accounting audits are done. Those who work in hotels, restaurants, and stores may put in overtime during peak holiday and vacation seasons. How to Become a Bookkeeping, Accounting, or Auditing Clerk Most bookkeeping, accounting, and auditing clerks are required to have a high school diploma. Most bookkeeping, accounting, and auditing clerks need a high school diploma, and they usually learn some of their skills on the job. They must have basic math and computer skills, including knowledge of spreadsheets and bookkeeping software. Education Most bookkeeping, accounting, and auditing clerks need a high school diploma. However, some employers prefer candidates who have some postsecondary education, particularly coursework in accounting. In 2009, 25 percent of these workers had an associate’s or higher degree. Training Bookkeeping, accounting, and auditing clerks usually get on-the-job training. Under the guidance of a supervisor or another experienced employee, new clerks learn how to do their tasks, including double-entry bookkeeping. (Double-entry bookkeeping means that each transaction is entered twice, once as a debit (cost) and once as a credit (income) to ensure that all accounts are balanced.) Some formal classroom training also may be necessary, such as training in specialized computer software. This on-the-job training typically takes around 6 months. Certification Some bookkeeping, accounting, and auditing clerks become certified. The Certified Bookkeeper (CB) designation, awarded by the American Institute of Professional Bookkeepers, shows that people have the skills and knowledge needed to carry out all bookkeeping tasks, including overseeing payroll and balancing accounts, according to accepted accounting procedures. For certification, candidates must have at least 2 years of bookkeeping experience, pass a four-part exam, and adhere to a code of ethics. Several colleges and universities offer a preparatory course for certification. Some offer courses online. In addition, certified bookkeepers are required to meet a continuing education requirement every 3 years to keep their certification. The National Bookkeepers Association also offers certification. The Uniform Bookkeeper Certification Examination is an online test with 50 multiple-choice questions. Test takers must answer 80 percent of the questions correctly to pass the exam. Advancement With appropriate experience and education, some bookkeeping, accounting, and auditing clerks may become accountants or auditors. Important Qualities Detail oriented. These clerks are responsible for producing accurate financial records. They must pay attention to detail to avoid making errors and to recognize errors that others have made. Math skills. Bookkeeping, accounting, and auditing clerks should be comfortable with basic arithmetic because they deal with numbers daily. Computer skills. Bookkeeping, accounting, and auditing clerks need basic computer skills. They should be comfortable using spreadsheets and bookkeeping software. Also, these workers have control of an organization’s financial documentation, which they must use properly and keep confidential. It is vital that they keep records transparent and guard against misappropriating an organization’s funds. Pay Bookkeeping, Accounting, and Auditing Clerks Median annual wages, May 2010 Bookkeeping, Accounting, and Auditing Clerks $34,030 Total, All Occupations $33,840 Office and Administrative Support Occupations $30,710 Note: All Occupations includes all occupations in the U.S. Economy. Source: U.S. Bureau of Labor Statistics, Occupational Employment Statistics The median annual wage of bookkeeping, accounting, and auditing clerks was $34,030 in May 2010. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $21,270 and the top 10 percent earned more than $51,470. Many bookkeeping, accounting, and auditing clerks work full time. About 1 of 4 clerks worked part time in 2010. They may work longer hours to meet deadlines at the end of the fiscal year, during tax time, or when monthly or yearly accounting audits are performed. Those who work in hotels, restaurants, and stores may put in overtime during peak holiday and vacation seasons. Job Outlook Bookkeeping, Accounting, and Auditing Clerks Percent change in employment, projected 2010-20 Total, All Occupations 14% Bookkeeping, Accounting, and Auditing Clerks 14% Office and Administrative Support Occupations 10% Note: All Occupations includes all occupations in the U.S. Economy. Source: U.S. Bureau of Labor Statistics, Employment Projections program Employment of bookkeeping, accounting, and auditing clerks is expected to grow 14 percent from 2010 to 2020, as fast as the average for all occupations. Job growth for these workers is largely driven by overall economic growth. As the number of organizations increases, more bookkeepers will be needed to keep these organizations' books. In addition, in response to the recent financial crisis, investors will pay increased attention to the accuracy of corporate books. Stricter regulation in the financial sector will create demand for accounting services, creating opportunities for accounting clerks. Some tasks that these clerks do have been affected by technological changes. For example, electronic banking and bookkeeping software has reduced the need for bookkeepers and clerks to send and receive checks. However, when checks are sent or received, these workers are still needed to update statements and check for accuracy. These changes are therefore expected to help bookkeeping, accounting, and auditing clerks do their jobs, rather than reduce the need for these workers. Job Prospects Because this is a large occupation, there will be a large number of job openings from workers leaving the occupation. This means that opportunities to enter the occupation should be plentiful. Employment projections data for bookkeeping, accounting, and auditing clerks, 2010-20 Change, 2010-20 Occupational Title SOC Code Employment, 2010 Projected Employment, 2020 Percent Numeric 14 259,000 Employment by Industry SOURCE: U.S. Bureau of Labor Statistics, Employment Projections program Bookkeeping, Accounting, and Auditing Clerks 43-3031 1,898,300 2,157,400 [XLS] Similar Occupations This table shows a list of occupations with job duties that are similar to those of bookkeeping, accounting, and auditing clerks. OCCUPATION JOB DUTIES Accountants and Auditors Accountants and auditors prepare and examine financial records. They ensure that financial records are accurate and that taxes are paid properly and on time. Accountants and auditors assess financial operations and work to help ensure that organizations run efficiently. Budget Analysts Budget analysts help public and private institutions organize their finances. They prepare budget reports and monitor institutional spending. ENTRY-LEVEL EDUCATION 2010 MEDIAN PAY Bachelor’s degree $61,690 Bachelor’s degree $68,200 OCCUPATION JOB DUTIES Cost Estimators Cost estimators collect and analyze data to estimate the time, money, resources, and labor required for product manufacturing, construction projects, or services. Some specialize in a particular industry or product type. Financial Clerks Financial clerks do administrative work for banking, insurance, and other companies. They keep records, help customers, and carry out financial transactions. Loan Officers Loan officers evaluate, authorize, or recommend approval of loan applications for people and businesses. Tax Examiners and Collectors, and Revenue Agents Tax examiners and collectors, and revenue agents ensure that governments get their tax money from businesses and citizens. They review tax returns, conduct audits, identify taxes owed, and collect overdue tax payments. ENTRY-LEVEL EDUCATION 2010 MEDIAN PAY Bachelor’s degree $57,860 High school diploma or equivalent $33,710 High school diploma or equivalent $56,490 Bachelor’s degree $49,360 Contacts for More Information For more information about bookkeepers, visit American Institute of Professional Bookkeepers National Bookkeepers Association Suggested citation: Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, 2012-13 Edition, Bookkeeping, Accounting, and Auditing Clerks, on the Internet at http://www.bls.gov/ooh/office-and-administrative-support/bookkeeping-accounting-and-auditing-clerks.htm (visited October 18, 2013). Publish Date: Thursday, March 29, 2012