Class XII - KIIT World School

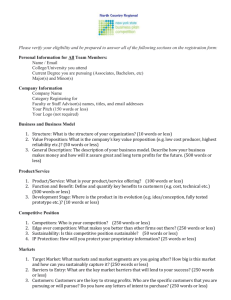

advertisement