Economic Ordering Quantities: A Practical Cost Reduction Strategy for Inventory

Management

By Todd Duell

Abstract

Pressures for Low Inventories

Inventory management is an important concern for all

managers in all types of businesses. For companies that

operate on relatively low profit margins, poor inventory

management can seriously undermine the business. But,

that’s not to say that companies with large profit margins

can’t benefit from a practical cost reduction strategy for

inventory management. The challenge isn’t to reduce

inventories to the bone, to reduce costs, or to have plenty of

stock available to satisfy all demands, but to achieve the

right balance to meet your competitive priorities. There are

several pressures for low and high inventories that have to

be balanced to achieve the “optimal” inventory management

strategy. Pressures for low inventories include, but are not

limited to: holding costs, interest or opportunity costs,

storage and handling costs, taxes, insurance, and shrinkage

costs. Pressures for high inventories include, but are not

limited to: customer service (backorders and stockouts),

ordering costs, setup costs, labor and equipment utilization,

transportation costs, and quantity discounts. One model

above all, Economic Ordering Quantity (EOQ), provides

the most practical cost reduction strategy for inventory

management.

(1) Holding Cost: is the variable cost of keeping items on hand,

including interest, storage and handling, taxes, insurance,

and shrinkage. Companies usually state an item’s holding

cost per period of time as a percentage of its value.

(2) Interest or Opportunity Cost: is the difference between the

cost to obtain a loan and the opportunity of an investment

promising an attractive return. This variable is typically the

largest component of the holding costs.

(3) Storage and Handling Cost: is the opportunity cost

associated with storage space that can be used more

productively in some other way. Since inventory takes up

space, companies usually express their storage costs in

terms of cost per square foot. Costs may include lease or

loan payments, maintenance, and utilities.

(4) Taxes, Insurance, and Shrinkage: more taxes are paid if

end-of-year inventories are high and insurance on assets

increase when there is more to insure. Shrinkage takes the

form of theft, obsolescence, or deterioration through

Todd Duell is the Vice President & CIO of Formulations Pro, Inc and has been creating powerful commercial and custom solutions using FileMaker Pro since 1989. He holds an

MBA in Technology Management and has been an Associate member of the FileMaker Solutions Alliance since 1998. Todd may be reached at tduell@formulationspro.com

© 2001 Formulations Pro, Inc. All rights reserved. www.formulationspro.com

expiration or damage. When the rate of deterioration is

high, building large inventories may be unwise.

(4)

Labor and Equipment Utilization: by creating more

inventory, management can increase the work-force

productivity and facility utilization in three ways. (1) Placing

larger, less frequent production orders reduces the setup

costs. (2) Holding excess inventory reduces the chance of

costly rescheduling of production orders because

components were not available. (3) Building inventories

improves resource stabilization when demand is cyclical or

seasonal. The company uses the excess inventory

produced during the slack periods to handle the extra

demand during the peak periods to minimize the need for

extra shifts, extra equipment, temporary workers, and

overtime.

(5)

Transportation Cost: can be reduced by having more

inventory on hand. This minimizes the number of

shipments that need to be expedited by more expensive

modes of transportation. Combining orders or ordering

larger lot sizes can also reduce the costs by providing

quantity discounts and decreasing the shipping costs. In

almost all situations, economies of scale can be used to

negotiate large discounts that provide incentives for

ordering larger quantities.

Pressures for High Inventories

(1)

(2)

(3)

Customer Service: can speed delivery and improve on

time deliveries. Having inventory available reduces the

potential for stockouts and backorders. A stockout

occurs when an item that is typically stocked is not

available to satisfy the demand when it occurs. A

backorder is a customer demand that cannot be filled

when promised. Occasionally customers will wait, but in

today’s fast paced internet enabled community, you will

most likely loose the sale to your competitor. However,

an even bigger problem will occur if this problem

persists, the company will loose their reputation and

good will.

Ordering Cost: the cost to place each order (purchase

requisition). For every item, the cost is exactly the same

regardless of the size of the order. Utilizing ecommerce can help to streamline the order process and

reduce the costs of placing orders by reducing the

number of errors, amount of paperwork, and staffing

requirements.

Setup Cost: the cost involved in changing over

equipment to produce a different product. It includes the

labor and time to make the change, cleaning, and new

tools. Setup cost is also independent of order size, so

there is a pressure to order a large supply of the

component and hold it in inventory.

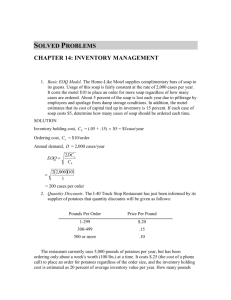

Economic Ordering Quantity Assumptions

Using the EOQ model provides the most practical cost

reduction strategy for inventory management by minimizing the

total amount of annual inventory Holding costs and Ordering

costs. This approach to determining the EOQ is based of the

following five assumptions:

Page 2

(1) The demand rate for the item is constant (i.e.

100Kg/year) and known with relative certainty.

(2) There are no constraints on the size of the lot (i.e.

material handling limitations).

inventory, which happens when an order is received. During the

cycle, the inventory is used at a constant rate. Since demand is

known with relative certainty and the lead time is constant, a

new lot of material can be ordered so that the inventory falls to 0

when a new lot is received.

(3) The only two relevant costs are the inventory holding

cost and the fixed cost per lot for ordering or setup.

(4) Decisions for one item can be made independently for

other items (i.e. there is no advantage for combining

several different orders going to the same

manufacturer).

(5) There is no uncertainty in the lead time or supply. The

lead time is known with relative certainty. The amount

received is exactly what was ordered and it arrives all at

once rather than piecemeal.

At first glance, you might think that this is a really nice

theory, but it doesn’t reflect the reality of your situation. In

fact, different lot sizing approaches may need to be

evaluated to reflect quantity discounts, uneven demand

rates, expiration dates, or interaction between items.

However, as the remainder of this white paper will show,

EOQ is often the most reasonable first approximation of

average lot sizes, even when one or more of the

assumptions don’t quite apply.

EOQ Theory

When the EOQ assumptions are satisfied inventory

behaves as shown in Figure 1. A cycle begins with Q units in

The annual Holding cost for this amount of inventory,

which increases linearly with Q, as Figure 2a shows, is

calculated as:

Annual Holding Cost = (Average cycle

inventory)(Unit holding cost)

The annual Ordering cost is calculated as:

Annual Ordering Cost or Setup Cost = (Number

of orders/year)(Ordering or setup cost)

Page 3

The average number of orders per year equals the

annual demand divided by Q. For example, if 1000 units

must be ordered each year and the average lot size is 200

units, 5 orders (1000/200 = 5) will be placed during the year.

The annual ordering or setup cost decreases non linearly as

Q increases, as shown in Figure 2b because fewer orders

are placed. The total annual cost is the sum of the two cost

components as shown in Figure 2c:

Total Cost = Annual Holding cost + Annual

Ordering or Setup cost

EOQ Reality

or

Equation 1:

Where: Q = Lot Size, in units

H = Cost of holding one unit in inventory for

one year (holding cost)

D = Annual demand in units per year

S = Cost of ordering or setting up one lot, in

dollars per lot

Figure 2c also reveals that when the holding cost

exceeds the ordering cost, we can immediately conclude

that the quantity ordered is too large. Thus, a smaller

quantity should be ordered to balance the holding cost and

ordering cost. Conversely, if the ordering cost exceeds the

holding cost, we can conclude that the quantity ordered is

not large enough. Thus, a larger quantity should be ordered

to balance the holding cost and ordering cost.

Applying calculus to the total cost formula (Equation 1),

we can derive a more practical formula for EOQ that

simultaneously minimizes the holding costs and ordering costs

as shown in Figure 2c (Best EOQ).

Equation 2:

Where: D = Annual demand in units per year

S = Cost of ordering or setting up one lot, in

dollars per lot

H = Cost of holding on unit in inventory for one

year (holding cost)

Understanding the Effects of Changes

Since the EOQ model works best when the five

assumptions are met, it’s important to understand what will

happen if changes are made to critical parameters. Let’s

Page 4

consider the effects of making changes to each of the

parameters.

(1)

Changes to the Demand Rate (D): Because D is in the

numerator, the EOQ increases in proportion to the

square root of the annual demand. Therefore, when

demand rises, the lot size should also rise, but more

slowly than the actual demand.

(2)

Changes to the Setup Cost (S): Because S is in the

numerator, increasing S increases the EOQ.

Conversely, reducing S reduces the EOQ. This

relationship explains why it is important to cut ordering

costs and setup costs. When weeks of supply decline,

inventory turns increase. When ordering costs and

setup costs become trivial, a major impediment to small

lot production is removed.

(3)

(4)

Changes to the Holding Cost (H): Because H is in the

denominator, the EOQ declines when the holding costs

increase. Conversely, when the holding costs decrease,

the EOQ increases. Thus, larger lot sizes are justified

by lower holding costs.

Errors in Estimating D, H, and S: Total cost is fairly

insensitive to errors even when estimates are off by a

large margin. The reason are that errors tend to cancel

each other out and the square root reduces the effect of

the error. Let’s look at an example of how this

relationship works:

Example 1:

D = 936 units/year

S = $45/order

H = $15/year

Now that we know the EOQ, we can calculate the total cost

from Equation 1:

Example 2: Let’s say we overestimate the holding costs from

Example 1 by 2H, which is a 100% error:

Now that we know the new EOQ, we can calculate the total

cost from Equation 1:

So although we introduced a 100% error into our holding

cost estimate, the actual increase in total cost (from $1124 to

$1590) is only 29%. This allows managers to deviate somewhat

from the EOQ to accommodate supplier contracts or storage

constraints.

Page 5

(5) Errors in Estimating EOQ with Expiration Dates: EOQ

assumes that you are consuming and producing

“widgets” without expiration dates. This becomes a

problem when the entire EOQ quantity of material will

not be consumed before the material expires. Thus,

leading to costly unused raw materials and in some

cases extra handling and disposal costs. To

compensate for expiration dates, we need to determine

if the entire EOQ quantity of material will be consumed

before the expiration date of the material. If the entire

quantity will not be used, the EOQ needs to divided by

the ratio of the number of days in the EOQ period

divided by the number of days in the expiration date of

the material (Equation 3).

Equation 3:

EOQexp = EOQ ÷ [(Demand Period ÷ EOQ

Number of Orders) ÷ (Expiration Date)]

Where: EOQ Number of Orders = Demand Amount ÷ EOQ

Example 3: Given the following information, do we need to

reduce the EOQ to compensate for the expiration date of the

material?

EOQ = 13Kg

Demand Period = 30 Days

EOQ Number of Orders = 0.1

Expiration Date of the Material = 180 Days

Start by determining the EOQ Period — how many days it

will take to use up the entire raw material if the EOQ

quantity is purchased.

30 Days ÷ 0.1 EOQ Number of Orders = 300 Days

This is more than the number of days for the expiration date

of the material. Thus, we need to adjust the EOQ based on

the expiration date of the material using Equation 3.

EOQexp = 13 ÷ [(30 ÷ 0.1) ÷ (180)] = 7.8 Kg

Thus, by taking into consideration the expiration date of

the material when calculating the EOQ, we have just saved the

company the cost of purchasing 5.2 Kg (13 Kg — 7.8 Kg = 5.2

Kg) of the raw material that won’t be consumed as well as the

additional disposal cost.

Safety Stock and Reorder Point

The EOQ answers the important question: How much do

we order? Another important question that needs to be

answered is: When should we place the order? A reorder point

(ROP) system is used to track the remaining inventory of an

item each time a withdrawal is made to determine whether it is

time to reorder. However, the problem facing all systems is that

demand and lead times aren’t always predictable. Thus, safety

stock levels also need to be determined to prevent stock-outs.

Managers must weigh the benefits of holding safety stock

against the cost of stock-outs. This is usually a function of how

critical the material is to the manufacturing process and the lead

time to order, receive, test, inspect, and release materials. To

weight the risk of a stock out, you can use the Normal

Page 6

probability function to assign the desired probability of not

running out of stock. For example, if you were to select a z

value of 1.645 (90% from the Normal probability table), you

are assuming that the risk of running out of stock during the

lead time is 10% (100% — 90% = 10%). Higher values of z

provide more safety stock. Lower values of z provide less

safety stock.

To translate this policy into a specific safety stock

level, we must know how the demand during the lead time is

distributed. If demand varies little around the average, safety

stock can be small. Conversely, if demand during the lead

time varies greatly around the average, the safety stock

must be large. Variability is measured with mean and

variance. It is usually acceptable to assume that the demand

during the lead time is normally distributed. Thus, safety

stock is calculated by multiplying the risk (z) by the number

of standard deviations from the mean ( s ) by the square root

of the lead time ( L ).

Equation 4:

Where: z = Risk represented by the Normal probability

s = Standard deviation of the demand

L = Lead time in days

Once you have determined the safety stock, the

actual reorder point (ROP) can be calculated as the average

demand (D) multiplied by the lead time (L) plus the safety

stock.

ROP = DL + Safety Stock

Equation 5:

Where: D = Average of the demand in days

L = Lead time in days

Example 4: If the demand for a buffer is 20 liters per week with

a standard deviation of 5 liters and a lead time of 2 days for

manufacturing, what is the safety stock and reorder point

amount with a 90% risk level?

D = 20 liters per week = 20/7 = 2.8 liters per day

s = 5 liters per day

L = 2 days

z = 1.645 (90%)

Use Equation 4 to find the safety stock amount:

Safety Stock = 1.645 x 5 x

2 = 11.6 Liters

Now that we know the safety stock amount, we can use

Equation 5 to find

the reorder point:

ROP = 2.8 x 2 + 11.6 = 17.2 Liters

The primary advantages of calculating the safety stock

and reorder point with these methods are:

(1) The review frequency of each item may be individualized.

Tailoring the review frequency to the item can reduce the

total ordering and holding costs.

(2) Fixed lot sizes, if large enough, may result in quantity

discounts. Physical limitations such as material handling

methods, storage, preparation equipment, the time allotted

for manufacturing, or validated manufacturing methods may

require a fixed lot size.

Page 7

(3) Lower safety stock will results in a cost savings.

(4) Computerized systems can automatically monitor the

reorder process when materials have dropped below the

reorder point.

Summary

By utilizing the EOQ model, there are only two main

costs to calculate, the holding cost and the setup or ordering

cost. It is important to calculate these two costs accurately to

ensure that you are optimizing your EOQ. To further

optimize the EOQ, finding strategies to reduce the ordering

and setup cost and/or holding cost is probably the best place

to start. However, EOQ is just one part of the equation to

create a cost reduction strategy for managing your inventory.

You should always consider a cost-benefit-analysis of the

pressures for low inventory versus the pressures for high

inventory. Once these criteria are established, the risk for

holding inventory can be weighed against the expiration data

of the material, the safety stock and the reorder point can be

established to hopefully prevent stock outs with a minimal

impact on your overall cost to carry the inventory.

Formulations Pro Makes EOQ and ROP Easy to Manage

The first piece of information that you will need to know for

the EOQ is the demand for your buffer and raw materials

over a specified period of time. To make this process easy to

use, the Formulations Pro database has a two step

process (see Figure 3):

(1) Enter the Data: Enter the demand and cost information into

the fields.

(a) Start/End: Enter the start and end date for the demand

period of time.

(b) Lead Time: Enter the lead time for ordering and testing

the material.

(c) Order or Setup Cost: Enter the order and setup costs.

(d) Holding or Carrying Cost: Enter the holding or carry cost

per day.

Figure 3

Next, with the demand, lead time and cost figures,

Formulations Pro will help you to determine the economic

ordering and reorder point quantities.

(2) EOQ Recommendations: All the recommendations will be

calculated for you to minimize your costs. All you have to do

is enter the safety stock risk factor, desired order and

reorder levels (Figure 4).

(a) The number of orders that will be placed on an annual

basis will tell you how often you will need to place a new

order.

(b) The total cost to carry the inventory takes into

consideration the number of units ordered, the holding

Page 8

and carrying cost, the demand, and the order and

setup cost.

(c) The EOQ will tell you the amount to order to

minimize your costs.

(e) The desired or actual order amount allows you to

specify how much you will order or manufacture for

each lot. This allows you to compensate with

standardized order quantities which may be easier to

order or manufacture.

(d) The EOQ taking into consideration the expiration

date of the material will fine tune the EOQ

recommendation for materials that will expire before

they are consumed.

(f) The safety stock risk factor is used to compute the

safety stock quantity.

(g) The safety stock amount is the calculated amount of

safety stock needed to prevent a stock out during the

lead time.

(h) The recommended reorder amount should be

followed as closely as possible to maximize your

ordering and production schedules. This value uses

the average demand rate and compensates the

reorder amount based on the lead time and safety

stock. When the stock falls below this level it is time

to place a new order.

(i) The desired or actual reorder amount lets you

actually specify when you will need to reorder or start

the next manufacturing lot. This will help to prevent

backorders and stockouts. As well, this allows you to

compensate with safety stock for inconsistencies in

supply or demand and production schedules.

Figure 4

In just 2 short steps, Formulations Pro can give you the

competitive edge you need to implement a practical cost

reduction strategy for inventory management. For further

information about more advanced EOQ strategies or how

Formulations Pro can give your company the competitive edge

that you need please contact:

Formulations Pro, Inc.

12608-36 Carmel Country Rd

San Diego, Ca 92130

858-794-1530

© 2001 Formulations Pro, Inc. Formulations Pro is a trademark

of Formulations Pro, Inc., registered in the U.S.A. The

Formulations Pro logo and Formulations Pro are trademarks of

Formulations Pro, Inc. Product specifications and availability are

subject to change without notice.

Page 9