(Hons) Accounting and Finance (RDI)

advertisement

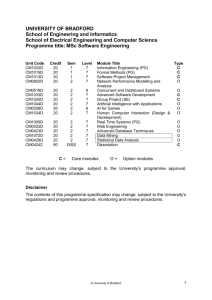

UNIVERSITY OF BRADFORD Faculty of Management and Law Programme title: BSc (Hons) Accounting and Finance Awarding and teaching institution: University of Bradford (Awarding and teaching institution) RDI Management Learning, Hong Kong (Teaching institution) Final and interim awards: BSc (Honours) [Framework for Higher Education Qualifications level 6] BSc (Ordinary) [Framework for Higher Education Qualifications level 6] Diploma of Higher Education [Framework for Higher Education Qualifications level 5] Certificate of Higher Education [Framework for Higher Education Qualifications level 4] Programme title: Accounting and Finance Modules approved /accredited by: Association of Certified Chartered Accountants Chartered Institute of Management Accountants Institute of Chartered Accountants in England and Wales Association of International Accountants CPA Australia Duration: 34 months full time, 38 months part time UCAS code: N/A Subject benchmark statement(s): Accounting (2007), Finance (2007) FHEQ Levels: 4-6 Date produced: February 2011 Last updated: June 2015 Introduction The BSc in Accounting and Finance programme has been designed for those business students who wish to pursue a career in accounting and finance but at the same time provides these students with a general business education. One of the School of Management’s main aims is to address major challenges for business and society such as global responsibility and sustainable development. Accordingly, the School seeks to prepare students who are able to contribute in an effective manner to debates about BSc Accounting and Finance (RDI) June 2015.docx Page 1 sustainable development and critically appraise the relationship(s) between the social, economic and environmental dimensions. Our intention is to nurture students who can apply the principles of sustainable development in their professional capacity. Whilst there are a number of modules specifically designed to develop those personal transferable skills that will increase your attractiveness to future employers (e.g. MAN0116M Student Self Development and MAN2012L Employability and Enterprise Skills), employability is an over-arching theme across the programme and many of the modules will develop your employability skills in different ways. The BSc Accounting and Finance programme of study combines academic rigour with practicality and relevance for business and management in industry and commerce. A fundamental aim of the programme is to add value to the contribution students make to their organisations. Added value is evidenced for all students as they apply their learning in the future. The degree programme offers exemptions from some of the professional examinations for the Association of Certified Chartered Accountants (ACCA), Chartered Institute of Management Accountants (CIMA), Institute of Chartered Accountants in England and Wales (ICAEW), and Association of International Accountants (AIA) professional exams and the CPA Australia. Programme Aims The programme is intended to: provide you with an opportunity to equip yourself with specialised knowledge and understanding of accounting and finance practices, theory and applications which enables you to pursue further programmes of study or to progress in your chosen career provide you with a basic knowledge and understanding of some of the contexts in which accounting and finance operates e.g. the legal and social environment, the accounting and finance profession, the business entity, and the capital markets provide a supportive, structured environment in which you are encouraged to develop independent learning skills enable you to develop an awareness of the broad range of knowledge required in modern management provide educational opportunities for mature and alternatively qualified applicants, as well as for traditionally qualified applicants. develop in you an appreciation of the principles and importance of sustainability in the context of the global business environment provide you with the skills and competences to enhance your employability and which will open up opportunities for meaningful employment when you graduate. Programme Learning Outcomes When you have completed Level 4 of this programme you will be able to: LO1 Demonstrate an understanding of management knowledge within the various key business and management disciplines including, for example, a generalised BSc Accounting and Finance (RDI) June 2015.docx Page 2 awareness of business, economics; accounting and finance; marketing; operations, information and data management; and human resource management. LO2 Understand skills for the management of people, finance, marketing and operations. LO3 Understand the sustainability agenda in its broadest sense. LO4 Demonstrate information technology skills relevant to an evolving business environment. LO5 Interpret and relay information to describe business decisions. LO6 Express confidence in report writing and oral presentation. LO7 Engage in effective team working skills and demonstrate the ability to work effectively with others. LO8 Identify your on-going professional and career development needs and to take action to maintain your knowledge and skills. When you have completed Level 5 of this programme you will be able to: LO9 Demonstrate knowledge and critical understanding of the principle concepts, techniques and/or regulatory frameworks relevant to accounting and finance disciplines. LO10 Critically appraise various subject-specific theories and/or techniques used in accounting and finance. LO11 Understand specialist knowledge in particular subject areas, which will reflect your choice of modules from the range of options on offers. LO12 Develop the ability to apply appropriately underlying concepts, principles and skills for the management of accounting information, finance and business decision making. LO13 Demonstrate the ability to assess information and be creative in problem solving. LO14 Compare accounting, finance and other business issues in both written and oral presentation. LO15 Recognise and evaluate the value of collaborative working. LO16 Review your on-going professional and career development needs and to take action to maintain your knowledge and skills. When you have completed Level 6 of this programme you will be able to: LO17 Demonstrate a systematic understanding of the up-front knowledge and/or skills in accounting and finance. LO18 Develop the ability to critically evaluate and then apply appropriate theories, concepts and/or techniques for the analysis of subject-specific issues. LO19 Appraise and apply advanced specialist knowledge in particular subject areas which will reflect your choice of modules from the range of options on offer. LO20 Critically evaluate and comment upon current research, practice and policy related to accounting, finance and other business disciplines. BSc Accounting and Finance (RDI) June 2015.docx Page 3 LO21 Critically evaluate and debate theory and practice in written and oral presentation. LO22 Evaluate the development of appropriate polices and strategies within a changing environment to meet stakeholder interests and engage with the complexity of the sustainability agenda in its broadest sense. LO23 Initiate and take personal responsibility for successful and collaborative working. A Bachelor’s degree (Ordinary) may be awarded to students who have demonstrated: a systematic understanding of key aspects of their field of study, including acquisition of coherent and detailed knowledge informed by aspects of a general business and management. an ability to deploy accurately established techniques of analysis and enquiry within general business and management. conceptual understanding that enables the student: o to devise and sustain arguments, and/or to solve problems, using ideas and techniques. o to describe and comment upon particular aspects of current research, or equivalent scholarship, or practise in general business and management. an appreciation of the uncertainty, ambiguity and limits of knowledge. the ability to manage their own learning, and to make use of primary sources. Typically, holders of the qualification will be able to: apply the methods and techniques that they have learned to review, consolidate, extend and apply their knowledge and understanding. communicate information, ideas, problems and solutions to both specialist and non specialist audiences. And holders will have: the qualities and transferable skills necessary for employment requiring: o the exercise of initiative and personal responsibility o the learning ability needed to undertake appropriate further training of a professional or equivalent nature. The holders of a Bachelor’s degree (Ordinary) will meet the above learning outcomes, but undertake fewer credit requirements as per University regulations. Curriculum The map of your studies is detailed in the following section. Each taught ‘year’, or Stage, of the BSc (Hons) programme at Management Learning, Hong Kong consists of three terms with 40 credits being studied in each term. These terms begin in January, May and September. As a full-time student you will study in the daytime during 12 week terms with an extended summer break. As a part-time student you will study in the evening and for BSc Accounting and Finance (RDI) June 2015.docx Page 4 block delivery on some weekends – the part-time timetable has been devised to ensure that your study can fit around your other commitments. A number of modules are core to the programme (compulsory for all students) and have two primary purposes. The first set, found exclusively in Stage 1, are foundational modules which provide grounding in all of the basic business and management programme areas. The second set are found in Stage 2, including a module in Business Law and a module in Employability and Enterprise Skills which develops your ability to search for work, make applications and be successively employed. In Stage 2, you will take 110 credits worth of compulsory modules and 10 credits worth of optional modules. In Stage 3 you will undertake 80 credits worth of core modules and 40 credits of options. In addition to these core subjects, Management Learning, Hong Kong will select, through a process of consultation, and incorporating student feedback, a fixed diet of additional modules for this programme. These are selected from a wide range of options from all areas within the study of business and management designed and delivered at the Bradford campus. The full list of the current Bradford optional modules is provided in the tables below. By the end of the programme you will have achieved all of the programme learning outcomes. You will see in the tables below that the core programme modules are aligned to set study periods (terms: Jan, May or Sept). Stage 1 – Framework for Higher Education Level 4 Module Code Module Title Type Credits Level Study period MAN0130L Business Economics C 20 4 Jan MAN0131L People, Work and Organizations C 20 4 Jan MAN0132L Operations and Information Systems Management C 20 4 May MAN1061L Introduction to Accounting and Finance C 20 4 Sept MAN1073L Foundations of Marketing C 20 4 Sept MAN0116M Student Self Development C 10 4 May MAN0111M Quantitative Methods in Information Management C 10 4 May Students who have achieved at least 120 credit points at Level 4 may exit the programme and are eligible for the award of Certificate of Higher Education. Stage 2 – Framework for Higher Education Level 5 Module Code Module Title Type Credits Level MAN2012L Employability and Enterprise Skills C 20 5 MAN2907L Financial Accounting C 20 5 BSc Accounting and Finance (RDI) June 2015.docx Study period Sept Jan Page 5 Module Code Module Title Type Credits Level MAN2908L Management Accounting C 20 5 MAN0201M Economics of Industry C 10 5 MAN0405M Financial Management C 10 5 MAN2011M Business Law C 10 5 MAN0115M Company Law and Administration C 10 5 MAN2909M Capital Markets, Investment and Finance C 10 5 MAN0801M Organisational Design C 10 5 Study period May Sept May Jan Sept Sept Jan Students who have achieved at least 120 credit points at Level 5 may exit the programme and are eligible for the award of Diploma of Higher Education. Stage 3 – Framework for Higher Education Level 6 Module Code Module Title Type Credits Level Study period MAN0333L Auditing C 20 6 MAN3040L Taxation C 20 6 Sept Sept MAN0402M Corporate Reporting C 10 6 May MAN0408M International Finance C 10 6 May MAN0308M Contemporary Issues in Accounting C 10 6 Jan MAN3024M International Accounting C 10 6 May MAN0205M Global Business Environment O 10 6 Jan MAN0208M Understanding Strategic Management O 10 6 Jan MAN0204M International Business Strategy O 10 6 Jan MAN0209M Applied Strategic Management O 10 6 Jan C Compulsory/Core module O Optional module The curriculum may change, subject to the University's programme approval, monitoring and review procedures. Learning, Teaching and Assessment Strategies The approach to teaching and learning aims to integrate applied and theoretical knowledge, taking into consideration the learning outcomes, progression through the levels of study, the nature of the mode of study and the need for you to take greater responsibility for your own learning as you progress through the programme. BSc Accounting and Finance (RDI) June 2015.docx Page 6 Stage 1 of the programme contains only core modules and provides the foundation level understanding to support the attainment of learning outcomes 1 to 8. During Stage 1 core knowledge and understanding of business and management will be introduced (LO1-5) to support the broader application and understanding of these issues for those who undertake the Accounting and Finance programme. Alongside these, key graduate learner skills including communication and the correct sourcing, use of and presentation of information including referencing will be introduced. Such skills will enable you to write in an academic manner (LO6) and begin to reflect on the value and usefulness of the information (LO5) with which you are presented, engage in team working (LO7) and consider your future career paths (LO8). Stage 2 contains 110 credits of core modules. This is where the Accounting and Finance student develops their subject specialisms. MAN2907L Financial Accounting, MAN2908L Management Accounting, MAN0405M Financial Management and MAN2909M Capital Markets, Investment and Finance, all allow the student to gain levels of critical understanding in their subject discipline area (LO9, 10, 12, 14), whilst MAN2011M Business Law continues the development of theory and provides more specialist knowledge to underpin business decision making (LO11). MAN2012L Employability and Enterprise Skills supports the attainment of core transferable skills such as problem solving and career enhancement (LO13, 15, 16). During Stage 2 of the programme you begin to develop specialist knowledge and understanding of the key disciplines, and are encouraged to critically review the current theory and its practical applications through both your core subject specialisms and your option choice (LO9, 11 and 13). During Stage 2 you will also encounter a wide variety of assessments that build and test graduate attributes (LO14, 15 and 16). As a Stage 3 student, you will be prepared to demonstrate your ability as an independent learner. For the final stage, advanced specialist knowledge in accounting and finance is gained via the 80 credits of core modules. You will be presented with teaching materials, methods and assessment strategies that will require you to be more evaluative and critical of theory and utilise problem solving skills (LO 17, 18, 19), often in relation to advanced accounting techniques, or business scenarios for your optional modules. Graduate transferable skills will be gained as you research and present information in depth (LO21) and communicate this effectively, either individually (LO21) or as part of a group (LO23). Methods of assessment are varied and linked to learning requirements. They will include closed and open book examinations, essays, programme work, case studies, practical exercises, computer assisted assessment, group work and presentations. There are various opportunities for formative feedback, for example in tutorials, via programme work feedback, feedback from formative online quizzes, interactive learning software, and online discussion forums. Assessment Regulations This Programme conforms to the standard University Assessment Regulations which are available at the following link: http://www.bradford.ac.uk/aqpo/ordinances-and-regulations/ Learning Resources The RDI Management Learning, Hong Kong Library is open Monday to Saturday and is BSc Accounting and Finance (RDI) June 2015.docx Page 7 housed within the premises at South Central building. All Management Learning students have access to the MDS Library Service (MDS) which is operated and managed by the Institute of Professional Education and Knowledge of the Vocational Training Council. This provides you with access to e-resources including over 1,700 international leading business and management e-journals, over 850 essential management e-books and the latest executive book summaries. Training in research skills, online resources and information literacy is available to all students. Please talk to the Head of Student Support who will help you find the advice and training you need. At the University of Bradford, the JB Priestley Library on the city campus and our specialist libraries in the Faculty of Health Studies and the Faculty of Management and Law provide a wide range of printed and electronic resources to support your studies. You will be able to access online e-journals through the University of Bradford library website and Athens authentication scheme. Most of our online journals are available on the internet (both on and off campus), and you can also access your University email account, personal information and programme-related materials this way. Student Support and Guidance Programme Team Support for you personally and in your programme of study, will be provided both by RDI Management Learning and the Programme Team. The Lead Tutor at RDI Management Learning has overall academic and pastoral responsibility for your programme. If you experience any personal problems during your programme the Lead Tutor will be able to provide you with advice and support. Students at partner institutions are given a student handbook with local adaptations and the full range of module handbooks. The latter will be available, with additional learning materials, on a dedicated Blackboard site. Through the Library facilities and Blackboard ‘organisations’ you will also be able to access CD-ROM and online databases, including business and management periodicals and company information. Students’ Union Students studying our programmes in Hong Kong are entitled to use the web-based information and support provided by our Students’ Union in Bradford (see: www.ubuonline.co.uk/your-union ). We value the feedback provided by students and collaborate with the Students’ Union, through a system of Student Representatives and formal staff student liaison committees, so that any issues you wish to raise are addressed rapidly. The Students’ Union and the University of Bradford work in partnership to provide confidential counselling and welfare services where you can get help with any aspect of your personal or academic life. Student Financial and Information Services (based in the Hub) will provide you with information about a diverse range of issues such as council tax, personal safety and tourist information. International students can access a range of additional advice and support services through the Student’s Union. All international students have access to the Student Union via email, web and can arrange dialogue if required. BSc Accounting and Finance (RDI) June 2015.docx Page 8 Employability and Career Development The University is committed to helping students develop and enhance their employability profile and capabilities through learning opportunities embedded within the curriculum. Furthermore, the University is committed to supporting students to develop their commitment towards a career pathway(s) and to implementing a career plan. Professional career guidance and development support is available throughout your time as a student and as a graduate from Career Development Services. The support available from Career Development Services includes a wide range of information resources, one to one appointments, a weekly workshop programme, a mentoring programme, graduate recruitment and careers fairs, plus information and help to enable you to find part time work, summer work placements, graduate internship programmes and graduate entry vacancies. In addition, some students as part of their programme of study may have the opportunity to complete a Career & Personal Development accredited module delivered by the Career Development Service. All students are encouraged to access Career Development Services at an early stage during their studies and to use the extensive resources available on their web site www.careers.brad.ac.uk. Career Development Services annually undertakes a survey of all graduates to find out their destination six months after graduation. The survey gathers data on the employment and further study routes graduates have entered and a range of other information including job roles, name and location of employers, salary details etc. The survey findings for each programme of study are presented on the programme information pages on the University website and via Career Development Services’ website www.careers.brad.ac.uk. Employability is a theme running throughout each of the Faculty of Management and Law’s undergraduate programmes. Within each year of the programme you will be provided with opportunities to learn and develop employment skills, including job search, CV writing, professional communication, problem solving, team working and many more. The curriculum will equip you both with the theories and concepts of business and management and the personal skills to enter a career in business. Learner Development Unit for Academic Skills Advice For undergraduate students who are looking to improve their marks during their time at university, study skills and maths advice is available to all regardless of degree discipline or level of study. Our advisers offer a wide range of online and paper based materials for self-study. http://www.bradford.ac.uk/learner-development/ The School’s Effective Learning provision can be found at http://www.brad.ac.uk/management/els/ Disability Disabled students will find a supportive environment at Bradford where we are committed to ensuring that all aspects of student life are accessible to everyone. The Disability Service can help by providing equipment and advice to help you get the most out of your time at Bradford and is a place where you can discuss any concerns you may have about adjustments that you may need, whether these relate to study, personal care or other BSc Accounting and Finance (RDI) June 2015.docx Page 9 issues. For more information contact the Disability Service by phoning: 01274 233739 or via email: disabilities@bradford.ac.uk University policies and initiatives Learning and Teaching Our University approach to learning, teaching and assessment is encapsulated by an integrated set of themes and principles within our Curriculum Framework. All of our degree programmes have been designed to provide you with an inclusive and engaging learning environment, which gives you the opportunity to thrive and develop in your area of study. Our research-informed programmes have a particular focus on developing your employability. We also place a strong emphasis on collaborative, real-world and enquirybased learning, supported by appropriate learning technologies. Our assessment is designed not just to measure your achievement, but also to shape and guide your learning through preparing you for the increasing level of challenge as you progress through your degree. Together, these lead to you developing a distinctive set of graduate attributes which will prepare you for life beyond university. Ecoversity Ecoversity is a strategic project of the University, which aims to embed the principles of sustainable development into our decision-making, learning and teaching, research activities campus operations and lives of our staff and students. We do not claim to be a beacon for sustainable development but we aspire to become a leading University in this area. The facilities we create for teaching and learning, including teaching spaces, laboratories, IT labs and social spaces, will increasingly reflect our commitments to sustainable development. Staff and student participation in this initiative is crucial to its success and its inclusion in the programme specification is a clear signal that it is at the forefront of our thinking in programme development, delivery, monitoring and review. For more details see: www.bradford.ac.uk/ecoversity Further Information: For further information, please check the University prospectus or contact Admissions. The Admissions Office The Undergraduate Office The University of Bradford Faculty of Management and Law Richmond Road The University of Bradford Bradford, BD7 1DP Emm Lane UK Bradford, BD9 4JL UK +44 (0)1274 233054 +44 (0)1274 234321 http://www.brad.ac.uk/courses/ http://www.brad.ac.uk/acad/management BSc Accounting and Finance (RDI) June 2015.docx Page 10 The contents of this programme specification may change, subject to the University's regulations and programme approval, monitoring and review procedures. BSc Accounting and Finance (RDI) June 2015.docx Page 11 Appendices to Programme Specifications 1. Curriculum map This table shows in which modules the main learning outcomes are developed and/or assessed: Stage 1 – Framework for Higher Education Level 4 LO1 Demonstrate an understanding of management knowledge within the various key business and management disciplines including, for example, a generalised awareness of business, economics; accounting and finance; marketing; operations, information and data management; and human resource management. LO2 Understand skills for the management of people, finance, marketing and operations. LO3 Understand the sustainability agenda in its broadest sense. LO4 Demonstrate information technology skills relevant to an evolving business environment. LO5 Interpret and relay information to describe business decisions. LO6 Express confidence in report writing and oral presentation. LO7 Engage in effective team working skills and demonstrate the ability to work effectively with others. LO8 Identify your on-going professional and career development needs and to take action to maintain your knowledge and skills. Stage 2 – Framework for Higher Education Level 5 LO9 Demonstrate knowledge and critical understanding of the principle concepts, techniques and/or regulatory frameworks relevant to accounting and finance disciplines. LO10 Critically appraise various subject-specific theories and/or techniques used in accounting and finance. LO11 Understand specialist knowledge in particular subject areas, which will reflect your choice of modules from the range of options on offers. LO12 Develop the ability to apply appropriately underlying concepts, principles and skills for the management of accounting information, finance and business decision making. LO13 Demonstrate the ability to assess information and be creative in problem solving. LO14 Compare accounting, finance and other business issues in both written and oral presentation. LO15 Recognise and evaluate the value of collaborative working. rdi-bsc-accounting-and-finance-rdi-June 2015.docx 12 LO16 Review your on-going professional and career development needs and to take action to maintain your knowledge and skills. Final Stage – Framework for Higher Education Level 6 LO17 Demonstrate a systematic understanding of the up-front knowledge and/or skills in accounting and finance. LO18 Develop the ability to critically evaluate and then apply appropriate theories, concepts and/or techniques for the analysis of subject-specific issues. LO19 Appraise and apply advanced specialist knowledge in particular subject areas which will reflect your choice of modules from the range of options on offer. LO20 Critically evaluate and comment upon current research, practice and policy related to accounting, finance and other business disciplines. LO21 Critically evaluate and debate theory and practice in written and oral presentation. LO22 Evaluate the development of appropriate polices and strategies within a changing environment to meet stakeholder interests and engage with the complexity of the sustainability agenda in its broadest sense. LO23 Initiate and take personal responsibility for successful and collaborative working. rdi-bsc-accounting-and-finance-rdi-June 2015.docx 13 Learning Outcomes Stage Module Module Title 1 2 3 4 1 (C) MAN0130L A 1 (C) MAN0131L 1 (C) MAN0132L 1 (C) MAN1061L 1 (C) MAN1073L Business Economics People, Work and Organisations Operations and Information Systems Management Introduction to Accounting and Finance Foundations of Marketing 1 (C) MAN0116M 1 (C) MAN0111M 2 (C) MAN2012L 2 (C) MAN2907L Student Self Development Quantitative Methods in Information Management Employability and Enterprise Skills Financial Accounting 2 (C) MAN2908L Management Accounting 2 (C) MAN0201M Economics of Industry 2 (C) MAN0405M Financial Management A 2 (C) MAN2011M 2 (C) MAN0115M 2 (C) MAN2909M 2 (C) MAN0801M Business Law Company Law and Administration Capital Markets, Investment and Finance Organisational Design 3 (C) MAN0333L Auditing A A 3 (C) MAN3040L Taxation A A 3 (C) MAN0402M Corporate Reporting A A A 3 (C) MAN0408M A A 3 (C) MAN0308M International Finance Contemporary Issues in Accounting A A A 5 6 A A A A S S A A S A A A A S S A A A A S A S A rdi-bsc-accounting-and-finance-rdi-June 2015.docx A 7 8 9 10 11 12 13 S S A A A A A A A A A A 14 15 16 A S A A A A A S A A A A S A A A A S A A A A A A A S 17 18 19 20 21 22 A S S S S S S S A S A 23 A S A A A A A A A A A A A A A A A S A A S A S S S A A S A A A A A A A 14 A A A A S A A Learning Outcomes Stage Module Module Title 3 (C) MAN3024M 3 (O) MAN0205M 3 (O) MAN0208M 3 (O) MAN0204M 3 (O) MAN0209M International Accounting Global Business Environment Understanding Strategic Management International Business Strategy Applied Strategic Management 1 2 3 4 5 6 7 8 9 10 11 12 14 15 16 17 18 19 20 21 22 23 A A A A A A A A A A A A A A A A A A A A A A Notes: A list of the outcomes should be provided next to the table. A = this outcome is formally assessed in the module S = this outcome is explicitly supported in the learning and teaching but is not formally assessed rdi-bsc-accounting-and-finance-rdi-June 2015.docx 13 15 A A A 2. Assessment map This table shows the methods of assessments used across different stages and modules (key below): Stage Module 1 1 (C) 1 (C) MAN0130L Business Economics X MAN0131L People, Work and Organisations X 1 (C) MAN0132L Operations and Information Systems Management 1 (C) MAN1061L Introduction to Accounting and Finance 1 (C) MAN1073L Foundations of Marketing X (s) 1 (C) MAN0116M Student Self Development X 1 (C) MAN0111M Quantitative Methods in Information Management 2 (C) MAN2012L Employability and Enterprise Skills 2 (C) MAN2907L Financial Accounting 2 (C) MAN2908L Management Accounting 2 (C) MAN0201M Economics of Industry X 2 (C) MAN0405M Financial Management X (s) 2 (C) MAN2011M Business Law X 2 (C) MAN0115M Company Law and Administration X 2 (C) MAN2909M Capital Markets, Investment and Finance X (s) X 2 (C) MAN0801M Organisational Design X (s) X 3 (C) MAN0333L Auditing X 3 (C) MAN3040L Taxation X 3 (C) MAN0402M Corporate Reporting X (s) X X 3 (C) MAN0408M International Finance X (s) X X 3 (C) MAN0308M Contemporary Issues in Accounting X (s) X rdi-bsc-accounting-and-finance-rdi-June 2015.docx 2 3 4 5 6 X X X X X X X X X X X X X X X X X X X X X X X 16 8 X X (s) X (s) 7 X Stage Module 1 2 3 (C) MAN3024M International Accounting X (s) X 3 (O) MAN0205M Global Business Environment X X 3 (O) MAN0208M Understanding Strategic Management X X 3 (O) MAN0204M International Business Strategy 3 (O) MAN0209M Applied Strategic Management Individual programme work 2 Group programme work 3 Open book examination 4 Closed book examination 5 Individual presentation 6 Group presentation 7 Computer based assessment 8 Oral examination rdi-bsc-accounting-and-finance-rdi-June 2015.docx 4 X X X Methods of Assessment in Assessment Map: 1 3 17 5 6 X 7 8 3. Teaching map This table shows the main delivery methods which are used across modules and stages: Teaching methods Stage 1 (C) 1 (C) 1 (C) 1 (C) 1 (C) 1 (C) 1 (C) 2 (C) 2 (C) 2 (C) 2 (C) 2 (C) 2 (C) 2 (C) 2 (C) 2 (C) 3 (C) 3 (C) 3 (C) 3 (C) 3 (C) 3 (C) 3 (O) 3 (O) 3 (O) 3 (O) MAN0130L MAN0131L MAN0132L MAN1061L MAN1073L MAN0116M MAN0111M MAN2012L MAN2907L MAN2908L MAN0201M MAN0405M MAN2011M MAN0115M MAN2909M MAN0801M MAN0333L MAN3040L MAN0402M MAN0408M MAN0308M MAN3024M MAN0205M MAN0208M MAN0204M MAN0209M Module Business Economics People, Work and Organisations Operations and Information Systems Management Introduction to Accounting and Finance Foundations of Marketing Student Self Development Quantitative Methods in Information Management Employability and Enterprise Skills Financial Accounting Management Accounting Economics of Industry Financial Management Business Law Company Law and Administration Capital Markets Investment and Finance Organisational Design Auditing Taxation Corporate Reporting International Finance Contemporary Issues in Accounting International Accounting Global Business Environment Understanding Strategic Management International Business Strategy Applied Strategic Management 1 X X X X X X X X X X X X X X X X X X X X X X X X X X 2 X X X X X X X X X X X X X X X X X X X X X X X X Methods of Teaching in Delivery Map: 1 Lectures 2 Tutorials/Seminars 3 Directed Study 4 Laboratories/Practical rdi-bsc-accounting-and-finance-rdi-June 2015.docx Page 18 3 X X X X X X X X X X X X X X X X X X X X X X X X X X 4 X X X