MGX Annual Report 2014

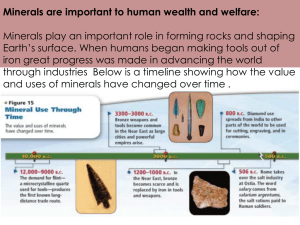

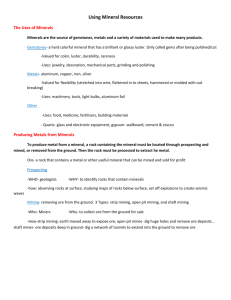

advertisement