Iluka Annual Report 2014

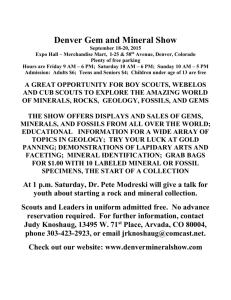

advertisement