Fund Rules - Defence Health

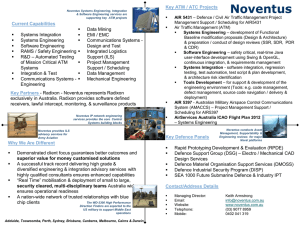

advertisement