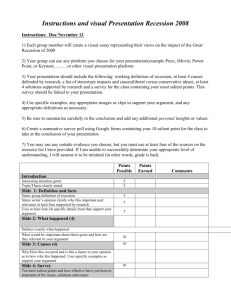

Human Resources in the Recession

advertisement