Fact sheet UK

advertisement

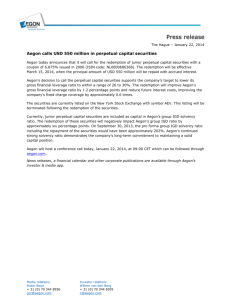

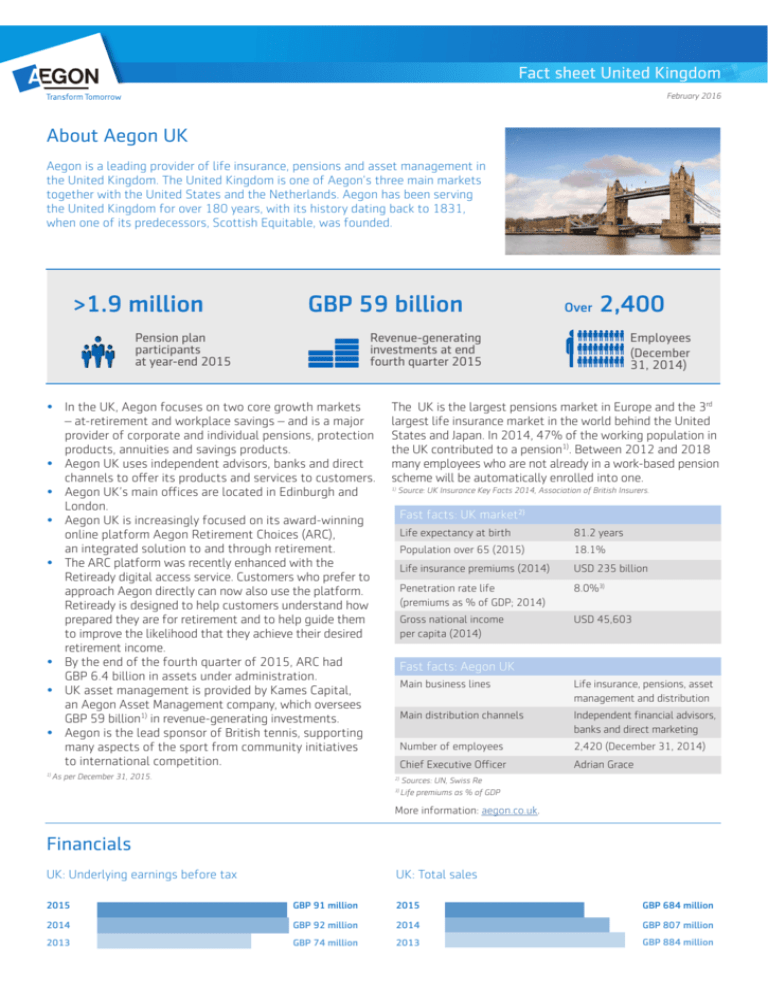

Fact sheet United Kingdom February 2016 About Aegon UK Aegon is a leading provider of life insurance, pensions and asset management in the United Kingdom. The United Kingdom is one of Aegon’s three main markets together with the United States and the Netherlands. Aegon has been serving the United Kingdom for over 180 years, with its history dating back to 1831, when one of its predecessors, Scottish Equitable, was founded. >1.9 million GBP 59 billion Pension plan participants at year-end 2015 2,400 Revenue-generating investments at end fourth quarter 2015 • In the UK, Aegon focuses on two core growth markets – at-retirement and workplace savings – and is a major provider of corporate and individual pensions, protection products, annuities and savings products. • Aegon UK uses independent advisors, banks and direct channels to offer its products and services to customers. • Aegon UK’s main offices are located in Edinburgh and London. • Aegon UK is increasingly focused on its award-winning online platform Aegon Retirement Choices (ARC), an integrated solution to and through retirement. • The ARC platform was recently enhanced with the Retiready digital access service. Customers who prefer to approach Aegon directly can now also use the platform. Retiready is designed to help customers understand how prepared they are for retirement and to help guide them to improve the likelihood that they achieve their desired retirement income. • By the end of the fourth quarter of 2015, ARC had GBP 6.4 billion in assets under administration. • UK asset management is provided by Kames Capital, an Aegon Asset Management company, which oversees GBP 59 billion1) in revenue-generating investments. • Aegon is the lead sponsor of British tennis, supporting many aspects of the sport from community initiatives to international competition. 1) Over As per December 31, 2015. Employees (December 31, 2014) The UK is the largest pensions market in Europe and the 3rd largest life insurance market in the world behind the United States and Japan. In 2014, 47% of the working population in the UK contributed to a pension1). Between 2012 and 2018 many employees who are not already in a work-based pension scheme will be automatically enrolled into one. 1) Source: UK Insurance Key Facts 2014, Association of British Insurers. Fast facts: UK market2) Life expectancy at birth 81.2 years Population over 65 (2015) 18.1% Life insurance premiums (2014) USD 235 billion Penetration rate life (premiums as % of GDP; 2014) 8.0%3) Gross national income per capita (2014) USD 45,603 xxxxxxx Fast facts: Aegon UK Main business lines Life insurance, pensions, asset management and distribution Main distribution channels Independent financial advisors, banks and direct marketing Number of employees 2,420 (December 31, 2014) Chief Executive Officer Adrian Grace Sources: UN, Swiss Re 3) Life premiums as % of GDP 2) More information: aegon.co.uk. Financials UK: Underlying earnings before tax UK: Total sales 2015 GBP 91 million 2015 GBP 684 million 2014 GBP 92 million 2014 GBP 807 million 2013 GBP 74 million 2013 GBP 884 million