Commercial Real Estate and the 1990

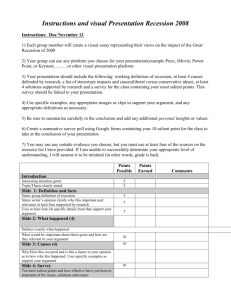

advertisement