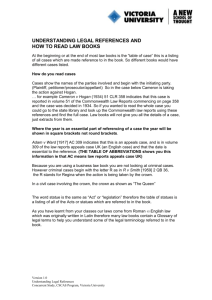

Orders page 1

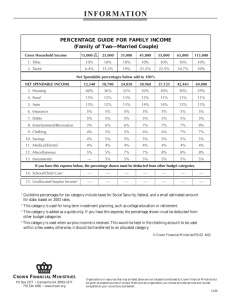

advertisement