(14) Other Borrowings (15) Junior Subordinated Debentures

advertisement

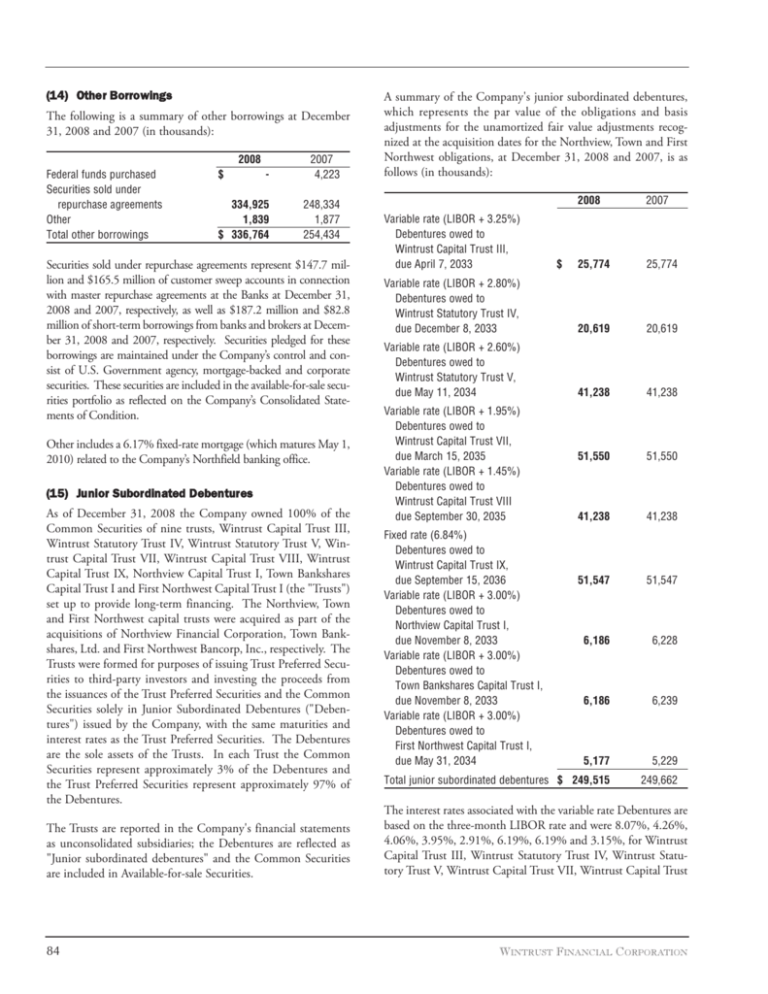

(14) Other Borrowings The following is a summary of other borrowings at December 31, 2008 and 2007 (in thousands): 2008 Federal funds purchased Securities sold under repurchase agreements Other Total other borrowings - 2007 4,223 334,925 1,839 $ 336,764 248,334 1,877 254,434 $ Securities sold under repurchase agreements represent $147.7 million and $165.5 million of customer sweep accounts in connection with master repurchase agreements at the Banks at December 31, 2008 and 2007, respectively, as well as $187.2 million and $82.8 million of short-term borrowings from banks and brokers at December 31, 2008 and 2007, respectively. Securities pledged for these borrowings are maintained under the Company’s control and consist of U.S. Government agency, mortgage-backed and corporate securities. These securities are included in the available-for-sale securities portfolio as reflected on the Company’s Consolidated Statements of Condition. Other includes a 6.17% fixed-rate mortgage (which matures May 1, 2010) related to the Company’s Northfield banking office. (15) Junior Subordinated Debentures As of December 31, 2008 the Company owned 100% of the Common Securities of nine trusts, Wintrust Capital Trust III, Wintrust Statutory Trust IV, Wintrust Statutory Trust V, Wintrust Capital Trust VII, Wintrust Capital Trust VIII, Wintrust Capital Trust IX, Northview Capital Trust I, Town Bankshares Capital Trust I and First Northwest Capital Trust I (the "Trusts") set up to provide long-term financing. The Northview, Town and First Northwest capital trusts were acquired as part of the acquisitions of Northview Financial Corporation, Town Bankshares, Ltd. and First Northwest Bancorp, Inc., respectively. The Trusts were formed for purposes of issuing Trust Preferred Securities to third-party investors and investing the proceeds from the issuances of the Trust Preferred Securities and the Common Securities solely in Junior Subordinated Debentures ("Debentures") issued by the Company, with the same maturities and interest rates as the Trust Preferred Securities. The Debentures are the sole assets of the Trusts. In each Trust the Common Securities represent approximately 3% of the Debentures and the Trust Preferred Securities represent approximately 97% of the Debentures. The Trusts are reported in the Company's financial statements as unconsolidated subsidiaries; the Debentures are reflected as "Junior subordinated debentures" and the Common Securities are included in Available-for-sale Securities. 84 A summary of the Company's junior subordinated debentures, which represents the par value of the obligations and basis adjustments for the unamortized fair value adjustments recognized at the acquisition dates for the Northview, Town and First Northwest obligations, at December 31, 2008 and 2007, is as follows (in thousands): 2008 2007 25,774 25,774 Variable rate (LIBOR + 2.80%) Debentures owed to Wintrust Statutory Trust IV, due December 8, 2033 20,619 20,619 Variable rate (LIBOR + 2.60%) Debentures owed to Wintrust Statutory Trust V, due May 11, 2034 41,238 41,238 51,550 51,550 41,238 41,238 51,547 51,547 6,186 6,228 6,186 6,239 5,177 5,229 Total junior subordinated debentures $ 249,515 249,662 Variable rate (LIBOR + 3.25%) Debentures owed to Wintrust Capital Trust III, due April 7, 2033 Variable rate (LIBOR + 1.95%) Debentures owed to Wintrust Capital Trust VII, due March 15, 2035 Variable rate (LIBOR + 1.45%) Debentures owed to Wintrust Capital Trust VIII due September 30, 2035 Fixed rate (6.84%) Debentures owed to Wintrust Capital Trust IX, due September 15, 2036 Variable rate (LIBOR + 3.00%) Debentures owed to Northview Capital Trust I, due November 8, 2033 Variable rate (LIBOR + 3.00%) Debentures owed to Town Bankshares Capital Trust I, due November 8, 2033 Variable rate (LIBOR + 3.00%) Debentures owed to First Northwest Capital Trust I, due May 31, 2034 $ The interest rates associated with the variable rate Debentures are based on the three-month LIBOR rate and were 8.07%, 4.26%, 4.06%, 3.95%, 2.91%, 6.19%, 6.19% and 3.15%, for Wintrust Capital Trust III, Wintrust Statutory Trust IV, Wintrust Statutory Trust V, Wintrust Capital Trust VII, Wintrust Capital Trust WINTRUST FINANCIAL CORPORATION