27 residential sites for the 2H2012 Government Land Sales

advertisement

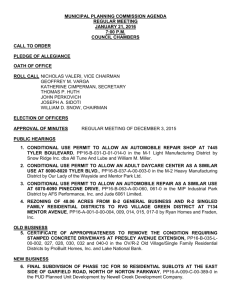

16 27 residential sites for the 2H2012 Government Land Sales Programme By Heng Chan Yeng 15 Confirmed List sites and 24 Reserve List sites will be made available in the Government Land Sales (GLS) Programme for the second half of 2012 (2H2012). These sites can yield about 14,200 private residential units, including 3,100 Executive Condominium (EC) units, 388,000 sqm gross floor area (GFA) of commercial space and 3,700 hotel rooms. The Government has placed 13 sites1 for private residential development on the 2H2012 Confirmed List which can yield about 7,100 residential units. This is comparable to the supply made available on the Confirmed List in the first half 2012 (1H2012). The 2H2012 GLS Programme has a total of 27 sites for residential development, including 6 EC sites and one commercial and residential site. Together, they can generate about 14,185 private residential units (including 3,100 EC units). Most of the private residential sites in the 2H2012 GLS Programme, including the 6 EC sites, are located in Outside Central Region2 or in locations in Rest of Central Region where more affordable private housing is expected to be built. There is also a large supply of about 86,000 private housing units (including about 7,000 EC units) in the pipeline, of which about 38,000 units (including 1,800 EC units) are still unsold. Attractive commercial sites A commercial site at Venture Avenue with a minimum office GFA quantum will be added to the 2H2012 Confirmed List to cater to users who need more affordable office space outside the Central Business District. It will also help to continue the momentum to develop Jurong Gateway into a vibrant commercial hub. In addition, the 2H2012 Reserve List will have three sites for office developments. The commercial site at Sims Avenue/Tanjong Katong Road and the white site at Marina View, which are already available in the 1H2012 Reserve List, will be carried over to the 2H2012 Reserve List. URA has revised the sale conditions for the Sims Avenue/Tanjong Katong Road site after taking into consideration market feedback3. (1) This includes a commercial and residential site at Yishun Ring Road/Yishun Ave 9. (2) O utside Central Region refers to areas located outside of the Central Region. The Central Region covers the postal districts 9, 10, 11, Downtown Core Planning Area and Sentosa. The Rest of Central Region refers to the areas within the Central Region but is outside of the postal districts 9, 10, 11, the Downtown Core Planning Area and Sentosa. The Core Central Region refers to the postal district areas 9, 10 and 11, Downtown Core and Sentosa. A map showing these areas is available at http://spring.ura.gov. sg/lad/ore/login/map_ccr.pdf A new commercial site at Cecil Street will also be added to the 2H2012 Reserve List. Together, these three sites will provide opportunities for the market to initiate more office space over and above the 762,000 sqm GFA4 of office space in the pipeline, if there is demand. (3) Key changes include removal of the minimum hotel use requirement and allowing some residential use to give greater flexibility for the developer to propose the mix of uses for the site. For instance, under the new conditions the developer may choose to opt for an integrated office-retail-residential development, an officeretail-hotel development or an office-retail development. Single ownership for both the office and retail space will also be required to ensure better integration and management of this mixed use development. The commercial site at Punggol Point will be transferred from the 1H2012 Reserve List to the 2H2012 Confirmed List. Located near Punggol Point Walk and Punggol Point Park, it has the potential to be developed into a rustic seaside dining destination. (4) The 762,000 sqm GFA of office space are from new development and redevelopment projects that have been granted planning approvals, i.e. either PP or WP, as at 1st Quarter 2012. More supply will also come from projects that are pending approvals such as the Choon Guan Street site and the 6 plots of land at Marina Bay and Ophir Road/Rochor Road development by M+S Pte Ltd. The GLS Programme is reviewed regularly to ensure that there is a sufficient supply of land to meet demand for economic growth and to maintain a stable and sustainable property market. Sites in the GLS Programme are released through two main systems — the Confirmed List and the Reserved List. Confirmed List sites are released on a fixed, pre-determined date; while a site on the Reserve List will only be released for sale if the criteria for triggering the sale of the site are met5. (5) The Government will put up a Reserve List site for public tender if it receives an application from a developer who commits, by signing an agreement and paying a deposit of 3% of the bid price, to bid for the site at or above the minimum price which is acceptable to the Government. The Government will also consider launching a Reserve List site for sale if it receives sufficient market interest for the site. A site is deemed to have received sufficient market interest if more than one unrelated party submit minimum prices that are close to the Government's Reserve Price for the site within a reasonable period. 17 MAY ⁄ JUN 2012 NEW SITES IN THE GOVERNMENT LAND SALES PROGRAMME FOR THE 2ND HALF OF 2012 S/N location site area (ha) proposed gpr Estimated No. of Residential Units(i)(ii) Estimated No. of Hotel Rooms(i)(ii) Estimated Commercial Space (sqm)(ii) Estimated Launch Date Sales Agent confirmed list residential sites 1 Woodlands Avenue 6 / Woodlands Drive 16 (EC) 1.66 2.8 465 0 0 Aug-12 HDB 2 Sengkang West Way / Fernvale Link (Parcel B) (EC) 1.40 3.0 420 0 0 Sep-12 HDB 3 Pasir Ris Drive 3 / Pasir Ris Rise (EC) 2.80 2.1 590 0 0 Sep-12 HDB 4 Sembawang Crescent / Sembawang Drive (EC) 2.32 2.8 650 0 0 Oct-12 HDB 5 Punggol Field Walk / Punggol East (EC) 1.45 3.0 435 0 0 Oct-12 HDB 6 Ang Mo Kio Avenue 2 / Ang Mo Kio Street 13 1.84 3.5 680 0 0 Nov-12 URA 7 Jurong West Street 41 / Boon Lay Way (Parcel A) 2.24 3.5 825 0 0 Nov-12 URA 8 Commonwealth Avenue 1.21 4.9 700 0 0 Dec-12 HDB 0.90 2.8 160 0 10,080 Nov-12 HDB COMMERCIAL & residential sites 9 Yishun Ring Road / Yishun Avenue 9 COMMERCIAL sites 10 Venture Avenue (Jurong Gateway) 1.20 5.6 0 0 67,200 Dec-12 URA S/N location site area (ha) proposed gpr Estimated No. of Residential Units(i)(ii) Estimated No. of Hotel Rooms(i)(ii) Estimated Commercial Space (sqm)(ii) Estimated available Date(iii) Sales Agent reserve list residential sites 11 Alexandra Road / Alexandra View (Parcel B) 0.86 4.9 495 0 0 Sep-12 URA 12 Tampines Ave 10 (Parcel C) 2.30 2.8 680 0 0 Oct-12 URA 13 Tampines Ave 10 (Parcel D) 1.60 2.8 470 0 0 Oct-12 URA 14 Jurong West Street 41 / Boon Lay Way (Parcel B) 1.87 3.5 690 0 0 Nov-12 URA 15 New Upper Changi Road / Bedok South Avenue 3 (Parcel B) 2.69 2.1 595 0 0 Dec-12 URA 0.78 12.88 0 0 77,380 Dec-12 URA 0.77 4.2 0 785 4,850 Nov-12 URA COMMERCIAL sites 16 Cecil Street / Telok Ayer Street hotel sites 17 Victoria Street / Ophir Road (i) The estimated number of hotel rooms and dwelling units for some sites carried forward from 1H2012 Reserve List have been updated to take into account revisions to site areas. (ii) The actual number of housing units, hotel rooms and commercial space could be different from the estimated quantum depending on the actual plans of the developers in terms of mix of uses and the size of the housing units and hotel rooms. (iii) Refers to the estimated date the detailed conditions of sale will be available and applications can be submitted.