Abstract Let x. be the total claim amount of an insurance policy in

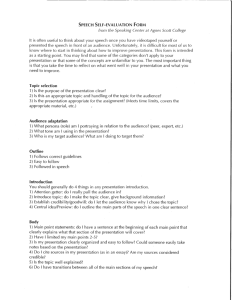

advertisement

- i -

Abstract

Let

x.J.

be the total claim amount of an insurance policy

in calendar year

i.

We assume that the

x.J. 's

are con-

ditionally independent given an unknown random parameter

e, and that

a..m(8)

J.

+[3.

J.

i.

J.

=

<P·

J.

V(m(8)) = 1

E(m(8)) ::: 0

for all

EV(x.l 8)

In the present paper it is under these assump-

tions shown how to calculate the credibility estimator of

m(8)

by recursive updating.

the unknown parameters

folio data.

described.

a..,

J.

We also give estimators for

s.,

J.

and

<P·J.

based on port-

Some generalizations of the model will be

Finally we mention some related models.

- 1 -

1.

Introduction

In credibility models of insurance experience rating it is

usually assumed that for a given policy the risk characteristics are generated by an unknown random parameter

8 descri-

bing how this policy may differ from other similar policies

in the portfolio.

In the simplest case we assume that the

total claim amounts from different years are conditionally

independent and

variance

identica~ly

s 2 (e), given

e.

distributed with mean

m(8)

and

The assumption of identical dis-

tribution is in many cases rather unrealistic.

important reason is inflation.

One very

And factors influencing the

risk may change; for instance, motor insurance claim amounts

may be influenced by improved roads and increased traffic.

In the present paper we shall modify the model by assuming

that the total claim amount from calendar year

a. m (e)+ B.

~

~

s~(e)

and variance

propose estimators for

~

~

has mean

given e , and we shall

a., 8. , and

~

~

!P.

~

= E(s~(e))

~

based

on portfolio data.

The model will be generalized into two directions:

1) to the case of estimating loss ratios and 2) to the case

when

2.

m(8)

develops randomly over time.

Preliminaries

2 A.

With a few minor exceptions we use the notation of

Sundt (1979a).

2 B.

Let

m

All displayed moments are assumed to exist.

be an unknown random variable.

(1)

We shall say

that an estimator

m

is a better estimator of

another estimator

m( 2 )

if

that is, we use quadratic loss.

m

than

- 2 -

Let

0

call an estimator

on

m

of

""

m

if

where

We shall

be observable random variables.

g 0 ,g 1 , ••• ,gn

m

m (based

may be written

are non-random numbers.

estimator of

m

m

x 1 , ••• ,xn).

(based on

a linear estimator of

will be called the

The best linear

~redibility

estimator of

A model with identical policies

3.

3 A.

We consider an insurance policy that has been in force

since calendar year

c

inclusive.

To get convenient nota-

tion we shall assume that one insurance year covers one

calendar year.

Let

policy in year

i.

x.

~

be the total claim amount of the

We shall assume that

xc,xc+ 1 , •••

are

conditionally independent given an unknown random parameter

e,

and that for all

i

E(x.j8)=a.m(8)+j3..

~

~

(1)

~

For the present we shall assume that the

are non-random numbers.

X.

~

1

S

Without loss of generality we let

<P. = EV(x. I e).

~

~

(2)

It is assumed that different

a.

are positively correlated, that is, that

tive for all

8.~ 's

and

~

V(m(8)) = 1.

E(m(8)) = 0

~ve introduce

a.'s

1.

is posi-

i.

Formula (1) says that the policy has a risk element

m(e)

that remains unchanged as time passes, and that the conditional means of the claim amounts are linear transformations of

m(e).

The coefficients and constant terms are the same for

all policies in the portfolio and can be estimated from

portfolio data.

An assumption like

E(x.j 8)

~

= a.m(8)

~

would

be natural to take care of inflation, and in (1) we have

- 3 -

added a constant term

3 B.

$.

1.

that gives further flesibility.

In this subsection we are going to describe how to

calculate

and

and

based on

xt, the credibility estimators of

xc, xc+ 1 , ... ,xt_ 1 .

m( e)

We are going to give

the formulae on recursive form as described in Sundt (1980a).

Let

yi

= (xi-8i)/ai.

given

e'

and

Then

yc,yc+ 1 , ...

are

in~ependent

E(y.!e) = m(8)

1.

As the

mt

yi's are linear transformations of the

must be the credibility estimator of

m(8)

X.' S,

1.

based on

yc, ... ,yt_ 1 , and formula (11) in Sundt (1980a) gives

q>t-1

wt-1 -2 at-1

,..,

mt =

q>t-1

2

a .L.. 1

Wt-1

y

+

<tJ t-1 t- 1

(f.'lt-1

Wt-1 +-2tVt-1 +--;at ... 1

at-1

.....

m = 0

c

we

We rewrite

wt =

mt =

(3)

( 3)

""'

(4)

mt-1

= 1•

and (4) as

Wt-1 t.pt- 1

(5)

2

at-1 Wt-1+tpt-1

2

a t-1 l/Jt-1

2

at-1 wt-1+qJt-1

xt-1- 8t-1

at-1

+

q>t-1

a2 1/J

+tp

t-1 t-1 t-1

mt-1

(6)

- 4 "'

mt'

we can easily find

When we have

by

( 7)

3 C.

The

~.'s

a.'s,

1

. B.'s,and

1

are supposed to be unknown

1

and therefore have to be estimated from portfolio data.

We

assume that we have a portfolio of independent policies that

satisfy the conditions of subsection 3 A and have the same

(a.,s.,~.)'s.

Suppose that klN

in both years

k

1

1

1

and

1~

claim amount of policy

and let

1

-

We introduce

klxj = klN

policies have been in force

in year

-1

klxij

j

denote the total

(i=1 , ... ,k 1 N;j=k,l).

kl

Li= 1 klxij"

The obvious estimator of

Bk

1s

Let

klN

= kl;r-1

i~ 1

<klxik-klxk><klxil-klxl).

We easily see that

k=l

k:t:l •

As

a2 =

k

a

rs

r<s<k, we estimate

for

A

ak

a rkask

=

ak

by

'

,/ir<s<k kwrsarkask

;

V Lr<s<k kwrs~rs

where the

W

k rs

instance choose

's

are non-random weights.

proportional to

rs

One could for

N.

~

5 -

can now be estimated by

....

"'

!Ck = akk -

3 D.

3 A-B.

"'

ak ·

Let us now return to the situation of subsections

vJe see that at the end of year

estimates of

( (l • ,

l

for i=c, ... , t-1

13 l• ' 'P.l )

described in the previous subsection.

~

mt

t-1

we can get

by the method

Hence we may estimate

by putting these estimates into (5) and (6).

we also need estimates

by (7) we see that to estimate

of

Unfortunatel~

and

However,

these quantities cannot be

estimated from the available data unless we introduce some

more structure.

The author believes that because of the

uncertainty by the choice of such structure it should be

used to construct estimators

s;

and

to be used only

in formula (7), but that in recursion (5)-(6) we should use

A

estimators

a., "'s., and

l

l

(p.

l

as developed in subsection 3 C.

The choice of additional structure seems to depend very

much on the actual situation, and we shall therefore restrict

ourselves to some vague general suggestions.

We shall for the rest of subsection 3 D assume that the

ai's and Si's are random variables independent of the

of the portfolio.

8's

Then all expectations and covariances

introduced in subsections 3 A-C becomes the analogous conditional quantitites given the

a l. ' s and Bl• ' s .

One possibility is to assume that

known parametric forms

a(i;y)

,...

and

E(a.) and

l

b( i; y).

E(B.) have

l

Then we may

A

find an estimator y

of the unknown parameter vector

y

"'

"'

based on the available

A

8t

by

a~= a(t;,r>

a.'s and B.'s and estimate

l

l

at

and

A

and 8~ = b(t;r).

Because of the appro-

ximative nature of the assumption of parametric forms

.,.. 6 -

a(i;y)

and

f"'<J

recent

-

we ought to give more weight to the most

b(i;y)

......

a.'s

and

~

"

than to the older ones when construe-

f3.~ ' s

....

ting the estimator y

.

f"'<J

The special case where the (a.,f3.)'s

are independent and

~

l

identically distributed, is closely related to the model

described in Sundt (1979b).

In this case we may estimate

and

"

B~ = Li<t twiei ,

where the

and

are non-random weights.

Another approach is to make some martingale assumption.

We shall give a few cases.

Suppose that {a.} is a martingale.

Then

~

.t =

and

~

This

t-1 would be a natural estimator of

solution seems intuitively very sound; as we have no data for

a.

a.'~

the next year, the best we can to is to use what we have found

for the present year.

estimate

et .

Nmv- let

gale.

The same approach could be used to

n i -- api

-

a~-'i-1

and assume that

{n·}

l

is a martin-

Then

( 8)

A

and

A

nt*

= 8t-1 - 8t-2 would be a reasonable estimator of

"

As st = nt + 8t-1 ' we estimate Bt by B~ = nt + 1\_ 1 =

"

= 2Bt_

1 -st_ 2 . The present martingale assumption can be

nt.

A

interpreted as a very weak assumption of linear trend in the

f3.~ 1 s.

An analogous approach could of course be used in the

estimation of

Now suppose that

gale.

Then

{o .}

~

given by

o.

~

=a./a. 1

~

~-

is a martin-

- 7 -

and

o~

= ~t-l/~t- 2

would be a reasonable estimator of

ot .

As

The quantity

oi

could 1JB thought of as a rate of inflation,

and the martingale assumption would then say that the expected

inflation of next year is equal to the inflation of the present

year.

If

8.l

is interpreted as rate of inflation, it would be

natural to assume that it is also related to the

e.'s.

l

Let

( 9)

Then

Bt

could be estimated by

A

A

The assumption (9) says, roughly speaking, that the expected

claim amounts of next year are equal to the expected claim

amountsof the present year increased by a multiplicative

inflation, and in addition we get an additive element, ~hich

according to our present knowledge has expectation zero.

As an intermediate case between (8) and (9) we could

assume that

Then

St

could be estimated by

- 8 -

3 E.

St

He have now proposed several estimators of

based on claim data from before year

t.

at

and

However, the

insurance company may also possess additional information

that ought to be incorporated into the estimators

S~.

a*

t

and

For instance, in motor insurance one ought to use greater

estimated values of

and

st

than indicated by the avail-

able data if it 1s known that the speed limits are to be in-.

creased in year

t.

And the company ought to incorporate

available prognoses about inflation.

3 F.

As we have seen in the two previous subsections,

there are several approaches that can be used to find estia~

mators

Bt•

and

Experience and knowledge would probably

give the actuary some idea that some of the approaches are

better than others in his actual situation.

the claim data from year

t

However, when

are available, one ought to

examine different choices of

a*

t

and

S~

approaches seem to be better than others.

and see if some

It

s~ems

that the

function

where the sum is taken over all policies that have been in

force in year

a~

S~

and

t, is useful in this connection5 the estimators

that minimize

Qt

would be preferable.

If this

analysis indicates that one approach of finding estimators

a~

8~

and

is better than the others, it would be natural

to use this approach for the estimators

Instead of

A

(a -a*)

t

t

Qt

and

one could of course minimize the functions

A

2

and

the estimated

minimize

Qt.

cst-8~) 2 , but as we essentially want to fit

Xt

Is

to the

xt's, it seems more natural to

- 9 -

4.

Credibility for loss ratios

4 A.

We shall now modify the model of Section 3 to credi-

bility estimation of loss ratios.

Our approach is a genera-

lization of a model by Blihlmann and Straub (Buhlmann &

Straub (1970); Blihlmann (1971)).

We consider an insurance portfolio that has been ceded

since calendar year

c

inclusive.

It is assumed that one

reinsurance year covers one calendar year.

direct insurance risk premium of year

reinsurance claims of the same year.

ratio of year

1

is

x. = s./p ..

l

l

l

1

Let

and

p.l

s.l

be the

the total

Then the observed loss

It is assumed that the xi's

are conditionally independent given an unknown random parameter

e, and that assumptions (1) and

are satisfied with positive

and

Let

and

based on

a.'s.

l

(2) of subsection 3 A

We further assume that

be the credibility estimators of

m( e)

xc, .•. ,xt_ 1 , and let

The situation is obviously the same as in subsection 3 B,

and we get

xt-1- 13 t-1

cp t-1

+

a

p

a 2 ,,,

t-1

t-1 t-1 '~"t-1

=0

=1

+~

¥t-1

- 10 -

4 B.

The difference from the model of Section 3 appears

when we are going to estimate the

(a·,"·,

]. JJJ. 1.0·)

. ]. 's

by data

from a portfolio of ceded portfolios as the different ceded

portfolios have different amounts of direct insured premiums.

We assume that we have a portfolio of independent ceded

portfolios that satisfy the conditions given in subsection 4A

I

and have the same

(a.]. ,e.]. ,tp.)

's.

].

Suppose that

folios have been ceded both calendar years

let

port-

and 1 , and

denote the observed loss ratio of Portfolio

klxij

J.n year

k

klN

(i = 1, ... 'kl N; j = k,l)

j

Let

klN

klxj = li=1 kl aij klxij '

where the

kl aij' s are non -random weights.

Then

k =1

:k=l=l

with

Let

where the constants

klbi

are chosen so as to satisfy

klN

Li=1 kl bi kl ci = 1 '

Then we have

k=l

k

*1

.

].

- 11 -

with

and

ak

may be estimated by

~

Ct

rs

are non-random weights, e.g. proportional

k wrs 's

I rs p r rs p s , tJhere

.,

where the

to

j

~

(j)k =

.

can now be estimated by

(j)k

~

= r,s

~2

Ctkk - Ctk

kc

•

As choice of

klaij

and

klbi

we propose

with

(cf. Sundt (1980b), subsection 3B).

As

kkN

v

E

i=1

~= kkN

E

i=1

is the best linear unbiased estimator of

available claim amounts (see Sundt (1978)).

based on the

we propose to

~

estimate

sk

kkN

~

13 k

12 -

by

kkpik

r

~z

~

kkxl.k

i=1 kkpik ak +r.pk

N

kk

kkpik

i~1 kkPik a~+ 0k

=

For estimation of

year

st

by claim data from before

t , we refer to subsections 3D-F .

.5. Estimation when

SA.

and

~

a

varies with time

In subsection 3A we assumed that the claim amounts

xc,xc+ 1 , ...

of an insurance policy depended on an unknown

random parameter

e •

a

(ac,ac+ 1 , ... ) of unknown random parameters

is a sequence

and that

x.

l

Now we are going to assume that this

depends on

a only through

e.l ,

that is, we

allow the individual risk characteristics of the policy to

change as time passes.

This is a very natural assumption;

e.g., in motor lnsurance a car owner's driving abilities are

not constant.

We shall assume that

xc,xc+ 1 , ...

are inde-

pendent glven

e , and replace assumptions (1) and (2) by

E(x.!a> =a. m(a.)+B.

l

l

l

l

E(m(e.))

l

= o

C(m(a.),m(a.))

l

J

= p I i-J· I •

(10)

Assumptions similar to (10) have been studied by Sundt (1980a).

It is assumed that the

a.'s

l

are positive, and that pE<0,1] .

- 13 -

In the same way as 1n subsection 3B we find

=0

SB.

= 1

We are now go1ng to develop estimators of the ai's,

e.'s,

1

~.'s,

1

and

p

•

Assume that we have a portfolio of

independent policies that satisfy the conditions given in the

previous subsection and have the same

-

Let

~

(a 1. , B1• ,<.p.1 ) ' s and

and let

k

=1

k

=I=

1 .

~

Bk

As for all

a

a

__r_-_3~'~r_-_1___r_-_2-L,r_

a r-3,r-2 a r-1,r

by

P~

I fr

ak ·

r

= a r-3,r

a

r-2,r-1

a r-3,r-2 a r-1,r

we suggest to estimate

p

a

where the non-random weights

proportional to

r- 3 ,r N •

= p2,

by

wr <a r-3,r-1 ar-2 ,r +a r-3 ,r

-; - 2 E w

a

r r r-3,r-2 r-1,r

_

•

be defined as in subsection 3C,

klN' klxj' Bk' and

We estimate

p

wr

a

r-2,r-1

).

'

could e.g. be chosen

-- 14

~

We also have

r

ak-3 k-2

= ak-1,k/~-3,k-~ ak-2,k-1

and may estimate

=~

ak-l,k

~k

I

ak

by

a

t

k-3,k-2

ak-3,k-1 ak-2,k-1 •

can now be estimated by

For the estimation of

by claim data from

and

before year t , we refer to subsections 3D-F.

SC.

As we in Section 4 nodified the model of Section 3

to estimation of loss ratios, we can do a similar extension

of the present model.

SA we then replace

In the model assumptions of subsection

EV(xi!a>

= mi

by

EV(xila>

= ~i/Pi

and

get

,,,'~'c = 1

=0

,....

X

t

We shall not go any further into this model.

§.

Conclusion. Related models

6A.

The methods treated in Sections 3 - 5 may seem a bit

inconsequent; at the end of year

of

Bi's

a.

and

1

B.1

t-1

we have estimators

assuming no connection between

a.'s and

1

from different years, but then for the estimation of

and

Bt

we suddenly introduce some structure.

The

- 15 -

reason for the introduction of this structure is, as argued

in subsection 3D, the need of additional assumptions to be

able to estimate

But as we do not feel too

and

confident about these assumptions, we are willing to use them

only when strictly necessary.

6B.

1

Alternatively, we may find it reasonable that for all

E(x.! 8) =

J.

X·'

b(8) ,

J. -

design vector, and

.

where

b(8)

~

y.

~J.

is a known non-random

is a vector function of

e .

Such

models were introduced in credibility theory by Taylor (1975)

and Hachemeister (1975).

Of later contributions to the theory

we mention Jewell (1975), Taylor (1977), De Vylder (1977,1978),

and Norberg (1980).

6C.

These regression models assume that different policies

are independent, and that time-heterogeneity occurs in accordance with known design vectors.

assume that to each calendar year

An opposite approach is to

J.

there is connected an

unknown random parameter

n.J.

folio in that year.

ni's are assumed to be independent

The

that influences the whole port-

and identically distributed, and for a policy with random

risk parameter

e and the

function

year.

e

n.J. 's

F<·l •,•)

the conditional distribution of

is of the form

J.S

F<·le,nt),

given

where the

independent of the policy and the

Such models may describe cases where purely random

elements influence the whole portfolio; e.g., in motor insurance a winter with extremely icy roads may lead to many

accidents.

Models of this sort have been treated by Welten

(1968) and Sundt (1979b).

- 16 -

fl.cknowledgement

The present research was supported by Association of

Norwegian Insurance Companies and the Norwegian Research

Council for Science and the Humanities.

References

Buhlmann, H . . (1971).

Credibility procedures,

Proceedings

of the 6th Berkeley symposium on mathematical statistics

and probability, Vol.1, pp. 515-525.

University of

California Press, Berkeley and Los Angeles.

Buhlmann, H. & Straub, E.

(1970).

Glaubwurdigkeit fur

Schadensatze. Mitteilungen der Vereinigung schweizerischgr

Versicherungsmathematike, 2Q, 111-133.

De Vylder, F. (1977).

distributionfree

Optimal parameter estimation in semicredibility theory.

Paper presented to

the 13th ASTIN colloquium in Washington D.C.

De Vylder, F. (1978).

theory.

Parameter estimation in credibility

ASTIN Bulletin 10, 98-112.

Hachemeister, C.A. (1975).

Credibility for regression models

with application to trend.

In Credibility: Theory and

applications (ed. P.M. Kahn), pp. 129-163.

Academic Press,

New York.

Jewell, W.S.

(1975).

Bayesion regression and credibility

theory.

RM-75-63.

International Institute of Applied

Systems Analysis, Laxenburg, Austria.

Norberg, R. (1980).

Empirical Bayes credibility.

Submitted

for publication 1n Scand. Acturial J.

Sundt, B. (1978).

On models and methods of credibility.

Statistical Research Report 1978-7.

Institute of Mathe-

matics, University of Oslo.

Sundt, B. (1979a).

model.

A hierarchical credibility regression

Scand. Actuarial J. 107-114.

- 17 -

Sundt, B. (1979b).

An insurance model with collective

seasonal random factors, Mitteilungen der Vereinigung

schweizerischer Versicherungsmathematiker 79, 57-64.

Sundt, B. (1980a).

Recursive credibility estimation.

Submitted for publication in Scand. Actuarial J.

Sundt, B. (1980b).

models.

Parameter estimation in some credibility

Statistical Research Report 1980-6.

Institute of Mathematics, University of Oslo.

Taylor, G.C. (1975).

loss ratios.

Credibility for time-heterogeneous

In Credibility: Theory and applications

(ed. P.M. Kahn), pp. 363-389.

Taylor, G.C. (1977),

Academic Press, New York.

Abstract credibility.

Scand.

arial J. 149-168.

Welten, C.P. (1968).

ASTIN

Bulletin~'

The unearned no claim bonus.

25-32.

Actu~·