Planning Solutions

Supplemental Executive Retirement Plans

Business owners can use nonqualified plans such as the Supplemental Executive Retirement Plan (SERP) to create specially

designed benefits to recruit, retain, or reward select employees. SERPs are flexible and can be tailored to meet specific

needs of the employer or the executive, and also be used to overcome the effects of “reverse discrimination” associated

with contribution limits for qualified plans.

In a SERP, the employer promises to pay an executive a future benefit, structured as a single payment or as a series of

payments which typically commence at the executive’s retirement or upon the executive’s death. The benefit amount

typically can be based on years of service, reaching retirement age, or at death. The executive does not pay income

taxes until the benefits are paid out. Businesses will typically purchase a life insurance policy to provide funds that will

be needed to pay the promised benefits. These plans are subject to the requirements of IRC § 409A.

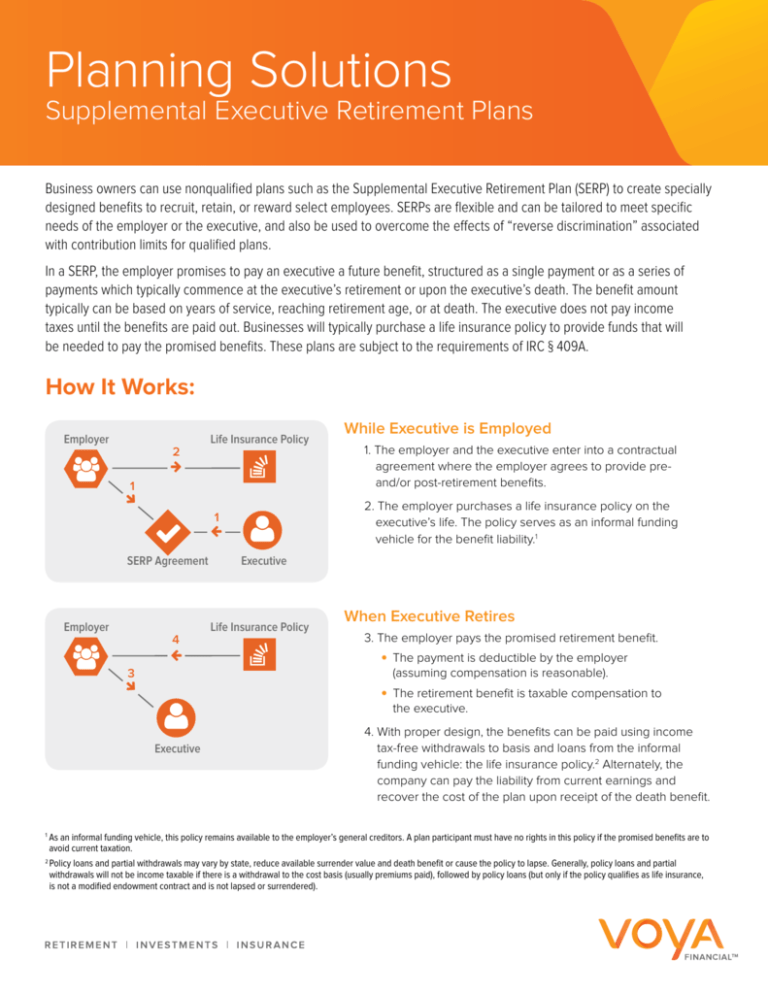

How It Works:

Employer

SERP Agreement

Employer

4

3

Executive

1

While Executive is Employed

1. The employer and the executive enter into a contractual

agreement where the employer agrees to provide preand/or post-retirement benefits.

2. The employer purchases a life insurance policy on the

executive’s life. The policy serves as an informal funding

vehicle for the benefit liability.1

1

2

Life Insurance Policy

Executive

Life Insurance Policy

When Executive Retires

3. The employer pays the promised retirement benefit.

he payment is deductible by the employer

T

(assuming compensation is reasonable).

The retirement benefit is taxable compensation to

the executive.

4.With proper design, the benefits can be paid using income

tax-free withdrawals to basis and loans from the informal

funding vehicle: the life insurance policy.2 Alternately, the

company can pay the liability from current earnings and

recover the cost of the plan upon receipt of the death benefit.

s an informal funding vehicle, this policy remains available to the employer’s general creditors. A plan participant must have no rights in this policy if the promised benefits are to

A

avoid current taxation.

2

Policy loans and partial withdrawals may vary by state, reduce available surrender value and death benefit or cause the policy to lapse. Generally, policy loans and partial

withdrawals will not be income taxable if there is a withdrawal to the cost basis (usually premiums paid), followed by policy loans (but only if the policy qualifies as life insurance,

is not a modified endowment contract and is not lapsed or surrendered).

1

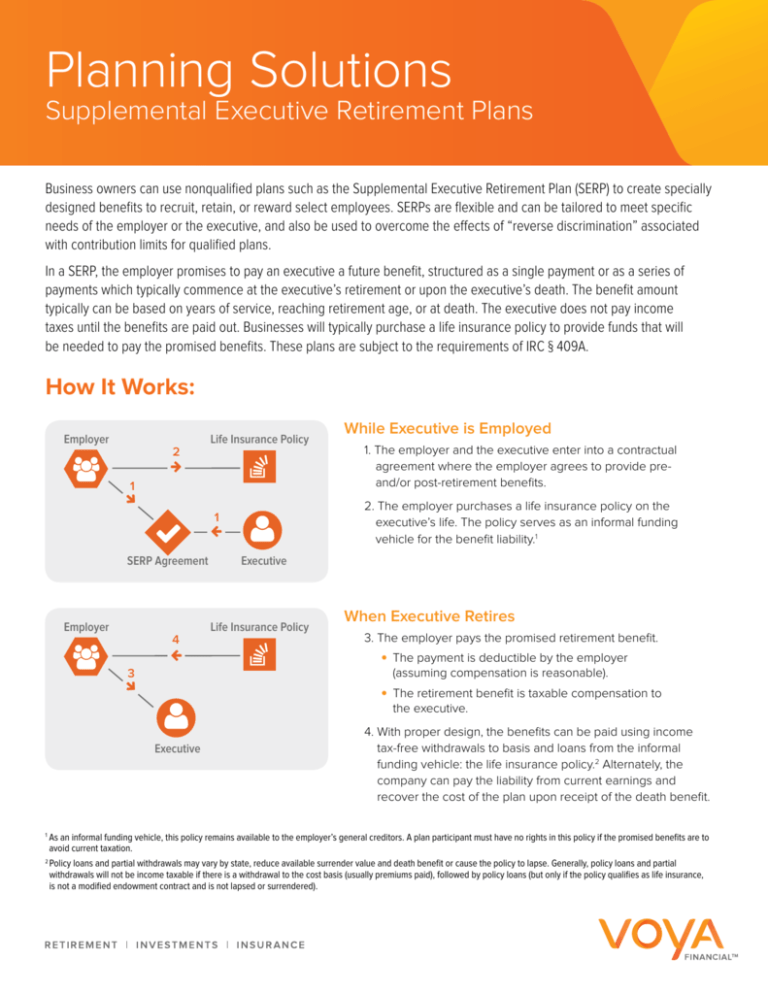

Employer

5

Life Insurance Policy

6

If the Executive Dies Prior to Retirement

5. The policy pays an income tax-free death benefit to

the employer.3

6. The employer pays any benefit owed to the executive’s

heirs. This payment is deductible by the employer and is

taxed as ordinary income to the heirs.4

Executive’s Heirs

or Estate

3

Death benefits from life insurance will be received income tax free if the policy purchase complies with the requirements of IRC Section 101(j), including the written notice and

consent provisions for the insured. May be subject to corporate alternative minimum tax (AMT).

4

Compensation which was earned by the decedent but not included in his taxable income for the year of death is income in respect of a decedent (IRD).

These materials are not intended to and cannot be used to avoid tax penalties and they were prepared to support the promotion or marketing of the matters addressed in this

document. Each taxpayer should seek advice from an independent tax advisor.

The Voya™ Life Companies and their agents and representatives do not give tax or legal advice. This information is general in nature and not comprehensive, the applicable laws

change frequently and the strategies suggested may not be suitable for everyone. You should seek advice from your tax and legal advisors regarding your individual situation.

Life insurance products are issued by ReliaStar Life Insurance Company (Minneapolis, MN), ReliaStar Life Insurance Company of New York (Woodbury, NY) and Security Life of

Denver Insurance Company (Denver, CO). Variable life insurance products are distributed by Voya America Equities, Inc. Within the state of New York, only ReliaStar Life Insurance

Company of New York is admitted and its products issued. All are members of the Voya™ family of companies.

Not FDIC/NCUA Insured | Not A Deposit Of A Bank | Not Bank Guaranteed | May Lose Value | Not Insured By Any Federal Government Agency

©2014 Voya Services Company. All rights reserved. CN0312-16136-0417

116709 09/01/2014

Voya.com