Valuation & Analysis

advertisement

Valuation & Analysis

Clay Mauldin

clayton.mauldin@ttu.edu

Alex Orr

alex.orr@ttu.edu

Kevin Beck

kevin.beck@ttu.edu

Chance Turner

jordan.c.turner@ttu.edu

Dane Chambless

dane.chambless@msn.com

1

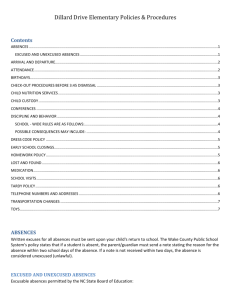

TABLE OF CONTENTS

Executive Summary

3

Overview of Dillard’s, Inc.

6

Industry Overview & Analysis

10

Value Chain Analysis

14

Competitive Advantage Analysis

15

Accounting Analysis

17

Ratio Analysis

25

Cross-Sectional Analysis

26

Financial Statement Forecasting

45

Cost of Capital Estimates

46

Method of Comparables

48

Intrinsic Valuation Models

51

Credit Risk Analysis and Z-Score

55

Appendix 1

57

Appendix 2

63

Appendix 3

73

References

77

2

Executive Summary________________________________________

Investment Recommendation: Overvalued, Sell (4/1/07)

Dillards

DDS - NYSE

52-Week Range

Revenue (2006)

Market Cap.

Shares Outstanding

$35.50

25.36-36.47

7,810,067

2.78 Billion

81,533

Dividend Yield

Average Trading

Vol.

Altman Z-Score:

0.49%

1,175,270

DDS

EPS Forecast

FYE

2007

EPS

235,527

2008

238,389

2009

241,313

Ratio Comparison

Trailing P/E

Forward P/E

Dillard’s

$23.98

$32.15

Industry

$18.91

$23.38

$23.55

$1.07

$19.11

$1.13

Forward PEG

M/B

3.32

Book Value Per

Share

ROE

ROA

Est. 5-year EPS Growth Rate

Valuation

Estimates

Actual Current Price

$32.28

5.23%

2.13%

5.05%

Cost of Capital

Est.

R2

Beta

Ke

Ke Estimated

3-Month

1-Year

5-Year

7-Year

10-Year

Published

0.0855

0.0855

0.0855

0.0855

0.0855

0.9029

0.9029

0.903

0.903

0.9031

0.95

10.76%

10.77%

10.87%

10.40%

11.02%

Kd

WACC

6.80%

8.58%

3

34.40**

Ratio Based Valuations

P/E Trailing

$16.23

P/E Forward

Enterprise Value

$15.45

$55.58

Intrinsic Valuations

Discounted Dividends

Free Cash Flows

Residual Income

Abnormal Earnings Growth

$1.48

$14.90

$12.71

$8.91

2010

244,301

Dillard’s is one of the largest department store retailers in the nation. The firm

specializes in offering a broad selection of men’s and women’s clothing and

accessories, as well as cosmetics, furniture, and cookware. Dillard’s has several

direct and indirect competitors in the industry including; Federated Department

Stores, Saks, Inc., JC Penney, Nordstrom’s, and Neiman Marcus. Dillard’s

competes in the industry by maintaining its competitive advantage of offering

brand name products at competitive prices with greater customer satisfaction.

The accounting strategies of Dillard’s are important when valuing the firm.

Through accounting disclosures in the 10-K, Dillard’s exhibits a moderately

conservative approach towards accounting. Dillard’s accounting policies are

displayed accurately, as well as honestly throughout the firm’s 10-K. Changes in

policies are effectively communicated to outside parties. Dillard’s uses accounting

policies that are common of the industry, as well as policies that adhere to

Dillard’s key success factors. Inventories are stated at cost and managers have

the accounting flexibility to enforce mark ups and mark downs in accordance

with the firm’s current sales. This allows the firm to maximize revenues from

inventories and liquidate overstocked merchandise. Dillard’s recently raised their

pension rate in an effort to prevent understating pension expense. This is a

conservative move by management not common within the industry. JC Penny’s,

Dillard’s main competitors uses similar accounting strategies that reflect a

consistency within the industry. Dillard’s uses conservative strategies to reflect

accurate information to shareholders. This honest approach is consistent

throughout Dillard’s financial statements. Dillard’s continues its honesty with

more than satisfactory disclosures in the footnotes of their SEC statements that

show investors and auditors accurate details of the accounting policies used.

By calculating the core financial ratios, we are able to directly compare Dillard’s

performance with other competitors within their industry. We computed ratios to

determine the liquidity, profitability, and the capital structure of the firm.

4

Dillard’s debt service margin is favorably higher than their competitors which

exhibits their ability to control their debt. The steady increase in the debt service

margin for the firm indicates that Dillard’s has less pressure to use its cash flows

from operations to finance its liabilities. Dillard’s has also worked towards a

lower debt to equity ratio as well. A declining debt to equity ratio year to year

would be a favorable impact for the company. The debt to equity ratio states

that a firm has a certain amount of liabilities for every dollar of owners’ equity.

The main reason why this is possible is due to Dillard’s ability to lower their total

liabilities. Dillard’s also showed high rates of return on equity between 2004 and

2005 because total assets and total liabilities declined at a constant rate to keep

equity equal to the previous year. This illustrates a higher profitability by

maintaining a constant level of equity invested into the firm.

Our forecast valuations for Dillard’s were calculated 10 years into the future, to

ultimately evaluate Dillard’s future performance. Through our forecasting, we

were able to determine that Dillard’s is maintaining constant stable growth. The

values we forecasted helped us with the intrinsic value calculations. Then,

through our valuations, we were able to conclude if Dillard’s was under, over, or

fairly valued compared to its current market price.

After each of the intrinsic values was computed, we came to the conclusion that

Dillard’s is highly overvalued. The discounted dividends model was the poorest

valuation to predict the estimated value per share. This model was inaccurate

because dividends do not do a fair job of evaluating the market price of a firm.

The residual income, abnormal earnings growth, and the free cash flows models

were the primary valuation models that we relied on in determining Dillard’s

overall value. All three models consistently showed that Dillard’s current stock

price is inflated by around $20.

5

OVERVIEW OF DILLARD’S, INC._______________________________

Dillard’s, Inc. is among the nation’s largest fashion apparel and home furnishings

retailers in the department store industry. The 330 Dillard’s store locations offer

a broad selection of name brand men’s and women’s clothing, accessories,

cosmetics, cookware, and home furniture. Dillard’s was incorporated in

Delaware in 1964 after the first store opening in 1938. Over the next forty-two

years, the firm has expanded over twenty-nine states with fifty-one stores being

located in the western U.S., 124 in the eastern region, and the remaining 155

located in the central region of the U.S.

Competitors

Dillard’s operates in the high end retail department store industry. Its direct

competitors include Federated Department Stores, Saks Inc, Nordstrom’s,

Neiman Marcus, and JC Penney. However, the broad array and diversity of

department store products allows for many indirect competitors, such as large

and local retail, outlet, and furniture stores to challenge as substantial threats to

firms within the industry. Under these conditions, the industry is a highly volatile

and competitive sector characterized by reputation, advertising, price, and

quality. Dillard’s focuses primarily on extensive customer service and maintaining

brand loyalty through exclusive upscale contemporary choices.

Market Capitalization

Currently, Dillard’s holds a market capitalization of 2.8 billion compared to an

overall industry capitalization of 18.28 billion. Dillard’s ranks second among the

direct top competitors in market capitalization. Federated benefits from a much

larger capitalization at 21.69 billion due to the coalition between Macy’s and

Bloomingdale’s Department Stores under the same umbrella corporation. Sears,

Kohl’s, and TJX Companies actually acquire a larger share of the market

capitalization but are not considered to be direct competitors of Dillard’s.

6

5 year Sales Volume & Growth

Dillard’s sales depend greatly on the success of the last quarter of the fiscal year

due to the holiday season. Sales for the fourth quarter on average are

approximately one-third of annual sales. Overall, total salves volume has

decreased from 2001-2004 with a slight increase in 2005 by approximately

$36,000. Along with sales, assets have decreased significantly over the past five

years by a total of about $1.5 million in total asset deduction.

Table 1: Dillard’s

Year

Net Sales

($)

Total Assets

($)

%Change

in Net Sales

2001

8,154,911,000 7,199,309,000

-

%Change

in Total

Assets

-

2002

7,910,996,000 7,074,599,000

(3.00)

1.73

2003

7,598,934,000 6,675,932,000

(3.94)

5.63

2004

7,528,572,000 5,691,581,000

(0.93)

14.74

2005

7,560,191,000 5,516,919,000

.42

3.07

In recent years, Saks, Inc. has shown a steady decrease in net sales and total

assets with the exception of 2004. Nordstrom’s total assets and net sales have

grown considerably in recent years. Neiman Marcus also shows growth in these

two categories.

7

Table 2: Saks, Inc.

Year

Net Sales

($)

Total Assets

($)

5,050,611,000

%Change

in Net

Sales

-

%Change

in Total

Assets

-

2001

6,581,236,000

2002

6,070,568,000

4,595,521,000

(7.76)

(9.01)

2003

6,055,055,000

4,579,356,000

(0.26)

(0.35)

2004

6,437,277,000

4,709,014,000

6.31

(2.83)

2005

5,953,352,000

3,850,725,000

(7.52)

(18.23)

Table 3: JC Penny’s

Year

8

Net Sales

($)

Total Assets

($)

2001

17,384,000,000 17,787,000,000

%Change

in Net

Sales

-

%Change

in Total

Assets

-

2002

17,513,000,000 18,300,000,000

.3

2.88

2003

18,096,000,000 14,127,000,000

3.7

(2.28)

2004

18,781,000,000 12,461,000,000

3.8

(11.7)

2005

19,903,000,000 12,673,000,000

6.3

1.7

Table 4: Nordstrom, Inc.

Year

Net Sales

($)

Total Assets

($)

2001

5,607,687,000

%Change %Change

in Net

in Total

Sales

Assets

4,084,356,000

-

2002

5944,656,000

4,185,269,000

6.01

2.47

2003

6,448,678,000

4,569,233,000

8.48

9.17

2004

7,131,388,000

4,605,390,000

10.59

0.79

2005

7,772,860,000

4,921,349,000

9.0

6.86

Table 5: Neiman Marcus

Year

9

Net Sales

($)

Total Assets

($)

%Change %Change

in Net

in Total

Sales

Assets

-

2001

3,015,534,000

1,785,870,000

2002

2,948,332,000

1,907,546,000

(2.22)

6.81

2003

3,080,353,000

2,034,430,000

4.48

6.65

2004

3,524,771,000

2,617,648,000

14.43

28.67

2005

3,821,924,000

2,660,660,000

8.43

1.64

Stock Price Performance

The stock price for the firm since the beginning of January 2003 seems to be on

a steady climb after an apparent volatility in the year of 2002. After studying the

industry, the three main competitors seem to be following the same price trend.

5 FORCES MODEL__________________________________________

The five forces model is the basis of assessing the profit potential of the industry

in which a firm is competing. The factors that affect profitability in the industry

include the degree of actual and potential competition. This is classified by rivalry

among existing firms, threat of new entrants, threat of substitute products, and

bargaining power in input and output markets described by bargaining power of

buyers and suppliers.

Rivalry Among Existing Firms

The high-end retail industry is a very competitive industry. Firms must find a way

to differentiate themselves from their high-end competitors. The industry has

been growing over time and existing firms have become larger and larger. Due

to the size of the large firms, they dominate the market. Nordstrom Inc. holds a

market share in this industry at 12.95 Billion. Federated Department Stores holds

a 22.13 Billion market share. This market is dominated by the main firms of the

industry, Nordstrom’s Inc, Federated, Saks, Dillard’s and Neiman Marcus. The

10

only way to gain market share is to take it away from other players. With an

increasing demand for designer products firms must rely on their credibility and

authenticity of their products. The major firms also face competition from smaller

stores. These stores compete on reputation, fashion, advertising, price, quality,

service, and credit availability. However, it is anticipated that the most intense

competition will continue to be on price. Switching costs in the industry are

relatively low. Most firms sell the same brands and models. This allows consumer

switching cost to be very low. This causes firms to rely heavily on personal

customer service as well as price to hold their market share. All of the main firms

in the industry have expanded their sales to the internet. This is way of offering

more personal customer service. Internet sales have helped these firms increase

net sales and have given larger firms an edge against smaller retail competitors.

With all of the competitive advantages held by larger firms in the industry they

mainly compete with one another. For this reason, we conclude that the rivalry

among existing firms in the high-end retail-department store industry is very

high. Firms in this industry must be large to maintain and must find a way to

differentiate themselves from competitors.

Threat of New Entrants

Economies of scale are important in determining business strategy when entering

a new industry. When there are large economies of scale, new entrants face a

difficult decision to enter such a competitive industry. They either have to invest

in a large capacity which may not be immediately utilized or enter with less than

optimum capacity. It is very difficult for a new firm to compete with Dillard’s,

Saks, Nordstrom’s, or Neiman Marcus. In the high end retail-department store

industry supply surpassed demand. This excess capacity favors larger firms that

can sustain operations with reduced margins. Larger firms usually have

substantially larger marketing budgets; which provides them with a competitive

advantage. The large direct competitors in the industry produce large economies

of scale. This puts smaller firms at a disadvantage because they are not able to

11

obtain prices offered to larger firms by suppliers. An advantage to new entrants

is the possibility of utilizing the internet. Online companies avoid rental and

facility cost which can allow for competitive pricing. However, the inability to

offer consumers a tangible product before purchase can decrease the

attractiveness of online shopping. Internet sales still struggle to come anywhere

close to store sales in the industry.

Since the industry is driven by high price competition it is extremely hard to

generate a first mover advantage. Many larger firms have exclusive rights to

manufactures. For example, Dillard’s holds exclusive agreements with Antonio

Melani, Gianni Bini, and Daniel Cremieux. These exclusive rights are the result of

an initial action to establish market share. The relationships between large high

end firms and manufacturer’s make it very hard for new entrants to access

channels of distribution and break into the market. It is because of this that we

conclude the threat of new entrants to be very low.

Threat of Substitute Products

The high-end retail Industry is definitely one that competes on price. There is a

high degree of a customer’s willingness to substitute products. Most all of

Dillard’s competitors carry the same lines of clothing. This causes little variation

in the products that consumers are looking for. It proves that Dillard’s, and other

firms, have to compete on price, or they will experience a loss in customer base

and market share. For example, designer label clothing commands a price

premium even if it is not superior in terms of basic functionality because

customers place a value on the image offered by designer labels. So, in order for

firms to keep their customers, they must keep prices at a competitive level along

with a high degree of customer service. In this industry, there will not be much

of a difference in the price between competing stores. Therefore, as stated

before, Dillard’s will have to provide their customers with all of the extras that

come with shopping at their store. In recent quote, William T. Dillard said, “Our

12

companies main goal in this business is not to provide the lowest price products.

That is not our goal at all. Our goal is to beat our competitors with superior

customer relations and an outstanding product.” The threat of substitute product

in this industry is very high. Without offering the customer service, customers

will easily be willing to switch products.

Bargaining Power of Buyers

There are two factors that determine the power of buyers including price

sensitivity and relative bargaining power. Price sensitivity refers to the extent to

which buyers care to bargain on price. Relative bargaining is the extent to which

they will succeed in forcing the price down. As stated before, this high-end

industry competes heavily on price. However, since some firms introduce their

products as being differentiated, customers are not that sensitive to price

increases. Most all of Dillard’s products are clothing lines that are offered by all

of their competitors. This causes a high degree of price sensitivity which drives

prices down. Considering these factors, it is easy to see that buyers have quite a

bit of bargaining power. One factor that might lessen the amount of bargaining

power is the wide variety of products Dillard’s carries. With all of these factors

considered, we consider the bargaining power of buyers to be relatively high.

Bargaining Power of Suppliers

The bargaining power of suppliers can prove to be a very powerful tool when

there are only a few companies and few substitutes available to their customers.

This is not the situation with the high end retail industry. The numerous amounts

of competing firms and various product lines restrict supplier’s ultimate power.

The supplier’s need the big name firms to maintain, more than the big firms

need the single supplier. Firms develop relationships with suppliers to receive low

prices. High prices from suppliers result in high prices to the consumer, and

lower margins to firms like Saks, Neiman Marcus, and Nordstrom, Inc. Since

firms compete on price, developing relationships with these large firms is

13

essential to suppliers. Many large firms operate under the belief that they should

never be dependent on one supplier. For example, last year Dillard’s ordered no

more than 5% of its inventory from a single supplier. With all of these factors

considered, we believe the bargaining power of suppliers to be relatively low.

Competitive Force

Conclusion

Rivalry Among Existing Firms

Very High

Threat of New Entrants

Low

Threat of Substitute Products

High

Bargaining Power of Buyers

High

Bargaining Power of Suppliers

Low

VALUE CHAIN ANALYSIS_____________________________________

High end retail department stores compete in a highly competitive market based

on price. Although their retail department stores are in shopping malls, they have

to compete on national and local levels. Competitors compete on many different

strategies including differentiation and outstanding customer service. Firms in

this industry must find a way to differentiate themselves in order to gain profits.

Dillard’s sells its products slightly cheaper than other high end stores like

Nordstrom’s or Saks. Nordstrom’s and Saks attempt to make the shopping

experience more elegant and enjoyable. They appeal to the consumer who is

willing to spend a little more in order to have a lavish shopping experience. All

high end retailers in this industry make sure that their products are of the

highest quality. Firms really focus on enhancing in the in-store experience to add

value to their products.

14

High end retailers also focus on offering a wide selection of merchandise. The

more merchandise they have, the more people they can appeal to. Many of the

firms in the industry offer the same types of products. A firm can stand out when

its merchandise selection exceeds that of a competing firm. Again switching cost

is low, so presentation and a large merchandise selection can add value to a

firm.

COMPETITIVE ADVANTAGE ANALYSIS__________________________

Dillard’s believes that they are in a strong competitive position with regard to a

various number of factors. These factors include location, reputation,

assortment, advertising, price, quality, service, and credit availability. Dillard’s is

constantly seeking new ways to separate itself from the rest of their competition.

They try to position their stores in such a way that attract new customers, who

are excited about the manner in which Dillard’s operates its stores. Dillard’s can

also compete by obtaining new clients, while working to maintain its existing

clientele. They constantly work to expand and improve their product lines for

their customers.

Due to the expansive pricing budget of its competitors, Dillard’s has had to

reduce prices and reduce margins. The retail merchandise business has

fluctuated due to some of the changes in the local and national economic

conditions and has changed consumer preferences and spending patterns.

Dillard’s differentiation allows them to provide more distinct products and

services that are valued by their customers. They invest heavily in brand image,

offer superior product quality, and have superior customer service. In all 330

stores, Dillard’s provides its customers brand names such as Polo, Coach, and

Daniel Cremieux. Throughout every department in each Dillard’s store,

employees try to foster a brand image of strength, status, and reliability.

According to a poll on www.epinions.com, Dillard’s customer service has been

ranked in the top five in its industry since 1983. Dillard’s upholds their superior

15

customer service name by offering twenty-four hour online support as well as

customer service departments in each store. Dillard’ also allows other

independent firms to run certain departments where specialization, focus, and

expertise is critical. Throughout our history Dillard’s has been able to acquire

knowledge in each of their trade areas and customer bases, which gives

consumers full knowledge of the product they are buying. Dillard’s has expanded

and integrated vertically by establishing a vast source of suppliers. In doing so, it

has afforded itself not only the opportunity to provide a higher quality of

products, but also greater control over the merchandise it sells.

Another competitive advantage of Dillard’s is the issuance of all proprietary credit

cards to their customers and the making of all credit card loans. As a customer,

ownership of a card provides them the ability to receive monthly discounts on a

variety of discount products. This also bodes well for Dillard’s having a steady

inflow of frequent customers. In November of 2004, Dillard National Bank was

bought out by GE Consumer Finance whose already established company

acquired all of the existing credit card accounts. In conjunction with the sale,

Dillard’s experienced an income of $83.9 million. According to Dillard’s 10k, they

became a more focused retailer and used the proceeds generated from the sale

and ongoing compensation to strengthen their balance sheet and return value to

their shareholders.

Dillard’s dedication to their customer service, competitive pricing, and variety of

products will continue to keep them competitive in the industry. Dillard’s is

always looking to expand by opening new stores, keeping its product lines up to

date, and keeping its name associated with superior quality.

16

Accounting Analysis________________________________________

It is important for any company’s accounting practices to reflect the goals of the

company. Investors should be able to easily decipher and interpret the

information disclosed by the company. Companies in each industry compete with

different strategies and different policies. How they account for these policies

financially is of great interest to the investor.

A goal of accounting analysis is to see if the firm’s accounting practices capture

current and prospective financial actions of the company. We will also look at

how these financial actions relate and support Dillard’s key success factors.

Dillard’s, in the department store industry, competes on product quality,

competitive pricing, and extensive customer service. We have identified the

following key success factors whose fluctuations have a significant impact on its

operating results.

As stated in our five forces model, Dillard’s is a company that competes on price

and differentiation. Dillard’s offers quality merchandise at a slightly lower cost

than its other high end competitors. Using mark downs Dillard’s is able to

manage its inventory and avoid being overstocked. Managers must also watch

spending on SG&A. Dillard’s, having a lower marketing budget than most of it’s

competitors, must find a way to sell it’s merchandise while incurring minimal

SG&A expenses. Maintaining revenues, cash flows, and store growth are also

key factors necessary for the continued success of Dillard’s.

Key Accounting Policies

The fashion industry has escalated over the last five years. An increase in

demand for designer brand products has sent department stores sales very high.

Since Dillard’s relies on their high-quality products, their revenues are steadily

increasing. Consumers are willing to pay a good price for a quality product.

Dillard’s recognizes revenue at the “point of sale.” The company also recognizes

17

an allowance for sales returns that are recorded as a component of net sales in

the period in which the related sales are recorded. Dillard’s is also very profitable

in their sale of gift cards. This is an effective strategy to help Dillard’s predict

future revenues and anticipated inventory sales. Preparing for fashion and

industry trends plays a huge role in Dillard’s attempts to manage its inventory.

According to our key success factors Dillard’s must control its inventory. Dillard’s

mainly uses upscale merchandise at a low cost which helps maintain lower

inventories. Since Dillard’s is part of the department store industry, inventory

management is essential. This requires Dillard’s to have low input cost in

inventory. In addition, Dillard’s incurs low distribution cost to transport their

products from manufactures to consumers. Keeping just enough inventory to

display in stores helps avoid expenses incurred with stock piling inventory.

Roughly 98% of Dillard’s inventory is accounted by using the Retail Inventory

LIFO method. The remaining 2% of the inventory is valued by the retail

inventory method (RIM). RIM is a method used by retailers to value inventory

with a physical count by converting retail prices to cost. This method requires

Dillard’s to keep the total cost and retail value of goods purchased and available

for sale, and also sales for the period. Additionally, RIM will result in valuing

inventories at LCM if markdowns are currently taken as a reduction of the retail

value. Dillard’s merchandise inventory has steadied between 1.6 and 1.8 million

over the last five years. In comparison with two industry competitors, this figure

fits right in the middle. JC penny reported inventory at 3.4 million in 2006, and

Saks, Inc. reported inventory around 800,000.

Revenue is accounted for at the point of sale. Allowance for sales returns are

recorded under nets sales in the period in which the sales are recorded. The

firm’s provision for sales returns varies upon prior evidence of its return rate. The

allowance for sales returns during 2006, 2005, and 2004 was 7.7 million, 7.6

million, and 6.3 million respectively. Gift cards and other credit accounts are also

18

recognized during the time of sale, and the liability is decreased upon

redemption. Any remaining balance of the liability is amortized over a 36 month

period and recorded as a reduction of cost of sales.

Property and Equipment is stated at cost and is depreciated using the straight

line method of its estimated useful life. The buildings owned by the firm have an

estimated useful life of 20-40 years. Furniture, fixtures, and other equipment

only utilize a useful life of 3-10 years. Depreciation for 2006 was estimated at

$300 million which only differed slightly from 2005’s actual depreciation of $302

million. This minor differentiation between the estimated and actual cost of 2005

and 2006 shows that Dillard’s tends to keep its depreciation in accordance with

the previous year’s actual depreciation cost. The related rental expense of 62

operating lease stores is recognized over the lease term under a straight-line

basis. The difference between the amounts charged to expense and the rent

paid are recognized as deferred rent liability. Currently, a balance of $200 million

remains in operating leases and $31 million remains is capital leases as of 2006.

Cash flow from operations is a primary source of liquidity that is adversely

affected when the industry faces market driven challenges and new existing

competitors seek areas of growth to expand their business. If the firm does not

sell sufficient quantities of merchandise, they respond by taking markdowns. If

they have to reduce prices, the cost of goods sold on the income statement will

equally rise, thus reducing income. Dillard’s success is also dependent upon

brand image and predicting customer’s fashion preferences. Dillard’s will need to

identify suitable markets and locations to ensure success when opening new

stores.

Dillard’s did raise the discount rate the company uses for determining future

pension obligations. The rate increased to 5.6% in 2006 from 5.5% in 2005. The

increase in amounts set back for pension funds is a conservative move by

19

Dillard’s. Many firms in the industry have had problems when under estimating

pension obligations. Dillard’s is attempting to prevent any unexpected loss in

revenues as a result of under estimating future pension expenses.

Accounting Flexibility

The FASB imposes certain accounting standards and policies in accordance with

Generally Accepted Accounting Principles (GAAP). However, GAAP allows a broad

view of flexibility for managers of a firm to report an accurate fair market value

of estimations on several accounting policies. Dillard’s has a great deal of

flexibility when reporting its inventory. This is ideal for the industry because of

the ever changing demand for department store merchandise.

Dillard’s success depends greatly on selling of retail merchandise. Retail sales are

the key operating cash component providing 98.1% and 96.3% of total revenues

over the past two years (Dillard’s 10-k). If sufficient quantities of inventory are

not sold Dillard’s uses markdowns. Retail markdowns increase Dillard’s cost of

goods sold, but it is necessary in-order to liquidate inventory. Since Dillard’s

competes on the basis of high quality, investing in high amounts of inventory

reduces the rate of product failure. To account for this Dillard’s uses a flexible

accounting system for inventories.

Using the LIFO inventory method for 98% of inventories allows Dillard’s to value

most of their inventory at the lower of cost or market. LCM allows managers the

flexibility to adjust the inventory account to show loss on inventory. The

remaining 2% of the inventory is valued by the RIM method. The RIM includes

significant management judgments such as merchandise markups and

markdowns, which significantly impact the ending inventory and the resulting

gross margins. Decisions based on LIFO and RIM provides an inventory valuation

that will not surprise the company if losses are incurred. This is a conservative

20

approach that allows managers to be prepared for changing revenues and is

flexible enough to handle markups and markdowns.

Actual Accounting Strategy

Firms can manipulate their financial appearance using the flexibility of GAAP.

They can influence performance data as well as change the firm’s financial

standing. Accounting strategies range from aggressive to conservative and are

utilized by firms as they desire. Dillard’s uses conservative approaches in their

financial reporting.

Dillard’s management believes RIM values inventory at the lower of cost of

market. However, the RIM approach does require management to make quite a

few assumptions. Managers must correctly anticipate future markups and

markdowns, which can greatly impact the ending inventory valuation as well as

the resulting gross margins. Dillard’s past accounting estimates can fluctuate but

are usually caused by factors beyond the firm’s control. Sales and operating

results vary from quarter to quarter affected mainly by variations in timing and

volume of sales. Changes in cost of availability of material and labor, as well as

changes in shipping cost of supplies also contribute to Dillard’s inconsistent

estimates.

In 2004 Dillard’s sold its private label credit card business to GE finance for 1.1

billion. GE assumed $400 million of long-term securitization liabilities. The sale of

Dillard’s credit card debts reduced its account receivable by nearly 1.2 billion.

However the transaction could have taken place to achieve certain accounting

objectives. We believe that the selling of the credit card company was a major

effort to reduce expenses, to increase net income for the year 20004. In 2002

Dillard’s experienced a loss when it adopted Statement of Financial Accounting

Standards No. 142, “Goodwill and other Intangible Assts” (Dillards 10-K). Net

21

income hit a record low for the past five years. Below are some expense

reductions that occurred as a result of selling the credit card company:

SG&A Expense

(53,700,000)

Payroll

(15,000,000)

Advertising

(17,600,000)

Communications

(10,000,000)

Insurance

(8,300,000)

Net income was reported as 117.6 million as opposed to 9.3 million in 2004. This

increase could show that the selling of the credit card company was a decision

by management to increase net income to take investor attention away from the

past and excite them about the future. This is a more aggressive move that

shows management is hoping for future growth. Their actions are an effort to

demonstrate prosperity on the financial reports of the firm. Dillard’s also

capitalizes its operating leases to consider them as assets during the accounting

period. By doing this Dillard’s can represent a more promising outlook by failing

to disclose some of the debt associated with operations. This technique is

commonly used in the industry.

Dillard’s chooses to use the Last in First Out method as well as the RIM method

to account for excessive inventories. Dillard’s accounting strategy is necessary

when competing on the basis of high quality. Dillard’s has also been working

toward increasing net income since 2002. The selling of Dillard’s credit card

company in 2004 could be a significant effort to decrease expenses to report

increased net income. Dillard’s uses a conservative strategy coupled with

aggressive movements to help show the future prosperity that the company

hopes for.

22

Quality of Disclosure

Quality of Disclosure is an effort by the company to release information to

investors that allows them to see for themselves the details of the company.

Companies must be careful not to release information that could hurt the

company if accessible to the public. The quality of disclosure is a measure of the

accuracy of the financial statements to that of the actions of the company.

The firm provides adequate disclosure in its letter to shareholders. The letter

clearly lays out the firm’s industry conditions, its competitive position, and plans

for the future. The letter to the shareholders is intended to give shareholders

insight as to the goals and upcoming actions of the company. The letter also

explains financial documents with footnotes. The letter offers an easy

understanding of the progress of the companies operations and finances.

Dillard’s is very forthcoming with their information on a qualitative and

quantitative level concerning the particular Market risk that they are currently

facing. The company is very clear that they are particularly responsive to the fact

that their obligations have given them concerning current interest rate changes.

Dillard’s is also very open with the public stock holders concerning personal

evaluations that the company’s key staff member made dealing with the

effectiveness of the company’s disclosure controls and procedures consistent to

the Securities Exchange Act. Dillard’s state’s that after all the evaluations have

taken place, their disclosure controls and procedures are at an assuring level. We

believe this to be true. As for overall quality, Dillard’s policies and procedures are

correct and productive.

23

Sales and Core Expense Manipulation Diagnostics

YEAR

SALES/AR SALES/INV

SALES/TA

CFFO/OI

2002

7.76

5.37

1.19

2.02

2003

6.15

5.16

1.23

.80

2004

6.60

4.82

1.23

1.79

2005

805.80

4.51

1.37

1.62

2006

615.57

4.27

1.40

1.50

The only standout change in the sales diagnostics appears in net sales over

accounts receivables. Net Sales over accounts receivables experienced quite a

jump in 2005. This is due to Dillard’s selling their credit card company. The ratio

shows a huge decrease into accounts receivable. This boosted the firm’s financial

position by collecting on accounts receivable immediately. The company’s net

income has been consistently higher since the sale of the credit card company.

Potential Red Flags

When working on financial valuation of a company, a certain amount of time

and energy must be spent looking for any suspicious accounting principles.

When searching for potential red flags, we researched Dillard’s 10-K statements

over the last four years. During the research, we paid particular attention to

their income statements, balance sheets, and cash flow statements. Dillard’s

shows sound financial statements with no unusual increases or decreases in any

of their inventory, cash equivalents, or tax income.

A look into the quarterly reports from past Dillard’s 10-Q’ show that fourth

quarter earnings are continually larger than the other three quarters in the year.

This increase in sales and earnings can be attributed to the holiday season. One

area we did decide to look into a little further was the company’s Accounts

Receivables. Looking back to the Accounts Receivable in 2003 shows you that

24

Dillard’s had a balance of 1.3 billion dollars. This seemed strange when looking

at the current 10-K because it shows Accounts Receivables with a balance of

12.5 million. This was all a result of Dillard’s selling their credit cards to GE

Consumer Finance. “GE acquired our proprietary credit card business, which

previously owned and securitized the accounts receivable generated by the

proprietary credit card accounts. The sale of the Company’s credit card business

significantly strengthened its liquidity and financial position. The Company had

cash on hand of $300 million as of January 28, 2006 and reduced outstanding

debt and capital leases by $163.9 million during fiscal 2005. After identifying this

information, there were no more potential ‘red flags’ discovered.

Undo Accounting Distortions

After evaluating Dillard’s accounting practices, no major adjustments took place.

As far as we can tell, Dillard’s is not trying to hide or manipulate any numbers to

deceive their shareholders and potential lenders. They do an adequate job

describing what they are doing and why. The “red flag” mentioned previously is

slightly suspicious, but Dillard’s contributes the discrepancy to the sale of their

credit card program. Not only did the numbers match, but they explained why

there were a few minor increases and decreases. Dillard’s discloses all of their

information in many of their reports, proving they have laid everything out for

investors to see. They provide the investors with footnotes, and memos that

clearly explain why events occurred the way they did. We see no need for

Dillard’s to adjust any of their accounting information.

Financial Ratios Introduction_________________________________

For the next part of our evaluation of Dillard’s Inc, we are going to assess the

company’s performance by calculating several financial ratios. In order to make

a proper assessment, we will perform a ratio analysis for the past 5 years. By

calculating the ratios with information we get from the financial statements, we

can evaluate our company’s performance individually. We also can determine

25

where Dillard’s ranks in the department store industry by evaluating their

competitors and the industry as a whole. By looking at these ratios, we can get

an in-depth look at Dillard’s past and present performance, and then take that

information and utilize it to make the logical forecasts for the next ten years. In

order to give investors an insight into the company, we must paint a clear picture

of the company through the successive analysis.

Ratio Analysis_____________________________________________

In order to properly evaluate the financial condition of a company, financial

statements must be analyzed and interpreted. Financial statement analysis

provides information that is necessary to evaluate the financial dimensions of

management performance, detect emerging trends, and to help explain

relationships contained in the basic financial statements (Dr. Moore’s Notes.) Our

analysis of Dillard’s and its competitors will focus on the three major areas:

liquidity, profitability, and capital structure. We will be conducting our analysis by

using 16 ratios that fall under the three major areas of liquidity, profitability, and

capital structure. By using these ratios we will be able to create an industry

comparison for Dillard’s and its competitors. We will compute our ratios for up to

five years in order to provide for a fair level of comparison.

Trend (Time Series) Analysis/Cross Sectional Analysis______________

Liquidity

The first category of ratios we will be using deal with liquidity. Liquidity refers to

a firm’s ability to generate cash flow and to pay back their short term financial

obligations in a timely fashion. The first ratio we will be discussing is the current

ratio. The current ratio is found by dividing current assets by current liabilities.

Both of these are found on the company’s balance sheet.

26

Current Ratio=Current Assets/Current Liabilities

4.00

3.00

2.00

1.00

0.00

2002

2003

2004

2005

2006

Dillards

3.03

3.53

2.26

2.19

1.87

Federated

1.75

1.97

1.91

1.75

1.34

Saks

2.25

2.41

2.11

2.21

1.95

Industry Average

2.00

2.19

2.01

1.98

1.65

Above are the current ratio calculations of Dillard’s, Federated, and Saks. We

also calculated the industry average, excluding Dillard’s. The current ratio is a

valuable calculation because it states that for each dollar of liabilities a company

has, they must have current assets to match it. Current assets consist of cash,

cash equivalents, accounts receivable, inventory, marketable securities, and prepaid expenses. The higher the current ratio, the more liquid a firm is.

This cross sectional graph above shows the industry average and it compares it

to Dillard’s, Federated, and Saks. The industry average from 02’-06’ stays right

around two. Dillard’s in the first two years of our calculations had a current ratio

above three. This is well above the industry average and could mean that

Dillard’s is not efficiently utilizing their current assets. We can contribute the drop

in the ratio in the last three years because of the sale of their credit card

corporation in 2004, which significantly declined their accounts receivables. From

2003 to 2006 Dillard’s current assets declined each year, while their current

liabilities remained about the same. This is another reason why Dillard’s current

ratio started to decline in the last three years of our calculation. In the last three

years Dillard’s is much closer to the industry average, each year it is about two

tenths of a percentage point higher. For example, in 2005 Dillard’s had a current

27

ratio of 2.19, while the industry average was 1.98. In all five years Dillard’s

current ratio is above the industry average. In the first two years, we would say

that Dillard’s had an excess of assets that could have been utilized more

efficiently elsewhere. But, from 04-06 they are above the industry average and

have better liquidity than Federated, and are about equal to Saks.

The next ratio we will discuss is the quick asset ratio. This is calculated by

dividing the firm’s quick assets by current liabilities. Quick assets consist of cash,

securities, and accounts receivable.

Quick Asset Ratio=Quick Assets/Current Liabilities

2.00

1.50

1.00

0.50

0.00

2002

2003

2004

2005

2006

Dillards

1.32

1.67

1.01

0.49

0.27

Federated

0.63

1.02

1.06

0.49

0.36

Saks

0.43

0.60

0.44

0.46

0.23

Industry Average

0.53

0.81

0.75

0.475

0.295

Up until the most recent year, Dillard’s quick asset ratio stayed above the

industry average. Once again the ratio in the first couple of years in our

calculation is well above the industry average. Then in the last couple of years it

declined heavily and is right around the average. As we discussed earlier, this

happened because of their heavy drop in their accounts receivable resulting from

the sale of their credit card corporation in 2004. Saks quick asset ratio stays

consistent from 2002-2005. Based on our calculation, Federated’s ratio is very

inconsistent. From 2002-2004 it increased heavily, then after 2004 it started to

28

decline heavily. All three companies experienced unfavorable changes in the last

two years.

The Inventory Turnover ratio is found by dividing cost of goods sold by

inventory. The ratio determines how many times the firms inventory is sold and

replaced over a period of time. The Days Supply of Inventory is found by dividing

365 by the inventory turnover. This ratio tells you the number of days inventory

stays with the company before it is sold.

Inventory Turnover=Cogs/Inventory

4.00

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

29

2002

2003

2004

2005

2006

Dillards

3.53

3.30

3.17

2.90

2.78

Federated

2.82

2.75

2.74

2.88

2.35

Saks

3.06

2.84

2.59

2.64

2.92

Industry Average

2.94

2.80

2.67

2.76

2.64

Days Supply of Inventory=365/Inventory Turnover

180.00

160.00

140.00

120.00

100.00

80.00

60.00

40.00

20.00

0.00

2002

2003

2004

2005

2006

Dillards

103.51

110.76

115.24

126.06

131.23

Federated

129.43

132.73

133.21

126.74

155.32

Saks

119.28

128.52

140.93

138.26

125.00

Industry Average

124.36

130.62

137.07

132.50

140.16

Dillard’s inventory turnover exceeds the industry average each year. It also

exceeds both of its competitors each year until 2006, when Saks has a higher

turnover. A strong inventory turnover creates a good day’s supply of inventory.

Dillard’s inventory average for five years is 3.14. The turnover decreased each

year, which translates into a negative impact for the company. Each year

Dillard’s inventory stayed with the company longer than the previous year. As

you can see in the Days Supply of Inventory graph, it increased from around 103

days in 2002 to 131 days in 2006. This is consistent with its competitors and the

industry average. Dillard’s maintains a competitive advantage over the industry

each year by about an average of 15 to 16 days. Although Dillard’s inventory

turnover is experiencing a negative impact from 2002 to 2006, so are its

competitors. We conclude from these calculations that Dillard’s, along with the

industry’s, cost of goods sold is remaining constant, but the inventory is

increasing each year. Although sales have remained constant, this could be a

result of more merchandise being produced each year, but fewer sales

associated with the increased inventory.

30

The accounts receivable turnover is calculated by dividing sales by accounts

receivable. The accounts receivable turnover tells you how long it takes a

company to turn its receivables into cash. We encountered some problems in

computing the receivables turnover. First, when Dillard’s sold their credit card

company in 2004, it left the company with a small amount of receivables in 2005

and 2006. This is the reason our receivables turnover in the last two years of our

calculations is so high.

Saks did not disclose any financial information on its accounts receivables;

therefore we cannot make any calculations involving accounts receivable with

that company. Therefore we cannot have an industry average for these two

calculations. The industry average is simply the ratios of Federated.

Accounts Receivable Turnover=sales/accounts receivable

2002

2003

2004

2005

2006

Dillard’s

7.59

5.91

6.38

780.08

603.70

6.58

5.24

4.75

4.57

8.88

Federated

n/a

Saks

Days Sales Outstanding=365/A/R Turnover

2003

2004

2005

2002

Dillard’s

48.11

61.74

57.23

0.47

Federated

55.47

69.66

76.84

79.87

Saks

n/a

2006

0.60

41.10

From 2002 to 2004 Dillard’s experienced an unfavorable change in its accounts

receivable turnover. It went from 7.59 to 6.38, thus increasing their day’s sales

outstanding by about 9 days. Federated also experienced an unfavorable change

in that same time period. Their turnover went from 6.58 to 4.75, which increased

their day’s sales outstanding by about 11 days. Both of these companies

experienced negative impacts because of a decrease in sales in this time period.

The day’s sales outstanding for Dillard’s in the last two years are misrepresented

because of the unusually high account receivables turnovers. This significantly

31

low number in day’s sales outstanding is attributed to the huge decline in

accounts receivable from 2004 to 2005.

Working Capital Turnover=Sales/Working Capital

10.00

9.00

8.00

7.00

6.00

5.00

4.00

3.00

2.00

1.00

0.00

2002

2003

2004

2005

2006

Dillards

4.32

3.53

4.50

6.03

7.54

Federated

4.38

4.34

4.27

4.87

8.76

Saks

6.18

5.26

5.62

5.65

7.45

Industry Average

5.28

4.80

4.95

5.26

8.11

The working capital turnover is a useful measure in determining how a company

is using its working capital to generate sales. For example, in 2002 Dillard’s has a

working capital turnover of 4.32. This states that for each dollar in working

capital there are a $4.32 sales as a result. Working capital is found by

subtracting current liabilities from current assets. Dillard’s has experienced a

favorable impact since 2002 in its working capital turnover. In order, for this to

take place, one of three things must happen. Current assets have to decrease,

current liabilities have to increase, or more sales must be generated. Dillard’s

sales and current liabilities have remained fairly constant from 2002 to 2006.

Dillard’s current liabilities have decreased throughout the five year time span and

this is the reason its working capital turnover is increasing. Once again this is a

result of the sale of its credit card corporation which heavily decreased the

company’s accounts receivable. In computing current assets, accounts receivable

is one of its inputs.

32

In the early years of our valuation, Dillard’s was losing to its competitors and

were well below the industry average for working capital turnover. A high

working capital turnover is sought after because it states a firm has high sales

revenue as a result of working capital. At the end of 2004, with the sale of their

credit card corporation reducing their accounts receivable, thus reducing their

current assets, they gained ground on the industry and its competitors. In 2005,

Dillard’s had a working capital of 6.03 which put them ahead of both Federated

and Saks. In 2006, their working capital increased heavily once again, but the

industry did as well. It put Dillard’s ahead of Saks, but below the industry

average. Based on our calculations, Dillard’s had a favorable change in their

working capital, but they are still below the industry average. In order for

Dillard’s to regain their competitive advantage on the industry, they need to

generate more sales, reduce current assets, or increase its current liabilities.

Profitability

The profitability analysis of a firm is used to evaluate the efficiency of a company

associated with its operating activities by examining the operating efficiency,

asset productivity, return on assets, and return on equity. The construction of a

common size income statement is helpful in the comparison of the firm’s sales

from each year. Sales are represented as 100% in the income statement, and

each line item is shown as a percentage of sales for each specific year. These

percentages show a clear comparison of the expenses and where improvement is

needed.

Operating Efficiency

Dillard’s gross profit margin is the lowest between its two competitors and the

industry average each year from 2002-2006. The firm is demonstrating a steady

profit margin due to the consistency between sales and its cost of goods sold.

The ratios neither increased nor decreased significantly for any firm, which

illustrates essentially no change between each year.

33

Gross Profit Margin=Gross Profit/Sales

45.00%

40.00%

35.00%

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

Dillards

2002

2003

2004

2005

2006

32.46%

33.58%

31.96%

33.35%

33.68%

39%

40%

40%

40%

41%

Saks

35.10%

37.10%

37.90%

37.90%

37.10%

Industry Average

37.05%

38.55%

38.95%

38.95%

39.05%

Federated

In evaluating the operating profit margin, the most significant change in

percentages occurred in 2004 when it dropped almost 2% from 2003. This

negative impact is contributed to the substantial decrease in operating income.

The operating income in 2004 dropped almost $190 million from the previous

year while maintaining constant sales. Overall, each competitor is experiencing a

steady increase in its operating profit margin, which can be examined by the

industry average. Although Dillard’s experienced an unusual effect in 2004, its

graph demonstrates that it is following the same pattern of its competitors and is

closely related to the industry average for each of the other four years.

34

Operating Profit Margin=Operating Income/Sales

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

2002

2003

2004

2005

2006

Dillards

5.59%

6.23%

4.35%

5.47%

6.68%

Federated

6.99%

8.63%

8.70%

8.87%

10.83%

Saks

1.70%

3.90%

3.80%

3.00%

3.40%

Industry Average

4.35%

6.26%

6.25%

5.94%

7.11%

The net profit margin evaluation has somewhat skewed information because

some of the contributing factors are not applicable due to the net loss for

Federated and Saks, Inc. in 2002, and for Dillard’s in 2003. The net loss for

Dillard’s can be contributed to the change in accounting policies for that year and

therefore net income increased considerably the following year. The industry

average evaluation for 2002 was not applicable and therefore, we were unable to

factor this into our evaluation to compare to the next year. Since 2004, Dillard’s

has experienced an increasing level in net profit margin due to the considerable

change in net income. In 2004, net income was only $9,344,000 and increased

significantly to $117,666,000 the next year. This information explains the

positive 1.44% increase between these two periods. Currently, the ratios are

beginning to become stable for the firm, but are still below the industry average

because of Federated’s improving net income. This may skew the average

somewhat because Federated clearly has a competitive advantage over the

market in this profit margin. Saks is becoming the laggard in this evaluation due

35

to its decreasing net income from 2004. Currently, Dillard’s retains nearly two

cents of every sales dollar as profit.

Net Profit Margin=NI/Sales

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

Dillards

2002

2003

0.88%

2004

2005

2006

0.12%

1.56%

1.61%

Federated

5.30%

4.50%

4.40%

6%

Saks

0.40%

1.40%

0.90%

0.40%

Industry Average

2.85%

2.95%

2.65%

3.20%

Overall, operating efficiency for Dillard’s over the past five years inherits a

positive evaluation. The key factors for this evaluation were the positive factors

in both the operating income margin and net profit margin. The gross profit

margin for Dillard’s showed no significant change to receive a negative result

although it was the industry laggard in that ratio evaluation. The biggest

improvement the firm demonstrated was increasing its net profit margin to try

and compete with Federated. Although Dillard’s may not ever catch up to

Federated in this aspect, this shows that Dillard’s is continuing to grow and

improve its operations.

Asset Productivity

The asset productivity of a company is used to measure the revenue output of its

resources. This estimation is calculated with the asset turnover ratio which is

computed by dividing net income by total assets. The concept of this ratio

36

implies how well the firm’s assets are used to generate the amount of sales

volume.

Asset Turnover=Sales/Total Assets

1.80

1.60

1.40

1.20

1.00

0.80

0.60

0.40

0.20

0.00

2002

2003

2004

2005

2006

Dillards

1.15

1.19

1.19

1.32

1.37

Federated

0.97

1.07

1.05

1.03

0.68

Saks

1.32

1.29

1.3

1.37

1.55

Industry Average

1.15

1.18

1.18

1.20

1.12

Dillard’s has maintained a constant growth in this financial ratio and is continuing

to rise above the industry average for the past two years. This is contributed to

a constant sales rate with a slight decline in total assets as of late. Federated is

showing a significant decline since 2005 which could be contributed to its

excessive increase in assets. Saks, Inc. is performing similar to Dillard’s in this

productivity measure and is setting the industry benchmark. Overall, Dillard’s

recent rise in this particular percentage warrants a positive result because its

steady sales are supporting the firm’s total resources.

Return on Assets

The return on assets ratio is a comprehensive measure of profitability than

incorporates both the firm’s profits and resources utilized. This ratio is calculated

by taking the net income of a firm for a particular year and dividing it by total

assets. The evaluation of the graph on this ratio shows a somewhat similar

37

pattern to the net profit margin. The return on assets ratio also has misaligned

information because of the net loss for Federated and Saks in 2002 and Dillard’s

in 2003. Again, Dillard’s recent rise in this evaluation is due to the improvement

in net income after the irregular downfall in 2004. Federated has been the

industry leader in this measure since 2003, but is now showing a decline in this

ratio because of its increase in total assets since the end of 2005.

Return On Assets=NI/Total Assets

7.00%

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

Dillards

2002

2003

1.00%

2004

2005

2006

0.14%

1.84%

2.13%

6%

5%

5%

4%

Saks

0.01%

1.80%

1.30%

0.50%

Industry Average

3.00%

3.40%

3.15%

2.25%

Federated

In general, Dillard’s is experiencing a significant improvement in this calculation

since 2004. Over the past five years, the rate of return on assets has increased

by over 1%, which is a sizeable change for the firm and the industry as a whole.

The overall profitability for the firm is expanding due to the considerable

increases in most of the ratios.

Return on Equity

The rate of return on equity is a significant measure to the financial management

of a company. This ratio represents the profitability from the owners’ interest in

the firm.

38

Return On Equity=NI/Total Equity

16.00%

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

2002

2003

2005

2006

0.41%

5.26%

5.23%

14%

12%

11%

10%

Saks

1.10%

3.70%

2.60%

1.10%

Industry Average

7.55%

7.85%

6.80%

5.55%

Dillards

Federated

2.73%

2004

Dillard’s showed high rates of return on equity between 2004 and 2005 because

the total assets and liabilities declined at a constant rate to keep the equity

almost equal to the previous year. This illustrates a higher profitability by

maintaining a constant level of equity invested into the firm. In this instance, as

profits increase, the return on owner’s equity will also increase due to lower debt

financing and investments in total assets.

Capital Structure Ratio

The third category of ratios we calculated deal with capital structure. The capital

structure of a company uses sources of financing activities to acquire assets, and

is represented by the liabilities and owners’ equity section of the balance sheet.

The amount of debt relative to the owners’ equity, the ability to service the

principal and the interest requirements on debt are the main concerns in

analyzing capital structure. There are three main ratios we used in our valuation

of Dillard’s capital structure. The debt to equity ratio is the first one we

calculated. It is important because it measures a firm’s credit risk. A firm has a

39

high credit risk if there is a chance that a firm’s interest and debt repayments

cannot be satisfied with available cash flows. The debt to equity ratio is found

by dividing total liabilities by total owners’ equity.

Debt to Equity Ratio=Total Liabilities/Total Equity

2.50

2.00

1.50

1.00

0.50

0.00

2002

2003

2004

2005

2006

Dillards

1.65

1.95

1.87

1.45

1.36

Federated

1.70

1.51

1.45

1.41

1.45

Saks

1.02

1.02

1.00

1.26

0.93

Industry Average

1.36

1.27

1.23

1.34

1.19

A declining debt to equity ratio year to year would be a favorable impact for a

company. The debt to equity ratio states that a firm has a certain amount of

liabilities for every dollar of owners’ equity. For example, Dillard’s in 2002 had a

debt to equity ratio of 1.65. This states that Dillard’s has $1.65 worth of debt for

every $1.00 of owners’ equity. Every year in our calculations, Dillard’s is well

above the industry average. Although towards the end, Dillard’s started making

progress on the industry average. Saks has the most consistent ratio throughout

the five year average. For the debt to equity ratio Saks sets the standard for the

industry. A ratio around 1 is very favorable for a company. A ratio of 1 would

essentially mean no credit risk for a company. A firm would have the available

cash flows necessary to pay of its interest and debt repayments. Federated is

like Dillard’s in the first couple of years of our calculations, the company has a

very high debt to equity ratio. Then towards the end, they too start to lower

40

there number. Dillard’s acquires lower ratios by lowering their total liabilities

substantially from 2003 to 2006. This is the reason their ratio drops from 1.95 to

1.36 in that same time period. Overall Dillard’s is experiencing a favorable impact

by lowering its ratio each year, but Dillard’s is unable to obtain a competitive

advantage in the debt to equity ratio. We can make this conclusion based on the

fact that Dillard’s ratios each year are well above the industry average.

The next ratio under capital structure is the times interest earned. Before there

can be profits to stock-holders of a corporation, income from operations must be

able to cover the required interest expense. The times interest earned ratio

determines the company’s ability to pay back its interest on borrowed money.

The ratio is found by dividing operating income by interest expense.

Times Interest Earned=NIBIT/Interest Expense

7.00

6.00

5.00

4.00

3.00

2.00

1.00

0.00

2002

2003

2004

2005

2006

1.09

2.33

2.29

Dillards

1.55

Federated

3.34

4.32

5.04

4.68

5.74

Saks

0.80

1.88

2.10

1.70

2.36

Industry Average

2.07

3.1

3.57

3.19

4.05

In 2003, we do not have a calculation for Dillard’s because in that year the

company’s NIBIT was a negative number. This was due to an accounting change

that took place within that year; it had nothing to do with the company’s

earnings for the year. Dillard’s times interest earned ratio from 2002 to 2006

showed a slightly favorable impact. However, Dillard’s was below the industry

average in every single year of our calculations. Federated from 2002 to 2006

41

had the greatest ability to repay its interest expense. Although Dillard’s ratio is

improving; the rest of the industry is improving at the same rate.

The last ratio used to value the capital structure of the firm is the debt service

margin. This ratio measures the ability to cover the annual payments of the

previous year’s liabilities with the cash flows generated from operations. This

ratio is computed by dividing the operating cash flows from the current year and

dividing it by the notes payable from the previous year. The cash flows from

operations are a major contributor to the retirement of debt.

Debt Service Margin=Operating Cash Flow/Prev. Yr Current

Notes Payable

5.00

4.00

3.00

2.00

1.00

0.00

2002

2003

2004

2005

2006

Dillards

2.95

3.63

3.11

3.34

4.03

Federated

0.77

1.11

0.76

0.56

1.04

Saks

0.20

0.20

0.35

0.32

0.14

Industry Average

0.49

0.66

0.56

0.44

0.59

Over the past five years, Dillard’s has exhibited a competitive advantage in this

particular ratio. The steady increase in the debt service margin for the firm

indicates that Dillard’s has less pressure to use its cash flows from operations to

finance its notes payable. A ratio less than 1 indicates that the firm is forced to

use most, if not all, of its cash flows to pay off its liabilities. This may compel the

firm to finance its obligations with investing activities. According to the graph,

this may be true for each of the other competitors in the industry. The current

42

ratio for Dillard’s of 4.03 denotes a favorable result, and prevails over its

competitors.

IGR & SGR________________________________________________

Internal Growth Rate

The internal growth rate is the maximum level of growth a company can achieve

without obtaining outside financing. This model is derived by multiplying the

firm’s return on assets (Net Income/ Total Assets from previous year) by the

dividend payout ratio (Total Dividends/ Net Income) subtracted from 1.

IGR = ROA (1 – Total Dividends/ Net Income)

Dillard’s has shown a relatively steady internal growth over the past 5 years

compared to its top competitors. The growth rate in 2003 was unable to be

determined because the return on assets was not applicable due to the net loss

for that year. The firm’s rates have stayed steady due to the firm paying a

constant dividend rate per share and not increasing the number of shares

outstanding. The net income has varied significantly between each year, but is

beginning to show a steady increase between 2005 and 2006.

IGR

8.00%

6.00%

4.00%

2.00%

0.00%

Dillard's

-2.00%

Federated

-4.00%

Saks

-6.00%

-8.00%

-10.00%

-12.00%

Dillard's

0.80%

Federated

-1.70%

Saks

43

2002

2003

2004

2005

2006

-0.06%

1.60%

1.90%

6%

4.50%

4.30%

3.60%

1.10%

3.70%

-9.40%

1.10%

Sustainable Growth Rate

The sustainable growth rate is calculated by multiplying the internal growth rate

by (1 + Total Debt/ Stockholder’s Equity) for each year.

SGR = IGR (1 + Debt/ Equity)

By examining the model, there is a clear relationship between the sustainable

and internal growth rates for the entire industry. Since the debt to equity ratio is

multiplied by the IGR, the SGR is going to increase (or decrease if the IGR is a

negative number) by almost the same percentage amount of the IGR. The

number is not exactly equal because of the addition of 1 to the debt to equity

ratio, but illustrates a constant relationship between the two. Again, the SGR for

2003 was unable to be determined because of the unknown IGR for the year.

Total debt and shareholder’s equity has changed relatively little from year to

year, but seem to display a decline in total debt over the recent two years.

SGR

20.00%

15.00%

10.00%

5.00%

Dillard's

0.00%

Federated

-5.00%

Saks

-10.00%

-15.00%

-20.00%

-25.00%

Dillard's

2.10%

Federated

-4.90%

Saks

44

2002

2003

2004

2005

2006

-0.17%

3.90%

4.50%

15%

11%

10.40%

8.80%

2.20%

7.40%

-21.50%

2.10%

Financial Statement Forecasting Methodology Section______________

Income Statement

We first analyzed all trends and benchmarks for Dillard’s in order to make our

assumptions on what we would be using to forecast 10 years ahead.

Dillard’s had an internal growth rate of 1.90, as of the end of 2005. With the

steady increase in this rate we projected that Dillard’s would grow by about 2

percent in the early stages of our forecasting. We believe this figure is an

accurate growth rate for Dillard’s. After the first three years of forecasting, we

came to the conclusion that sales would start to level off and come closer to a

1.5 percent growth rate.

For the rest of our income statement forecasts we used five year averages,

excluding outliers. An outlier is basically a calculation that is statistically different