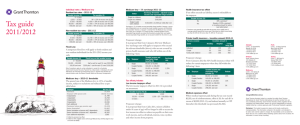

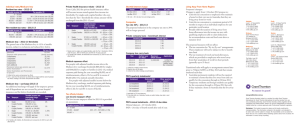

Rates of Tax – 2011/12

advertisement

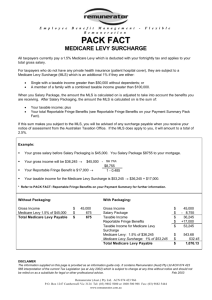

Rates of Tax – 2011/12 Resident Individuals The following rates apply to individuals who are residents of Australia for tax purposes for the entire income year. Taxable Income1 $ 0 – 6,000 6,001 – 37,000 37,001 – 80,000 80,001 – 180,000 180,001+ Tax Payable2, 3 Nil 15% of excess over $6,000 $4,650 + 30% of excess over $37,000 $17,550 + 37% of excess over $80,000 $54,550 + 45% of excess over $180,000 1 The tax-free threshold may effectively be higher for taxpayers eligible for the low-income tax offset, the Senior Australians Tax Offset and/or certain other tax offsets. 2 The above rates do not include the Medicare Levy of 1.5%. 3 These rates do not include the temporary Flood Levy which may also apply. Resident Minors – Unearned (Division 6AA) Income The following rates apply to the income of certain minors (e.g., persons under 18 years of age on the last day of the income year who are not classed as being in a full-time occupation) that is not excepted income (e.g., employment income): Division 6AA Income $ 0 – 416 417 – 1,307 1,308+ Tax Payable1, 2 Nil 66% of excess over $416 45% of the entire amount 1 Medicare Levy may also be payable. 2 These rates do not include the temporary Flood Levy which may also apply. Non-resident Individuals The following rates apply to individuals who are not residents of Australia for tax purposes for the entire income year: Taxable Income $ 0 – 37,000 37,001 – 80,000 80,001 – 180,000 180,001+ Tax Payable1, 2 29% of the entire amount $10,730 + 30% of excess over $37,000 $23,630 + 37% of excess over $80,000 $60,630 + 45% of excess over $180,000 1 Medicare Levy is not payable by non-residents. 2 These rates do not include the temporary Flood Levy which may also apply. Non-resident Minors – Unearned (Division 6AA) Income The following rates apply to the income of certain non-resident minors (e.g., persons under 18 years of age on the last day of the income year who are not classed as being in a full-time occupation) that is not excepted income (e.g., employment income). Division 6AA Income Tax Payable1, 2 $ 0 – 416 29% of the entire amount 417 – 732 $120.64 + 66% of excess over $416 733+ 45% of the entire amount 1 2 The Medicare Levy is not payable by non-residents. These rates do not include the temporary Flood Levy which may also apply – see below. Flood levy For the 2011/12 income year only, a levy (tax) is imposed on taxpayers to assist reconstruction work from the floods and Cyclone Yasi (i.e., the “flood levy”). The flood levy generally operates as follows: • no levy is payable where the taxpayer has a taxable income of $50,000 or less, or where an exemption applies (broadly where the taxpayer has been affected by a natural disaster); • individuals, both residents and non-residents, with a taxable income between $50,001 and $100,000 in the 2012 income year will pay a 0.5% levy on that part of taxable income above $50,000; and • individuals, both residents and non-residents, with a taxable income of $100,001 or more in the 2012 income year will pay a 0.5% levy on that part of their taxable income between $50,001 and $100,000 and a 1% levy on that part of their taxable income above $100,000. The flood levy is automatically included in the tax taken out of salary and wages by an employer (for salary and wage earners). If the taxpayer pays instalments towards their expected tax liability, the flood levy will automatically be included in the instalment rate. For example, this includes self-employed persons and investors, or self-funded retirees. Note that the flood levy cannot be reduced by non-refundable tax offsets. Pro-Rated Tax-Free Threshold – Non-residents The tax-free threshold that applies to residents (currently, $6,000 per annum) is pro-rated in an income year in which a taxpayer was not a resident for tax purposes for the entire year. Specifically, the $500 threshold is allowed for each month that the taxpayer was a resident (including the month in which the taxpayer became/ceased to be a resident). Genuine Redundancy Payments The tax-free amount of a genuine redundancy payment in 2011/12 is $8,435 plus $4,218 for each completed year of service. S.99 Assessment – Resident Deceased Estate The following rates apply where a trustee is assessed under S.99 ITAA 1936 in respect of a resident deceased estate. Where the date of death is less than 3 years before the end of the income year, the trustee is assessed as a resident individual. Taxable Income Rate1, 2 $ % Less than 3 years since death 0 – 6,000 6,001 – 37,000 37,001 – 80,000 80,001 – 180,000 180,001+ 3 years or more since death 0 – 416 417 – 594 595 – 37,000 37,001 – 80,000 80,001 – 180,000 180,001+ 1 2 Nil 15% of excess over $6,000 $4,650 + 30% of excess over $37,000 $17,550 + 37% of excess over $80,000 $54,550 + 45% of excess over $180,000 Nil 50% of excess over $416 $89 + 15% of excess over $594 $5,550 + 30% of excess over $37,000 $18,450 + 37% of excess over $80,000 $55,450 + 45% of excess over $180,000 Medicare Levy does not apply to S.99 assessments of deceased estate trustees. These rates do not include the temporary Flood Levy which may also apply. S.99A Assessment – No Beneficiary Presently Entitled The following rate applies where there is no beneficiary entitled to the net income of a resident trust: Taxable Income Rate1 $ % 1+ 45% of the entire amount 1 Medicare Levy is not included but does apply (except in relation to deceased estates). Medicare Levy – 2011/12 General Rate Taxpayer Individual (resident) Rate % 1.5% of taxable income Low-income Thresholds – Individuals The 2011/12 Medicare Levy low-income thresholds for individuals are as follows: Threshold Phase-in Limit2 1.5% at or Amount1 Single Taxpayer Above3 $ $ $ Not eligible for Senior Australians Tax Offset or Pensioner 19,404 19,405 – 22,828 22,829 Tax Offset Eligible for Senior Australians Tax Offset 30,685 30,686 – 36,100 36,101 Eligible for Pensioner Tax Offset only 30,451 30,452 – 35,824 35,825 1 2 3 No Medicare Levy is payable on taxable income levels at or below the Threshold Amount. Where taxable income falls within the Phase-in Limit, Medicare Levy is payable at 10% of the excess over the Threshold Amount. The Medicare Levy of 1.5% applies to the entire amount of taxable income. Family Thresholds A taxpayer who: ♦ has a spouse (married or de facto) on the last day of the income year; ♦ has not remarried after their spouse died during the income year; or ♦ who is eligible for the notionally retained sole parent rebate, the housekeeper or the childhousekeeper rebates (or would be entitled if they did not qualify for the Family Tax Benefit Part B); may be eligible to pay no (or a reduced) Medicare Levy if their family income is within the thresholds set out below for the relevant income year. Family Thresholds – 2011/12 The 2011/12 Medicare Levy thresholds for families are as follows: No. of Dependent Family Income Reduced Levy2 1 Children/Students Threshold $ $ $ Taxpayer Not Eligible for Senior Australians Tax Offset 1.5% at or above3 $ 0 32,743 32,744 – 38,521 38,522 1 35,750 35,751 – 42,058 42,059 2 38,757 38,758 – 45,596 45,597 3 41,764 41,765 – 49,134 49,135 4 44,771 44,772 – 52,671 52,672 5 47,778 47,779 – 56,209 56,210 6 50,785 50,786 – 59,747 59,748 Each extra child 3,007 3,538 Taxpayer Eligible for Senior Australians Tax Offset 1 0 44,500 44,501 – 52,352 52,353 1 47,507 47,508 – 55,890 55,891 2 50,514 50,515 – 59,428 59,429 3 53,521 53,522 – 62,965 62,966 4 56,528 56,529 – 66,503 66,504 5 59,535 59,536 – 70,041 70,042 6 62,542 62,543 – 73,578 73,579 Each extra child 3,007 3,538 Family Income is the combined income of a taxpayer and their spouse. If the taxpayer does not have a spouse, Family Income is the taxpayer’s taxable income only. No Medicare Levy is payable on taxable income levels at or below the Family Income Threshold. 2 The Medicare Levy shades in at 10% for every dollar where Family Income exceeds the Family Income Threshold. There is no 'Phase-in Limit' stated for families as there is with individuals since the figures change with the number of dependants. Instead, a formula is applied to reduce the levy payable by families to 10% of the amount by which Family Income exceeds the Family Income Threshold. The reduction is calculated as: A – (0.085 x (B – C)) where A is 1.5% of the relevant Family Income Threshold, B is the Family Income and C is the Family Income Threshold. Where the levy is also payable by the spouse, the reduction is shared according to the proportion that the taxable income of each bears to the total Family Income. 3 The levy payable by the relevant taxpayer is 1.5% of their entire taxable income. Medicare Levy Surcharge Thresholds A surcharge of 1% is imposed on top of the 1.5% Medicare Levy where a taxpayer, their spouse and dependants do not have an appropriate level of private patient hospital cover and the taxpayer's 'income for surcharge purposes'1 exceeds the relevant threshold from the following table2: No. of Dependent Children or Students 0 1 2 3 4 5 Each extra child 1 2 3 4 Singles3 $ 80,000 160,000 161,500 163,000 164,500 166,000 1,500 Family4 $ 160,000 160,000 161,500 163,000 164,500 166,000 1,500 A taxpayer's 'income for surcharge purposes' is the sum of their: – taxable income (including the net amount on which family trust distribution tax has been paid); – reportable fringe benefits total; – reportable superannuation contributions; – exempt foreign employment income; – total investment loss (including net financial investment losses and net rental losses), Less any taxed component of a superannuation lump sum received which does not exceed the taxpayer's low rate cap. Note however, the 1% Medicare Levy surcharge is only payable on a taxpayer's taxable income and reportable fringe benefits total. A policy taken out where the annual excess is greater than $500 for singles ($1,000 for couples) is deemed not to provide private patient hospital cover. Single taxpayers with dependants apply the 'Family' thresholds. However, the dependants' 'income for surcharge purposes' is ignored. Where the taxpayer is married, both the taxpayer's and spouse's 'income for surcharge purposes' are taken into account when determining if the 'Family' threshold is exceeded. To the extent either spouse is not liable for the 1.5% Medicare Levy due to deriving insufficient income, they are also not liable to the 1% Medicare Levy surcharge. HELP Repayment Thresholds – 2011/12 The Higher Education Loan Programme (HELP) offers Commonwealth loans to eligible students to assist them with paying their higher education fees and to study overseas. A HELP debt is repaid through the taxation system on a taxpayer's 'repayment income'. Repayment income is the sum of the taxpayer's: – taxable income; – total net investment loss; – reportable fringe benefits; – exempt foreign employment income; and – reportable superannuation contributions. HELP Repayment Thresholds (including accumulated HECS debt) Rate of Repayment % HELP Repayment Income $ Nil 0 – $47,196 4 $47,196 – $52,572 4.5 $52,573 – $57,947 5 $57,948 – $60,993 5.5 $60,994 – $65,563 6 $65,564 – $71,006 6.5 $71,007 – $74,743 7 $74,744 – $82,253 7.5 $82,254 – $87,649 8 $87,650+ Company Rates of Tax – 2011/12 General Company Tax Rate1 Rate % Description of Taxpayer Private companies (except life insurance companies RSAs + PDFs) 30 Public companies (except life insurance companies RSAs + PDFs) 30 Corporate Unit Trusts 30 Corporate Limited Partnerships 30 Public Trading Trusts 30 Strata Title Bodies Corporate 30 1 In the 2012/13 Federal Budget, the Government announced that the company tax rate will not be reduced to 29% (as was announced in the 2011/12 Federal Budget). Non-profit Company Tax Rates Taxable Income $ 0 – 416 417 – 915 916+ Rate % Nil 55% of excess over $416 30% of the entire amount