NOTESforming - Tata Chemicals

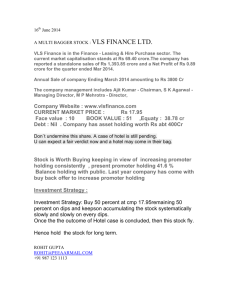

advertisement