proposed apra prudential standards

advertisement

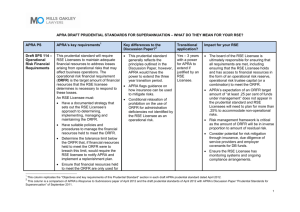

PROPOSED APRA PRUDENTIAL STANDARDS: HOW WILL THEY AFFECT INVESTMENT MANAGERS? What you need to know • The Australian Prudential Regulation Authority (APRA), the prudential regulator of superannuation funds, insurance bodies and banks, is proposing to release new prudential standards for trustees of superannuation funds. • The new prudential standards will have an impact on investment managers that provide investment management services to superannuation trustees, as existing investment management agreements relating to management of superannuation fund assets are likely to need to be amended to take into account the standards. What are the APRA prudential standards? The Australian Prudential Regulation Authority, the prudential regulator of superannuation funds, insurance bodies and banks, has proposed mandatory prudential standards for 1 Registrable Superannuation Entities (RSEs) to be effective from 1 July 2013 (Prudential Standards). The Prudential Standards that are the most relevant for investment managers that provide services to RSEs are: • SPS 231: Outsourcing; and • SPS 530: Investment Governance. Other Prudential Standards that may affect the services provided by investment managers to RSE’s are SPS 232 Business Continuity Management, SPS 510 Governance and SPS 520 Fit and Proper. Although the onus is on the RSE licensee (not the investment manager) to ensure compliance with the Prudential Standards, investment managers should be mindful of them when entering into contracts with RSE licensees. Investment managers should also anticipate that any current clients that are RSE licensees will be asking for amendments to their existing contractual relationship. How will the prudential standards affect investment managers? The prudential standards are likely to affect existing and new Investment Management Agreements (IMAs) since IMAs will be required to include some matters not previously required by the existing operating standards under the Superannuation Industry (Supervision) Regulations (SIS Regulations). RSE licensees may also be subject to more onerous requirements, such as the obligation to monitor outsourced service providers, and these requirements will most likely have an impact on investment managers. Non-Australian investment managers will also be affected by an RSE licensee’s obligation to consult with APRA before appointing a foreign manager. The Prudential Standards discussed in this note will generally take effect from 1 July 2013, except certain of the new outsourcing (SPS 231) and business continuity management (SPS 232) requirements. In relation to outsourcing, the effect of this is that most of the key provisions of SPS 231 that affect the form and content requirements for IMAs are expected to become effective in late 2012 or early 2013 (see paragraph C below), although the precise date for this is still unknown. 1 The RSE is the superannuation entity, i.e. the trust. An RSE licensee is the trustee. FUNDS MANAGEMENT 1 jws.com.au Proposed APRA Prudential Standards: how will they affect investment managers? Authors: Austin Bell and Andrew Moore, October 2012 The key potential effects of the proposed Prudential Standards that are likely to be relevant to an investment manager are summarised below: Outsourcing - SPS 231 SPS 231 relates to the process for entering into outsourcing agreements (including IMAs), and the form and content of those agreements. Among other things, from 1 July 2013 an RSE licensee must (SPS 231, para 18) be able to demonstrate to APRA that, in assessing the options for outsourcing a material business activity (which includes investment management), the RSE licensee has: “(b) undertaken a tender or other selection process for the service provider; (c) undertaken a due diligence review of the chosen service provider, including the ability of the service provider to conduct the business activity on an ongoing basis; … (g) considered all the matters outlined in paragraph 20 [see below], that must, at a minimum, be included in the outsourcing agreement itself; (h) established procedures for monitoring outsourcing agreement on a continuing basis; performance under the (i) addressed the renewal process for outsourcing agreements and how the renewal will be conducted; (j) developed contingency plans that would enable the outsourced business activity to be provided by an alternative service provider or brought in-house if required; and (k) determined that the outsourcing agreement is in the best interests of beneficiaries.” SPS 231 also introduces prescriptive requirements in relation to the form and content of 2 outsourcing agreements, such as IMAs, entered into by RSE licensees. These are set out at paragraphs 19 to 24 of SPS 231. While there is some overlap with the existing SIS Regulation 4.16, the requirements of SPS 231 extend beyond this regulation in the following areas: “19. All outsourcing arrangements must be contained in a documented legally binding agreement that is enforceable in Australia and is subject to Australian law. The agreement must be signed by all parties to it before the outsourcing arrangement commences. 20. At a minimum, the agreement must address the following matters: (a) the scope of the arrangement and services to be supplied;… (c) review provisions;… (e) service levels and performance requirements; (f) the form in which the data is to be kept and clear provisions identifying ownership and control of the data; (g) reporting requirements, including content and frequency of reporting;… (o) insurance; and (p) to the extent applicable, offshoring arrangements (including through subcontracting). 2 There are some exceptions to the requirements to comply with the form and content requirements that apply where an outsourcing agreement is entered into as a result of “unexpected extreme events”: in para 22 of SPS 231. FUNDS MANAGEMENT 2 jws.com.au Proposed APRA Prudential Standards: how will they affect investment managers? Authors: Austin Bell and Andrew Moore, October 2012 21. An RSE licensee that outsources a material business activity must ensure that its outsourcing agreement includes an indemnity to the effect that any subcontracting by a service provider of the outsourced function will be the responsibility of the service provider, including liability for any failure on the part of the sub-contractor… 24. An RSE licensee must take all reasonable steps to ensure that a service provider will not disclose or advertise that APRA has conducted an on-site visit, except as necessary to coordinate with other entities regulated by APRA that are existing clients of the service provider.” In addition, under SPS 231, from 1 July 2013: • RSE licensees will need to consult with APRA before they appoint an offshore 3 investment manager. For such managers, the potential delay will need to be factored in to the timing for finalisation of IMAs (SPS 231 para 27). • The RSE licensee has obligations in relation to monitoring outsourced provision of services, including ensuring regular contact and monitoring, that may have an impact on investment managers (SPS 231 para 29). • RSE licensees have certain obligations in relation to review of outsourcing arrangements by an RSE licensee’s internal and (at APRA’s request) external auditor. Although these are obligations of the RSE licensee itself, it is possible that they may affect an investment manager to the extent that the investment manager is required to co-operate with the auditor (SPS 231 para 32). SPS 530 – investment governance RSE licensees will be required to implement investment governance arrangements as set out in SPS 530. Given that these requirements relate specifically to investment management, it seems likely that RSE licensees may want to include them in IMAs as obligations binding on the investment manager; this would be a significant means of ensuring that RSE investments are managed in accordance with SPS 530. As with SPS 231, this may, in some cases, require renegotiation of existing IMAs and review of draft new IMAs to ensure that the relevant requirements are included. The SPS 530 requirements that may be addressed in an IMA include: • investment objectives for a given investment option, including return and risk objectives (SPS 530 paragraph 14); • the investment strategy for an investment option (SPS 530 paragraph 15), including for example (when there are multiple assets or asset classes) asset allocation targets and ranges, and a rebalancing policy to monitor and correct deviations outside the asset allocation ranges; • processes and criteria for selecting each investment to give effect to the investment strategy to ensure that effective due diligence that is commensurate with the nature and characteristics of the investment is undertaken prior to the selection of an investment for an investment option (SPS 530 paragraph 20); • appropriate risk and return measures, approved by the Board, to monitor the performance of investments on an ongoing basis and regularly report the performance of investments to the Board and senior management (SPS 530 paragraph 22); • a policy for review of the investment strategy (SPS 530 paragraph 27); and 3 For the purposes of SPS 231, ‘offshoring’ means the outsourcing by an RSE licensee of a material business activity to a service provider where the outsourced activity is to be conducted outside Australia. Offshoring includes arrangements where the service provider is incorporated in Australia, but the physical location of the outsourced activity is outside Australia. Offshoring does not include arrangements where the physical location of an outsourced activity is within Australia but the service provider is not incorporated in Australia. FUNDS MANAGEMENT 3 jws.com.au Proposed APRA Prudential Standards: how will they affect investment managers? Authors: Austin Bell and Andrew Moore, October 2012 • a liquidity management plan (SPS 530 paragraph 29). SPS 232 - business continuity management Under SPS 232, RSE licensees must ensure, among other things, that outsourced service providers (which includes investment managers) have in place certain business continuity management procedures. Although under SIS Regulation 4.16 outsourcing arrangements were required to provide for business continuity planning, the SPS 232 requirements appear more extensive, and RSE licensees will most likely be reviewing their existing IMAs to ensure that they include warranties from investment managers regarding compliance with these requirements. SPS 510 – governance Under SPS 510 RSE licensees are not permitted (from 1 July 2013) to impose constraints on outsourced service providers’ communications with APRA or with others who have statutory responsibilities in relation to the RSE licensee. RSE licensees will most likely be reviewing their IMAs to ensure that the IMA confidentiality and other provisions conform to these requirements. Also in relation to governance, it should be noted that the Financial Services Council (FSC) has published a proposed superannuation corporate governance policy. This goes beyond the requirements of SPS 510; among other things it requires an RSE licensee to maintain an environmental, social and governance policy in relation to investee companies, and to disclose a proxy voting policy and publish its Australian proxy voting record. Some RSE licensees may seek to include in their IMA’s material relating to the licensee’s obligations under this policy. The final version of the policy is to be released in about December 2012, and will become effective from 1 July 2013. Compliance will be mandatory for RSE licensees that are full FSC members. SPS 520 – fit and proper It is still unclear whether investment managers or their employees or officers are intended to fall within the ambit of SPS 520, which requires RSE licensees to have a Fit and Proper policy in respect of certain responsible persons. If SPS 520 does extend to all or some of an investment manager, its employees or its officers, from 1 July 2013 the RSE licensee would need to satisfy themselves that these persons are fit and proper for the purposes of the RSE licensee’s Fit and Proper Policy. RSE licensees may seek to satisfy this obligation by having their IMAs refer specifically to these SPS 520 requirements. When will the prudential standards start to apply? Outsourcing – SPS 231 The key date in relation to the provisions dealing with the form and content of IMAs4 is the date of registration of the Prudential Standards on the Federal Register of Legislative Instruments. Based on the information released by APRA, this date (the Registration Date) seems likely to be in late 2012 or early 2013. An RSE licensee must ensure that, on and from the Registration Date, the form and content requirements are met in relation to all outsourcing arrangements that it enters into (which includes IMAs). 4 Set out in paragraphs 19 to 24 of SPS 231. FUNDS MANAGEMENT 4 jws.com.au Proposed APRA Prudential Standards: how will they affect investment managers? Authors: Austin Bell and Andrew Moore, October 2012 The RSE licensee must also assess existing outsourcing arrangements (those entered into before the Registration Date) and identify whether or not they comply with the SPS 231 requirements. To the extent that existing IMAs do not currently comply with SPS 231, these IMAs will need to be conformed to SPS 231; an RSE licensee will need to make reasonable efforts to renegotiate existing arrangements where these do not currently comply with SPS 231. Where, as a result of the reasonable efforts made by the RSE licensee, the RSE licensee determines that renegotiating the terms of the arrangement would be contrary to the best interests of beneficiaries, the RSE licensee must demonstrate to APRA why it considers the existing arrangement should continue. The RSE licensee must also report to APRA the anticipated end date for all existing outsourcing arrangements. Given that most IMAs will be open-ended and not for a specific term, each of them will most likely need to be amended to specify a particular end date. The requirements of SPS 231 dealing with matters other than the form and content of outsourcing arrangements, including consultation with APRA on the appointment of foreign managers, monitoring, and audit, commence on 1 July 2013. Business Continuity Management – SPS 232 New business continuity arrangements must comply with SPS 232 from the Registration Date. The RSE licensee must also assess existing business continuity arrangements as at the Effective Date; in respect of these existing arrangements, similar provisions regarding reasonable efforts to renegotiate the arrangements apply as for SPS 231. In other respects, the effective date of SPS 232 is 1 July 2013. Other Prudential Standards The other Prudential Standards discussed above commence on 1 July 2013. Note that APRA also proposes to release prudential practice guides to support the Prudential Standards, towards the end of 2012 or in early 2013, and these are likely to provide further detail on APRA’s expectations in relation to the Prudential Standards. For further information please contact: Austin Bell Partner Andrew Moore Senior Associate T +61 2 8247 9620 T +61 8274 9525 austin.bell@jws.com.au andrew.moore@jws.com.au Important Disclaimer: The material contained in this article is comment of a general nature only and is not and nor is it intended to be advice on any specific professional matter. In that the effectiveness or accuracy of any professional advice depends upon the particular circumstances of each case, neither the firm nor any individual author accepts any responsibility whatsoever for any acts or omissions resulting from reliance upon the content of any articles. Before acting on the basis of any material contained in this publication, we recommend that you consult your professional adviser. Liability limited by a scheme approved under Professional Standards Legislation (Australia-wide except in Tasmania). FUNDS MANAGEMENT 5 jws.com.au