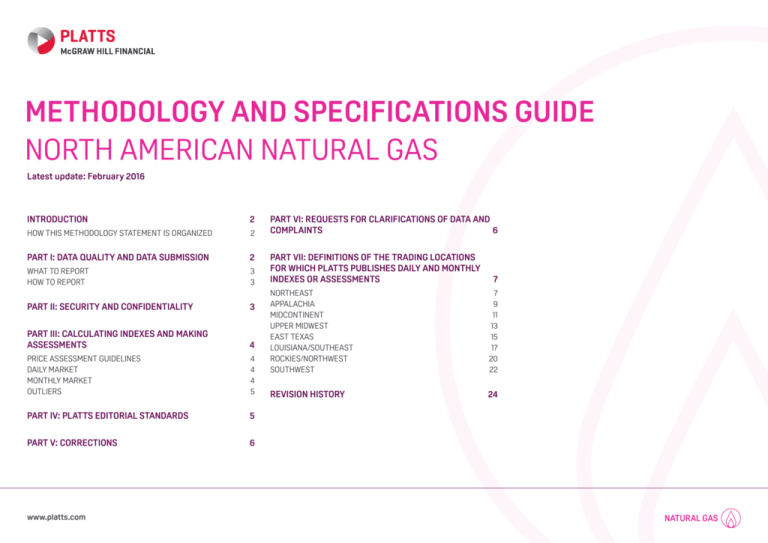

methodology and specifications guide north american

advertisement