“Copper and Nickel Supply Side Economics Make Strong Case for

advertisement

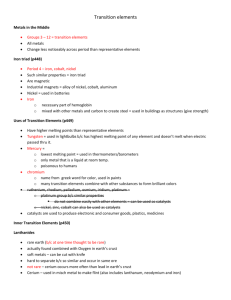

“Copper and Nickel Supply Side Economics Make Strong Case for Titanium”

Rob Henson

Manager, Business Development

VSMPO Tirus US

Steven Hancock

Market Analyst

TiRus International SA

Abstract

Increasing population growth and urbanization is driving demand for potable water, electricity, waste water

treatment, refrigeration and air conditioning. All of these industrial processes have historically depended on

copper and nickel alloys for reliable process equipment, whereas in the case of electrical power generation and

distribution there is no alternative to copper. The resulting strong demand projections for copper and nickel come

just at a time when mine yields are declining due to depth limitations and processes are becoming more expensive

due to increased energy consumption per ton of produced metal.

The growing stress on the supply side of these commodity metals is impacting on the economics of material

selection and titanium will be shown to be an attractive alternative for many applications within these industrial

processes. Our paper will explore the supply side economics of copper and nickel production, including ore

reserves, mine development, extraction processes and analyst projections, to show the price impact these

developments could have.

Global Population Growth and Urbanisation

In 1960, the world’s population consisted of 3 billion people, one billion in the industrialised world and two billion

in developing countries. In the subsequent half century industrialised countries have seen modest population

growth but the developing world has grown threefold. The rate of growth however, continues to decrease

especially in Asia as people become wealthier, more educated and have smaller families. Some projections show

the world’s population topping out at around 10 billion by the middle of the century. However, pressure on

resources and the environment as a result of population growth, are compounded by an alarming rate of

urbanisation: by 2050, 64% of the world’s developing population will live in cities in comparison to just under 50%

today and only 18% in 1950. Both phenomena result in higher demand for resources and infrastructure:

population growth through sheer numbers and urbanization through higher consumption per capita. As a result,

continued economic growth in the developing world will necessitate compound growth in resource extraction and

infrastructure construction.

Global Population (billion) & Growth (%)

10

2.5%

8

2.0%

6

1.5%

4

1.0%

2

0.5%

0

0.0%

1950 1960 1970 1980 1990 2000 2010 2020 2030 2040 2050

1

Industrialised

Developing

Growth Rate

Global Economic Growth

The industrialisation of the developed world was facilitated by the availability of the raw materials and fossil fuels

and simplified by scant regard for environmental impacts. However, real concerns are now emerging over the

sustainability of resource extraction at current growth rates. Inevitably, mine yields for many commodities are

declining as deposits are being depleted, copper and nickel being the two pertinent examples discussed in the

current paper. Also, environmentally unfriendly techniques of extraction and refinement are becoming

unacceptable with the deterioration in community health, water and air quality levels.

Since the 2009 recession, global economic growth has stabilised at around 4.5% but includes a wide spread

between the growing developing economies lead by China (8.5%) and stagnant developed economies of Europe

(2%). However, in the light of both declining yields from resource extraction and environmental impact concerns,

the sustainability of continued economic growth at current rates is questionable at least while pressure on supply

side economics is undeniable. Medium and long term growth will be largely dependent on emerging technologies

for clean, efficient and sustainable processing of resources.

15.0%

Forcast Economic Growth (%)

10.0%

China, 8.5%

India, 7.0%

5.0%

ME&NA, 4.6%

CIS, 4.0%

USA, 2.9%

EU, 2.0%

0.0%

-5.0%

2006

2008

2010

2012

2014

2016

2018

2

World Net Electricity Generation

The International Energy Agency estimates that 19% of the world's population did not have access to electricity in

3

2010 and 57% of the African population remains without access to electricity . In 2010, OECD and non-OECD

1

2

United Nations, World Population Prospects: The 2012 Revision

IMF 5 year forecast: April 2013 (growth at constant prices)

countries each generated half the net electricity produced globally but by 2050, current non-OECD countries could

be generating twice as much as the OECD. To achieve this, developing countries will need to make massive

investments in all forms of electricity generation. For example, the World Nuclear Association predicts that China

has almost 30 nuclear reactors planned to give more than a three-fold increase in nuclear capacity by 2020 and is

4

aiming for 150 GWe by 2030 and considerably more by 2050 . New capacity will also be required in developed

countries as under-investment has meant that a large proportion of operating plants are reaching the end of their

useful life. So whilst total generation will increase in parallel with demand, growth in the market for new

installations and infrastructure may see a step change in the medium term.

Net Electricity Generation (trillion kWh) & Growth (%)

45

4.0%

40

3.5%

35

3.0%

30

2.5%

25

2.0%

20

1.5%

15

10

1.0%

5

0.5%

0

0.0%

2005

2010

2015

OECD

2020

2025

non-OECD

2030

2035

Growth Rate

2040

5

Demand for Desalination

Water and energy are inextricably linked with 90% of global generation being water intensive and more that 15%

of all water withdrawals going to energy production. Choices made in one domain have direct and indirect

consequences on the other and both are essential for human well-being so economic development is not possible

without sufficient supplies of both. UNESCO is projecting global water demand in terms of withdrawals to increase

by some 55% by 2050. With 20% of the world’s population currently living in areas of high water stress, that

6

number could increase to 40% by 2050. China, India and the Middle East will account for around 60% of the

increase in demand over the next 20 years and with water scarcity already a major issue, water management will

be absolutely critical to enabling continued economic development in these countries. Water and energy

infrastructure and technologies with inherent synergies for co-production can minimise trade-offs and will play an

essential role. Desalination through combined heat and power plants is one such example of integrated planning

and will become far more common, if not essential in the future.

7

The long term growth in desalination market is estimated by GWI at 9% CAGR with the Middle East continuing to

be the main demand region but with China and India become increasingly important in the medium term. For

example, it’s likely that China’s South-North water transfer scheme will need to be complimented by seawater

desalination to ensure year round supply. Industrial desalination will also become increasingly important as

domestic and industrial demand compete for limited resources.

3

International Energy Agency – Global Energy Outlook 2013

World Nuclear Association – Country profile: China

5

Energy Information Administration – International Energy Outlook 2013

6

UN World Water Development Report 2014, Volume 1 – World Water Assessment Programme

7

GWI Desaldata.com forecast webinar June 2013 – Christopher Gasson

4

16

New Desalination Capacity (million m3/day)

14

12

Other

10

Europe

8

Americas

6

Asia South Pacific

Middle East and Africa

4

2

0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

8

Demand for Corrosion Resistant Metals

Since the majority of the growth in population is taking place in underdeveloped regions of the world the

infrastructure to support this population is not in place. Potable water is scarce, water for irrigation may not be

available and the power grid will have to be built from the ground up. Additionally, sanitation systems and water

reclamation systems are often non-existent. To provide an acceptable standard of living for these growing

populations a tremendous investment in infrastructure will be required.

The impact of population growth on the demand for specialty metals has been well documented and reported by

9

many authors . Essentially, copper for electrical power generation and distribution, copper and nickel for alloy

production will also create demand for titanium products. While the demand for finished goods will be significant

the focus of the current paper is the impact this demand will have on the supply side of the copper and nickel

industries.

Increasing demand for copper and nickel alloys have driven large investment in mines and processing plants

globally. However, the quality of these new mines has been rapidly declining over the last 25 years and production

costs have skyrocketed as a result. Understanding the facts behind this increased production cost will allow

projections on future comparative prices for copper, nickel and alloys thereof.

The Status Quo

The markets for traditional corrosion resistant materials (copper, copper-nickel and stainless steel) are facing some

important supply side constraints that could potentially lead to price rises, improving the economics of substitute

materials. For example, copper supply is strained as resources become scarce and production cost increases. Nickel

market dynamics could be in for some turmoil due to export restrictions imposed by Indonesia on laterite ore.

Both copper and nickel mines have shown declining yields and growing energy costs translate into increased cost

of production.

While prices have declined recently, most analysts see this this as temporary due mainly to slowing demand from

China and the US Federal Reserve’s plan to reduce their program of bond purchases. In all likelihood the above

mentioned constraints on supply could begin to take effect as early as next year. This paper will investigate these

constraints in more detail and suggest what impact they might have on bolstering the market for alternative

materials such as titanium.

8

9

GWI Desaldata.com - new contracted capacity in year of contract

References ???

Global Copper Reserves

The US Geological Survey estimate current mining operations of conventional copper hold reserves of around

690million MT, most of which is held in the Andes Mountains of South America. In total, known resources could

amount to 1.8billion MT some of which has already been exploited.

10

Global Copper Production

Current mining operations extract just over 16million MT of contained copper per year with global copper demand

for semi-finished products estimated at around 25million MT. 5million MT of that is recycled as directly melted

high grade copper scrap and around 4million MT of low grade scrape passes back into smelting and refining

operations. Chile mines around one third of the world’s copper some of which is further refined but China has

ramped up smelting and refining over the last 10 years to become the by far the world’s largest copper producer.

20

OTHERS

10

USA

PERU

CHINA

5

15

15

10

10

5

0

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Refined (mil MT)

OTHERS

CHILE

-

20

OTHERS

RUSSIA

CHILE

JAPAN

CHINA

5

-

RUSSIA

USA

JAPAN

CHILE

CHINA

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

15

Smelted (mil MT)

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Mined (mil MT)

20

11

Assuming copper demand grows at least as fast as that of global economy (a conservative estimate), it could

double over the next 20 years but whether or not supply can meet this demand at current prices is not as certain.

Despite growth in copper production, supply is becoming constrained by a number of difficulties in the production

cycle, namely:

•

•

•

10

11

CapEx costs are escalating due to declining ore grades so larger scale operations need to be developed.

Rising energy costs translate directly into higher production costs.

Greater political risks and infrastructure challenges are being faced as a result of more remote locations.

US Geological Survey 2014

US Geological Survey 2014

1.8

1.6

1.4

1.2

1

0.8

0.6

0.4

0.2

0

Copper Grades (% Cu)

1985

1990

1995

2000

2005

2010

2015

2020

2025

Industry Head Grade Trends (Weighted Paid Copper) - Oracle Mining Corp / Brook Hunt

12

Average Grades for Copper Industry - AQM Copper

In addition, skills and equipment shortage, smaller areas available for exploration, lengthy and difficult permitting

processes, environmental concerns, social unrest and natural disasters have all been contributing factors to

13

escalating production costs .

86%

84%

82%

80%

78%

76%

74%

72%

70%

Copper Mine and Refinery Capacity Utilisation (%)

Mine Capacity Utilisation

Refinery Capacity Utilisation

2009

2010

2011

2012

2013

14

Copper Supply and Demand

Although output of refined copper grew in 2013 due to recovery from previous production constraints, the real

copper supply deficit, adjusted for Chinese bonded stock changes, grew to 450’000 MT compared to a surplus of

15

300’000MT in 2012. This amounts to around 2% of demand . Although there is enough material in stock around

the world to cover this deficit, the constraints to new capacity coming online in the future is of greater concern.

Since 1900, copper demand has grown at a compound annual growth rate of 3.4% until today, with the global

average per capita use rising from 2kg to 3kg per person over the last 50 years. Since two thirds of all end use

applications are for electrical components and construction, economic growth and development translates

inevitably into copper demand. For this reason it’s difficult to see a scenario where growth in copper demand

doesn’t at least match that of regional economic growth. With China already accounting for 60% of primary copper

demand and their long term economic growth expected to remain above 6% for at least the next 20 years, it is

highly likely that the business case for substitute materials will improve.

12

Oracle Mining Corp, AQM Copper, Rio Tinto

Mining.com - http://www.mining.com/web/global-copper-production-under-stress/

14

International Copper Study Group – press release March 2014

15

International Copper Study Group – including seasonal and Chinese bonded stock adjustments

13

6%

12%

9%

13%

Copper Demand by Region

Copper Demand by Product

Copper Demand by Sector

33%

14%

16%

13%

20%

60%

72%

32%

Electrical Products

Construction

Industrial Machinery

Transport

Consumer Products

Asia

Europe

Americas

Other

Wire Rod

Cake / Slab

Billet

45

16

Copper Supply and Demand (million MT)

Mine Production

Refined Production

Refined Usage

Demand assuming 3% CAGR

40

35

30

25

20

15

10

5

1960

1970

1980

1990

2000

2010

2020

2030

17

Global Nickel Reserves

The US Geological Survey estimate current nickel mining operations hold reserves of around 74million MT with

Australia and New Caledonia holding the largest share. In total, known resources could amount to 130million MT.

18

16

US Geological Survey

International Copper Study Group Statistical Yearbook 2013

18

US Geological Survey

17

Indonesia Export Ban

The global nickel market was rocked in January this year when the government of Indonesia made good on the

long standing threat to restrict export of unprocessed nickel laterite ore. Chinese producers of stainless steel have

come to rely on this ore supply to produce the nickel pig iron as an alternative to refined nickel for stainless steel

production.

Nickel pig iron (NPI) is a low grade ferronickel invented in China as a cheaper alternative to pure nickel for the

19

production of stainless steel . The production process of nickel pig iron utilizes laterite nickel ores instead of pure

nickel sold on the world market. The alternative was developed as a response to high price of pure nickel and this

cheaper substitute for pure nickel influences the price of nickel on the world market by lowering the demand in

certain applications, the most important being the production of stainless steel, representing about two thirds of

nickel use.

Nickel pig iron is composed of low-grade nickel ore, coking coal, and a mixture of gravel and sand as an aggregate.

This mixture is heated in either a blast furnace or an electric arc furnace depending on the desired grade.

Impurities are then removed via smelting and sintering processes and the resulting nickel pig iron contains 4 – 13%

pure nickel.

The export ban for unprocessed ore is a game changer for the nickel industry in that stainless steel producers in

China which account for 50% of the global production will now be forced to use refined nickel. According to

Macquarie Group if the ban remains in place beyond the July 2014 presidential election in Indosesia the nickel

20

market will see massive deficits and a resulting tightness of supply similar to that of 2006 and 2007 .

China and Nickel Pig Iron

Eramet, a French nickel and manganese producer reported that despite a 5% increase in global stainless

steel production, LME nickel prices fell 14% on average 2013 as compared with pricing in 2012. In the

second half of 2013 nickel prices fell further as the production of nickel pig iron in China using ore

imports from Indonesia and the Philippines has nearly tripled in just three years and now totals almost a

quarter of global supply of nickel.

On Feb. 21, Eramet announced that the deteriorating nickel market and short-term outlook for nickel

prices means that they are putting off a final investment decision on its flagship Weda Bay nickel project

in Indonesia. According to Scotiabank’s Patricia Mohr “The nickel market is different market today than

it was five years ago, mainly due to the production of nickel pig iron in China, where technology has

been honed to upgrade the ore to make nickel pig iron.” But the commodities specialist believes that

the outlook for nickel prices is probably brightening with the implementation of Indonesia’s ban in

January. She predicts that by the second half of 2014, “China will have used up its inventories of ore

from Indonesia that it can use to operate nickel pig iron plants and nickel prices will start to firm.”

While there is not universal agreement about how quickly Chinese producers will exhaust their supply of

stockpiled ore there is a consensus that if the export ban remains in place nickel prices will continue to

firm up as China reverts to the import of refined nickel to meet its needs. Whether the stock piles are

consumed by mid-year or last until year’s end the demand for those nickel units will have to be met by

import of refined nickel as China’s needs exceed the capacity for production of refined nickel in country.

19

20

Wikipedia

Financial Times, 4/10/2014 Nickel Jumps Above $17,000…

Raymond Goldie of Salman Partners estimates that Western inventories of nickel will drop to 100 days’

of consumption some time in 2016. “Once inventories have hit that pinch point,” he adds, “we expect

that nickel prices could rise sharply to the double-digit level.” While prices will remain flat until 2016, he

expects the spike will likely come in 2017. Andrew Mitchell, principal nickel analyst at Wood Mackenzie

in London, expects nickel prices will to continue to climb and expects another 25% increase in price

going into 2016. Mitchell points out that last year production of nickel in nickel pig iron totalled 490,000

tonnes, but anticipates that that number will fall to 450,000 tonnes this year and to 250,000 tonnes in

2015.

Mining and Production

Nickel Mined Products (‘000 MT)

2,000

Nickel Production ('000 MT)

2,000

1,800

1,800

1,600

1,600

1,400

1,200

BRAZIL

1,000

OTHERS

800

400

Norway

Australia

Canada

Japan

200

Russia

AUSTRALIA

600

CANADA

PHILIPPINES

RUSSIA

2009

2008

2007

2006

2005

2004

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

China

-

INDONESIA

-

2003

200

2002

400

2001

600

2000

800

2011

NEWCALEDONIA

1999

1,000

OTHER

1998

1,200

2010

1,400

21

Nickel Supply and Demand

Primary Ni Production ('000 MT)

1800

1600

1600

1400

1400

Oceania

1200

1000

1200

Europe

800

600

Asia

US Geological Survey

International Nickel Study Group

2012

America

2011

2012

2011

Africa

0

2010

200

America

2010

2007

2008

Africa

0

2009

200

Asia

400

2009

400

2008

600

22

Europe

1000

800

21

Ni Consumption ('000 MT)

2007

1800

22

Distribution of Nickel Ore Raw Materials

Distribution of Nickel Raw Materials (million MT)

Ore

400

300

200

100

-

Laterite ore

Concentrate

Ores and

concentrates

23

Stainless Steel Production

Stainless Steel Production (million MT)

70%

SS Production Year on Year Growth (%)

China

Rest of the World

60%

35

50%

30

40%

China &

Central

The

Eastern

Americas

Europe

Asia

20%

10%

0%

2013e

2012

2011

2010

2009

2008

2007

2006

-20%

2005

2013e

2012

2011

2010

-10%

2009

2008

2005

2004

2003

2002

2001

0

2007

5

2006

without

China

Western

Europe &

Africa

10

2004

15

30%

2003

20

2002

25

2001

40

China Stainless Steel Production

According to Stainless Steel World, SMI GmbH has conducted an in-depth analysis of the Chinese stainless steel

industry during the past three months – Chinese producers has melted more than 20 million tonnes (MT) of

stainless steel which also catapulted the global melt production to over 40MT. Chinese production has been

accounted for 50.5 % of the global output in 2013.

The total stainless crude production climbed to 20.5MT in 2013 (up 17 % from 17.5MT in 2012) and finished

product output reached 18MT(up 16 % from 15.5MT in 2012). Production volumes of more than 100 Chinese

plants (including around 60 with own melting) were aggregated and all double-counting was eliminated.

The crude output of the major state owned and foreign invested producers (TISCO, Baosteel, LISCO, ZPSS, JISCO,

Dongbei) increased by 11 % in 2013. Private producers contributed to most of the growth: their combined crude

production rose by 24 % in 2013.

23

24

International Nickel Study Group

International Stainless Steel Forum

24

The biggest increase came from Tsingshan Group which already is the second largest producer of stainless steel in

China behind the state owned giant TISCO. Eight producers were melting more than 1MT in 2013, including

25

newcomer Beihai Chengde which started production in 2012 in southern Guangxi Province.

The 2013 melt production of 20.5MT was split into the following grades:

•

•

•

200 series incl. CrMn steels 31 %

300 series 50 %

400 series 19 %

Nickel Consumption

Nickel Consumptions by Source Product

Nickel Consumption by End-use Product

3.9%

4.5%

6.8%

10.4%

28.3%

10.9%

9.8%

15.6%

16.2%

Other Electrolytic

Ferronickel

Nickel pig iron

Pellets, Powders, Salts, Ni Oxide

Premium Electrolytic NI

Briquettes

9.9%

18.6%

HPAL versus Heap Leach Project Cost

Parameter

Nickel Production (LOM)

Cobalt Production (LOM)

Capital Cost

Capital Intensity

Cash Cost (exclude by-products)

Cash Cost (include by-products)

NPV (10% real, non geared)

IRR (real, post tax)

Capital Payback (from free cash)

25

Stainless Steel

Electroplating

Nickel Alloy

Other

Other Steel

Foundry

26

27

Unit

tpa

tpa

US$m

US$/lb Ni

US$/lb Ni

US$/lb Ni

US$m

%

Years

Stainless Steel World, 10/4/2014

International Nickel Study Group – data for 2011

27

Malachite Process Consulting, Wedderburn, 2010

26

65.1%

HPAL

55,700

4,100

$3,750m

$30.5/lb

$4.59/lb

$3.86/lb

($2,160)m

1.60%

N/A

HL

32,800

640

$950m

$13.1/lb

$3.58/lb

$3.39/lb

$220m

17%

7 years

Declining Ore Grades for Copper and Nickel

Nickel Grade (% Ni dry 12MMA)

3

2.9

2.8

2.7

2.6

2.5

2.4

2.3

2.2

2000

2005

2010

Average grade of nickel saprolite ore mined in New Caledonia Macquarie Research / Brook Hunt

28

High Pressure Acid Leaching of Ni Laterite

The application of pressure acid leach (PAL) and pressure oxidation technology to the treatment of metal ores has

more than a 40 year history of successful application. The Moa Bay processing plant built in the late 1950’s utilizes

PAL and steam agitation to treat nickel/cobalt laterite ores. This portion of the plant is very similar to processes in

use and under construction today. However, metal recovery and refining options do vary considerably from site to

site.

Laterite Ni/Co ores are abundant and may contain as much as 70% of the world’s nickel reserves. While run of

mine nickel grades vary widely the ores can be upgraded by grinding, washing and sizing. The PAL process and

selective precipitation are effective for producing mixed Ni/Co intermediates from these low grade deposits. As

known nickel sulphide ore bodies are rapidly being exhausted the industry must rely on laterite deposits for future

supply.

The following list outlines some recent project and associated problems:

•

•

•

•

•

28

Bulong was never large enough to generate positive cash flow and a heavy debt burden doomed the

project early on. The plant has not operated since 2002 and is currently owned by Norilsk as a result of

the LionOre acquisition in 2007.

Cawse Nickel like Bulong was too small to stand on its own and failed to generate cash for expansion. A

large portion of capital was invested in the SX/EW plant that never did produce high quality nickel, a plan

to utilize the refinery for EMD has never gotten off the ground.

Murrin Murrin was largely designed for success and has weathered the storm. A design choice by the

original EPC contractor on the flash vessels proved disastrous and the project was significantly delayed

while replacements were built. Moreover, the replacement flash vessel design was constrained by

existing equipment and a full 20% reduction in autoclave throughput was unavoidable.

Goro Project in New Caledonia suffered badly due to cost overruns and major revisions to the process

flow sheet during construction. The plant is now operating but continues to suffer from compromises

made in an effort to reduce capital costs.

Ravensthorpe Nickel was constructed by BHP Billiton (BHPB) beginning in 2004 with an initial capital

estimate of $1.2B, construction took 4 years and the plant was commissioned in 2008. Final capital costs

were reported to be $2.4B and still the plant produced only 35% of design volume. BHPB shuttered the

plant in 2009, took a write down of $3.6B and sold the facility to First Quantum Minerals for a price

Macquire Resarch / Brook Hunt

•

•

reported to be less than 10% of the total investment. First Quantum has made modifications to the

process plant and is operating today at an annual nickel production rate of 39,000 MT/yr.

Coral Bay was built with a simplified flow sheet which produces a Ni/Co sulphide product which is further

processed at a smelter in Japan. The absence of an acid plant and metal refinery at the mine site greatly

reduces capital cost and allowed production ramp up to reach name plate capacity in only 14 months.

Final capital cost for the project came in within 10% of budget.

Ambatovy required five years and $4.5B to construct a plant for the production of 60,000 MT/yr refined

nickel. The plant delivered the first nickel in late 2012 and continues to push toward design capacity.

High Pressure Acid Leach (HPAL) Processing - HPAL Project Costs vs Heap Leach

Parameter

Nickel Production (LOM)

Cobalt Production (LOM)

Capital Cost

Capital Intensity

Cash Cost (exclude by-products)

Cash Cost (include by-products)

NPV (10% real, non geared)

IRR (real, post tax)

Capital Payback (from free cash)

Unit

tpa

tpa

US$m

US$/lb Ni

US$/lb Ni

US$/lb Ni

US$m

%

Years

29

HPAL

55,700

4,100

$3,750m

$30.5/lb

$4.59/lb

$3.86/lb

($2,160)m

1.60%

N/A

HL

32,800

640

$950m

$13.1/lb

$3.58/lb

$3.39/lb

$220m

17%

7 years

Commodity Prices

Commodity markets and especially major base metals have been affected by two main factors recently:

•

•

Slowing industrial growth in China: this has translated into weaker demand for metals and reduced prices.

The US Federal Reserve’s winding down of stimulus measures (quantitative easing / government bond

purchases): commodity markets are widely thought to have benefitted from liquidity generated by these

measures.

Both of these factors have put downward pressure on previously inflated prices but at the same time have masked

the supply constraints that exist for some commodities, notably copper and nickel. It’s likely that prices will begin

to reflect the supply / demand imbalance more closely in the near term.

35.00

Nickel and Copper Commodity Prices (US$/kg)

LME Nickel

30.00

LME Copper

316 Stainless Flat Coil

25.00

Cupro Nickel 90-10

20.00

Cupro Nickel Scrap 30-70

15.00

10.00

5.00

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

30

29

Malachite Process Consulting, Wedderburn, 2010

Cu-Ni Tube Trade

According to trade data, China exports about half of all copper-nickel tubes and pipes traded around the world.

Quantity and unit values have increased from insignificance in the early 2000’s to current levels with a peak in mid2011. Since then unit values have moderated slightly to their current level of between $11-$12/kg.

Trade Uniti Price (US$/kg)

1,400

2010 onwards by month

Annualised

14

Unit Price (US$/kg)

Trade Quantity (MT/month)

11.27

12

1,200

1,000

10

800

8

600

6

400

4

200

2

Trade Quantity (MT/month)

Chinese exports of Cu-Ni Tubes and Pipes

16

-

0

2000

2005

2010

2011

2012

31

Comparative Prices for Condenser Tubes

Since Titanium is usually an alternative to Copper in desal, the price differential is a driver in the material choice.

The drop in price differential during 2010-11 resulted in the titanium becoming significantly more attractive. Were

the prices of both materials to rise, other technologies such as RO are favoured. Typically, Ti tubes make up 10% of

the tube bundle and are used where corrosion risk is high. Since the density of Ti is half that of brass, if the price of

Ti tubes is less than double that of copper tubes, Ti will be cheaper per meter irrespective of the value associated

with its corrosion resistance.

Comparison of 19.05mm OD condenser tubes of different materials

Comparative cost per meter

Comparative

Alloy Cost

Ti Gr2 = 100%

350%

100%

85%

250%

200%

200%

150%

60%

150%

100%

100%

35%

0.5

4.51

0.711

75%

7.67

8.47

300%

8.95

8.96

1.2

1.2

1.2

Ti Gr2 = 100%

340%

Density

g/cm3

280%

Wall Thickness

mm

50%

30

Ti Gade 2

Al Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

Ti Gade 2

Al Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

Ti Gade 2

Al Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

Ti Gade 2

Al Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

0%

Metalsprices.com – March 2014

UNComtrade database - HS741122 Pipes & tubes, copper-nickel base alloy or copper-nickel-zinc base alloy

32

VSMPO estimates

31

32

Copper vs Titanium Pricing

The price differential between copper and titanium can be a good indicator of the business case for using titanium

in industrial heat exchange applications since copper-nickel and titanium tubes are to a certain degree

interchangeable. For example, the rising price of copper in 2009/2010 would have helped make the case for

titanium for Ras Azzour and Yanbu 3 desalination plants where all condensers were made entirely from titanium a first for the desalination industry.

LME Copper Cash Official

Ti Gr.1 Slab FOB Rotterdam

Unit Price

Copper versus Titanium Pricing

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

33

Titanium Metal Supply

Having only entered the titanium sponge production market 10 years ago, China has built up a vast sponge

production capability brining global capacity well above demand. Most of the sponge produced in China is destined

for commercial and industrial applications rather than aerospace or medical applications so supply of commercial

grade titanium is reasonably secure for the foreseeable future. This in addition to the proliferation of titanium tube

welding lines around the world is likely to add to the case for titanium tubes as an alternative to incumbent

materials such as copper-nickel.

400

Global Titanium Sponge Capacity (MT)

400

Global Titanium Melting Capacity (MT)

350

350

300

300

250

250

200

200

Russia & CIS

150

150

Europe

100

100

50

50

China

Japan

US

-

2001

2003

2005

2007

2009

2011

2013

2001

2003

2005

2007

2009

2011

2013

34

Conclusion

It is clear that the combined effect of declining head grade at mines and increased energy costs will drive the LME

price of nickel and copper higher over time. Substitution of other materials for construction will alleviate the

33

34

Metalprices.com

Regional Titanium Associations & VSMPO Estimates

demand shortfall in some instances but many of the applications for these commodity metals do not currently

have a substitute such as nickel for jet engine application and copper for electrical power generation. The pressure

for additional tonnage will continue on the supply side and this will result in a steepening price curve.

With regards to the titanium industry, there is a well developed mining industry that is currently shipping 95% of

its production as a mineral product. The potential increase in value to the titanium miners is very attractive if they

ship to a metal production facility, and as only 5% of mined titanium product is reduced to titanium metal in

today’s market there is considerable elasticity in the supply side of the business.

In spite of the advances in nickel pig iron production over the last three years copper-nickel alloys are at a price

disadvantage to titanium products. Furthermore, with regulatory restrictions on exports of non-processed nickel

ore, this advantage for titanium is expected to increase. Increasing production cost for copper and the lack of an

alternative metal in electrical power generation is expected to also widen the cost of ownership in favor of

titanium.

Copper and Nickel Supply Side Economics

Make Strong Case for Titanium

VSMPO-AVISMA Corporation

Rob Henson, Manager, Business Development

Steve Hancock, Market Analyst

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Demand for corrosion resistant materials

• Population

– Inevitable demand on resources

• Economic Growth

– China needs to maintain but moderate growth

• Electricity Generation

– Hand-in-hand with population & economic growth

• Water – Desalination

– Resources are finite and under pressure globally

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Global Population Growth

• 7.1 billion now ~ 10 billion by 2050

World Population

(Billions)

12

10

8

More developed regions

Less developed regions

6

4

2

1950 1960 1970 1980 1990 2000 2010 2020 2030 2040 2050

Source: United Nations, World Population Prospects: The 2012 Revision

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Global Economic Growth

• China & India moderate while West stabilises

15%

World

GDP Growth

10%

China

8%

7%

5%

0%

4%

3%

2%

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

-5%

Source: IMF 5 year forecast: April 2013 (growth at constant prices)

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

India

United States

European Union

Middle East and North Africa

CIS

World Net Electricity Generation

• China and India leading capacity expansion

12

10

Trillion kWh

OECD Americas

Forecast CAGR

3.2%

OECD Europe

8

OECD Asia

6

1.3%

4

Middle East & Africa

India & Other Asia

Forecast CAGR

3.5%

2

0

2005

Europe and Euraisa

Forecast CAGR

China

Central and South America

2010

2015

2020

2025

2030

2035

2040

Source: Energy Information Administration – International Energy Outlook 2013

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Demand for Desalination

7

Millions

Capacity (m3/day)

Middle East and Africa

6

4

Europe

3

Other

Asia South Pacific

5

Americas

2

1

-

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Online Year

Source: Desaldata Forecast, June 2013

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

The status quo under threat

Primary materials in corrosive environments

• Copper Nickel & Stainless

– Copper supply is strained as resources become

scarce and production cost increases

– Nickel market dynamics could be in for some

turmoil due to export restrictions

– Chinese stainless production is directly linked

with Indonesian laterite ore exports

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Global Copper Reserves & Trade

• Remaining global copper reserves

– 280 Million MT

Arrows showing trade are indicative only

Poland

26mil MT

US,

Canada &

Mexico

87mil MT

Chile &

Peru

266mil MT

Russia &

Kazakh

27mil MT

Congo &

Zambia

40mil MT

China &

Indonesia

58mil MT

Australia

86mil MT

Source: US Geological Survey

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Production or Use (million MT)

Global Copper Production

40,000

Mine Production

Refined Production

Refined Usage

Demand assuming 3% CAGR

35,000

30,000

25,000

20,000

15,000

10,000

5,000

1960

1970

1980

1990

2000

2010

2020

Source: International Copper Study Group

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

2030

Copper Demand & End-use

• China dominates demand

12%

9%

13%

13%

33%

Sector

16%

14%

Product

20%

6%

Region

72%

32%

Electrical Products

Construction

Industrial Machinery

Transport

Consumer Products

Wire Rod

Cake / Slab

Billet

Source: Anglo-American, International Copper Study Group, 2012

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Asia

Europe

Americas

Other

60%

Copper Supply & Demand

• CapEx costs are escalating because:

– Declining ore grades mean larger scale operations for the

same yield

– Newer projects are more often in remote areas with little or

no infrastructure

• Capital intensity for Teck’s Quebrada Blanca’s reported to be

$28,000 USD/MT

• Other factors putting pressure on supply:

– Skills shortage

– lengthy and difficult permitting processes

– environmental concerns

Source: (1) Mining.com

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Copper Supply & Demand

• Difficult road ahead for mining companies:

– Peru

• > 15 projects have been delayed due to social unrest

– Chile

• Power and water shortages

• Environmental groups opposed to new capacity

• Codelco sites lower copper grades and higher energy

prices as reason for increasing production cost

Source: (1) Mining.com

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Global Nickel Reserves & Trade

• Remaining global nickel reserves

– 75 Million MT (estimated 70% are laterite ores)

Arrows showing trade are indicative only

Russia

6.1mil MT

Canada

3.3mil MT

Brazil &

Columbia

8.6mil MT

South Africa,

Madagascar &

Botswana

5.8mil MT

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

China,

Indonesia &

Philippines

8.3mil MT

New

Australia

20mil MT Caledonia

12mil MT

Source: US Geological Survey

The effect of Indonesia’s export ban

•

•

•

78% of Indonesia’s mined nickel products are exported unprocessed

– 90% of that goes to China for conversion to NPI

– China has been stockpiling in anticipation of the ban

Indonesia’s electricity supply could be a challenge for the economic

viability of developing domestic processing.

The Philippines will be watching the Indonesian experiment carefully

Ref: Materials World Feb, 2014

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

China, Nickel Pig Iron & Stainless

•

Chinese stainless steel makers have increasingly used NPI as a cheaper

alternative to pure Ni

•

China’s production of NPI using ore form Philippines and Indonesia has nearly

tripled in three years and is now ¼ of global supply

•

China has been stockpiling laterite ore in anticipation of the Indonesian ban on

exports but this will be used up by the end of 2014

•

The question now is whether or not China will carry out planned invest in

plants in Indonesia

•

Nickel price is expected to rise which will bring additional capacity to market

Source: The Northern Miner

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Asia

Source: International Nickel Study Group

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

2012

America

2011

Africa

2010

2012

2011

2010

America

2009

Africa

Europe

2009

Asia

Ni Consumption

2008

Europe

1800

1600

1400

1200

1000

800

600

400

200

0

2007

‘000 MT

Oceania

2008

1800

1600

1400

1200

1000

800

600

400

200

0

Primary Ni Production

2007

‘000 MT

Nickel Supply & Demand

Distribution of Raw Materials

• Indonesian export ban: 72% of exports go to China

350,000

300,000

250,000

200,000

150,000

100,000

50,000

-

Ore

Laterite ore

Concentrate

Ores and concentrates

Other

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Nickel Consumption

Ni Source Product

Ni End-use Product

3.9%

4.5%

6.8%

10.4%

28.3%

10.9%

9.8%

15.6%

9.9%

16.2%

65.1%

18.6%

Other Electrolytic

Ferronickel

Nickel pig iron

Pellets, Powders, Salts, Ni Oxide

Premium Electrolytic NI

Briquettes

Stainless Steel

Electroplating

Nickel Alloy

Other

Other Steel

Foundry

Source: International Ni Study Group, 2011

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Impending Nickel Shortage?

• Long term demand growth 2%pa

3000

Highly Probably Projects

‘000 MT

2500

Existing Supply

2000

620kT

Consumption

1500

1000

500

0

2000

2005

2010

2015

2020

2025

Source: Wood Mackenzie

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

2030

Copper

2025

2020

2015

2010

2005

2000

1995

Nickel Grade (% Ni dry 12MMA)

3

Industry Head Grade Trends (Weighted Paid Copper) Oracle Mining Corp / Brook Hunt

Average Grades for Copper Industry - AQM Copper

1990

1.8

1.6

1.4

1.2

1

0.8

0.6

0.4

0.2

0

1985

Copper Grade (% Cu)

Declining Grades

Nickel

2.9

2.8

2.7

2.6

2.5

2.4

Average grade of nickel saprolite ore mined in

New Caledonia - Macquarie Research / Brook

Hunt

2.3

2.2

2000

2005

Source: Oracle Mining Corp, AQM Copper

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

2010

Commodity Prices

• Nickel & Copper 1990 to present

35.00

LME Nickel

LME Copper

25.00

316 Stainless Flat Coil

20.00

Cupro Nickel 90-10

Cupro Nickel Scrap 30-70

15.00

10.00

5.00

-

Jan-90

Jan-91

Jan-92

Jan-93

Jan-94

Jan-95

Jan-96

Jan-97

Jan-98

Jan-99

Jan-00

Jan-01

Jan-02

Jan-03

Jan-04

Jan-05

Jan-06

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

$/kg

30.00

Source: Metalprices.com

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Unit Price (US$/kg)

• Chinese export stats

16

14

12

10

8

6

4

2

0

annualized

Trade Quantity (MT/month)

Trade Uniti Price (US$/kg)

2010 onward by month

1,400

11.27 1,200

1,000

800

600

400

200

2000

2005

2010

2011

2012

Source: UNComtrade database - HS741122 Pipes & tubes, copper-nickel base alloy or copper-nickel-zinc base alloy

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

-

Trade Quantity (MT/month)

Cu-Ni Tube Trade

Alloy Comparison for Heat Exchange Tubes

100%

Ti Gade 2

150%

Aluminum Brass

Source: VSMPO estimates

70-30 Cu/Ni

Ti Gade 2

0%

Al29-4Ci

200%

280%

100%

35%

Aluminum Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

Ti Gade 2

Aluminum Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

300%

200%

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

400%

Comparative cost / meter

Ti Gr2 = 100%

90-10 Cu/Ni

85%

75%

60%

4.51

8.47

7.67

8.95

8.96

0.5

Ti Gade 2

100%

Comparative alloy cost

Ti Gr2 = 100%

Density

g/cm3

1.2

Aluminum Brass

Al29-4Ci

70-30 Cu/Ni

90-10 Cu/Ni

0.711

1.2

1.2

Wall Thickness

mm

340%

• Comparison for 19.05mm OD Tube

Titanium Metal Supply

• No shortage in Ti sponge & melting capacity

Sponge

400

350

Melting Capacity (MT)

Production Capacity (MT)

400

300

250

200

150

100

50

-

2001 2003 2005 2007 2009 2011 2013

Melting

350

300

China

250

Japan

200

Russia & CIS

150

Europe

100

US

50

-

2001 2003 2005 2007 2009 2011 2013

Source: Regional Titanium Associations, VSMPO

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy

Conclusion

• Increasing energy cost and lower mine grades will result in higher

prices for copper and nickel

• Titanium currently has a price advantage over this materials and

expanded use of titanium is expected

• Additional incentive to specify titanium can be found in:

– Reliability

– Environmental compatibility

– Longevity

– Expanding global production which ensures product availability

Rob Henson, Manager, Business Development

May 19-21, 2014 • Hilton Sorrento Palace, Sorrento, Italy