country, industry and firm size effects on foreign subsidiary strategy

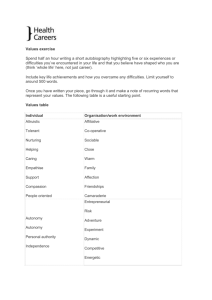

advertisement