Form 5471 Compliance

advertisement

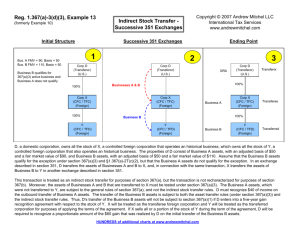

Form 5471 Compliance Mission Society of Enrolled Agents International Tax Seminar August 23, 2013 Campbell, CA William R. Skinner, Esq. wrskinner@fenwick.com (650) 335-7669 ____________________ Fenwick & West LLP Silicon Valley Center 801 California Street Mountain View, CA 94041 Phone: 650.988.8500 www.fenwick.com Types of Foreign Entities John U.S. Foreign Trust Foreign LLC Foreign Partnership Passive Foreign Investment Company (PFIC) Controlled Foreign Corporation (CFC) Foreign Corporation Other Foreign Corporation 2 Taxation of Foreign Corporations - Overview Controlled Passive For. Foreign Corps Inv. Cos (CFCs) (PFICs) Other Foreign Corps Taxation of Corporation: Only on U.S. income Only on U.S. income Only on U.S. income Taxation of Shareholder on Undistributed / Retained Earnings: Shareholder taxed at ordinary rates on “subpart F income” or investments in U.S. property Shareholder may elect current taxation to avoid significant penalty taxes. N/A. No tax. Taxation of Dividends: Potential cap gain if corporation qualifies under IRC 1(h)(11) Ordinary income, plus possible penalty tax. Potential cap gain if corporation qualifies under IRC 1(h)(11) Taxation of Sales: Dividend to the extent of retained earnings, then capital gain. Ordinary income, plus possible penalty tax. Capital gain. 3 Purpose of Form 5471 Provides a way for the IRS to obtain information about foreign corporations from their significant U.S. owners. Puts the burden on the U.S. shareholders to present information in a U.S. tax format. Monitors compliance with international tax rules, including: Subpart F Dividends Foreign tax credits 4 Heightened Focus on Form 5471 IRS offshore voluntary disclosure program focuses on curing Form 5471 and other international noncompliance. Significant penalties encourage compliance: • • • • Monetary penalties of $10,000 for each year’s failure ($50K if intentional) 10% reduction in any foreign tax credits claimed from the relevant foreign corporation under IRC Sec. 902. Tolling of statute of limitations under until Form 5471 is filed 40% penalty for any income attributable to an unreported foreign asset (including on Form 5471). 5 Form 5471 – Identifying Different Categories of Filers 6 Example of Form 5471 Filers Brothers Simon Tony China/U.S. Ralph U.S. China 45 Shares 45 Shares 10 Shares Hong Kong Co LTD CEO - Tony On Jan. 1, 2014, Tony becomes a U.S. tax resident. On Sept. 1, 2014, Ralph joins the company and receives 10 shares of stock. What are the required Form 5471 filings? 7 Form 5471 – Filing Requirements • Generally, Form 5471 is only required to be filed if there is at least one 10% U.S. shareholder in the foreign corporation. • The following categories of persons are required to file Form 5471: – Category 1 – obsolete. – Category 2 – U.S. citizen or resident who is an officer or director, and a U.S. person has acquired stock that meets a 10% ownership requirement or a U.S. person has acquired an additional 10% of stock. – Category 3 – U.S. citizen or resident who acquires a 10% ownership interest, sells stock and drops below 10%, or becomes a U.S. person while owning 10%. – Category 4 – a U.S. person that had “control” of the corporation for at least 30 uninterrupted days during its taxable year. – Category 5 – a U.S. person who was a “United States shareholder” of a “Controlled Foreign Corporation” for at least 30 uninterrupted days, and who owned stock on the last day of the foreign corporation’s taxable year. 8 Key Definitions Controlled foreign corporation (“CFC”) Any foreign corporation if, on any day during its taxable year, U.S. shareholders own more than 50 percent of the total combined voting power or value of all of the corporation’s stock. (§ 957(a)) United States shareholder Any U.S. person who owns (within the meaning of § 958(a)) or is considered as owning by applying the constructive ownership rules of § 958(b), 10% or more of the total combined voting power of all classes of stock entitled to vote of the foreign corporation. (§ 951(b)) 9 Example – Analyzing Categories of Filings Let’s consider each category of Filer separately. Category 2 Filers Category 3 Filers Category 4 Filers Category 5 Filers Which of Tony, Simon and Ralph are within the Category? 10 Lower-tier Companies – Example 1 Brothers Simon Tony China U.S. Ralph U.S. 45 Shares 45 Shares 10 Shares Hong Kong Co 100% China Co Question: Does Tony and/or Ralph have to File Form 5471 for China Co? Answer: Yes, both do. “Constructive ownership rules” generally treat U.S. shareholders as owning a proportionate amount of stock owned by the foreign corporation. 11 Lower-tier Companies – Example 2 Tony U.S. Simon 51% Hong Kong Co 49% 51% China Co Question: Does Tony have “control” of China Co? Answer: Yes. Even though Tony’s economic interest is only 26% (.51 * .51), he is treated as controlling China Co because each link in the chain is greater than 50% ownership. 12 Form 5471 – Review of Filing Requirements 13 Filing Requirements by Category of Filer Schedule A Schedule B Schedules C, E and F Schedule G Schedule H Schedule I Schedule J Schedule M Schedule O - Pt 1 Schedule O - Pt 2 Category of Filer 1 2 3 4 X X X X X X X X X X X X X X X X 5 X X X X X 14 Form 5471 – Ownership Information Purpose of Schedule A and Schedule B – track ownership of U.S. shareholders and inclusions of subpart F income. Schedule O— Triggered by U.S. persons going above or below 10% ownership. Note broad scope of information – any organizations, acquisitions, dispositions. Acquisitions / transfers may also trigger Form 926 filing requirement. 15 Form 5471 – Schedule G Items Schedule G incorporates reporting for interests held in other foreign entities (e.g., a foreign trust) through a Foreign Corporation. Schedule G also tracks significant “hot button” items for the IRS: Cost-sharing agreements for offshoring IP Listed and “reportable” transactions Certain arrangements that hype foreign tax credits 16 Form 5471 – Schedules C, E and F Schedules C, E and F present the foreign corporation’s financials in US GAAP. Corporation’s “functional currency” may be a non-Dollar currency in which it conducts significant activities and maintains its books and records. Generally cannot change functional currency without IRS consent (Form 3115). 17 Schedule H – Why is it Important? Tony Simon Ralph $45K Declares Dividend $10K USD Hong Kong Co $45K Earnings & Profits — ? The distribution to Ralph and Tony will be taxable as a dividend to the extent of HK Co’s current or accumulated “earnings and profits” 18 Schedule H - Adjustments “Earnings and profits” are generally the taxable income, minus taxes, of the foreign corporation computed under U.S. tax principles. Schedule H reconciles U.S. tax E&P with GAAP P&L and categorizes major adjustments. Translation into US Dollars – generally done using the spot rate on the date of the dividend. See Schedule I, line 7. 19 Schedule I – Computing Effects on U.S. Shareholders 20 Schedule I – Impact on U.S. Shareholders A U.S. shareholder can include income from a CFC in one of four ways: 1. Receive an actual dividend out of CFC’s earnings and profits 2. Sell shares and recognize a gain 3. Include pro rata share of the foreign corporation’s subpart F income, or 4. Include pro rata share of foreign corporation’s investment of earnings in U.S. property under Section 956. 21 Subpart F – Background Absent subpart F, a foreign subsidiary’s earnings are not subject to U.S. tax until distributed to the U.S. shareholder. Subpart F ends deferral of certain “subpart F income” or investments in U.S. assets. Joseph U.S. French CFC Department Store 28% French Tax Donald U.S. Cayman CFC Securities Portfolio 0% Cayman Tax 22 Statutory Overview - Subpart F Income Section 952 – Subpart F income means, in the case of any CFC, the sum of insurance income (§ 953) foreign base company income (§ 954) international boycott income an amount equal to payments which would be unlawful under the Foreign Corrupt Practices Act of 1977, and the income derived from any foreign countries with which the U.S. has severed diplomatic relations 23 Foreign base company income Section 954 – “Foreign base company income” is comprised of the sum of: foreign personal holding company income – § 954(c) foreign base company sales income – § 954(d) foreign base company services income – § 954(e) foreign base company oil related income – § 954(g) Subpart F income generally includes income of a CFC that is passive or otherwise easily mobile, but not income earned in an active business. 24 Foreign Personal Holding Company Income Joseph Section 954(c) – Foreign personal holding company income (“FPHCI”) includes the following types of gross income: Dividends, interest, royalties, rents, and annuities Certain property transactions (generally, gains from the sale of property which (i) gives rise to passive income, (ii) is a partnership interest, or (iii) which does not give rise to income) CFC Passive income Examples: *Bank deposit interest *Royalties or rents not in an active business *Captial gains from sale Of shares • Generally excludes property that is used in a trade or business. Commodities transactions Foreign currency gains • Exceptions for hedging transactions Income equivalent to interest Income from notional principal contracts Payments in lieu of dividends 25 Exceptions to Subpart F Treatment 1. The Same Country Exception: For certain dividends, interest, rents and royalties which are from related persons (§ 954(c)(3)) organized in the same country as the CFC. 2. Active Rents and Royalties Exception: Rents and royalties derived in an active business (§ 954(c)(2)(A)). A. Active development of the property (e.g., R&D or building the personal property) B. Active sales and marketing through an office outside of the U.S. (25% safe harbor test). C. Occasional rental of property used in an active business. 3. Section 954(c)(6) CFC look-through rule: Look through dividends, interest, rents and royalties received or accrued from a CFC which is a related person are generally not subpart F income. 26 REVIEW - Subpart F Income Section 954 – Foreign base company income is comprised of the sum of: foreign personal holding company income – § 954(c) foreign base company sales income – § 954(d) foreign base company services income – § 954(e) foreign base company oil related income – § 954(g) Subpart F income generally includes income of a CFC that is passive or otherwise easily mobile, but not income earned in an active business. 27 Foreign Base Company Sales Income Section 954(d)(1) – Foreign base company sales income means Income derived in connection with any of the following: 1. The purchase of personal property from a related person and its sale to any person, 2. The sale of personal property to any person on behalf of a related person, 3. The purchase of personal property from any person and its sale to a related person, or 4. The purchase of personal property from any person on behalf of a related person Where the following conditions exist: (i) The property is manufactured outside the CFC’s country of organization, and (ii) The property is sold for use outside the CFC’s country of organization 28 Foreign Base Company Sales Income Joseph >50% Unrelated Party purchases sales S Corp >50% CFC HK Co. Resales Makes electronics in U.S. This is an example where HK Co very likely has subpart F sales income because: Goods are purchased from a related party (S Corp) Goods are made outside of the Hong Kong (US) Goods are probably shipped to customers outside Hong Kong. HK Co. does not appear to further manufacture the goods before resale. 29 REVIEW - Subpart F Income Section 954 – Foreign base company income is comprised of the sum of: foreign personal holding company income – § 954(c) foreign base company sales income – § 954(d) foreign base company services income – § 954(e) foreign base company oil related income – § 954(g) Subpart F income generally includes income of a CFC that is passive or otherwise easily mobile, but not income earned in an active business. 30 Foreign Base Company Services Income Section 954(e) – Foreign base company services income (“services income”) means income (whether in the form of compensation, commissions, fees, or otherwise) derived in connection with the performance of technical, managerial, engineering, architectural, scientific, skilled, industrial, commercial, or like services which: are performed for or on behalf of any related person, and are performed outside the country under the laws of which the CFC is created or organized. 31 Foreign Base Company Services Income Services which are performed for, or on behalf of, a related person” include (but are not limited to) services performed by a CFC where— The CFC is paid or reimbursed by a related person for performing such services; The CFC performs services which a related person is, or has been, obligated to perform; The CFC performs services with respect to property sold by a related person and the performance of such services constitutes a condition or a material term of such sale; or Substantial assistance contributing to the performance of such services has been furnished by a related person. 32 Foreign Base Company Income – Limitations and Special Rules De minimis amount - § 954(b)(3)(A) If FBCI is less than the lesser of 5% or $1 million, then no FBCI. Full inclusion rule - § 954(b)(3)(B) If FBCI exceeds 70% of gross income, then all of the CFC’s gross income will be FBCI. High taxed income - § 954(b)(4) FBCI does not include any item of income received by a CFC if the taxpayer establishes that such income was subject to an effective rate of income tax imposed by a foreign country greater than 90 percent of the maximum rate of tax imposed on corporations. For example, with a U.S. maximum corporate tax rate of 35%, an item of FBCI subject to a foreign tax rate in excess of 31.5% would qualify for this exception Deductions taken into account - § 954(b)(5) Reduce FBCI by expenses (including taxes) properly allocable and apportionable to the income. 33 Schedule I – Part II – the Sec. 956 Amount The U.S. shareholder shall include its pro rata share of the CFC’s Sec. 956 amount. The Sec. 956 amount is the lesser of untaxed “applicable earnings” and average of amounts of U.S. property held by CFC on each of its quarter ends. 34 Schedule I – Part II – the Sec. 956 Amount Definition of “U.S. Property”: Real or tangible property located in the U.S. Debt obligations issued by related U.S. persons Stock in related U.S. persons. Intellectual property developed or acquired for use in the United States. Certain exceptions include inventory for export, short-term loans and ordinary course A/R, etc. 35 Schedule I – Another Example Raj is an Indian citizen who, together with other members of his family, owns all of a Mauritius investment company. Among the company’s assets are U.S. stocks and bonds, U.S. real estate, Indian real estate, and a 75% stake in an Indian family business. Raj and his wife obtain greencards and become U.S. tax residents in 2014. What items may be relevant to Raj’s Form 5471 disclosure? 36 Example – Steps to Analyze 1. Is Raj (or his wife) a Form 5471 filer? In what categories? 2. Is Mauritius HoldCo and/or Indian family company a Controlled Foreign Corporation (CFCs)? 3. If so, does either company have any subpart F income? 4. A. Foreign personal holding company income B. Foreign Base company Sales Income or Services Income Also, if either company is a CFC, does it own any U.S. property within the meaning of Sec. 956? 37 Form 5471 Schedule J – Earnings Accounts 38 Example of Previously Taxed Income Tony 2013 − $200 Sub F Income U.S. 2014 − $150 Cash Distribution Hong Kong Co 2014 E&P − $400 Total $200 Subpart F from 2013 $200 Other E&P Review. Distributions from a foreign corporation are taxable to the extent of current and accumulated earnings and profits (“E&P”). But here $200 of HK Co’s E&P was already taxed to Tony under Subpart F. 39 Schedule J – E&P Accounts Schedule J tracks the foreign corporation’s accumulated Earnings and Profits in different categories: Undistributed / non-previously taxed E&P (col. (a)) Previously taxed income due to subpart F inclusions and Sec. 956 investments (col. (c)) These accounts are adjusted year-over-year as different categories of earnings are generated. Distributions always come from Previously Taxed Income (PTI) first. 40 Schedule M – Related Party Transactions Only required to be filed by Category 4 filers (U.S. shareholder with “control” of the CFC). Schedule M lists all related party transactions with the controlling U.S. shareholder and any foreign affiliates. Finish completing model Form 5471 for sample problem (Schedules J, M and O) 41 The IRC Section 962 Election 42 Taxation of Dividends from Foreign Corps Dividends received from a foreign corporation are taxed at ordinary income rates, unless the corporation is a “qualified” foreign corporation: Publicly traded on a U.S. stock market, OR Located in a Treaty country and eligible for the Treaty, AND NOT a PFIC at any time. Subpart F inclusions and Sec. 956 investments are taxable at ordinary rates, even if received from a qualified foreign corporation. 43 Example Joseph Donald U.S. U.S. $70 Distribution Hong Kong Co $70 Distribution Delaware Corp $100 Subpart F Income ($30) French Tax $70 Distribution French Office $100 Subpart F Income ($30) French Tax 44 Tax Rates on Donald and Joseph Item Taxable Income French Corp Tax Net Income US Corp Taxable Inc. Tent. US Corp. Tax Comparative All-In Tax Rates Joseph $100 ($30) $70 Foreign Tax Credit for French Corp Tax Net U.S. Corp Tax Total Corp Tax (%) Donald $100 ($30) $70 $100 ($35) 30% $30 ($5) 35% Sub F Inclusion Taxable at OI Rates (35%) ($24.50) $0 Shareholder Dividend Tax at LTCG (15%) Rate Total Shareholder Tax (%) $0 24.50% ($9.75) 9.75% All-In Tax Rate 54.50% 44.75% 45 Section 962 Election Election allows shareholder to be treated as if it were a Domestic C corporation earning the subpart F income, and paying tax at corporate rates. Shareholder can claim foreign tax credit for CFC’s foreign taxes under Sec. 960. Actual distributions by CFC become taxable to the extent they exceed income tax paid under Sec. 962. 46 IRS CIRCULAR 230 DISCLOSURE To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice in this communication (including attachments) is not intended or written by Fenwick & West LLP to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein. 47