Drug Cost Management Guide

advertisement

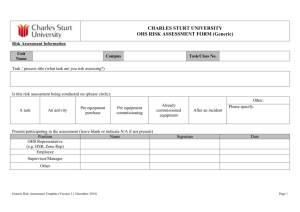

group insurance Drug Cost Management Guide A partner you can trust. www.inalco.com › Table of Contents For a cost-effective, competitive plan that benefits you and your plan members ______________________________2 Potential savings at a glance _____________________________3 Part 1 – Cost management measures that can be implemented by plan sponsors ______________________4 1.1 Pay direct and deferred drug programs __________________4 1.2 Plan members’ contribution to drug costs _______________5 1.3 Generic substitution plan _____________________________6 1.4 Tiered plan _________________________________________6 1.5 Managed drug formulary _____________________________8 Part 2 – Cost management measures implemented by Industrial Alliance _________________________9 2.1 Prior authorization ___________________________________9 2.2 Coordination of benefits (COB) ________________________9 2.3 Hospital Drug Program ______________________________10 2.4 Dynamic Maintenance Drugs Process __________________10 2.5 P roactive Detection of Health Care Fraud and Abuse ___________________________________11 Myths of the Insurance World ____________________________12 Communication strategy ________________________________12 Making the right decision today for your group plan future___12 › For a cost-effective, competitive plan that benefits you and your plan members Escalating health care costs are a challenging reality for plan sponsors, plan members and insurance carriers, as they have a direct impact on the cost of group benefit plans. Drug costs generate the largest increase. They account for almost 2/3 of total group plan health expenses. New innovative and more costly drugs are constantly being introduced to the market and are putting a strain on group benefit plan capabilities. Ultimately group benefit plans will have to adapt and be creative in order to meet ever-evolving needs. Studies show that with an effective plan design, plan sponsors can reduce their benefit expenses. Savings could be used to provide additional benefits, provide a cushion for future increases or reduce overall expenses for plan sponsors. At Industrial Alliance, we aim to be a strong insurance partner in creating a value proposition for plan sponsors and plan members. To achieve this, we rely on 3 pillars: partnership, proactive management and, most importantly, communication. We focus on optimizing your plan performance, developing the right tools, facilitating your decisions and providing you with worthwhile alternatives. We commit to supporting your efforts in managing plan costs. We work in collaboration with Express Scripts Canada, one of the country’s leading providers of health benefits management services, to find effective solutions that make group benefit plans valuable and sustainable while providing plan members with the best health outcomes. This guide will walk you through the different drug cost management strategies implemented by Industrial Alliance as well as others you can implement in order to get the most value out of your group benefit plan. 2 Potential savings at a glance Cost management measures that can be implemented by plan sponsors Ease of Implementation Potential savings* Plan member’s contribution (deductible, co-insurance and maximum) $ - $$$ Caps on dispensing fees and mark-up $$ Generic substitution plan $ Tiered plan $$ Managed drug formulary $$$ Ease of implementation: Potential savings: : Easy : Challenging $: 0 to 2% of the drug costs $$: 2 to 4% of the drug costs $$$: > 4% of the drug costs * Savings may vary depending on the experience and the plan design of each group. Note: Most of these measures require the group benefit card, commonly known as the drug card. One or more of the above measures + Measures by Industrial Alliance = A lasting and valuable group benefit plan for you and your plan members 3 1 1.1 Cost management measures that can be implemented by plan sponsors P ay Direct and Deferred Drug Programs What are Pay Direct and Deferred Drug Programs? Pay direct and deferred drug programs provide on-the-spot claims processing of prescription drugs, provided that the pharmacy supports these programs. Plan members know up-front the reimbursement amount they are entitled to. Pay direct and deferred drug programs are automated processes that require the utilization of a drug card, contrary to the reimbursement plans where claims are processed manually by the insurance provider upon reception of claims. Whereas pay direct drug programs allow for a reimbursement directly at the point of sale, deferred programs require plan members to pay the total bill and get the reimbursement at a later date. Pay direct and deferred drug programs mainly facilitate the management of complex drug insurance plans. Industrial Alliance partners with Express Scripts Canada (ESC) to implement these programs. Claims are sent electronically from the pharmacy to ESC and are processed in real time while the pharmacist fills the prescription. These payment methods benefit both plan members and plan sponsors and are a key element of an effective cost management process. They help keep track of all transactions, which allows for data compilation and analysis. Gathering an overall picture of drug use within a plan is the starting point for the implementation of various drug cost management measures. 4 What are the advantages of Pay Direct and Deferred Drug Programs? For plan members: › Protection against potentially harmful (or fatal) drug interactions, since pharmacists are immediately aware of other medications prescribed and provided by another pharmacy › Immediate confirmation of the benefit payable by Industrial Alliance in accordance with the coverage provided by plan sponsors › Coordination of benefits with other coverage in real time (if a direct payment drug card is used) For plan sponsors: › Point of sale (POS) claim adjudication allowing for effective communication between plan members and pharmacists › Active management of the quantity of prescription drugs dispensed at each transaction (refill too soon, refill too late notifications are provided to pharmacists) › Effective management of drug utilization review systems, exception drugs and hospital drug programs at POS › Greater plan flexibility (generic substitution plans, tiered drug plans, managed formularies, etc.) 1.2 P lan members’ contribution to drug costs Some common opportunities to engage plan members in effective cost sharing are outlined below: Annual deductible: The amount a plan member must pay before the plan will provide any reimbursement for eligible expenses. Deductible by drug: The amount a plan member must pay for each prescription before the plan will provide any reimbursement for eligible expenses. Co-insurance: The percentage of each claim that the plan will reimburse for eligible expenses, with the balance paid by the plan member. Maximum: The total amount the plan will reimburse for eligible expenses for each plan member. The maximum can be combined for all medical expenses or a separate maximum may be applied for each drug class (e.g., stop-smoking products, treatment of infertility, narcotics). Control over three components of the cost of drugs: The price of a drug includes three components: ➞ Ingredient cost ➞ Pharmacist’s mark-up ➞ Dispensing fee The ingredient cost is relatively steady, whereas the other components vary from one pharmacy to another. Plan sponsors may establish mark-up and dispensing fee restrictions to manage drug costs within their plan. At the same time, plan members should be encouraged to purchase their prescription drugs from pharmacies with low dispensing fees. What are the advantages of having plan members contribute to plan costs? › Create a financial incentive to ‘shop smart’ by involving plan members in paying the total drug bill › › › Raise drug cost awareness Encourage prudent spending habits Engage plan members in effective cost management 5 1 1.3 Cost management measures that can be implemented by plan sponsors G eneric Substitution Plan 1.4 Tiered Plan What is a Generic Substitution Plan? What is a Tiered Plan? In a generic substitution plan, drug reimbursement is based on the cost of the least expensive generic drug, which creates a financial incentive for plan members to choose less expensive drugs. In a tiered plan, there are different reimbursement levels (tiers) depending on the drug purchased. The plan member’s share of the total cost increases from one level to another. This reimbursement method encourages the use of the most cost-effective drugs while preserving access to other prescriptions drugs, as needed. Two options are available under the generic substitution plan: standard or mandatory. The standard generic plan provides reimbursement according to the lowest priced interchangeable drug unless the physician indicates “no substitution” on the prescription, in which case the reimbursement is based on the cost of the brand-name drug. The mandatory generic plan, on the other hand, always provides reimbursement according to the lowest priced interchangeable drug, regardless of the “no substitution” indication. Increased use of generic drugs in place of brand-name drugs is an integral part of any effective drug cost management strategy. What is a generic drug? Health Canada-approved, generic drugs are copies of brand-name drugs whose patents have expired. The active ingredient(s) in generic and branded drugs must meet the same standards set by the Health Protection Branch of the federal government. On the other hand, non-medicinal ingredients used to give a generic product its shape, colour and taste may vary from the brand-name drug. Since less time is needed to do the initial research, generic drugs are often less expensive. However, the quality, purity, efficacy and safety of generic drugs are similar to those of branded drugs. What are the advantages of a Generic Substitution Plan? › › › Protect the viability and sustainability of the benefits program › Promote optimal drug management 6 Tiered plans can have 2 or 3 reimbursement tiers. According to the tiered plan that you implement, a drug card may be required. Reimbursement tiers may be defined according to: › Drug types › Tier 1: Generic1 or unique2 drugs › Tier 2: Brand-name drugs with a generic equivalent3 › Drug lists › Tier 1: Provincial formulary drugs › Tier 2: Non-provincial formulary drugs › Tier 3: Over-the-counter drugs ›Claimants › Tier 1: Plan member › Tier 2: Spouse › Tier 3: Other dependents ›Providers › Tier 1: Preferred provider network pharmacies › Tier 2: Mail order pharmacy › Tier 3: All other pharmacies What are the advantages of a Tiered plan? › Promote the use of generic or therapeutic equivalents that deliver the same outcomes › Encourage the use of the most cost-effective drugs Help control the rising costs of the benefits program Reduce the total amount payable as long as the plan member opts for the cheaper generic equivalent 1 generic drug is a copy of a brand-name drug. Since less A research is required than for the brand-name drug, the generic drug often costs less. 2 unique drug is a brand-name drug still under patent or a A drug for which there is no copy. 3 brand-name drug with a generic equivalent is a drug whose A patent has expired and for which there is a recognized generic copy. In Canada, unless otherwise noted by the attending physician, the pharmacist may substitute a generic drug for a prescribed brand-name drug without asking the physician. Examples to show the savings Generic substitution plans and tiered plans are two effective ways to encourage plan members to use generic drugs. Below are examples of the potential savings associated with generic drugs: Example of a 2-tiered plan providing the following reimbursement percentages: › › 90% for generic1 and unique2 drugs 75% for brand-name drugs with a generic equivalent3 Case 1 – The plan member takes the brand-name drug with a generic equivalent Case 2 – The plan member opts for the generic equivalent Drug cost $100 $40 Reimbursement $100 X 75% = $75 $40 X 90% = $36 Amount paid by the plan member $100 - $75 = $25 $40 - $36 = $4 Observation Under the tiered plan, opting for the generic equivalent saves the group $39 ($75 - $36) and saves the plan member $21 ($25 - $4). Example of a generic substitution plan providing a reimbursement percentage of 100%. Drug cost $100 $40 Reimbursement $40 $40 Amount paid by the plan member $100 - $40 = $60 $40 - $40 = $0 Observation Under the generic substitution plan, opting for the generic equivalent triggers a saving of $60 for the plan member. * These examples are simplified. They do not take into consideration provincial plan rules and the various components of the drug cost that may impact the drug reimbursement. 1 generic drug is a copy of the brand-name drug. Since less research is required than for the brand-name A drug, it often costs less. 2 A unique drug is a brand-name drug still under patent or a drug for which there is no copy. 3 brand-name drug with a generic equivalent is a drug whose patent has expired and for which there is A a recognized generic copy. In Canada, unless otherwise noted by the attending physician, the pharmacist may substitute a generic drug for a prescribed brand-name drug without asking the physician. 7 1 1.5 Cost management measures that can be implemented by plan sponsors M anaged drug formulary What is a managed drug formulary? A managed drug formulary is a tool that can be used to define a list of drugs to be covered under a group benefit plan. It is an effective way to manage drug coverage and plan costs. Several types of drug formularies exist on the market: › › › › Provincial drug formulary Prescription drug formulary Prescription and over-the-counter (OTC) drug formulary Dynamic Therapeutic Formulary (DTF) managed by Express Scripts Canada (ESC) The Dynamic Therapeutic Formulary (DTF) is a defined list of drugs that incorporates a dynamic process where drugs are reviewed on a monthly basis, and assessed as to their therapeutic effectiveness as the most clinically effective and affordable drugs. Using this list promotes the least expensive treatment options. ESC updates its DTF as new drug information becomes available. The DTF is a two-tiered formulary. The first tier of the DTF includes clinically sound and cost-effective preferred drugs for the most highly utilized drug classes. The second tier is an open plan design that can be personalized by the plan sponsor. All first tier prescription items are reimbursed at a higher level compared to the second tier. Because of the dynamic nature of the DTF, it is very important to manage plan members’ expectations so that there are no surprises when a drug that was previously covered by the DTF is no longer covered, or when new drugs are added to the list. ESC maintains a list of covered drugs and alternatives for non-covered drugs on its website www.express-scripts.ca. A plan sponsor can either use a list of drugs that already exists or create a customized list that meets the specific needs of his or her group for an additional cost. 8 What are the advantages of managed drug formularies? › › Facilitate cost management Manage coverage according to the changing needs of a group and emerging drug therapies 2 2.1 Cost management measures implemented by Industrial Alliance P rior authorization What is prior authorization? Industrial Alliance has developed a prior authorization (PA) program for the management of expensive drugs. Throughout the process, a team of specialists ensures that: › › › › The diagnosis is consistent with Health Canada indications; Therapeutic criteria are respected; First line drugs or less costly treatments are considered; No public or provincial funding is available. The prior authorization process allows Industrial Alliance to determine whether or not a drug will be eligible for reimbursement under the group plan, prior to an insured making a claim for the drug. All strengths and generics of the listed drugs are subject to prior authorization. Industrial Alliance will ensure that a drug indicated on the prior authorization drug list is reimbursed only if prescribed for the use for which it was designed. Please note that approved drugs will be reviewed on an annual basis. Which drugs require prior authorization? A list of drugs that are subject to the prior authorization process is maintained on our website at www.inalco.com. To access the list, go to the Group Insurance section, click on Member services and then To download forms. Under Prior Authorization Form for Drug Reimbursement, there are two lists of drugs: one for Quebec and one for all other provinces. The prior authorization list is subject to change at any time, without notice. The list does not guarantee that a listed drug is covered under a specific group plan. What are the advantages of a prior authorization program? › › › › › Monitor and maintain all new drugs entering the Canadian market Ensure appropriate utilization of costly drug therapies Improve management of costly drug therapies 2.2 What is coordination of benefits (COB)? COB is a process that is used when a person is covered by more than one plan. The coordination prevents duplicate payments and ensures that the total amount reimbursed under different plans does not exceed 100% of the actual expense incurred by the plan member. The primary insurer (called the primary payer) first pays the claim by applying the specific rules of its plan. The claim is then sent to the second insurer (called the second payer) for reimbursement according to its plan rules. When does COB apply? COB applies when a person is covered under at least 2 private plans. It also applies when a person is covered under a private and a public plan. Residents of various provinces can be eligible for coverage under provincially funded drug plans. Those publicly funded plans are based on various eligibility criteria including age, income, or specific diseases. The claim coordination process encourages plan members eligible for provincial coverage to submit their claims to the provincial plan first and then to their private insurer. In cases where the person is covered under 2 private plans (e.g., plan member’s and spouse’s), he/she has to submit his/her claim to the primary insurer. Then, the balance can be submitted to the other insurer. What are the advantages of coordination of benefits? › › Mitigate risk when there are 2 plans or more › Save money for the plan Monitor potential drug qualification for alternate funding Refer patient to alternate options when possible C oordination of benefits (COB) Ensure that the plan is not the first payer of drugs covered under another group insurance plan or under a government program 9 2 2.3 Cost management measures implemented by Industrial Alliance H ospital Drug Program 2.4 Dynamic Maintenance Drugs Process¹ What is the Hospital Drug Program? What is the Dynamic Maintenance Drugs Process? Some drugs are primarily given in a hospital setting as they require extensive monitoring with medical or nursing expertise due to the severity of condition they treat, the complex route of administration, or potential safety concerns. The Hospital Drug Program (HDP) contains a list of drugs that are intended to be administered in-hospital on an in-patient or out-patient basis (e.g., chemotherapy drugs or antibiotics given by injection) and should not be paid by a private drug plan. The Dynamic Maintenance Drugs (DMD) process is intended for patients with a chronic condition requiring maintenance medication. Depending on the drug data already in the system, the program determines whether a supply of up to 100 days may be given to the plan member. Most drugs that are part of the HDP are covered by the provincial plan. In cases where the provincial plan does not provide coverage, the group insurance plan is not required to provide reimbursement, unless it is stipulated in the group insurance policy. What are the advantages of the HDP? › Ensure that drugs administered in a hospital setting are not paid by private plans › Save money for the plan The DMD process begins when there is at least four months of claims history in the system. This program will treat any drug as a maintenance drug once a plan member has been stabilized on the drug for over 88 days. At the attending physician’s discretion, a supply of up to 100 days will be dispensed, which minimizes total dispensing fees. What are the advantages of the Dynamic Maintenance Drugs Process? › › It reduces drug wastage and promotes positive patient outcomes. › Analyzes medication history for the appropriate dispensing of chronic care medications. › The pharmacist will enhance plan member care by participating in this program. Specifically, the pharmacist will use professional skills and judgment to dispense appropriate quantities based on the plan member’s prior history. › The 100-day drugs supply encourages cost savings in regards to dispensing fees. It has the potential to eliminate wastage in the event that the prescription needs to be discontinued or changed. This means that a 100-day supply will not always be dispensed the first time a prescription is filled. ¹A pplies only if your plan offers a pay direct or deferred drug program using the drug card. 10 2.5 P roactive Detection of Health Care Fraud and Abuse As the incidence of fraud and abuse continues to increase, plan sponsors expect more vigilance on our part. We work in partnership with other corporate members of the Canadian Health Care Anti-fraud Association (CHCAA) to combat health care fraud and abuse. What methods are in place to prevent fraud and abuse? Our investigative services team is responsible for identifying abuse and fraud cases. Questionable claims practices are identified and resolved by targeting problematic claims and the service providers involved with such claims. In addition, as health care becomes more complex and as the administration review process becomes more clinical, we seek input from clinical experts to assist us in our assessment and decision process. Random claims review and audits by our investigative services team help detect atypical claims situations. Furthermore, Industrial Alliance subscribes to a special Audit program with Express Script Canada (ESC) to ensure the integrity and accuracy of health claims while maintaining a superior network of providers through diligent review and education. ESC works to resolve situations that may involve fraud or abuse in a timely manner. Which cases are more subject to investigation? Early prescription renewals, purchases with prescriptions from multiple doctors, and purchases from multiple pharmacies are the most common forms of abuse and fraud. What can plan sponsors do to help? Plan sponsors can help in various ways: › Co-operate with the insurer when a member’s claim is being audited › Report a fraud to the insurer if you suspect that fraud and abuse may be going on within your group plan › Engage your plan members in the active management of health care fraud and abuse Nevertheless, communication is the most efficient way to raise awareness among plan members. The audits help eliminate waste and manage costs, with proven savings to clients. 11 Myths of the Insurance World If the doctor prescribes it, it’s because I need it and, therefore, my insurance should cover it. – According to the plan design, a claim for a drug reimbursement can be denied or partly accepted if a cheaper and equally effective equivalent exists on the market and if the doctor does not object (contraindication) to the use of this drug equivalent. It is strongly recommended that the plan member asks for advice from his or her pharmacist. Innovative drugs are more expensive, but you do get what you pay for – Innovative drugs are more expensive because of the research they require, not because of their effectiveness. My drugs do not cost me anything, they are free. – The cost of drugs is included in the insurance premium paid. If total health claims costs for a group increase, the premium charged to that group will increase accordingly. If it’s new, then it’s effective. – Newcomers tend to steal the show, as they are synonymous with innovation, however they are not necessarily better clinically. Let’s work together to get rid of misconceptions! Communication strategy The involvement and contribution of plan members is key to the success of drug cost management initiatives. To have plan members aboard in the fight against soaring drug costs, a communication strategy is a must. It is important to make plan members aware of the cost of their group benefits plan and to help them understand that they have a financial incentive in keeping costs within a reasonable range. That is why we are willing to support you in developing a communication strategy regarding your benefits and in launching your awareness campaign among plan members. We have therefore developed a series of information bulletins that you can share with your plan members. The bulletins main goal is to make plan members realize that their decisions have a direct and lasting impact on their group benefits. To inform is to empower everyone to make a difference! Making the right decision today for your group plan future Taking care of your group plan health today will protect its value for tomorrow. That is why it is important to find the best way of allocating your money. No need to cut down on other coverage to offset rising drug costs. Opting for the most cost-effective treatments and monitoring your drug insurance coverage is the way to go. You can draw the line and we are there to help. 12 Industrial Alliance Founded in 1892, Industrial Alliance is an industry leader in insurance and financial services in Canada. Known for its financial strength and dynamic approach, Industrial Alliance is a major financial institution with operations across the country. Solutions adapted to your needs The Industrial Alliance Group Insurance division offers a wide range of traditional and specialized group insurance products designed to meet the individual needs of each client. To achieve this, we actively develop and maintain relationships of trust with our clients. Our success derives from our service-oriented culture, our openness and flexibility and our effort to continuously improve our practices. Need assistance? For more information on drug cost management options, please contact your benefits advisor or your Industrial Alliance group account executive. The elephant, F54-895A symbol of our 100 years of strength and longevity.