Linear Programming Introduction & Giapetto's Example

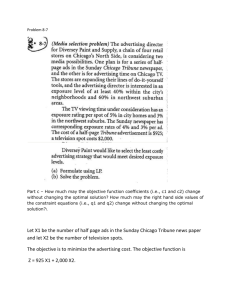

advertisement