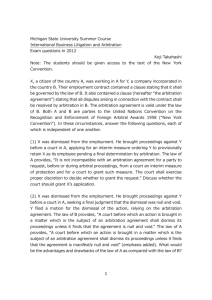

Case Studies: Investor-State Attacks on Public

advertisement