Reading

60

Chapter

3

'

Supply Chain Dtivcrs and Metrics

Marien, Edward

SupplY Chairr

60-6lJ.

O'Marah, Kevin

Suppll,Chairt l6-22.

J.

"The Four

Supply Chain Enablers"

Mdntgement Reri{,lt

(March-APril 2000):

"Thc

Tirp

'lwenty

Five Supply Chains

Mdnagement Revier' (Septernbcr 2007):

"

Prcsutti,

William D., Jr.' ancl John R' Mawhinncy "Thc Supply

Chain-Finance

Link''

Srl/'/tv ChditI ManaSlnettl Revie\t

(Septcmber 2007): 32-38.

Slone, Rcuben E.,

J

Paul Ditttnan, and John

T

Mcntzcr

Supply Chain Agenda: Th? Fivc Stcps thal

lie

rVerv

Drie

R?dl vulue

Bostont HaNard Busincss Press, 20 lu'

Case StudY

Seven-Eleven JaPan Co.

Established set up its

Octotei t by comiany was first listed on the

Co.

Ltd., lrst

SZS.

Ito store

Yokado in Koto-ku' Tokyo' in

On September was established

in

l, 2005, Seven

& i Holdings as t973'

Tokyo Stock Exchange the

Seven-Eleven Japan

May holding

1974 The company in for

Seven-Eleven Japan- Ito-Yt-rkado. and Denny's a result, detailed financial results

Japan' As for Seven-Eleven Japan have no{ been available since then and are only reported as the convenience store portion

of

Seven

& i

Holdings'

Seven-Eleven

Japan

realized

a

phenomenal growth between 1985 and 2009.

Du

ng that period, the number of stores ircrea'sed fro

m2,29

to 12,753 and annual increased from 386 billion to 2,?85 billion sales yen in Japan'

Globally, the firm had over 40,000 convenience stores by

January 201 1 and was tlre world's largest chain in terms

of

&

i from convenretail outleLs. Global revenues for Seven ience store operations were 1'968 an operating income billion yen in 2009 with

of

183 8

billion

yen' The

ltrm

was present in 38 of Japan's 4? prefectures and opened 966 sores in Japan while closing 5l

i

stores in 2009' Customer visits to Seven-Eleven outlets totaled

4

l

bitlion in 2007' for averaging almost 35 visits lo a Seven-Eleven annually every penon in JaPan

Company History and Profile

Both lto-Yokado and Seven-Eleven Japan were founded

by

Masatoshi

Ito.

He

started

his retail

empire after

*otlA

W"t

lI,

when he

joined his

mother and elder brorher and began to work in a small clothing store in

Tokyo.

By

1960, he was

in

sote control, and store had grown the single into a $3 million company After a

tnp

to the United States

in

1961, Ito became convinced that suDerstores were the wave

of

the

future At

that time'

Japan was

still

dominated by mom-and-poP stores'

Ito's chain of superstores in the Tokyo area was instantly popular and soon constituted the core of lto-Yokado's retail oDerauons.

h

1972,

Ito first

approached

the

Southland

Corporation about tie possibility of opening Seven-Eleven

2002

2003

2004

2005

2006

2007

2008

2009

1914

1979

1984

1989

1994

1999

2000

2001 convenience stores

in

Japan.

Aftcr

rejecting his

initial

request, Southland agreed

in

1973 to a licensrlg agreement. ln cxchange for 0.6 percent of total sales, Southland gave Ito exclusive rights throughout Japan

ln

May 1974' the first Seven-Eleven convenience store oPened

This n€w concept was an immediate in Tokyo' hit in Japan'

and

Seven-Eleven

Japan cxperienced

(remendous growth.

By

1979, there were already 591 Seven-Eleven itores in Japan; by 1984' there were 2,001' Rapid growth continued (Table 3-2), resulting in 12,753 stores by 2009'

On October eotered

24,

199O' the Southland CorPoration into bankruptcy protection.

Ito-Yokado's help, and on March

Southland asked for

wrs

formcd

by

Sevcn-Eleven Japan

Ito-Yokado

(52

p€rcent).

IYG

acquired 70 percent

of

Southland's common stock for

5, a t'otal

199l,IYG

Holding

(48

percen() and price of $430 million'

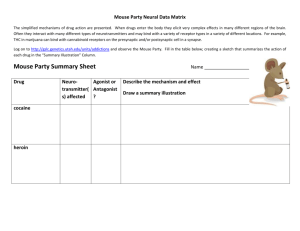

Numberof stores

15

801

2,299

3,954

5,905

8,153

8,602

9.060

9,690

10,303

10,826

11,310

11,735

12,034

12,298

12,753

Annual

(billion

Sales

Yen) o.7

109.8

386.7

780.3

'1,392.3

1.963.9

2,046.6

2,114-O

2,213.2

2,343.2

2,440.8

2,494.1

2,574.3

2,762.5

2,7A4.9

('haptcr.j

.

Supply ('hain Drivcrs rnd Mefrics 61

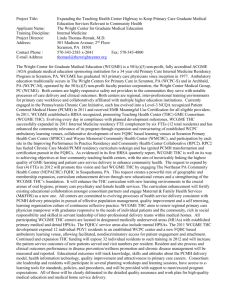

For Fiscal Years gnding

February 28/29

Total revenues (billion yen)

Total operating income lbillion yen)

Convenience store revenues (billion yen)

Convenience store operating income (billion yen)

2008

5,752.4

281.9

2,395.7

201.0

2009 2010

5,649.9

5,111.0

281.9

226.7

2,304.7

1,968.6

213.4

183.8

In

2005, Seven

&

i

Holdings

was established through a stock transfer combining Seven-Eleven Japan,

Ito-Yokado, and Denny's Japan.

ln

2009, convenience store operations

from

Seven-Eleven Japan and other subsidiaries

in

North America and China contributed

38.3 Errcent of total revenues from opcrations and 80.9

percent of operating income for the Seven

& i

Holdings

Company (see

Table 3-3

for

details). The

relative performance

of

convenience stores

within

Japancse operations was even more dominant. The drop in ftnancial performance in 2009 relative to 2008 was attributed largely to the drop

of

gasoline prices in North America and the skonger yen. The discrep:ncy between Tables 3-2 and 3-3 results because Table 3-2 reports sales (at both company owned and franchised stores), whereas Tablc

3-3 reporls revenues for only Seven

&

i.

The

Convenience Store Industry and

Seven-

Eleven in Japan

The convenicnca store sector was oDe of the few business arcas that continued to grow during the prolonged slowdown in Japan toward the end of the 20D ccntury and the start of the

2 I sr century. From

I

99 I to 2fi)2, the number

of

convenience stores

in

Japan increascd

from

19,603 to almost 42,000. As a perccntage

ofall

retail stores in Japtur,

this

representcd

an

increasc

liom

1.2 perccnt

to

3.2

percent. During that pcriod, annual sitles at convcniencc stores more than doublcd, from just over 3 trillion to 6.7

trillion yen. As a percentage

ofall

retail sales in Japan, this represcnted an incrcase fronr 2.2 perccnt to 5.0 pcrcent.

Japan's convenicncc

store secto.

gradually consolidated.

with

larger players growing and srnallcr operators shutting down. In 2004, the top l0 convenience store chains accountcd for approximately 90 percent

of

Japan's conveniencc sknes. As the chains improved their operating structures and bclter lcveraged economies

of

scale, smaller operators fbuncl it hitrd to compete.

Scven-Elcven Japan had increased convcnicnce storo markct sincc its share of the

it

oocned.

In

2008.

Scven-Eleven was Japan's leading convenience store operator, accounting for 34.3 percent market sharc in the convcnience store segnrent. Scven-Eleven was very eflective in terms

of

same-store sales. In 2004, average

daily

sales at the four major convenience store chains

excluding

Seven-Eleven Japan totaled 484,000 yen.

Seven-Eleven stores,

in

contrast, had

daily

sales

of

647,000

yen-more

than 30 percent higher than the competition put together. By 2009, average daily sales at

Seven-Eleven Japan stores had declined somewhat to

616,000 yen. In 2004, Seven-Eleven's operating income

of

165.7

billion

yen positioned it as a leader not only

of

the convenience store sector but also

of

Japan's retail industry as a whole. In terms of growth, its performance

was

even

mcre

impressive.

In

2004,

Seven-Eleven accounted for 60 percent of the total net increase in the number

of

stores among the

top

l0

convenience store

chains

in

Japan-

This

growth had bcen

carcfully planned, exploiting the core strengths that Seven-Eleven

Japan had developed in the areas of infbrmation systems and distribution systems.

The

Seven-Eleven Japan Franchise System

Seven-Eleven Japan developed an extensive franchise network and performed a key role in the daily operations

of

this network- The Seven-Eleven Japan network inoluded both company-owned stores and third-pany-owned franchises, In

2fiX,

foanchise commissions accounted for more than 68 percent of revenue from operations. To ensure cfficiency, Seven-Elevcn Japan based irs fundamental network expansion policy on a markct-dominance strategy. Entry into any new m:rket w:Ls built around a cluster of 50 to 60 stores supportcd by a distribution centcr. Such clustering gave Seven-Eleven Japan a high-density market presence and allowcd

it

to operate an efficient distribution system.

Seven-Eleven Japan, in its 1994 annual report, listed thc following six advantages of the markeGdominance strutegyi

.

.

.

.

.

.

Boostcd distribution efficiency

Improved brand awareness

Increascd system efficiency

Enhanced efficiency

Prevented of franchise support seryices

Improvcd advertising effectivenr:ss compctitors' entrance inlo the donlinant aret

62

Chirptcr

-l

.

Srrppll'('hain L)rivers and N'lellics

Japan

Adhering

to

its dominant stratc-qy, Sevcn-Elevcn opcned tho

maiority

ol

its

new stores

in

areas with existing clusters

of

stores. Rrr exanple, the Aichi prefccturc. whcre Sevcn Elevcn

bwan,rp\'nin!

slorcs in

2002, saw a large incrcasc in 2004,

witlt

108 ncw storc openings. This represented more than

l5

perccnt of the new Sevcn-Elcven stores opcned in Jrpan that year.

Seven-Elevcn had a

linited

gcog,raphic prescncc in Japan. In 2009, the conrpany had s(orcs in about 80

perc(rrt (3?

of

47)

of

thc prefectulcs within

Japan.

Howcver,

within

prefectures where they were present, stores tended

to

be dcnsc, As the 200'1 annual report stated,

"lrilling

in

the entire rnap

ol

Japan

is

not our

priority.

lnstead,

wc look for

demand where Seven-

Eleven stores already cxist, based on our fundamental area-dominance strategy

of

coDcentrating storcs in specific areas."

With

Seven-Elevcn lianchiscs

being

highly

sought after,

fewer

than onc

of

100 applicants was awarded a fianchise (a testament to store profitability).

The franchise owner was retluired to put a significant

anount

of

monoy up

front. Half of this

amount was used to prepare the store and train the owner. The rest was used

for

purchasing thc

initial

stock

for

the storc.

ln

1994, 45 percent of total gross profits at a store went

to

Scven-Elcven Japan, and the rest went

to

thc store owner. The responsibilities

of

thc

two

partics wcre as follows.

Seven-Eleven Japan responsibilities:

.

.

.

.

Devekrp supply and merchandise

Provide the

Pay ordering system for the system operation

Supply

.

Provide

.

Install

. accounting services advertising and remodel

Pay 80 percent of facilitie.,

utility

costs

Franchise owner responsibilities:

.

.

.

.

.

Operate and manage store

Hire and pay staff

Order supplies

Maintain store appgarance

Provide custolner service

Store

lnformation

and Contents

Seven-Elevcn had 12.753 stores in Japan as of 2009 (see

Table 3-2).

In

2004. Scven-Eleven Japan changed the standard sizc

of

new stores

fronr

125 squarc meters to

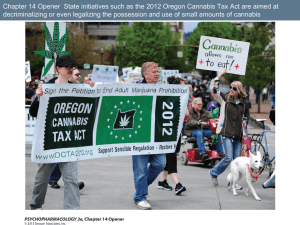

Processed foods

Fast foods

Fresh/daily toods

Nonfoods

Percentage of Total Sales

28.3

27.4

12.1

32.6

150 square metcrs,

still

significantly snlallcr than the size of Dost U.S. 7 Elevcn stores. In 2009, daily sales at a store averagcd 613,000 ycn (about

Xi?,558

in

March

201

|

at an cxchangc ratc

of

about

8l

yen to a U.S. dol lar), which was almost twice the averagc at a U.S. store-

Seven-Eloven Japan offered

its

stores a choice from a set of 5,00) SKUs. Each store carried on average

about 3,000 SKUs dcpending

on local

customer demand. Seven-Elevcn Japan emphasized regional mcrchandizing to cater precisely to local preferences. Each store carricd

food

items, beverages, magazines, and consumer items such as soaps and dctergents. The rclative sales across product categories

in

2009

for

Sevcn

Elcven Japan arc given in Table 3-4.

The food items were clnssified in lbur broad cate gories:

(l)

chillcd-temperature iterns including sandwiches, delicatessen products, and milk; (2; wam-temperature iterns including box lunches, ricc balls, and lresh brcad;

(3) frozcn itcms including ice cream, frozcn fotxis, and ice cubes; (4) and rcxrm-tcmperature items including canned food, instant noodles, and scasonings. Prosessed food and fast-food items were big sellers for the stores.

ln

2009,

Focessed and fast foods contributed about 55 percent the total sales at each store. More than

of

I

billion rice balts were sold in 20O4: this amoutlted to each Japauresc cilizen eating approximately eight Scven-Eleven rice balls a ycar.

Thc top-selling products in the fast-food category wcre lunch boxes, rice balls, bread-based products, and pasta.

As of February 20O4, Seven-Elevcn Japan had 290 dedicated manufacturing plants that produced only fast f(rcd for their stores.

Other products sold at Sevcn-Eleven steres included soft drinks, nutritional drinks, alcoholic bevcrages such as becr and wine, gamc soltware, rnusic CDs, and magrzines.

Seven-Eleven was fbcused on increasing the number

of original

items that werc available

only

at their stores. ln 2004, original itcrns accounted for roughly 52 percent of total store sales. In 200?. Scven

&

i launched

Scven Prcnriurn

plivatc

brand products

for

sale

al

its

Chuplcf

J

'

SLrpply

('haiD Drilers irDd

\4clrics stores.

By

February

2010,

Sev{rn Premium off-ered

1.035 SKUs. and this number was expected to grow ln the future. Private brand products were sold across all storg formats and were viewed by the complny as an imponant part

of

the expansion

of

synergies across its vari(,us retail formats.

Store

Services

Besides proclucts, Sevcn-Elevcn Japan gradually added a variety

of

services th4t customcrs could obtain at its stores. The tirst service, added in

October 1987, was the in-store payment

of

Ttrkyo

Elcctric

Power

bills.

The company later cxpanded the sct

of utilities for

which cusk)mcrs could pay their

bills

in the stores to include gas, insurance

premiuns,

and tclePhone.

With

more convenient operating hours and locations

tian

banks or other

financial

institutions,

thc

bill

payment servlce attracted millions of additional customers every year'

In

April

1994, Seven-Eleven Japan began accepting ment paynlents on behalf of credit companies install-

lt

startcd selling

ski-lift

pass vouchers

in

November 1994'

ln

1995, it began to accept payment es. lor mail-ordcr purchas-

This was expanded to include paynent for Internet shopping in November 1999.

In

August 2000, a meal delivery scrvice company, was established to servs

Seven-Mcal the

Service aging Japanese

Co

Ltd population'

'

Seven Bank was sct up as the core opcratlng company for Seven

& i

in financial services. l3y 2009, virtually evcry Seven Eleven Japan storc bad an ATM installed with Seven Bank having morc than 14'000

ATMs

Thc company averaged I 14 transactions per

ATM

per day'

Other scrvices offered

at sbres

include photocopying, ticket salcs

(inclucling baseball games, cxpress buses.

and music concerts) using

multifunctional copiers, and bcing a pick-up location for parccl delivery companies that typically do not leave the parccl outside

if

the customer is not at holDc. ln 2010' the convcnience skxes also started

oflcring

some governmenl servlces such as provitling cerlificates

of

rcsidencc. Thc major thrust for offering thcse servicus was to take advantage

of

thc convenient locations

of

Scven-Eleven stores in

Japan. Besidcs providing additional revcnue, thc servicos also got customors to visit the stores more frequently'

Scveral

of

thcse scrvices cxploited the existing Total

Information Systetn (see tcxt fi)llowing) in the store

In Febrtrary 2000, Seven-Eleven Japan established

?dream.com, an e-conlmerce company.

Thc go'll was to oxploit the existing clistribution system and the facl that storcs wcte casily acccssible to most Japlness Stores servcd as drop olT and

collection

points

lbr

Jrpanese customers.

A

survey tomers preferre<i by esBook (a

joint

venture among

Softbank,

Seven-Eleven

Japan,

YahoolJapan, and

Tohan. a publisher) discovered that 92 percent of iis custo pick up their online purchases at thc local convenience store, rather than have them delivered

to

their

homes.

This

was understandable

given

th€ tiequency

with

whieh Japanese customers

visit

their

lcral

convenience store; Tdream hoped to build on this prefereDce along

with

the synergies from the existing distribution system.

In

March 200?, Seven-Eleven Japan introduced

"Otoriyose-bin"

or

Internet shopping The

servica enabletl customers to buy products that were typically not available at the retail stores. Customors were alk)wed to ordcr on the Web with both pick-up and payment at

Seven-Eleven stores. There was no shipping fee charged for this service. Thc company built Seven Net

Shopping'

its

lntcrnet site aimed at combining the group's stores and Intemet services. In April 2007, "nanaco" elechonlc money was otTered in Seven-Eleven stores.

The service allowed customers to prepay and use a card or to make payments.

'fhe service was cell phone offered as a convcDience to customers making small purchases and was also a reward system offering one yen worth

of

points

tbr every

100 yen spent

by

thc customer.

By

the end

of

2007, nanaco was used by customcrs to make more than

30 million payments each morth.

(;ivcn

Japan's aging population and an increase in thc number of womcn working outside thc home (Seveo

Eleven

(slimatcd that

in

2009 nrore than 70 percent o[ women

ir

their 40s worked outside the home), Seven

Eleven wanted to exploit its "close by convenient stores" t.r

better.cne

ils cuslotners. Thc company atlcmpled to do

this

by

offcring "meal

solutions" that speeded up cooking at honte and services like "honte meal delivcry-"

Seven-Eleven Japan's

Information

System

Integrated Store

From its

sta

. Seven-Eleven Japan soughl k) sirnplify its opera(ions by using advanccd inftlnnation technology

Sevcn-Eleveu Japan slrccess altributed a significant part

oi

its

to

the

Total Information

System installed in every eutlet and linked

to

headquarters, suPplicrs, and lhe Seven-Eleven distlibution centcrs. The

first

online network linking

fic

head officc' stores, and vendo$ was establishecl

in

1979, though lhe cornpany did not collect poinrof-sales (POS) intbrmation at thal

tirne

ln

1982,

Scven-Eleven became

thc first

company

in

Japan to inlrrrducc a POS srstcm culnPrising POS cash reAi\ler\ and tcnninal control cquipment.

In l9li5.

thc company

._:i

'!

:l

,s

I

I

) i

64

Chapter

I '

Supply Chain Drivers and Mctrics developed,

jointly wilh

NEC. personal compulers

color

graphics that were

installed at

gach using store and linked to the POS cash registers, These computers were also on the net)vork linking the store to the head office as well as the vendors Until July 1991, head oflice' stores' distribution cente$, and suppliers were traditional analog

nelwork

linked only by a

Al

that

lime'

an integraled services digital network

(ISDN) was installed Linking more than 5,000 stores,

it

became one

of

the world's largest ISDN systems at lhat lime

The two-way, high-speed, online commumcahon capability

of

ISDN enabled Seven-Eleven Japan to

col'

lect, process, an<t feed back POS data quickly' Sales data gathe;ed ieady in each store

Eleven Japan by I l:0O r'r'''r' were processed and

for

analysis the next

morning

introduced its

ln

199?, Seven-

fifth

generation

of

the Total lnformation System' which was

still

in use in 20O4'

The

hardware system

at

a

1994 Seven-Eleven store included the following:

.

Graphic order

terminal:

This was a handheld by device with a wide-screen graphic display, used the store owner or manager to place orders The in items were recorded and brought up in the order

which

they were arranged

on

the shelves The store manager/owner walked down the aisles and placed orders by item. When placing an order, the storc manager had access

(from the storc computer) to detailed analysis

of

POS

dat

related to the

particuldi item. This

included sales analysis product

-of categories and SKUs over waste, lO-week sales trends by

of

lime. analysis

SKU'

l0-day sales trends by

SKU,

sales trends

for

new products, sales analysis by day and time, list

of

slowmoving items, analysis

of

sales and number

of

customers sections over time, contribution

of

product to

in

store display, and sales growth by product categories, The store manager used this information when antered

placing

an order,

which

was

directly into

the terminal- Once

all

the orders were placed. rhe lerminal was retumed to its slot, at which point tbe orders were relayed by the store computer to both the appropriate vendor

. and the Seven-Eleven

Scanner

distribution center'

terminal:

These

scanners

read

bar codes and recorded invenlory' They were used to receive products coming

in from

a distribution cenler,

This was automatically checked against a previously placed order' and the two were reconciled. Before the scanner terminals were rntroducad, ftuck drivers waited

in

the store

until

the delivery was checkecl. Once they were introduced' the driver simply dropped the delivery in the store' and a store clerk .eceived if at a suitable time when

{here were few custonters The scanner lernlinals

were also

used when examining

inventory

at stores.

.

Slore

computer:

This linked to the ISDN netterminal' work, the POS register, the graphic order and lhe scanncr terminul. lt communicated among thc various input sources. traeke''l slorc inventory and sales, placed orders' provided detailed analysis

of

POS data, and maintained and regulated store equipment.

.

POS

regkter:

To better unde$tand the functioning of this information network, one needs to consider a sampling of daily operations Assoonasa customer purchased an item and paid at the POS register, the item information was retrieved from the store computer and the time

of

sale was automatically recorde<1.

In addition' the cashier recorded the age and sex of the customer. To do this, the cashier used hve register keys under-13, 13-19,

20-29,30

for the categortes:

49,

and 50+' This

POS data was automatically transmitted online

to

a host computer.

All

sales data oollected by

I I

:00 P.M. were organized and ready for analysis by the

text

moming. The data were evaluated on a company-wide, district' and store basis' back

The analyzed and updated data were lo the Seven-Eleven Japan stores thsn sent via the network'

Each store computer automatically updated its product master ments.

file

to analyze its recent sales and

The main objective

stock move-

of

the

analysis was to improve the ordering process.

All

this information was uuuilubl" on the graphic order terminal used for order

Dlacement.

slores

The information

system allowed Seven-Eleven to better match supply with demand' Store staff

could

adjust

the

merchandising

lnix

on the

shelves according to consumption patterns throughout tbe day'

For example, popular breakfast items were stocked earlier during the day, while popular dinner items wcre stocked

later

in

the evening.

The identification

of

slow and nonmoving items allowed a store to convert shelf

to

introduce new items. More than 50 percent space

qf

the items sold at a Seven-Eleven store changed in the course

of

a year.

This was due partly to seasonal demand and

parlly ro

new products When

a

new

product wa\

introiuc"d,

the decision whether to continuc stocking it was made wilhin the first lhrcc wcek\. Each item on th(

( haPlcr.l '

SupDl) ('hltin Dri\crs and l\,letrics shelf contribuled to salcs and nlargin and did not wastc vltluablc shell space.

Seven-Eleven's

Distribution

System

The Sevcn-Elevcn distuibution sysrem tighrly linked the entire supply chain for all product categories. The disrribution centers and the infonnalion network played a key role in thal regard. The major objective was to carefully track sales

of

itcurs and offer shori replenishment cycle times. This allowed a store manager

to

forecast sales correspqrding to each order accurately.

Frorn

March

1987, Seven-Eleven offered threetimes-a-day store delivery of all ricc dishes (which comprised most of the fasrfood items sold). Bread and other frcsh food were delivered twice a day. The distribution system was flexible enough to alter dclivery schedules depending on customer demand. Rtr example, ice cream was delivered

daily

during the summer but

only

three times a week at other times. Thc replenishment cycle time

lbr

fresh and fast-food itcms had been shortened to fewer than

l2

hours.

A

store order

for

rica balls by l0:00 e.trr. was delivered before thc dinncr rush.

As

<liscussed earlier,

thc

storc managcr uscd a graphic order terminal lct place an ordcr.

All

storcs were given cukrff timcs for brcakfast, lunch, and dinner ordering. Whcn a store placed an

orde(

it

was imnrediately transmitted to the supplier as wcll as the distribution cen-

tsr

Thc supplier receivcd ordcrs fronr

all

Scven-Eleven stores and startcd pKxluction to

fill

thc orders. The supplier then scnt the orders by truck to the

distributiol

centcr.

Each store order was separated so the disaibution center could easily assign

it

to the appropriate sbre

tuck

using thc order information

it

already had. The key to store

dclivcry

was what Seven-Eleven called the conbined dolivcry systcn. At the distribution center, delivery of like products fronr cliffercnt supplicrs (e.g.,

milk

and sandwichcs) wirs directetl

truck. There were

into a single tempcrature-controlled

four

calcgories

of

teIr1peraturecontrollcd

lrucks: lrozet

foods,

chilled

foods. roomternpcrature processcd li)ods, and warm forxls. Each truck madc deliveries to mulliplc retiril stores.'Ihc nunrber stores pcr truck (lepcndcd on the salcs volumc.

All of

dcliveries were midc during

off

peak hours and wcre rcceived using the scanner terminals. The systctn worked on lrust and did lrot rcquire the dclivcry person to be present when the storc persontlcl scalned in the delivcly. That reducctl thc delivcry tirne spcnt at

c

ch storc.

This distribution syslcm cnublcd Scven-Elevt:n to reducc the number ofvchicles rcquired tbr daily dclivery sctvice to cach store. even though the delivery frcqucncy ofeach itenr was quitc high.

In

1974, 70 vehiclcs visitcd each sk)re every day. By 20O6, only 9 were nccessary.

This dramatically reduccd delivery costs and cnabled rapid delivery of a varicty of liesh foods.

As

of

Fcbruary 2004, Seven-Eleven Japan had a total

of

290 dedicated manul'acturing plants throughout the country that produccd only fast food f<rr Seven-Eleven storcs. These itcms were distdbuted through 293 dedicared distribution centers (DCs) rhat cnsured rapid, reliable delivery. None of thesc DCs carried any invenlory; thcy merely transferred inventory

from

supplier trucks to

Seven-Eleven distribution trucks. The tansDortation was providerJ by Transfleer Ltd.. a company sel up by Mitsui and Co. fbr the exclusiye use of Seven-Eleven Japan.

7-Eleven

in

the

United

States

Seven-Eleven had expanded rapidly around the world

(Table 3-5). The major growth was in Asia, although the

Uniled States continued to be the second largest market

for

Sevcn-Eleven. Oncc Seven-Eleven Japan acquired

Southland Corporation,

it

set about improving operations in the United

States.

7-Eleven stores

In

the

initial

years, several

in

the United States were shut down.

The number of stores started to grow beginning in 1998.

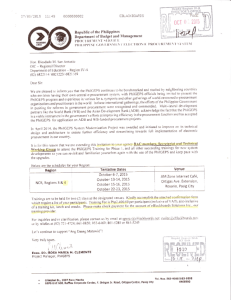

Country

Japan

United States

Taiwa n

Thailand

South Korea

China

Malaysia

Mexico

Canada

Australia

Singapofe

Ph ilippines

Norway

Sweden

Denmark

Inoonesra

Tota

I

Stores

't3,049

6,126

4,190

5,840

3,150

1,1t7

1

,250

1

,223

465

415

549

567

173

189

129

23

40,255

66

Chaptcr 3 ' Supply Chain Drivers

'nd

Mctrics

Historically, the distribution

structure

States was completely

in

the United

different from that

in

Japan'

Stores store in the United Siates were replenished using direct delivery (DSD) by some manufacturers, with the remaining products

delivercd

by

wholesalers. DSD accounted for about half thc total volume, with the rcst coming from wholesalers.

With the goal

of

introducing "fresh" products in thc Uniled Slates, 7-Elcven introduced lhe concepl

of

combinetl distribution centers (CDCs) around 2000. By

2003, 7-Eleven had 23 CDCs lmated throughout North

America supporting about 80 percent

of

the store network. CDCs delivered fresh items such as sandwiches, bakery products, bread, produce, and other perishables once a day.

A

variety of fresh-food suppliers sent product

lo

the CDC throughout the day. where they were soned for delivery to stores at

night

RequesB lrom store managers were sent to the nearcst CDC, and the products were en routg by 10:00 PM

'

to

the stores. Relative to

Japan, a greatcr fraction of the food sold' especially hot food such as wings and pizza, was prePared irt the store'

Fresh-food sales

in

North America

exceeded $450

million

in

2fi)3.

During this period, DSD by manufactutcrs and wholesaler delivery to stores also continucd'

This was a period when 7-Eleven worked very bard to introduce new fresh-food items ing more directly with the likes widr a goal of compet-

of

Starbucks than with traditional gas station food mans. 7-Eleven in the United

States had more than 63 percent

of

its sales from nongasoline products compa.red to the rest of the industry,

for

which this number was closer to 35

Percent.

The goal was to continue

to

increase sales in the fresh-food and fast-footi categories with a special focus on hot foods'

ln

2009, revenue in the United States and Canada totaled $16.0 billion, with about 63 percent coming from merchandise and the rest from the sale

of

gasoline. The

North

American inventory turnover rate

in

2004 was about 19, compared to more than 50 in Japan This, however, represented a significant improvement

in

North

American performance, whe.e inventory turns

in

1992 were around 12-

Study Questions

1. A convenience store chain attempts to be responslve ano provide customer$ with what they need, when they need wherc they nced it,

it

What are some different ways that a convenience store suPply chain can be responsive'l What are some risks in each case?

2. Seven-Eleven's supply chain strategy in Japan can be described as attempting

to

micro-match supply and dcmand using rapid replenishment. whal are some risls associated with this choice?

3. what has Seven-Eleven done in its choice of facility l(xation, inventory management, tnnspottatioD, and information inftashucture to develop capabi.lities that support its suPply chain stratcgy in Japan?

4. Seven-Eleven does not allow direct store delivery in Japan but bas all products no\" througb ils distribulion center'

What benefit does Seven-Eleven derive from this policy?

When is direct stot€

delivei

more appropriate?

5. what do you think about the Tdream concept for Sevcn-

Eleven Japan? From a supply chain perspective, is

it likcly to

be more successful

in

Japan or thc United states? Why?

6. Seven-Eleven is attemPting to duplicate thc supply chain structurc that has succeeded in Japan and the U.ited States with the introduction of CDCs. What are the pros and cons of this approach? Keep in mind that stores are also replenished by whole$alers and DSD by manufacturers'

7. The United States has food service distributors that also replenish convenience stores. What axe thc pros and cons to having a distributor rcplenish coDvenience storcs versus a company like Seven-Eleven managing its own distribution function?

Case

Study

Financial Statements for wal-Mart

Stores lnc.

Table 3-6 contains the financial resuls for Wal-Mart for

2008 and 2009 (declared on January year). Evaluate

3l

of the following

Wal-Mart's financial performance ba-sed on the various metrics discussed in Section 3.1, such as ROE,

ROA, profit margin, asset tums, APT, C2C' ART' II'IVT' anrl PPET. Compare the metrics for Wal-Mart with simi-

lar

metrics for Amazon from Table 3-1. Which metrics does Amazon perform better on? Which metrics does

Wal-M:m perform better on? What supply chain driYers and metrics might explain this differcnce in

In

2010, Wal-Mart announced that

Performanc€?

it

planned to move into urbzn areas in the United States by building and operating smaller format stores compared

to

the large stores it had operated up to that point. Which supply chain metrics

will

be impacted by this move? How

will

this move imDact the various financial metrics? Why?