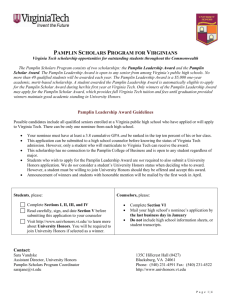

amplin Spring 2006 - Pamplin magazine

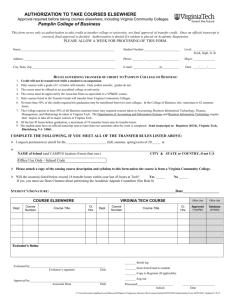

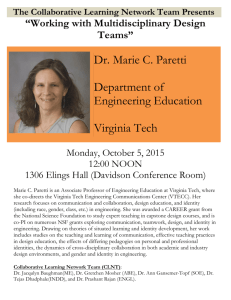

advertisement