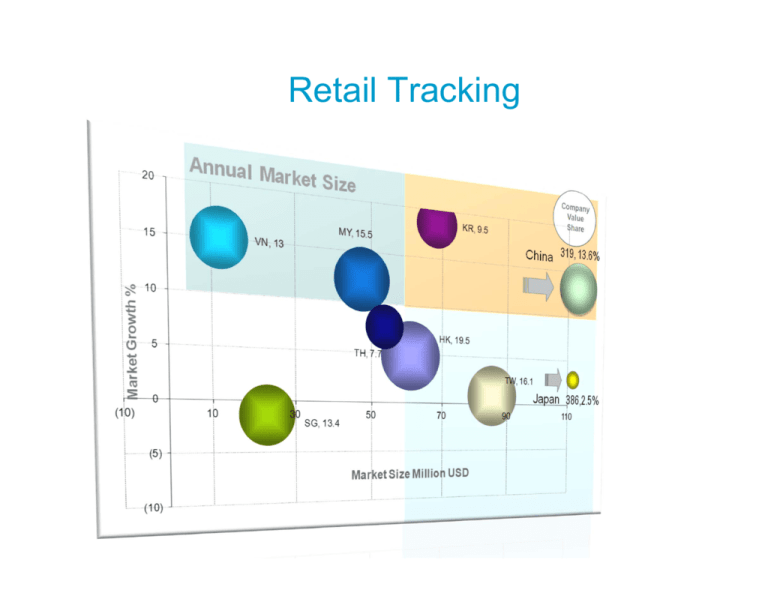

Session 7: Retail Tracking

advertisement

Retail Tracking Objective and Applications Objective - Provide an accurate assessment of the performance of products in terms of sales (volume and value) and availability (distribution) Applications - Monitor brand health and performance - Monitor competition - Understand market opportunities and threats - Develop market strategies - Set goals and targets - Evaluate sales, distribution and business performance - Evaluate performance of individuals - business leaders, marketing and sales personnel (?) Market Size / Share analysis - key input for market strategy Chart analysing firm’s growth across region MAT Growing faster than category, gaining market share KR 30 CN Market $ 25 Firm ($) ID Growing slower than category, losing market share. Firm’s Value Growth % 20 15 HK 10 VN JP MY 5 TH Market Value Growth% 0 (5) 0 SG (5) TW 5 10 15 20 25 30 Variety of approaches to Retail Tracking Continuous measurement of sales … Consumer Panel measures purchases brought home by the buyers Retail Index measures the pipeline here Richer data that yields Insights Most efficient and accurate method of measuring and monitoring market movements Data Pooling Low cost but unreliable Homes Retail Outlets Shoppers … Manufacturers Width and depth … basic components of sales Distribution Penetration % of Stores % of homes buying Retail Index Consumer Panel Rate Of Sale Sales per Store Volume per buyer Sales Sales No of stores distributing x Sales per store No of homes buying x Volume per buyer Retail Measurement Arthur C. Nielsen (1897-1980) Retail Measurement Services Nielsen, IRI, intage, Aztec FMCG products GfK Consumer Durables – Brown & White goods Pharmaceutical – Medicines / Tonics IMS Vision Care Pet foods – pet shops Chinese Tonics – CMHs Writing instruments Computers and Peripherals Mobile phones / Telecom products Hardware and Sanitary ware How it works? Retail Measurement Services a Six Steps process Design & Development of service 1. Define Universe 2. Undertake Census 3. Establish Sample Service Cycle … repeated every period 4. Collect Data 5. Process / Validate Data 6. Analyse, Interpret, Act 1. Defining the Universe TOTAL REGIONS Upper Trade Supermarkets Metros Other Lower Trade Convenience Metros Other Medical Provision Stores Urban Misc. Stores Rural Retail Universe in China Villages?? 4 Key City (SH/BJ/GZ/CD) 23 A City 254 B City 343 C City 1,327 D City 18,787 Towns 16,621 Townships Universe in Singapore … a precise definition of stores to be covered Supermarkets Scan Medical Scan/Audit NTUC FairPrice Scan Watson’s Scan Liberty Scan Guardian (DF) Scan Cold Storage Scan Unity Scan Market Place, Jasons Scan National Health Care Scan Shop & Save Scan Chinese Med Halls Audit Carrefour Scan Giant Scan Mini-Markets Audit Sheng Siong Scan Econ Independents Audit Audit C-Stores Scan 7 Eleven Scan Cheers Scan Esso, Mobil Scan Shell Scan Provision Coffee Shops Hawker Stalls NITE Entertainment Sundry Kiosks Audit Audit Audit Audit Audit BP / SPC Caltex Scan Scan Not Covered Not in Universe Coverage Gap Hotels, bars, schools, exports, etc... Coverage Gap due to: 1. Difference in Sales area and measurement Universe 2. Pick-up Client Primary Sales = 2,000,000 Agency Sales Estimate = 1,800,000 2. Census Retail Census - Objectives Identify different outlet types and quantify number of outlets in a Universe by type Provide key statistics (selection criteria) for setting up a representative panel / sample China 2009: Modern trade accounts for barely 3.5% of outlets yet contributes to 64% of sales. 2009: 3.289 Million Stores (Urban – Cities and Towns) FMCG Outlet (%) FMCG Sales (% value) Modern 3.5% Traditional 35.6% Traditional 96.5% Modern 64.4% China: Modern trade boom in 2004 and 2005 51807 +14% National Towns and Cities (73,907 stores) 45343 +20% 37925 +3% +2% 13789 13117 13339 +13% 1189 1346 +12% +22% +27% 6799 5577 4399 1512 Hypermarkets Supermarkets 2004 Minimarkets 2005 2006 CVS China China: 2008-2009: Modern trade continues to grow, but at a slower pace than the mid 2000s when it grew by 16% 4% 84363 80728 National Towns and Cities (115,415 stores + 8.5%) 10% 27% 10% 9224 14484 11591 17353 1912 2108 Hypermarkets Supermarkets 2008 2009 Minimarkets CVS China Retail Census – Store Details Collected Name Address (incl. directions) Telephone number Shop Type Presence of Air-conditioning Refrigeration Facilities Number of hours open per day Monthly Turnover Sales Mix : floor space/turnover 1. Define Universe 2. Undertake Census 3. Establish Sample More dots Less dots Setting Up the Sample Retail Index Samples are: - Stratified Random Samples - Disproportionate Stratified Random Samples provide greater accuracy than a Simple Random Sample of the same size Disproportionate Samples ensure that the key trade sectors affecting the total market are given greater importance to being correct Determining the Sample Size The precision (Sampling Error) of our estimates depends on : - The variation in the population. - The sample design. - The size of the sample (Note : universe size is not mentioned). Bias is prevented by : - A randomised selection process. - Eradication of systematic errors. How good is the data? 4. Collect the data Data Collection in Manual Audit Auditors visit each sample store every month Variations in time between visits is adjusted to a 31 day cycle Information collected from the store : 1. Stocks in the outlet (inside the shop & storeroom) 2. Retail selling price from the tags 3. Purchases made by the outlet since last visit (31 days) Monthly Audit cycle Assuming Jan is initial audit for a new category Month Feb Mar Apr - 31 days - - 28 days - - 31 days - Jan First Route Opening Stock for Feb Second Stocks, Purchases Feb - Closing Stock Mar - Opening Stock ………. Third Stocks Purchases Fourth Stocks Purchases Scan Data Sales data obtained directly from the POS terminals. Usually weekly data Cycle should ideally coincide with the chain’s promotional week Provides volume / value sales and price Does not provide stock / out-of-stock / distribution or purchase data. 1. Define Universe 2. Undertake Census 3. Establish Sample 4. Collect Data 5. Process / Expand Data How we derive Sales Purchases (Invoices) Stocks Consumer Purchases Consumers Computing Sales The “Audit Principle” Opening Stock Less Closing Stock Purchases Credit Returns and Transfers Equals Consumer Purchases Less Plus Computing Sales for March 25th Feb Audit Stocks = 500 (opening stock for March) (closing stock for Feb) 25th Mar Audit Stocks = 700 (closing stock for March) Purchases = 1200 Sales (25th Feb to 25th Mar) = Opening Stock – Closing Stock + Purchases = 500 – 700 + 1200 = 1000 Process / Expand the data Simplified example - Numeric Estimation Sample Universe Sales in sample Estimated Sales Supermarket 100 1000 (*10) 528 5,280 Provision 120 2400 (*20) 50 1,000 Mini-Market 200 800 (*4) 400 1,600 TOTAL 420 4200 7,880 1. Define Universe 2. Undertake Census 3. Establish Sample 4. Collect Data 5. Process / Expand Data 6. Analyse, Interpret, Act Basic Facts The data is essentially 3-Dimensional Product Market Time … Data Types Product Segment Manufacturer Brand SKU (item level) Market National Regional Trade Sectors Account Specific Time Annual (MAT) Monthly Weekly(Scan services) Data Types Volume Sales and Shares Value Sales and Shares Retailer Purchases Retail Stock Forward Stock Price Distribution - In-Stock, Out of Stock, Purchase (shown as Numeric, Weighted) Retail Index - Reported Data Types Sales Volume The sales volume for the audit period. Sales Value The sales value for the audit period. Year-to-date (YTD) Sales Volume (Value) The sum of the total sales volume (value) from the beginning of year to the present audit period. Moving Annual Total (MAT) Sales Volume (Value) The sum of the total sales volume (value) for the past 12 months … ending with the current audit period. Retail Index - Reported Data Types Average Price Average Price is calculated as follows: Total Sales Value Divided Total Sales Volume Retailer Purchases The volume of purchase made by retailers in the audit period. Returns to wholesalers and wholesale sales are offset from this figure. Retailer purchases not reported in Scan Channels Retail Index - Reported Data Types Stock Includes all retailer stock whether on display, on the shop floor space or stock room. Forward Stock Stock in the store’s selling area which can easily be accessed by customers. For example stock placed inside chillers, freezers, cabinets or on shelf. Stock Cover (Stock cover Days) Number of days the current stock cover would last assuming that sales continues at the same rate. Stocks, Forward Stocks & Stock Cover not reported in Scan Channels Stock Cover Forward Stock = 100 units Backroom stock = 200 units Sales = 600 units per month How many days will stock last? Stock Cover Days = Total Stock / Sales rate Total Stock = Forward + Back = 100+200 = 300 Sales Rate = Sales per day = 600 /30 = 20 Stock Cover Days = (100+200)/(600/30) 300/20 = 15 days Numeric Distribution Numeric % of stores handling product Universe: 10 Stores Distribution Numeric distribution = 60% Weighted Distribution Share % of category sales by handlers Universe: 3 Store, $50,000 category sales 1 Stores 2 3 Distribution Category sales $20,000 $10,000 $20,000 Product is handled by stores accounting for 80% of Product Category sales. Weighted Distribution = 80% Numeric & Weighted Distribution Store % of Sales Brand 1 Brand 2 Brand 3 A 40% B 30% C 20% D 10% Numeric Distribution 75% 50% 50% Weighted Distribution 60% 70% 30% Comparison of Weighted and Numeric distribution provides an understanding of the quality of distribution Stock Out and Loss of Distribution Stocked ... In stock Distribution Period 1 2 3 4 Either sales or purchases, but no stocks … Out of Stock Distribution Purchase Closing Stock Distribution Stock Out Yes Yes Yes No No No Yes - No sales, no purchases, no stocks … No Distribution Stock Out and Loss of Distribution Period 1 2 3 4 Purchase Closing Stock Distribution Stock Out Yes Yes Yes ? No No Yes ? Now what … Is it still loss of distribution?? What Benefits? Benefits – Market Understanding Market Structure - Size, Growth, Segments, Opportunities and threats. Channel performance - Channel development and the impact on your channel strategies. Brand Health - Your brand Growth, Share, Distribution, Price. Competition - The key players, their activities, Strengths & Weaknesses. Sales Evaluation - Distribution, Stocks, Stock Cover, Stockouts… These are fundamental to formulating Marketing Strategies and Sales Plans Coverage Theoretical background Why suppliers’ shipments differ ... Different Universe Pipeline - Lag between shipment and consumer purchase - Irregular shipment patterns - Investment buying - Promotions - Changes in Warehouse inventory or pipeline - Product life cycle Parallels … as well as exports Inaccuracies in measurement such as when the product’s distribution is low Different Universe: Coverage is usually less than 100%, since the Total Shipment from the factory can reach Markets not covered by research agency “Real World” Department Stores Cash & Carry(Makro) Agency’s Universe Army Hypermarkets Schools Supermarkets Construction Sites Hospitals / Pharmacies Convenience Stores Transient Hawkers Mini-markets Excluded Geographic Areas Provision Stores Exports “Measured World” Coffee Shops/Rest Permanent Hawkers Fresh and Weekend Markets Direct Selling Specialised Shops Hotels/Cafe Pipeline effect Pipeline is directly affected by distribution methods - Direct Delivery reduces Pipeline delay, - Elaborate structure of Wholesalers, Agents, Distributors and Concessionaires lengthens the Pipeline effect. Geography, size of country affects pipeline Pipeline is also affected by product re-purchasing rate - Products with “short shelf life” tend to have shorter pipeline than “long life” ones. ? Universe, Pipeline, Coverage Imports Exports Retailer’s Warehouse Shipments Retailer Covered Sales Retailer Factory Cash Van Retailer Wholesaler Retailer Warehouse Club / Cash & Carry Hotels, Bars.... Street Hawkers Consumer Conflict Resolution Examples: Kraft changes distribution network Example: Expected Coverage = 80% “Real World” 100% Cash & Carry(Makro) 80% Department Stores Agency’s Universe Army Hypermarkets Schools Supermarkets Construction Sites Hospitals / Pharmacies Convenience Stores Transient Hawkers Mini-markets Excluded Geographic Areas Provision Stores Exports 80%: Based on supplier’s records / judgement “Measured World” Coffee Shops/Rest Permanent Hawkers Fresh and Weekend Markets (Wet) Direct Selling Specialised Shops Hotels/Cafe Coverage and Pick-Up “Real World” (All outlets) Agency’s Universe 100% % of shipments to Universe picked up by measurement service 72% 80%: Based on supplier’s records / judgement “Measured World” 80% Pick-Up = 72/80 = 90% Coverage - Summary Expected Coverage is the proportion of total shipments that are delivered into the measured universe. (80%) Coverage is the measured purchase volume as a proportion of total shipments. (72%) Pick Up is measured purchase volume as a proportion of expected coverage. (90%)