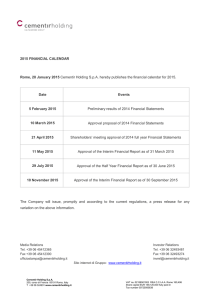

2012 - Investor Relations

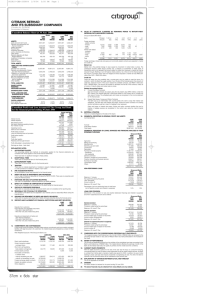

advertisement