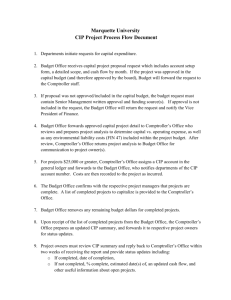

financial procedures rules, 2064 (2007)

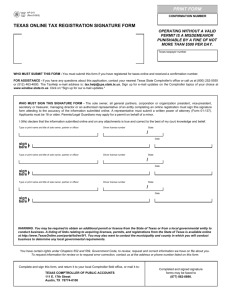

advertisement