internationalization process of automobile industry a case study of

advertisement

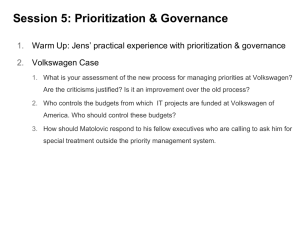

Área Temática Estratégia Internacional # ID 1576 INTERNATIONALIZATION PROCESS OF AUTOMOBILE INDUSTRY A CASE STUDY OF THE VOLKSWAGEN GROUP FOCUSING ON INSTITUTIONAL CONDITIONS IN BRIC COUNTRIES Lu Fu Technische Hochschule Deggendorf Mario Henrique Ogasavara ESPM-SP 1 Track: International Strategy INTERNATIONALIZATION PROCESS OF AUTOMOBILE INDUSTRY A CASE STUDY OF THE VOLKSWAGEN GROUP FOCUSING ON INSTITUTIONAL CONDITIONS IN BRIC COUNTRIES ABSTRACT This study analyzes the internationalization process of the Volkswagen Group in BRIC countries, with a focus of the institutional aspect. Based on the case study approach, the analysis considers geographical, economic, general development, cultural and institutional aspects using different indicators. We collect data from secondary sources such as documents and official reports. The analysis is combined international theories such as Uppsala model, OLI paradigm and institutional based view. As a result, this study finds out that the internationalization process of the Volkswagen Group can be well explained by OLI paradigm in combination with institutional-based view. However, the findings also show an essential need to explore in-depth each country’s situation while investigating the internationalization process of companies, since institutional aspects present differences at city- or province-levels. Keywords: internationalization, automobile industry, institution, BRIC countries, Volkswagen 1 INTRODUCTION Internationalization has already become a common phenomenon in many areas nowadays, such as textiles and electronics industries (Campos and Lootty, 2007), as well as automobile industry. No matter traditional market leaders such as Toyota and Honda or the market new competitors like Tata, they are all facing different chances and challenges under the global environment today (Morris, 1992; Salwan, 2011). First established under the name of ”Gesellschaft zur Vorbereitung des Deutschen Volkswagens GmbH” in Berlin in 1937, the Volkswagen Group (hereafter VWG) has grown to one of the largest and most successful car manufacturers worldwide ranked the 14th world’s biggest public companies by Forbes (2013). The VWG includes first of all passenger car brands VW, Audi, then Bentley, Bugatti, Lamborghini, Porsche, SEAT and Skoda; motorcycle brand Ducati and commercial vehicles under the brands MAN, Scania and VW Commercial Vehicles. To become world’s leading automaker by 2018 – both economically and ecologically is the next goal of the company (Volkswagen, 2013). BRIC refers to four developing countries (Brazil, Russia, India and China), which have all rapid economic growth during the last decades (Estrin and Prevezer, 2010). While the economy depresses in many developed countries in 2011, BRIC’s real GDP still keeps growing: China and India have GDP growth of 9.3% and 6.3%; Brazil and Russia have GDP growth of 2.7% and 4.3% (World Bank, 2013b). One of the most important drivers of economic growth in BRIC countries is automobile industry, for instance automobile industry represents about 5% of total Brazilian GDP in 2012 (Gerpisa, 2012). Thus, automobile industry plays an important role for the industry and governments in BRIC countries as well as for the foreign investors. The VWG has achieved a remarkable result in BRIC countries. In 2012, market share of the VWG’s new passenger cars in Brazil and China represents respectively 20.8% and 23%, ranking second and first in the market (Volkswagen, 2013). Therefore, this study considered the VWG would be a good example of internationalization of automobile industry in emerging economies. 2 Internationalization has been explored by different economists for a very long time. However, the new development of global economy as well as that of the whole society has brought new challenges to economists today. One of the most important changes is the rise of the developing economies. During the last two decades the participation of developing economies in the global economy plays a more and more important role both as market for goods and services and as production sites. Therefore, to understand the internationalization of MNEs in emerging economies has got more and more attention from the economists (Demirbag et al, 2007; Aulakh and Kotabe, 2008). BRIC countries are all developing economies and have rapid economic growth in the past several years. Therefore, BRIC countries are considered representative developing economies by this study and thus would be taken as research objective. To investigate the internationalization, the economists have developed different theories from different aspects, such as transaction cost theory (Hennart, 2010), Uppsala model (Johanson and Vahlne, 1977) and OLI paradigm (Dunning, 1980). All of those theories, however, concentrated on the country level of the internationalization process. One of the relative new considerations was the institutional aspect. Institutions used to only be considered as background for researching firms’ internationalization. However, some of the new generations of researches suggested that institutions directly determined what arrows a firm has in its quiver as it struggled to formulate and implement strategy, and to create competitive advantage (Ingram and Silverman, 2002). There are also more and more scholars combining different theories with institutional aspect. For example, Dunning and Lundan (2008) also incorporated institutional dimensions into their OLI paradigm. The institutional influences of internationalization are especially clear in the emerging countries, because normally the institutional frameworks in those countries differ greatly from that in developed countries (Meyer and Peng, 2005). Since the institutional aspect, such as rules, laws, labor market institutions in BRIC countries can be significantly different with the developed countries; this study would also concentrate on the institutional aspect and see if there is any institutional influence of the VWG’s internationalization process in BRIC countries. The research question of this study is: “How do institutional conditions in BRIC countries influence the internationalization process of Volkswagen?” By answering this question, it will help to get a better understanding of what the relationship between institutional conditions and the internationalization process of the VWG is and how do those conditions influence the firm’s decisions. Therefore, the specific objectives are related to: (i) to explore the whole internationalization process of the VW Group in the BRIC countries; (ii) to investigate different institutional influences sectors of BRIC countries on the VWG’s internationalization process. Although the VWG is one of most successful automobile firms in the world and its internationalization process has started since more than 60 years, it does not get many attentions from the economists. Previous researches have investigated the whole automobile industry and took VW only as one example, such as the paper of Rugman and Collinson (2004). There is also a paper that investigated VW itself, but mostly from the technique development aspects (Parisien and Thagard, 2007). There are also authors focusing on the strategy of VW in one country, for example in America (Gray, 1975). Although those previous paper contributed significantly to the literatures, to our knowledge there is no academic paper that really focus on the investigation of the internationalization process of the VWG in the BRIC countries. This study will fill this academic gap. It will analyze more about the success experience of the automobile industry giant and at the same time, get a better understanding about the automobile industry in BRIC countries. 3 2 LITERATURE REVIEW 2.1 The Uppsala model This model focuses on the gradual acquisition, integration and use of knowledge about foreign markets and operations, and on the incrementally increasing commitments to foreign markets (Johanson and Vahlne, 1977). Johanson and Vahlne assumed that the lack of market knowledge is the most critical constraint among all the difficulties for a firm’s internationalization process. This typical internationalization process can be explained by a dynamic model, which was published in 1977 and since then the business environment has changed a lot. Now the business environment is considered as a network, rather than as a market with many independent suppliers and customers. In their published paper in 2009, networks thinking have been taken account into the Uppsala model (Johanson and Vahlne, 2009). From the network aspect, a firm’s success requires to be well established in one or more networks. A firm that is well established in a relevant network or networks is an “insider”. If a firm attempts to enter a foreign market, where it does not have relevant network position, it will suffer from the liability of outsider-ship instead the liability of foreignness in the old model. The foreign market entry should be thus considered as a position-building process in a foreign market network instead of a decision about modes of entry (Axelsson and Easton, 1992). Business networks should be considered as a market structure in which the internationalizing firm is embedded and on the corresponding business network structure of foreign market (Johanson and Vahlne, 2009). 2.2 OLI Paradigm OLI paradigm also called eclectic paradigm is developed by Dunning and has been a general framework of analysis that explains the level and pattern of foreign value-added activities of firms since many years (Tolentino, 2001). According Dunning (1981) a country’s net international direct investment position is the sum of the direct investment by its own enterprises outside its national boundaries minus the direct investment of foreign owned enterprises within its boundaries. It asserts that the extent, geography and industrial composition of foreign production of MNEs, whether direct capital stock or changes in the stock over the time, is decided by three sets of interacted variables. The first is the ownership specific advantages (O), which are the competitive advantages of the enterprises seeking to engage in FDI or to increase their existing FDI. The greater those competitive advantages of the investing firms, the more they are likely to engage in or increase their foreign production. The second is locational attractions (L) of alternative countries or regions, for undertaking the value adding activities of MNEs (Dunning, 2000). The locational attractions can be the existence of raw materials, low wages, and special tariffs. The third is the internalization advantages (I), which explains the firm’s propensity to internalize cross-border structural or endemic imperfections in the intermediate good market (Dunning and Lundan, 2008). The internalization advantages are based on the other internationalization theory. According the internalization theory, rational agents will internalize markets when the predicted benefits exceed the expected costs. The firms will internalize intermediate product markets when the benefits and costs of internalization are at least equalized (Buckley and Casson, 2009). Being challenged by new forms of organizing, Dunning and Lundan (2008) assumed institutional dimension can be incorporated into the OLI paradigm. Since 19th century new forms of doing business has come out, such as the network MNEs. The network MNE consists of many different types of cross-border organizations (Dunning and Lundan, 2008). Inspired by the research of Peng and Delios (2006) about the firm boundaries in different Asian countries, Dunning and 4 Lundan decided considering the important role played by institutional analysis into the framework. Institutional aspects can help get a better understanding in both the determinants of MNE behavior, and its effects on home and host countries (Dunning and Lundan, 2008) With this institutional consideration, Ownership advantages can be divided into traditional assetbased advantages (Oa), institutional-based advantages (Oi) and transaction-based advantages (Ot). The Oa refers to the traditional asset advantages, directly related to the product or service. The Oi includes the institutional infrastructures, which is specific to a particular firm. Such an infrastructure comprises a collection of incentives, regulations and norms, each of which affects all areas of managerial decision-making, the attitudes and behavior of the firm’s stakeholders, and all the other important factors in the whole wealth creating process (Dunning and Lundan, 2008). The author also expanded the location advantages (L) into institutionally related location advantages of countries (Li), which can be significantly different between developed countries and developing countries and among developing countries. Institutions play also a big role for the internalization advantages (I) as well because for instance the structures or norms of the firms have influence on the cost and benefits of the firms. Besides, the intuitional content and quality in the host country may have influence on MNEs’ entry mode (Dunning and Lundan, 2008). 2.3 Institution-based view Besides the Uppsala model and OLI paradigm, institution-based view is also considered to be an insightful framework for this study. According to Peng et al. (2008) institutions are more than background conditions for firms today but a crucial determinant of their strategic management. Institution-based view should be combined with industry-based view and resource-based view as leading perspectives in strategic management (Peng et al., 2009). Many researchers and economists are focused on the industry-based view (Porter, 1980) and resource-based view (Barney, 1991) regarding the diversity of corporations’ strategies. However it has increasingly become clear that issues such as culture, legal environment, tradition and history in an industry and economic incentives all can impact an industry and, in turn entrepreneurial success (Baumol et al., 2009). A number of scholars suggested that in addition to industry and firm level conditions, a firm also needs to take into account wider influences from resources such as the state and society when crafting and implementing its strategies (DiMaggio and Powell, 1991; Oliver, 1997). These influences are considered as institutional frameworks (North, 1990). According to North (1990) institutions are the rules of the game in a society or, more formally are the humanly devised constraints that shape human interaction. Also, Scott (1995) has the similar definition for institutions, which is “cognitive, normative, and regulative structures and activities that provide stability and meaning to social behavior.” Both North and DiMaggio and Powell’s researches about institutions are considered as “new institutionalism”. North’s research is considered as the economic version, which focuses more on efficiency, while DiMaggio and Powell’s research is considered as a sociological version, which concentrates more on legitimacy (Peng, 2002). Institutions can be divided to two groups: formal and informal (North, 1990). Formal institutions include for example laws, regulations and rules, while informal institutions cover for instance norms, cultures and ethics. While according Scott’s (1995) idea institutions can be divided to three pillars: regulative (coercive), normative and cognitive. The two approaches have divided institution with different aspect, yet both gave very insightful opinions for the institution theory. According to Peng et al. (2009) both formal and informal institutions of emerging economies, which are very different from the ones of developed economies, significantly shape the strategy and performance of firms. There are researches showing that in developed economies firm- 5 specific effects are more critical for the foreign subsidiary performance, while in emerging economies institutional differences are more salient (Makino et al., 2004). Thus, institution-based view is considered to be a very insightful tool to analyze the firm’s activities in emerging economies (Hoskisson et al., 2000). Similar considerations are shared by many economists, for example, Seyoum (2011) has explored the relations between informal institutions and foreign direct investment in his paper. The institutional determinants of FDI in the paper are: domestic/international institutional variables, domestic institutions, rule of law, democracy/democratic accountability, political/economic stability, federalism, labor market institutions and industrial relations/intellectual property institutions. According to this paper the inflow FDI are positively related to the informal institutions. Informal and formal institutions are also positively relates to each other (Seyoum, 2011). 3 METHODOLOGY This study is a case study. According to Yin (2009), case studies are being used widely in social science research (sociology, political science, history etc.) as well as practice-oriented fields, such as urban planning, management science and so on. The distinctiveness of the case study, which also serves as its abbreviate definition is “An empirical inquiry about a contemporary phenomenon (e.g. a “case”), set within its real-world context-especially when the boundaries between phenomenon and context are not clearly evident”. This study will apply the possible theoretical framework into the internationalization process of VW. By this means it also tries to give a better understanding of the international theories. Our analysis is based on five aspects important for internationalization process such as: (i) geographical distance - refers to the physical remoteness of countries (Devinney et al, 2010) and it is measured by the difference between the VW Group’s headquarter city Wolfsburg and the city where the VW plant was built in the host countries; (ii) economic aspect – it is measures based on the GDP per capital (current US$) as indicator based on the data published by the World Bank (2013a); (iii) general development – is measured by the Human Development Index (HDI), which covers several of the most important aspects of one country’s development and the data is collected officially by the United Nations (2013); (iv) cultural aspect – based on the cultural dimensions of Hofstede (1980) that applied the cultural distance index (Kogut and Singh, 1988). It considers four dimensions: Power Distance (PDI), Individualism versus collectivism (IDV), Masculinity versus femininity (MAS) and Uncertainty avoidance (UAI); (v) institutional aspects – measured by the Institutional Profiles Database (IPD) provides more than 300 indicators to measure the countries’ institutional characteristics. The IPD is based on the surveys which was conducted by the French Ministry for the Economy, industry and Employment (MINEIE) and Agence Française de Développement (AFD) in countries worldwide (Crombrugghe et al, 2009). 4 RESULTS AND ANALYSIS This section analyzes the whole internationalization process of the VWG in the BRIC countries. The first part will analysis the VWG’s each step of internationalization in those countries. The second part will concentrate of the institutional aspect of each country and see if there are any influences of the internationalization process of the VWG. 4.1 The Volkswagen Group’s entrance process in BRIC Countries Except for Brazil, there is no exact time recorded for first imported VW auto in BRIC countries (Table 1). We can see from the table that the VW group’s international process in Brazil has 6 followed exactly the four steps described by Uppsala model (Johanson & Wiedersheim-Paul, 1975): no regular export, than agent, sales subsidiaries, than at the end it established its own plant in Brazil. From the first export to first plant in Brazil has only taken the VWG 9 years. The VWG also first had independent agent in Russia, than established the sales subsidiary and at the end built its plant. This process however took VW 14 years. However in India, the firm has built its first plant exactly in the same year with the establishment of its sales subsidiary. Moreover in China, the VWG built directly production plant before any sales subsidiaries established. One possible reason of this special situation is the country policy in China: till 1984 China has always planned economy and the market was strongly controlled by the state. The imported goods were very strongly controlled. Only after China’s reform and opening-up policy in 1978, did the foreign investor have the chance to open the Chinese market. The joint venture form of investment for automobile industry was encouraged by the Chinese government (Liu, 2011). VW is also the first JV partner of automobile industry in China. Similar like China, before 1980s in India there was strict policies to protect the local automobile manufactures. The first joint venture automobile company was founded in 1983. From 1995 to 2000 there were several foreign automobile firms built their own plant in India, such as Ford, GM or Toyota. Compared to the early move in China, the entrance of the VW group in India is a little behind. The establishment of the sales subsidiary as well as the plant was after 2000, in which the Indian government abolished the certain limitation of vehicle import and allowed 100% foreign investment. Table 1 - The Volkswagen’s international process in BRIC countries Country Brazil Russia India China Source: Volkswagen, 2008 No regular export 1950 NA NA NA Independent Representative (Agent) 1951 1993 NA NA Sales Subsidiary 1953 2003 2001 NA Establish production facilities 1959 2007 2001 1984 Therefore we can see that the internationalization process of the VW group in Brazil and Russia follows the process described by Uppsala Model: first export, than no regular export, agent, sales subsidiaries and final production facilities (Johanson & Wiedersheim-Paul, 1975). However, in China and India it doesn’t follow the Uppsala model. One of the possible reasons is the special institutional situation mentioned before in those two countries. 4.2 The Volkswagen Group’s expansion process in BRIC countries This section will analyze how VW group developed in each BRIC country. The first part will give a short introduction about the background of automobile industry in each BRIC country. Brazil From Table 2 people can see there are all together 6 plants of the VW group in Brazil, among which are 4 of brand Volkswagen itself and SCANIA and MAN each has one plant as well. All 6 plants are located in Southeast Brazil. 4 of them are in the largest state of Brazil Sao Paulo, 1 is in the second largest state Rio de Janeiro and 1 in the state Parana, which is but also on border with state Sao Paulo (IBGE, 2013). People can also see that the Human Development Index (HDI) of those cities are relative high (most of them HDI > 0.73), which belong to high human development (UNDP, 2013). Besides, according the data from 2011, it can also be observed that the GDP per capita of those states (no data available for each city) are also quite high. Sao Paulo is the 2nd and Rio de Janeiro is the 7 3rd regarding GDP per capita in Brazil. Even Parana is also on the 8th place. Similar, the GDPs of those cities are also quite high. Sao Paulo is the top 1, Rio de Janeiro is the 2nd and Parana is the 5th State in Brazil in terms of GDP of the State. Therefore, we can see that the economic development of those places is also quite good. Table 2 - The VW Group’s plant in Brazil Source: Volkswagen, 2012 Except for the economic situation and general development of those places are quite good, there are also other commons of the locations. As early as 1925, the first automobile plant was already built in Sao Paulo by GM and 2 years later Chevrolet also built its plant there. Roads and infrastructure had been built throughout the state. In 1956 Mercedes-Benz also built its truck plant in Sao Paulo. Till the end of 1960, Sao Paulo has become Latin America’s largest industrial center (Governo do Estado de Sao Paulo, 2014). Therefore, Sao Paulo has really good infrastructure for the automobile industry. Besides, there was also qualified manpower for the plants. Similar with Sao Paulo, Rio de Janeiro is also a big industrial center in Brazil. The main industry sectors in Rio are petroleum and metal industry, as well as automobile industry (Citydata, 2008). Moreover, the city Resende is on border with Sao Paulo. Thus, Rio has also good infrastructures and qualifies manpower for the development of automobile industry. The state Parana was also on boarder with Sao Paulo as well. It was a sate famous with agriculture. However, since 1970s the state has started to promote to promote its industry as well, especially since 1990s, it made big efforts to attract foreign investment. The French automobile company Renault has also built its plant in Parana in 1998 (Lopes, 2007). In conclusion we can see that there are following characteristic of the VW group’s plant. First of all, the plants are concentrated in Sao Paulo and its neighbor states. Second, the economic situation and the general development of those states are relative good. Besides, the infrastructures of those locations are good. There is also enough manpower in those states. Above all, the state all had policies to encourage the foreign investment. 8 Russia From Table 3 people can see that there are all together 2 plants of the VW’s group in Russia. The VW group also entered Russia relative late, the first plan was built in 2007. Both locations of the VW group’s plant in Russia have relative high HDI. Saint Pertersburg has also relative high GDP per capita. However, regarding GDP per capita Kaluga was only on the 31th place. The GDP of Kaluga is also not so high and only ranked 45th among all the Russia federations while Saint Petersburg ranked 4th. Table 3 - The VW group’s plant in Russia Source: Volkswagen, 2013 Saint Petersburg is second largest city in Russia in terms of population. It is also the nearest city of Russia to west Europe (only 200km to Finland EU border) with very good transport connections to other countries as well as to the other cities in Russia. Besides, Saint Petersburg is also a big industrial center in Russia (CEDIPT, 2012). It has many different industry sectors, such as electricity, gas and water production and distribution, metallurgy and metal products, as well as automobile manufacturing. There are many production facilities from world leading car companies, such as Toyota, General Motor and Nissan, which have all built their plants in Saint Petersburg before the VW group. Kaluga is only 150km away from the Russian capital and belongs to Moscow industrial area. However, the labor cost for firms in Kaluga is much lower than that in Moscow. The first industry park in Russia was built in this region in 2002. The world first atomic electric power station was also built there. Following the appealing of Russian government to attract foreign investment, Kaluga region has provided extensive support for large investors (Shereykin, 2008). According to chairman of the board VW, Kaluga has provided the best framework considering all the aspects among more than 70 location choices (Dow Jones, 2006). Therefore we can see that the plants’ locations in Russia chosen by the VW group have also some similarities. They are all located in two biggest industrial sphere of Russia. The infrastructures of the places are very good as well as the general development of the places. India As it showed Table 4, there are all together 3 VW’s group plants in India. One of them belongs to MAN SE. We can see that the plant’s locations, where the VW group has chosen also have relative high HDI. Even though there are not so high compared with the other countries but they are much higher than the average HDI of India. (Average HDI of India: 0.463 (2000), 0.507 (2005), 0.525 (2006)). Two of the plants were built in Maharashtra, which has relative high GDP per capita as well as GDP. The other one was built in Madhya Pradesh, where ranked only 27th regarding GDP per capita but ranked also on the 10th place regarding GDP among all the states in India. Maharashtra is the wealthiest state in India and second biggest state according the population (World Bank, 2014). The transport net in this state is also one of the densest in India. The capital city of India Mumbai is also located in this state as well. In order to attract more 9 foreign direct investment, Maharashtra has built many SEZs (Special Economic Zones). There are many manufacture companies such as LG, Mercedes-Benz and Volkswagen, as well as many software companies such as Infosys, tech Mahindra and Wipro (Taiwantrade, 2009). There was also another VW plant built in Madhya Pradesh, which means central state in Indian. Already from the name it can be seen what the geographical position it has. Madhya Pradesh is located in the center of India and also on border with Maharashtra. It is the second largest state in India by area and 6th largest by population. Madhya Pradesh used to be one of the least developed states with mainly agriculture economy. In recent years, however, the GDP growth of the state has been above the national average (UNDP, 2011). The state has also begun to change its agriculture based economy to industry based economy. The government has started to build SEZs as well to attract the investment. Many automobile manufacture firms have built their plants there, such as Mahindra 2 Wheelers, JMB Auto, Kach Motors and above all the MAN SE. Table 4 - The VW group’s plant in India Source: Volkswagen, 2012 In conclusion, the locations of VW’s plant in India have also something in common. The infrastructures are good and the local government encouraged FDI. Besides, they are also relative centralized. China The VW Group has all together 12 plants in China. The plants were concentrated of several provinces/ municipality: Shanghai (Anting, Loutang and Jiading), Jilin (Changchun), Jiangsu (Changzhou, Nanjing, Yizheng), Sichuan (Chengdu), Zhejiang (Ningbo), Liaoning (Dalian), Guangdong (Foshang) and Xinjiang (Urumuqi) (see Table 5). Most of those cities have relative high HDI. Only Urumqi has HDI under 0.7. Also, the GDP per capita of those provinces are also relative high. Most of them are top 10 provinces in terms of GDP per capita as well as GDP. Jilin ranked only 22th place in terms of GDP, but ranked 11 in terms of GDP per capita since the province has not so big density of population (China NBS, 2012). Meanwhile Sichuan has good GDP rank (8th place) but relative low GDP per capita rank (24th place) since the province has one of the biggest density of population. But we can consider both provinces still have quite good economy situation, since at least one of the economy indicators in those two provinces is high. Only Xinjiang has relative low GDP as well as GDP per capita. Table 5 - The VW group’s plant in China 10 Source: Volkswagen, 2013 Shanghai is the largest city in China in terms of population and also one of the strongest economy development cities. It is also the pioneer city since V.R. China undertook the reform and opening policy. In 1990, the Chinese government decided to build economic and technological development zone and SEZs in Shanghai in order to stimulate the local industrial development and attract the foreign investors. As early as 1978, Shanghai had its first automobile manufacture. Besides, Shanghai is also a harbor city, with convenient transport connection with the other cities in China as well as the countries outside China (Shangai Government, 2013). 11 Shanghai, Changzhou, Nanjing, Yizheng (Jiangsu) and Ningbo (Zhejiang) belong all to Yangtze River Delta Economic Zone, which takes Shanghai as central point. This region is the most comprehensive industry region in China, with very good geographical position and transport connection. This region has variety of industry sectors, electricity, textile, steel as well as automobile industry. The GDP of this region accounts for 20% of the China’s whole GDP. This region has started industrialization very early and has also enough manpower (Xinhua, 2004). Another plant of the VW’s group in China is in Jilin, where also China’s first automobile manufacture was built. Changchun (Jilin) and Dalian (Liaoning) are both belong to another very important industrial zone- the Northeast industrial base. The Northeast industrial base was very important for China’s industrialization and it is called the cradle of Chinese industry. This region was mainly concentrated on the heavy industry such as steel, oil or shipping industry as well as automobile industry. The VW’s second joint venture firm in China was built in Jilin. The development of this region is become slower since the new century. But in 2009 the government decides the Revitalize the Old Northeast Industrial Bases policy with several measures to keep the competence of this region and stimulate the development (China State Council,2010). Similar like Shanghai Guangdong province belongs also to an economic zone in China, the Pearl River Delta Economic Zone. This economic zone is considered as the most economically dynamic region in China, since it is the first region, which follows the launch of China’s reform program. This region is along the Pearl River and very close to Hong Kong. This special geographical position brings it very good transport connections. As early as 1979, it is allowed to set up SEZ to attract the FDI (China State Council, 2010). As mentioned before, Xinjiang is among all the host provinces the least developed province. Why would the VW group choose it as plant location? Xinjiang, officially called Xinjiang Uyghur Autonomous Region, is an autonomous region of China. It is also the largest Chinese administrative division with 1.6 million km2. Xingjiang is locates in the west of China and on border with many countries such as Russia, Mongolia, Kazakhstan etc. (BBC, 2008). Xinjiang has rich natural resource, such as oil, gas, minerals. However like many provinces in west China, the economic development of Xinjiang is far behind the provinces of the other parts of China. To reduce the big development differences between Southeast China and Western China, the Chinese government has launched the China Western Development strategy, which includes Xinjiang, as well as Sichuan. The main focus of the strategy includes the development of infrastructure in Western China, as well as the enticement of FDI. Since this strategy launched, the economy and general development of Western China has significantly increased (China Statistic Center, 2013). In conclusion, the commons of the VW group’s plants in China have good infrastructure, enough manpower and the policies of government as most important trigger. 4.3 Internationalization process of the VW group combining in BRIC countries From Table 6, it can be seen the overview of all the VW group’s plants in BRIC countries according to prior analysis. The VW group has all together 23 plants in BRIC countries. 18 of them have relative high HDI, which means that the general developments of those countries are good. 20 of them have relative good economy condition compared with the other regions in the country. 21 of them have relative good geographical location, which means those places have good transport connections, for example a harbor city or very near from capital or located in at transport junction. All of the 23 plants have relative good infrastructures, which mean that the plants located in an industrial 12 area, with the necessary infrastructures. Most important, all of those locations got institutional support, such as the special policies to stimulate the development of automobile industry. Table 6 - Summary of the VW group’s plants VW group's plants General development Economy Geographical Location Infrastructure Institution # of plants 18 20 21 22 23 The VW group has all together 23 plants in BRIC countries. 18 of them have relative high HDI, which means that the general developments of those countries are good. 20 of them have relative good economy condition compared with the other regions in the country. 21 of them have relative good geographical location, which means those places have good transport connections, for example a harbor city or very near from capital or located in at transport junction. All of the 23 plants have relative good infrastructures, which mean that the plants located in an industrial area, with the necessary infrastructures. Most important, all of those locations got institutional support, such as the special policies to stimulate the development of automobile industry. General institution condition in BRIC countries is not so good and the markets are “imperfecter” compared to the developed countries. Therefore, to establish own production facilities could help the firm reduce the transaction cost. This brings the VW group transaction-based ownership advantages (Ot). Besides, the automobile industry in BRIC countries was not as developed as that in Germany. The VW group possessed also asset-based ownership advantages (Oa), which are related to product and service, as well as institutional-based ownership advantages (Oi). Since for establish the plants, the firm also not only brought its technique, as well as its own culture and norms (Dunning and Lundan, 2008). Why did the VW group chose certain region for its plant can be understood under the location attractions of OLI paradigm. The traditional location attractions refer normally to the existence of raw material, low wages and special tariffs. The Li refers to the institutional related advantages, such as laws, regulations and conversions (Dunning and Lundan, 2008). It should be noted that not all the plants’ locations have well developed economy or good infrastructure, but one thing in common is that all of them had institutional-based location advantages. No matter it is special tax rate, or the establishment of industrial center, it all shows the support by the local governance. The local regulations or policies play a very big role in terms of attracting the FDI. Beside, to establish its own product facilities to reduce the extra cost of intermediate goods brings the firm internalization advantages. This is also normally related to the institutional situation of one country, since all BRIC countries used to have the local industry protection policies. An often used measure is for example to set a really high tax for the imported components. In order to overcome that extra cost, the firm also chose to build local plant, which brings it internalization advantages. 5 CONCLUSION This study investigated in depth the internationalization process of the VW group in BRIC countries and investigates how institutional situation could influence this process. After the analysis it can be seen that institutional factors have a strong influence on the internationalization process of the Volkswagen. Traditionally, the scholars only analysis internationalization of MNEs in a macro level and they observed the whole process. However, since firms’ decision can be influenced by many different factors and each single country has their own characteristic. It is also important to take a look of the specific situation of each country and make a comparison to get a better idea of the whole process. This study takes a further look into each BRIC country and sees how the specific situation in each country is. In this ways, it will not miss the specific conditions but also avoid losing the whole picture of internationalization’s process. From the result of this study people 13 can see that it is really important to explore different situation in each single country in a micro level, especially for the institutional aspect. This study has also some the limitations. First, some data are not available. Since there are many related countries and the data could be traced back to many years before, there are for some sectors no available data for each country. This could lead also small deviation on the results. Beside, since there are many different factors could have influence on the internationalization of the VW group as well, such as the request and demand relation in a market or the behavior of the competitors. This study could not consider them all. Since this study is a case study of the VWG’s internationalization process. It could also be further investigated if it is for other automobile firms the same situation or it is different. What leads to the differences? Besides, this study has analyzed institutional influencing factors mostly from the governmental aspect, such as economy stimulating policies. It could also be further investigate the institutional factors from company aspect and to see how the institutional factors, such as a company’s culture influences the internationalization of one company as well. REFERENCES Aulakh, P.S., Kotabe, M. 2008. Institutional changes and organizational transformation in developing economies. Journal of International Management, 14: 209-216. Axelsson, B., Easton, G. 1992. Industrial networks: A new view of reality. London: Routledge Barney, J.B. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17: 99-120. Baumol, W.J., Litan, R.E., Schramm, C.J. 2009. Good capitalism, bad capitalism, and the economies of growth and prosperity. New Haven, CT: Yale University Press BBC, 2008. Xinjiang Profile. BBC News Asia. Available at: <http://www.bbc.com/news/world-asiapacific-16860974> [7 Mar. 2014] Buckley, P.J., Casson, M.C. 2009. The internalisation theory of the multinational enterprise: A review of the progress of a research agenda after 30 years. Journal of International Business Studies, 40(9): 1563–1580. Campos, N., Iootty, M. 2007. Institutional barriers to firms entry and exit: Case-study evidence from Brazilian textiles and electronics industries. Economic Systems, 31: 346-363. CEDIPT, 2012. Doing Business in St. Petersburg: Guide for exporters, investors and start-ups. Enterprise Europe Network-Russia, Module A Regional Center. Available at: <http://www.spbhamburg.de/download/Doing_ SPB_2012.pdf> [6. March 2014] China NBS, 2012. NBS GDP Data- Revision of China GDP. Statistical communique of the provinces on the 2011 National Economic and Social Development. Available at: <http://219.235.129.58/ welcome.do> [7 Mar.2014] China State Council, 2010. Northeast Revitalization Plan. The Central People's Government of People's Republic of China. Available at: <http://www.gov.cn/gzdt/2007-08/20/content_ 721632.htm> [7 Mar. 2014] China Statistic Center, 2013. Overview of Western China. China Western Development Council online. Available at: <http://www.chinawest.gov.cn/web/Column1.asp?ColumnId =6> [7. Mar. 2014] Citydata, 2008. Economy of Rio de Janeiro. Cities of the world: Rio de Janeiro Available at: <http://www.city-data.com/world-cities/Rio-de-Janeiro-Economy.html>[6. Mar. 2014] Cromburgghe, D., Farla, K., Meisel, N., Neubourg, C., Ould Aodia, J., Szirmai, A. 2009. Insitutional Profiles Database. Presentation of the Institutional Profiles Database 2009. Les Cahiers de la DGTPE No.2009/14. Demirbag, M., Glaister, K.W., Tatoglu, E. 2007. Institutional and transaction cost influences on MNE's ownership strategies of their affiliates: Evidence from an emerging market. Journal of World Business, 42: 418-434. Devinney, T.M., Auger, P., Eckhardt, G.M. (2010). The Myth of the Ethical Consumer. Cambridge, US: Cambridge University Press. 14 DiMaggio, P., Powell, W. 1991. Introduction. In W. Powell and P .DiMaggio (eds.), The New Institutionalism in Organizational Analysis. Chicago: University of Chicago Press. Dow Jones, 2006. Volkswagen errichtet Fertigungswerk in russischen Kaluga. Finanznachricht Available at <http://www.finanznachrichten.de/nachrichten-2006-5/6488362-volkswagen-errichtetfertigungswerk-im-russischen-kaluga-015.htm> [2 Mar. 2014] Dunning, J.H. 1980. Toward an eclectic theory of international production: some empirical tests. Journal of International Business Studies, 2(3): 9-31. Dunning, J.H. 1981. Explaining the international direct investment position of countries: towards a dynamic or developmental approach. Weltwirtschaftliches Archiv, 119: 30-64. Dunning, J.H. 2000. The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review, 9(2): 163–190. Dunning, J.H., Lundan, S.M. 2008. Institutions and the OLI paradigm of the multinational enterprise. Asia Pacific Journal of Management, 25(4): 573–593. Estrin, S., Prevezer, M. 2010. A survey on institutions and new firm entry: How and why do entry rates differ in emerging markets? Economic System, 34: 289-308. Forbes, 2013. The world's biggest public companies. Forbes Global 2000. Available at <http://www.forbes.com/ global2000/list/> [06 Jan .2014] Gerpisa. 2012. New Brazilian Automobile Industrial Policy: risks and opportunities for the sector. Gerpisa Colloquium, Poland. Available at: <http://leblog. gerpisa.org/node/1649> [29 May 2013] Governo do Estado de Sao Paulo, 2014. Sao Paulo history: Auto Industry. Portal do Governo do Estado de Sao Paulo. Available at: <http://www.saopaulo.sp.gov.br/en/conhecasp/historia_republicaindustria-automobilistica. php> [6 Mar. 2014] Hennart, J.-F. 2010. Transaction cost theory and international business. Journal of Retailing, 86(3): 257–269. Hofstede, G. 1980. Culture’s Consequences: International Differences in Work-Related Values. Beverly Hills: Sage. Hoskisson, R.E., Eden, L., Lau, C.M., Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249-267 IBGE 2013. Division into regions. Available at: <http://www.ibge.gov.br/english/estatistica/economia/ pibmunicipios/2010/default.shtm> [2 Mar. 2014] Ingram P, Silverman B. 2002. Introduction: The new institutionalism in strategic management. Advances in Strategic Management, 19: 1-30. Johanson, J., Wiedersheim-Paul, F. 1975. The internationalization of the firm: Four Swedish cases. Journal of Management Studies, 12(3): 305–322. Johanson, J., Vahlne, J.E. 1977. Process of the internationalization development firm: A model of knowledge foreign and increasing market commitment. Journal of International Business Studies, 23–32. Johanson, J., Vahlne, J.E. 2009. The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership. Journal of International Business Studies, 40(9): 1411– 1431. Kogut, B., Singh, H., 1988. The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19: 411-430. Liu, Y. 2011. Review of 50 years Automobile Industry. Research Center of Automotive Technique. (Original in Chinese) Lopes, R.L. 2007. The automobile industry in Parana: The case of Renault. Latin American Business Review, (7): 77-96. Makino, S., Isobe, T., Chan, C.M. 2004. Does country matter? Strategic Management Journal, 25(10):1027-1043. Meyer, K.E, Peng, M.W. 2005. Probing theoretically into Central and Eastern Europe: transactions, resources, and institutions. Journal of International Business Studies, 36(6): 600-621. Morris, J. 1992. Japanese car transplants: implications for the European motor industry. European Management Journal, 9: 321-328. Gray, A. 1975. Volkswagen’s American Dilemma. Business Horizons, 18(5): 26–30. 15 North, D.C. 1990. Institutions, institutional change, and economic performance. Harvard University Press, Cambridge. Oliver, C. 1997. Sustainable competitive advantage: combining institutional and resource-based views. Strategic Management Journal, 18: 679-713. Parisien, C., Thagard P. 2007. Robosemantics: How Stanley the Volkswagen represents the world. Minds & Machines, 18: 169-178 Peng, M.W. 2002. Toward an institution-based view of business strategy. Asia Pacific Journal of Management, 19(2/3): 251-267 Peng, M.W., Delios, A. 2006. What determines the scope of the firm over time and around the world? An Asia Pacific perspective. Asia Pacific Journal of Management, 23(4): 385-405. Peng, M.W., Sun, S.L., Pinkham, B., Chen, H. 2009. The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23: 63–82. Peng, M.W., Wang, D.Y.L., Jiang, Y. 2008. An institution-based view of international business strategy: a focus on emerging economies. Journal of International Business Studies, 39: 920–936. Porter, M.E. 1980. Competitive strategy: techniques for analysing industries and competitors. New York: Free Press. Yin, R.K. 2009. Case Study Research: Design and Methods. SAGE Publications. California. Rugman, A.M., Collinson, S. 2004. The regional nature of the world’s automotive sector. European Management Journal, 22(5): 471–482. Salwan P. 2011. Growth and internationalization: The case of TATA Motors. The Indian Journal of Industrial Relations, 47:1, 1983-1993. Seyoum, B. 2011. Informal institutions and foreign direct investment. Journal of Economic Issues, 45(4): 917-940. Scott, W.R. 1995. Institutions and Organizations. Thousand Oaks, CA.Sage. Shanghai Government, 2014. Shanghai Economy Overview. General Introduction of Shanghai. Available at: <http://www.shtong.gov.cn/node2/node2247/node4576/ index.html > [7 Mar. 2014] Shereykin, Maxim 2008. Kaluga region: development for new opportunities. Minister for Economic Development of Kaluga region. Available at: <http://www.lemminkainen.ru/userfiles/file/pdf/ ipark/Kaluga_region.pdf> [2 Mar. 2014] Taiwantrade, 2009. Introduction of Maharashtra - the wealthiest state of India. Taiwantrade. Available at: <http://www.taiwantrade.com.tw/CH/bizsearchdetail/ 2255181/C/> [7 Mar. 2014] Tolentino, P.E. 2001. From a theory to a paradigm: examining the eclectic paradigm as a framework in international economies. International Journal of the Economics of Business, 8: 191-209 UNDP 2011. Madhya Pradesh: Economic and Human Development Indicators. Available at: <http://www.undp.org/content/dam/india/docs/madhyapradesh_factsheet.pdf > [7 Mar. 2014] UNDP 2013. Human Development Report 2013. Available at: <http://hdr.undp.org/sites/ default/files/hdr_2013_en_technotes.pdf > [22 Feburary 2013] Volkswagen. 2008. Volkswagen Aktiengesellschaft 2008: Volkswagen Chronicle-Becoming a global player, Hanover. Volkswagen. 2012. Volkswagen Aktiengesellschaft, Volkswagen group production plants 2012. Available at: <http://www.volkswagenag.com/content/vwcorp/content/en/the_group /production_ plants.html> [29 May 2013] Volkswagen 2013. Volkswagen Aktiengesellschaft 2013. Volkswagen Annual Report 2013, Wolfsburg. World Bank, 2013a. Data: GDP per capita, the World Bank data. Available at: <http://data. worldbank.org/indicator/NY.GDP.PCAP.CD> [30 Dec. 2013] World Bank, 2013b. World bank search: GDP growth (annual%). Available at: <http://search. worldbank. org/data?qterm=Gross+Domestic+Product+growth&language=EN&format=> [25 June 2013] World Bank, 2014. India Development Update. The World Bank country: India. Available at: <http://www. worldbank.org/en/country/india> [7 Mar. 2014]. Xinhua, 2004. Three main economic zones shaped in China. People’s Daily online. Available at: <http://english. peopledaily.com.cn/200407/08/eng20040708_148830.html> [7 Mar. 2014]