Alcohol policy in Canada: Reflections on the role of the alcohol

advertisement

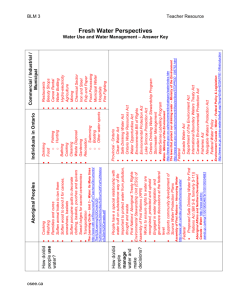

Norman Giesbrecht Alcohol policy in Canada: Reflections on the role of the alcohol industry Introduction The alcohol industry has played, and continues to play, a decisive role in alcohol policy issues. Given the importance of alcohol policy in reducing or preventing harm from alcohol (Babor et al. 2003), it is surprising that there have been relatively few studies that have looked at the role of the alcohol industry in policy-making (e.g., Addiction 2000; Greenfield et al. 2004; Ogborne et al. 2006; Giesbrecht et al. 2006a). Policy-makers face many challenges, and these can be highlighted by contrasting the view that emerges from recent alcohol epidemiology and social science with that from alcohol marketing and promotion. In the epidemiological studies such as the WHO Global Burden of Disease Project, the disease, death and disability from alcohol is similar to that from tobacco, and even higher in some developing countries (World Health Organization 2002; Rehm et al. 2003a). Alcohol is a major contributor to unintentional injuries or death, violence including homicide and suicide, and a wide range of chronic diseases (e.g. Bagnardi et al. 2001; Boffetta & Hashibe 2006; Room et al. 2005). While epidemiological literature has shown that alcohol is an important risk factor for acute and chronic damage (e.g. World Health Organization 2002; Haydon et al. 2006), Acknowledgement: An earlier version of this paper was presented at the Scientific Meeting on the Alcohol Industry and Alcohol Policy, Schaeffergaarden, Copenhagen, April 5–7, 2006. I wish to thank the following persons for providing advice or information: Rebecca Fortin, Emma Haydon, Robert Mann, Benjamin Rempel, Michelle Swenarchuk and Gerald Thomas, and anonymous reviewers of the manuscript. Special thanks are extended to Sunny Ba, Michael Roerecke and Gina Stoduto for their contributions. However, the views and opinions expressed here do not necessarily reflect those of the persons acknowledged, or the policies of the Centre for Addiction and Mental Health. NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 445 Canada alcohol still has a minor place in generic prevention planning and health promo- Context singular, rather than the alcohol indus- Structure A few companies with international ownership dominate the alcohol industry in Canada. Domestically produced beer, spirits and wine represent about 81.8% of beverage volume sold in Canada in fiscal year 2003–2004 (89.0% for beer, 72.6% for spirits and 39.8% for wine) (Statistics Canada 2005b). In addition there is extensive import with regard to all three beverage groups. A brief overview of the structure is provided in Appendix I. With regard to beer, just two international companies, Molson Coors Brewing Company and InBev S.A. (Labatt) control 90% of the market. Sleeman Breweries Ltd. controls about 6% of the market share while the remaining 4% goes to independent microbreweries and imports not controlled by the above companies. Each of the three largest breweries produces a number of brands as well as partnership with others for distribution. A few companies control about 45% of the wine market share. Here again international ownership is tries, plural, for convenience. There are evident with Vincor International lead- indeed a number of industries – produc- ing the Canadian wine industry at 21% of tion, wholesale, retailing, marketing, and the market share and Diageo also being a hospitality – either directly involved in or major owner. The distilled spirits industry related to the alcohol business. This col- is particularly concentrated, with Diageo lection of organizations is not monolithic being the largest firm internationally fol- in perspective, goals, and methods with lowed by Pernod Ricard. These two giants regard to alcohol policy and management basically control the entire spirits market topics. This paper focuses more on the by adding brands to their portfolios. Per- producers than any other group under the nod Ricard S.A. is the international owner general umbrella of “alcohol industry”. of Seagram and Allied Domecq (who pre- These organizations and their associations viously owned Hiram Walker), and Hiram tend to be among the most powerful and Walker owns in excess of 51% shares of well organized. Corby Distilleries. tion practice, including those focusing on chronic disease prevention (Chronic Disease Prevention Alliance of Canada 2004; see also Anglin et al. 2005). The alcohol industry has had a central and noteworthy role, but not a solitary one, in the positioning, promotion and entrenching of alcohol use and drinking into everyday life. This paper focuses mainly on recent Canadian experiences on the topic of the alcohol industry and alcohol policy. Three caveats should be noted. First, this is a snapshot of recent developments, rather than a more detailed analysis of longitudinal trends (see Room et al. 2006). There is reference to trends, but not a systematic examination of them. Second, a variation of the definition of Babor et al. (2003, pp. 6–7) is used for alcohol policy, including both those measures that may increase the harm from alcohol, as well as those that might reduce harm. Third, this paper refers to the alcohol industry, 446 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 Canada There are two main implications for wholesale operations. This combination alcohol policy. The globalization and of dominance in retailing and wholesal- oligopolization of the alcohol industry, ing indicates that at the provincial level, particularly of the beer and spirits indus- the government has considerable leeway tries, can enhance the industries’ political with regard to how alcohol is managed in strength internationally, and probably en- their jurisdiction. They can, in principle, hances marketing and promotional prow- control accessibility to alcoholic bever- ess in local markets (Room 1998, pp. 797– ages through pricing, density restrictions 798). However, there may be efficiencies of and location of outlets, hours of sale, and scale for public policy advocates or legis- through their liquor board stores set stand- lators seeking to influence alcohol produc- ards or at least examples through display ers, and working with a few rather than and promotion arrangements. The govern- dozens may be preferred. As Room (1998) ment liquor store networks can also set an indicated, the larger corporations may example for all outlets with regard to what have more at stake and therefore may not attention is paid to controlling sales to mi- be as innovative in using promotion and nors or intoxicated persons. selling practices that will be most harmful to public health. Licensed premises (for on-premise consumption) are privately run, but licensed and inspected by either the same liquor Alcohol management in Canada The system of alcohol management is a combination of government and private enterprises and controlled at the provincial level. In all provinces and territories, except for the province of Alberta, there is a government-run retailing system, i.e. commissions that oversee the retail sales, ­liquor board or commission, which han- boards, and their arrangement likely var- dles a large share of off-sale retailing. In ies by province, circumstance and indus- terms of the volume of products distribut- try sector. Nevertheless, some generaliza- ed, this varies greatly, with the government tions are feasible: the industry is not con- liquor stores in some provinces handling sistently or strongly opposed to govern- beer, wine and spirits. In Ontario, for ex- ment-run systems neither consistently in ample, liquor board outlets are responsible support of privatizing alcohol retailing. for off-premise sale of all spirits, imported There was not great enthusiasm from the wine and some beer in small packages. alcohol industry when the province of There is a parallel off-sale system in On- Alberta privatized their off-sale alcohol- tario of privately run beer stores and do- retailing network in 1993. In 1995 when mestic wine stores. However, even in these the Ontario government explored priva- mixed systems, the lion’s share of the ab- tizing of the retailing system, it was clear solute ethanol equivalent goes through the from comments at multi-sectorial regional government-run liquor stores. seminars held on the topic that at least the The provincial governments control or by a parallel government agency – for example, the Alcohol and Gaming Commission of Ontario. The alcohol industry has a longstanding well-established working arrangement with these commissions or brewers and vintners where not keen to NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 447 Canada see this proposal move forward (Giesbre- now a voluntary activity and is undertaken cht et al. 2006b). Also, in 2005 when the only at the request by the alcohol adver- Ontario Minister of Finance summarily tiser (Rempel & Fortin 2005). rejected a recommendation by a govern- In 2005 the ASC received 1,271 com- ment appointed commission to privatize plaints from consumers about 804 adver- the Liquor Control Board of Ontario, there tisements, and 38 were about alcoholic was no apparent protest from the brewers, beverages (Advertising Standards Canada vintners or distillers of that province. 2005). However, some have questioned whether the low volume of complaints is Marketing, promotion and sponsorship of alcoholic beverages The changes in alcohol retailing in Canada over the past decades indicate that the alcohol industry has played an active role during this transformation. The marketing of alcohol has increased dramatically in the past decades, and in this regard, Canada’s experience is not that different from that of other countries, including the United States and parts of Europe. Alcohol advertising is common on television, radio, and billboards, within licensed premises and government liquor stores. After a court challenge, distilled spirits can now be advertised on television (Ogborne & Stoduto 2006). In the past 10 years a self-regulatory arrangement has evolved with regard to alcohol advertising. Screening of advertising has been handled since 1997 by Advertising Standards Canada (ASC), and not by a branch of the federal government (Ogborne & Stoduto 2006). Broadcast advertisements for alcohol are regulated by the Canadian Radio-television and Telecommunications Commission (CRTC) through the Code for Broadcast Advertising of Alcoholic Beverages. And the ASC offers pre-clearance services of alcohol advertisements, and deals with complaints about any that are considered to contravene the Code (Advertising Standards Canada 2004). However, pre-clearance of alcohol advertising is 448 NORDIC STUDIES ON ALCOHOL AND DRUGS truly reflective of public sentiment, since the process and contact information for lodging a complaint is not easily accessible, and definitely does not accompany the print or electronic media advertisements (see Rempel & Fortin 2005, pp. 13–14). One assessment of the current domestic regulation of alcohol advertising was that the laws are toothless, ineffective and vague, could be interpreted subjectively, are applied leniently and invisible to the public, and involve inaccessible complaint procedures (Swenarchuk 2005). The liquor boards and alcohol industry collaborate on a number of fronts, for example, with regard to arrangements in liquor boards to display products and marketing them. For example, in Ontario’s liquor control board stores, Ontario wines are displayed on the most prominent shelves in a store. Liquor boards also collaborate in marketing beverage alcohol products. In Toronto, for example, about once a month or more often one can find multicolour glossy inserts in daily newspapers, with themes linked to special events, such as Valentine’s or special holidays. These inserts display and promote selected beer, wine and spirits products available at the government retail stores, as well as mixed drink recipes and advice on food to be served with the drinks, and appear to be produced in collaboration V O L . 2 3. 2 0 0 6 . 6 Canada between the Ontario liquor board and types of advertising suggest a close work- Access to Markets While there have been few dramatic changes overall in access to markets, the general direction is that of increased access. As indicated in tables 1 and 2, both off-premise and on-premise density rates have in- ing relationship between a government creased since 1950 in the most popu­lous retailer and the producers, and one that provinces. In some cases the change has is likely more cost-efficient under a gov- been quite marked, as in Quebec with the ernment-run retail system than one where introduction of certain wines into their retailing is handled by dozens if not more corner store network (see Trolldal 2005), private businesses. and specifically with regard to on-premise alcohol producers. The Food and Drink magazine, produced by the Liquor Control Board and available at retail outlets, also has extensive alcohol advertising. These There is also extensive promotion of sales. In addition, all provinces have re- alcohol through sponsorship of sport- laxed their hours of sale and allow sales ing, music and other cultural events, e.g., on Sundays. In some instances, such as Molson Indy races, Labatt’s sports events, in connection with Toronto’s annual film to name a few. A 2006 example, labelled festival, closing hours of on-premise ven- Budweiser Super Bowl Tailgate Train, was ues are extended to give celebrities and linked to that year’s Super Bowl event in theatregoers greater opportunity to visit Detroit, Michigan. Officials in Windsor, a licensed premises. Canadian city located just across the St. Clair river from Detroit, as well as VIA Rail Canada, Budweiser and NFL Canada collaborated in promoting an exclusive train trip, Toronto to Windsor, for 500 fans with the opportunity for some to win tickets to attend the Super Bowl. Consumption trends The trends in drinking in Canada are likely both a contributor to and product of these developments. As indicated in Figure 1, drinking rates display three main features in the last three decades: an increase be- Table 1. Rate of Off-Premise Alcohol Retail Outlets, Selected Canadian Provinces Year Nova Scotia Québec Ontario Alberta British Columbia 1950 1.26 11.70 1.24 0.93 1.19 1955 1.28 12.12 1.27 1.00 1.23 1960 1.33 13.42 1.50 1.01 1.11 1965 1.37 15.07 1.73 1.44 1.11 1970 1.45 17.90 1.71 1.41 1.08 1975 1.47 20.15 1.79 1.48 1.05 1980 1.25 22.68 1.82 1.28 1.25 1985 1.25 23.00 1.84 1.35 1.39 1990 1.35 21.04 1.86 3.83 1.32 1995 1.36 17.82 1.70 3.26 1.19 2000 1.30 15.32 1.66 3.83 1.10 Rates per 10,000 persons aged 15 and older NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 449 Canada Table 2. Rate of on-premise alcohol licenses, selected Canadian provinces Year Nova Scotia Québec Ontario Alberta British Columbia Licenses Premises 1950 4.71 7.90 13.23 5.94 14.49 6.74 1955 8.54 7.46 1960 10.47 8.28 12.43 5.66 13.82 11.89 11.25 5.43 13.83 11.99 1965 11.37 1970 13.18 11.37 11.98 6.13 13.68 13.68 14.07 11.83 6.43 13.47 15.36 1975 18.34 1980 29.47 26.50 8.15 21.59 19.20 33.17 12.28 20.74 21.76 1985 35.97 15.68 28.99 25.24 1990 38.26 17.82 31.92 1995 38.68 17.89 35.02 2000 39.04 33.57 Rates per 10,000 persons aged 15 and older tween 1960 and levelling off about 1980, crease, decline and increase again pattern a decline up until about 1996 and 1997, of overall consumption makes it difficult and an increase in the last seven years. to find a nice fit for potential explanatory There is no simple or single convincing ex- factors. An aging population, rise of self- planation for this overall picture. The in- help groups, such as AA, or more intensive Litres of absolute alcohol 12 10 8 Total 6 4 Beer 2 Spirits Wine 0 1950 1960 1970 1980 Year 1990 2004 Source: Statistics Canada (multiple years): Control & Sale of Alcoholic Beverages Figure 1. Per capita alcohol consumption, in litres of absolute alcohol, Canada, aged 15 and older (1950–2004) 450 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 Canada campaigns to control drinking and driving sidered to drink in a high-risk manner would be good candidates to explain the (see Figures 2 & 3). Those classified as period of decline, but these developments heavy drinkers1 represent 12.5% of those are not restricted to that period (see Smart surveyed in 2004, and the proportion is & Mann 1995). The increase in alcohol significantly higher compared to 1994 marketing and greater access to alcohol (8.7%). About 16% of drinkers in 2004 might serve as a partial explanation for the usually had 5 drinks or more on drinking earlier period and most recent years, but occasions, and 10% consumed alcohol at is not as convincing for the 1980 to mid- least 4 times a week. Also, 17% of drink- 1990s time frame. The increased concern ers were classified as hazardous drinkers, with controlling/reducing drinking and using the AUDIT score, and 23% exceeded driving in the 1980s and accompanying the low risk drinking guidelines (Table 4). increased enforcement possibly had con- Studies conducted a few years ago, fo- tributed in part to deflating consumption cusing on the Canadian experience be- during this time period, but it is likely not tween 1950 and 2000, and using the ba- the only or major factor. sic methods employed in the European However, the most recent increase in Comparative Alcohol Studies project (e.g. overall drinking rates seems to coincide Norström 2001), demonstrated that as with an increase in the proportion con- overall rates of consumption increased, so did alcohol specific mortality (Ramstedt Rate per 100,000 30,000 2003a), deaths from liver cirrhosis (RamMales 25,000 % 35 20,000 Both sexes 15,000 20–34 years 30 12–19 years 25 10,000 Females 5,000 35–44 years 20 45–64 years 15 0 10 1994– 1995 1996– 1997 1998– 1999 2000– 2001 2003 Year Note: This figure presents the data in a different way than published on the website of Statistics Canada as it displays the rates of heavy drinkers among the total population, not among current drinkers. Source: Statistics Canada (1999; 2004; 2005a): National Population Health Survey and Canadian Community Health Survey Figure 2. Age-standardized prevalence (Canada 1991) of heavy drinkers (5+ drinks on one occasion 12 or more times in the past year) 15 years and older, by sex, Canada, 1994–2003 65 years and over 5 0 1994– 1995 1996– 1997 1998– 1999 Year 2000– 2001 2003 Source: Statistics Canada, (1999, 2004, 2005a): National Population Health Survey and Canadian Community Health Survey Figure 3. Percentage of heavy drinkers (5+ drinks on one occasion 12 or more times in the past year) among current drinkers, Canada, 1994–2003 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 451 Canada Table 3. Drinking patterns, Canada, aged 15 and older (1989, 1994, 2004) Drinking Pattern Definition Lifetime Abstainers Never had alcohol beyond sips or tastes Former Drinkers NADS1 1989 CADS2 1994 CAS3 2004 % % % 6.6 12.8* 7.2 Drank some time during their lives, but not during the 12 months preceding the survey 15.7* 13.5 13.5 Light-infrequent drinkers Past-year drinkers who drink less often than once a week usually fewer than five drinks when alcohol is used 35.5 33.6* 38.1 Light-frequent drinkers Past-year drinkers who drink once a week or more usually fewer than five drinks when alcohol is used 31.3* 29.2 27.3 Heavy-infrequent drinkers Past-year drinkers who drink less often than once a week usually five drinks or more when alcohol is used 3.6* 3.3* 5.5 Heavy-frequent drinkers Past-year drinkers who drink once a week or more, and usually five drinks or more when alcohol is used 6.7 5.4* 7.0 0.6* 2.1 1.5 Not Stated * Significantly different from CAS 1) National Alcohol and Other Drugs Survey, 2) Canadian Alcohol and Other Drugs Surve, 3) Canadian Addictions Survey Source: Adlaf et al. (2005): Canadian Addictions Survey, Table 8.2 stedt 2003b), traffic fatalities (Skog 2003), suicide (Ramstedt 2005), homicide (Rossow 2004) and total mortality (Norström 2004). It is estimated that in Canada in 2002 there were 4,258 deaths due to alcohol (3,494 men and 764 women). These were net deaths and the estimation took into account the prevention of mortality from moderate use of alcohol. This work also produced estimates that premature mortality resulted in 191,136 years of life lost (140,776 men and 50,360 women) (Giesbrecht et al. 2005a; Rehm et al. 2006). 452 NORDIC STUDIES ON ALCOHOL AND DRUGS Damage from alcohol The alcohol industry acknowledges a number of problems related to the use of their products. There seems to be an underlying rationale in the problems that are identified and highlighted. It is a rationale that is not necessarily driven by the findings of epidemiology or social science, but by other considerations. They acknowledge problems that have one of the following characteristics: problems that are already widely known, problems that involve a minority – and usually lowvolume – consumers (e.g., pregnant women), or problems that are experienced by persons considered dependent on alcohol. V O L . 2 3. 2 0 0 6 . 6 Canada Table 4. Risky Drinking, Canada, aged 15 and older (2004), % prominent player in funding and working Hazardous drinking (AUDIT 8+)1 ,% and promoting interventions. Interven- Total drinkers (10,696) 17.0 Exceeding low-risk drinking guidelines (LRDG)2 ,% 22.6 Male tions that focus on the drinking driver or his or her companions, such as designated driver programs, are strongly supported. In contrast, there appears to be ambivalence Sex Female with groups involved in raising awareness 8.9 15.1 about programs that place substantial pres- 25.1 30.2 sure on servers to curtail sales, and opposition to interventions that would control Age Group 15–17 30.9 24.6 the volume consumed, such as lower of- 18–19 44.6 32.3 ficial BAC levels. Furthermore, it is other 20–24 34.2 38.0 groups and organizations that have taken 25–34 21.1 24.9 the lead in identifying alcohol damage as- 35–44 14.2 22.3 sociated with boating and snowmobiling, 45–54 14.0 22.4 for example, or with mass transportation 55–64 10.8 18.4 (e.g. operators of trains and ships, pilots 65–74 3.9 10.9 of airplanes, or alcohol-related ‘air rage’ 75+ 4.5 13.6 among airline passengers). 1) The Alcohol Use Disorders Identification Test (AUDIT) was developed by the World Health Organization as a tool to screen excessive drinking. A score of 8+ points (out of 40) from the ten-item questionnaire indicates hazardous consumption likely to result in harm, as well as possible alcohol dependence. 2) Ontario’s Low-Risk Drinking Guidelines advise no more than two standard drinks on any given day and up to 9 drinks a week for women and 14 drinks a week for men. A standard drink contains 13.6 grams of alcohol and is equal to a 5oz glass of wine, a 12oz bottle of beer, or a 1.5oz of spirits. Source: Adlaf et al. (2005): Canadian Addiction Survey, Tables 4.1 & 3.5 It is uncommon and unlikely that the alcohol industry takes the lead in identifying a problem, but rather once a problem gains ascendancy in social consciousness, media attention or via government interventions, the industry seeks to also become part of the solution. A classic case of the first example is drinking and driving. For at least two decades there has been extensive activities in this area, and in Canada, as elsewhere, the alcohol industry is a regular and often The alcohol industry and social responsibility and prevention initiatives The alcohol industry and their social aspect organizations have a large and seemingly growing role in raising awareness of alcohol problems, educating the public and special populations on specific risks, sponsoring or co-sponsoring programs and targeted interventions. These international activities have been explored elsewhere (McCreanor et al. 2000; Anderson 2002a, 2002b; Giesbrecht 2000; 2004). Appendix II provides a snapshot of recent initiatives by Canadian producers as well as some examples from the largest retailer of alcoholic beverages in Canada, the Liquor Control Board of Ontario. The range of activities is considerable with many focusing on drinking and driving, as well as youth, alcohol and pregnancy and acute damage from alcohol. Nevertheless, several themes are missNORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 453 Canada ing from the examples in Appendix II. However, it should be noted that there Although about 50% of the overall burden is not necessarily a good match between from alcohol in North American contexts whether there is research evidence show- is linked to chronic disease (Rehm et al. ing that a policy option reduces harm and 2003b), it is curious that no interventions, whether industry support for it. For ex- other than those dealing with foetal alco- ample, the following have been shown to hol effects, specifically focus on chronic reduce harm, but they are either not sup- disease where alcohol is a risk factor. Fur- ported by the alcohol industry or there is thermore, most are oriented to the individ- considerable ambivalence about these in- ual, and not directed at the aggregate level. terventions: higher taxes, reducing hours However, interventions at both levels are or days of sale, controls on outlet density, needed for an effective and comprehen- raising the legal drinking age, reducing the sive response, and the former, while im- official BAC limit, and, last but not least, portant, is typically less cost-effective and controlling overall per capita consump- with more limited ‘reach’ (see Chisholm et tion. al. 2004). Third, as noted in Babor et al. A number of these interventions come (2003, chapter 16), not all policies are of closest to negatively impacting the busi- equal potency. It turns out that those iden- ness of alcohol marketing and profit from tified as being of higher effectiveness are alcohol sales. While, in principle, restric- not strongly represented in Appendix II, tions might be introduced that do not pro- while those either not evaluated or found vide an unfair advantage to any one type from international evaluations to have of beverage, in practice this is seldom modest or minimal impact, figure promi- the case. Therefore, a preferred option is nently in this appendix. likely to be that of resisting or rejecting the restrictions on access, rather than the Alcohol industry and alcohol policy options The preceding sections have alluded to apparent positions of the alcohol industry on alcohol policy options. Here these themes are summarized (Table 5).2 There is support for a number of policy options and opposition to others. Opposition appears evident to a number of controls, while support was shown for interventions that involve information and persuasion, or more focused interventions. The control of drinking and driving is a highly developed area with a number of very specific interventions that are being tried in Canada and elsewhere. As indicated, there is industry support for a number of countermeasures. 454 NORDIC STUDIES ON ALCOHOL AND DRUGS complicated, time-consuming and collaborative approach that looks for opportunities where potentially convergent agendas can be realized between public health and market place proponents. Nevertheless, the deliberations underway with regard to the draft National Alcohol Strategy, which is not yet released, include tentative signals that alcohol industries are willing at this stage to consider a range of prevention strategies. Some measures include controlling access through a ceiling on density of outlets and a pricing policy that insures that alcohol beverages keep pace with the consumer price index, and thus reinforcing an effective public health approach to alcohol problem prevention. V O L . 2 3. 2 0 0 6 . 6 Canada Table 5. Apparent perspective of the alcohol industry on selected alcohol policy options, Canada Policy option or intervention Supports Ambivalent or varies1 Opposes Alcohol: Taxes & prices Higher taxes x Higher retail prices x Floor prices x Retail social reference price (linked to Consumer price index) x Retailing system Government retailing of alcohol x Government wholesaling x Access controls Ceiling on density of outlets x Reduce hours of sale x Reduce days of sale x Raise legal drinking age x Marketing Controls on marketing x Self-regulation of advertising x Government regulation of advertising x Controls on promotion x Information dissemination & persuasion Promote school-based programs x Expand counter-advertising x 2 Standard product content labels x Introduce warning labels x Types of Beverages Control high strength beverages x Control alcohol pops x Control alcohol smuggling x Consumers & drinking styles Discourage drinking by pregnant women x Discourage drinking by underage youth x Discourage high-risk drinking x Encourage moderate consumption x Drinking and driving Per se BAC limit of .08 x Per se BAC limit of .05 Provincial BAC limit of .05 with traffic ticket x x NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 455 Canada Policy option or intervention Supports Ambivalent or varies Provincial BAC limit with increased penalty Opposes x Administrative license suspension x Graduated licensure x Lower BAC for young/new drivers x Stricter repeat offender penalties x Tougher penalties for excessive BAC levels x Ignition Interlock device x Prevention education programs x Remedial programs x Conditional sentencing of offenders x Increased spot checks x Improved court processing of offenders x Other damage from alcohol Promote Bar-room interventions and controls x Identify a wide range of problems related to alcohol (e.g. cancers, other chronic diseases, violence) x x Disseminate information about dependence x Benefits of alcohol use Disseminate information about benefits of alcohol for CVD x General Control overall per capita consumption x Research on alcohol issues x Encourage health and safety advocates to be included at policy tables x x x 1) For example, if policy option does not create an unfair advantage across three main types of producers it is more likely to be supported. 2) Less likely to support messages that identify overall consumption or controls of promotion of alcohol as goals. The situation for some interventions is other sectors. not necessarily a simple one. There may From the perspective of the consumer be some areas where flexibility is feasible. and harm reduction potential of pricing, For example, there may be support among the active ingredient is the relative price, sectors of the alcohol industry for higher not the components, such as tax. It would prices or retail social reference price (e.g. seem that an effective way forward with annually raised to keep pace with the regard to pricing that can reduce harm consumer price index). But this support would require some interaction between is likely to be contingent on the govern- health and safety advocates, researchers, ments not receiving a larger share of the representatives of government depart- retail price, via tax increases, and being ments, liquor boards and the alcohol in- implemented so that no one sector of the dustry. alcohol industry benefits more than the 456 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 Canada Alcohol policy options and public opinion There is neither consistent agreement nor disagreement across these dimensions. A final comparison considers the apparent Nevertheless, a few points might be noted. alcohol industry positions with regard to Items where public support was weak several policy options, public support and (high scores in column two) were also op- the research evidence in terms of the as- posed by the alcohol industry. In general, sessed impact of a policy on overall con- a criticism that the alcohol industry tends sumption and/or alcohol-related harm. to be most supportive of the less effective This three-way comparison is summarized polices, is not necessarily one that should in Table 6. The first column ranks the re- be restricted to the alcohol industry. It search evidenced, based on Babor et al. must be noted that there is also strong sup- (2003), with the lower number indicating port for weak or ineffective interventions higher rank in terms of impact. The second and opposition to effective policies among column ranks public support in Ontario, governments and among members of the based on surveys involving representative general public. The motives for this sup- samples of adults (Giesbrecht et al. 2005b). port may vary by the group or organiza- The third provides an interpretation of tion, but the outcomes are similar. Ineffec- Canadian industry perspectives on these tive and often expensive interventions are policy options. promoted and sponsored while those with Table 6. Assessed impact of a policy, public support & apparent alcohol industry perspectives Policy item Assessed impact on consumption and/or harm1 Public support2 Alcohol industry Raise alcohol taxes3 1 11 oppose Raise minimum age 2 5 oppose Retain government retailing system 3 5 support Reduce number of liquor stores 4 9 ambivalent Reduce number of beer stores 5 8 oppose Reduce number of places to buy alcohol 6 7 oppose Reduce hours of sale – licensed premises 7 6 oppose One day dry 8 10 Stop service to intoxicated customers or patrons unknown 9 1 support Ban alcohol advertising on TV 10 12 oppose Ban alcohol advertising directed at youth 11 3 Ban alcohol sponsorship 12 13 oppose Introduce warning labels on beverage containers 13 2 oppose ambivalent 1) Based on Babor et al. 2003, chapter 16. 2) Based on responses to annual surveys of Ontario adults. 3) Lower number indicates higher rank, e.g. 1 for alcohol taxes indicates strong support in the research literature of impact from this intervention, but 11 indicates low support for this intervention among Ontario respondents. Source: Based, in part, on Giesbrecht, et al. (2005b). NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 457 Canada greater potential are not. As a consequence Other measures of access to alcohol have the chronic and acute negative effects of shown some increase in recent years, such an increase in high-risk drinking and rise as density of outlets, but not dramatically in overall consumption are not being ef- so, except for Alberta. Hours of sale are, on fectively controlled. average, longer, and Sunday sales are now fairly common. No changes in the mini- Discussion mum legal drinking age are expected, with The recent Canadian experiences with re- 3 provinces have it set at 18 and the other gard to alcohol policies indicates that the jurisdictions at 19. Despite the frequent influence of the alcohol industry appears to talk of privatization of alcohol retailing, have been significant, but not consistently only Alberta has, to date, gone that route so across policies (Giesbrecht et al. 2006c). fully, while in other provinces, an accu- An important caveat is that the position rate description might be privatization by and roles of the industry have not always stealth or by small steps. been transparent, and insider information However, there has been considerable is needed to gauge more accurately what activity in the domain of alcohol promo- their role has been in the policy domain. tion. There is extensive advertising and For example, a number of policy decisions promotion of alcohol, and concurrently a are not the outcome of public hearings or reduction of government having a direct committee deliberations that are a matter role in screening alcohol advertising. Al- of public record. though there have been several attempts Several interventions are considered to to introduce warning labels on alcohol be particularly effective in reducing alco- beverage containers, all have failed at the hol-related harm (e.g., Babor et al. 2003, national level. chap. 16). Based on this orientation, it is Also, of special importance is that, to feasible to highlight several developments date, neither controlling overall consump- in Canada. From a public health and safety tion nor controlling high-risk drinking perspective, some are worrisome and oth- appear to have been a central focus of al- ers less so. cohol policies supported by the alcohol There have been some changes in retail industry in the recent past. It remains to prices of all three beverages. At the na­tional be seen if the emerging National Alcohol level retail prices of beer are now higher Strategy will give high priority to both and than the consumer price index, compared also advocate for interventions that have a to the situation in 1991; wine prices have reasonable chance of making progress in also increased, but spirits prices have gen- controlling overall consumption and high- erally not kept pace with the consumer risk drinking levels. price index. Recent developments on this The policies that would have a high po- front include, for example, the discount- tential to achieve one or both are typically ing of beers in Ontario and British Colum- either ignored or undervalued. However, bia by a smaller brewer, which may lead there are extensive efforts to control drink- to the larger brewers or other producers ing and driving, and these initiatives stand doing the same. in sharp contrast to the relative absence of 458 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 Canada major policies to prevent other alcoholrelated problems. Furthermore, there is the more generic and persistent challenge of raising the profile of alcohol as a pub- Norman Giesbrecht, Senior scientist Centre for Addiction & Mental Health, 33 Russell Street, Toronto, Ontario M5S 2S1 Canada E-mail: norman_giesbrecht@camh.net lic health and safety issue; particularly in health promotion circles where alcohol problem prevention advocates are in a minority or not at the table. NOTES 1) Respondents who reported having 5 or more drinks on one occasion 12 or more times in the past year. 2) The table is based on a combination of sources: discussions with key informants, industry documents or web pages, and presentations by industry representatives. In some cases the information is sketchy or it is not fully clear what the industry perspective is on a topic; hence the table is cautiously labelled “apparent perspective”. REFERENCES Addiction (2000), 95 (Suppl. 4) [Issue on the supply side] Adlaf, E.M. & Begin, P. & Sawka, E. (eds.) (2005): Canadian Addiction Survey (CAS): A national survey of Canadians’ use of alcohol and other drugs: Prevalence of use and related harm: Detailed report. Ottawa: Canadian Centre on Substance Abuse Advertising Standards Canada (ASC) (2005): Welcome to Advertising Standards. Ontario, Canada: ASC. [Ref. September, 2005. Online: http://www.adstandards.com/en/ index.asp] Anderson, P. (2002a): The beverage alcohol industry’s social aspects organizations: A public health warning. The Globe 3: 3–30 Anderson, P. (2002b): The International Center for Alcohol Policies: a public health body or a marketing arm of the beverage alcohol industry? The Globe 1: 3–7 Anglin, L. & Giesbrecht, N. & Ialomiteanu, A. & Grand, L. & Mann, R. & McAllis- ter, J. (2005): Public opinion on low-risk drinking, alcohol and cancer, and alcohol policy issues: Findings from the 2004 CAMH Monitor Survey of Ontario adults. CAMH Research Document Series No. 203. Toronto: Centre for Addiction and Mental Health Babor, T. & Caetano, R. & Casswell, S. & Edwards, G. & Giesbrecht, N. & Graham, K. et al. (2003): Alcohol: No Ordinary Commodity – Research and Public Policy. Oxford and London: Oxford University Press Bagnardi, V. & Blangiardo, M. & La Vecchia, C. & Corrao, G. (2001): A meta-analysis of alcohol drinking and cancer risk. British Journal of Cancer 85 (11): 1700–1705 Boffetta, P. & Hashibe, M. (2006): Alcohol and cancer. The Lancet Oncology 7 (2): 149–156 Chisholm, D. & Rehm, J. & van Ommeren, M. & Monteiro, M. (2004): Reducing the global burden hazardous alcohol use: a comparative cost-effectiveness analysis. Journal of Studies on Alcohol 65: 782–793 Chronic Disease Prevention Alliance of Canada (2004): Integrated chronic disease prevention: getting it together. Conference proceeding from the First National Conference. 2004 Nov 6; Ottawa, ON Giesbrecht, N. (2000): Roles of commercial interests in alcohol policies: recent developments in North America. Addiction 95 (Suppl. 4): S581–S596 Giesbrecht, N. (2004): Science, public policy and the alcohol industry. In: Muller, R. & Klingemann, H. (eds.): From Science to Action? 100 Years Later – Alcohol Policies Revisited. Dordrecht: Kluwer Academic NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 459 Canada Publishers Giesbrecht, N. & Roerecke, M. & Rehm, J. (2005a): Alcohol and chronic disease: Implications for policies and prevention strategies in Canada. Background paper prepared for the National Alcohol Strategy Working Group and Health Canada Giesbrecht, N. & Anglin, L. & Ialomiteanu, A. (2005b): Alcohol policy effectiveness and public opinion: Is there support for effective policies in Ontario? Paper presented at the Annual Symposium of the Kettil Bruun Society for Social and Epidemiological Research on Alcohol, Riverside, California, May 30 to June 3, 2005 Giesbrecht, N. & Demers, A. & Ogborne, A. & Room, R. & Stoduto, G. & Lindquist, E. (eds.) (2006a): Sober Reflections: Commerce, Public Health and the Evolution of Alcohol Policy in Canada, 1980–2000. Montreal & Kingston: McGill-Queen’s University Press Giesbrecht, N. & Stoduto, G. & Kavanagh, L. (2006b): Privatization postponed? Ontario’s experience with convergent interests and extensive alcohol marketing. In: Giesbrecht, N. & Demers, A. & Ogborne, A. & Room, R. & Stoduto, G. & Lindquist, E. (eds.): Sober Reflections: Commerce, Public Health and the Evolution of Alcohol Policy in Canada, 1980–2000, pp., 175–200. Montreal & Kingston: McGill-Queen’s University Press Giesbrecht, N. & Room, R. & Demers, A. & Lindquist, E. & Ogborne, A. & Bondy, S. & Stoduto, G. (2006c): Alcohol policies: Is there a future for public health considerations in a commerce-oriented environment? In: Giesbrecht, N. & Demers, A. & Ogborne, A. & Room, R. & Stoduto, G. & Lindquist, E. (eds.): Sober Reflections: Commerce, Public Health and the Evolution of Alcohol Policy in Canada, 1980–2000, pp. 289–333. Montreal & Kingston: McGill-Queen’s University Press Greenfield, T.K. & Giesbrecht, N. & Kaskutas, L.A. & Johnson, S. & Kavanagh, L. & Anglin, L. (2004): A study of the alcohol policy development process in the United States: Theory, goals and methods. Contemporary Drug Problems 31 (winter): 591–626 Haydon, E. & Roerecke, M. & Giesbrecht, N. 460 NORDIC STUDIES ON ALCOHOL AND DRUGS & Rehm, J. & Kobus-Matthews, M. (2006): Chronic Disease in Ontario and Canada: Determinants, Risk Factors and Prevention Priorities. Toronto: Prepared for the Ontario Chronic Disease Prevention Alliance and the Ontario Public Health Association McCreanor, T. & Casswell, S. & Hill, L. (2000): Editorial. ICAP and the perils of partnership. Addiction 95 (2): 179–185 Norström, T. (2001): Per capita alcohol consumption and all-cause mortality in 14 European countries. Addiction 96 (Supplement 1): S113–S128 Norström, T. (2004): Per capita alcohol consumption and all-cause mortality in Canada, 1950–98. Addiction 99 (10): 1274–1278 Ogborne, A. & Stoduto, G. (2006): Changes in federal regulation of broadcast advertising for alcoholic beverages. In: Giesbrecht, N. & Demers, A. & Ogborne, A. & Room, R. & Stoduto, G. & Lindquist, E. (eds.): Sober Reflections: Commerce, Public Health and the Evolution of Alcohol Policy in Canada, 1980–2000, pp. 237–259. Montreal & Kingston: McGill-Queen’s University Press Ogborne, A. & Giesbrecht, N. & Room, R. (2006): Case studies of alcohol policy formation: Power politics, public opinion and research. In: Giesbrecht, N. & Demers, A. & Ogborne, A. & Room, R. & Stoduto, G. & Lindquist, E. (eds.): Sober Reflections: Commerce, Public Health and the Evolution of Alcohol Policy in Canada, 1980– 2000, pp. 43–58. Montreal & Kingston: McGill-Queen’s University Press Ramstedt. M. (2003a): Alcohol consumption and alcohol-related mortality in Canada, 1950–2000. Canadian Journal of Public Health 95: 121–126 Ramstedt, M. (2003b): Alcohol consumption and liver cirrhosis mortality with and without the mention of alcohol—the case of Canada. Addiction 98 (9): 1267–1276 Ramstedt, M. (2005): Alcohol and suicide at the population level – the Canadian experience. Drug and Alcohol Review 24: 203–208 Rehm, J. & Room, R. & Monteiro, M. & Gmel, G. & Graham, K. & Rehn, N. & Sempos, C.T. & Jerningan, D. (2003a): Alcohol. In WHO V O L . 2 3. 2 0 0 6 . 6 Canada (Ed.): Comparative Qualification of Health Risks: Global and Regional Burden of Disease due to Selected Major Risk Factors. Geneva: World Health Organization Rehm, J. & Gmel, G. & Sempos, C. T. & Trevisan, M. (2003b): Alcohol-related morbidity and mortality. Alcohol, Research & Health 27: 39–51 Rehm, J. & Giesbrecht, N. & Popova, S. & Patra, J. & Adlaf, E. & Mann, R. (2005): Overview of positive and negative effects of alcohol consumption – conclusions for Canada. Report for Health Canada Rehm, J. & Giesbrecht, N. & Patra, J. & Roerecke, M. (2006): Estimating chronic disease deaths and hospitalizations due to alcohol use in Canada in 2002: Implications for policy and prevention strategies. Preventing Chronic Disease 31 (4): A121. [Online: http://www.cdc.gov/pcd/issues/2006/oct/05_0009.htm] Rempel, B. & Fortin, R.B. (2005): The Effectiveness of Regulating Alcohol Advertising: Policies and Public Health. Prepared for the Association to Reduce Alcohol Promotion in Ontario, Ontario Public Health Association Room, R. (1998): Thirsting for attention (Editorial). Addiction 93 (6): 797–798 Room, R. & Babor, T. & Rehm, J. (2005): Alcohol and public health. The Lancet 365 (9458). 519–529 Room, R. & Stoduto, G. & Demers, A. & Ogborne, A. & Giesbrecht, N. (2006): Alcohol in the Canadian context. In: Giesbrecht, N. & Demers, A. & Ogborne, A. & Room, R. & Stoduto, G. & Lindquist, E. (eds.): Sober Reflections: Commerce, Public Health and the Evolution of Alcohol Policy in Canada, 1980–2000, pp. 14–42. Montreal & Kingston: McGill-Queen’s University Press Rossow, I. (2004): Alcohol consumption and homicides in Canada 1950–1999. Contemporary Drug Problems 31 (3): 541–560 Skog, O.J. (2003): Alcohol consumption and fatal accidents in Canada, 1950–98. Addiction 98 (7): 883–893 Smart, R. & Mann, R. (1995): Treatment, health promotion and alcohol controls and the decrease of alcohol consumption and problems in Ontario: 1975–1993. Alcohol and Alcoholism 30: 337–343 Statistics Canada (1999): National Population Health Survey Statistics Canada (2004): Canadian Community Health Survey, 2000 Statistics Canada (2005a): National Population Health Survey: Healthy aging Statistics Canada (2005b): The Control and Sale of Alcoholic Beverages in Canada. Catalogue No. 63–202-XIE. Ottawa: Government of Canada Statistics Canada (multiple years): The Control and Sale of Alcoholic Beverages in Canada. Ottawa: Government of Canada Swenarchuk, M. (2005): Trade Rules and Alcohol: An unhealthy mix. Paper presented at the Pan American Conference on Alcohol Policies, Brasilia, November 238–30, 2005 Trolldal, B. (2005): The privatization of wine sales in Quebec in 1978 and 1983–84. Alcohol Clinical & Experimental Research 29: 410–416 World Health Organization (2002): Reducing Risks, Promoting Healthy Life. Geneva: World Health Organization. NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 461 Canada Appendix I. Alcohol Industry of Canada – Brief Overview BEER Brewers Association of Canada International Ownership Molson Coors Brewing Company (from Montreal Molson and Colorado Adolf Coors 2004 merger) InBev S.A. (from Belgian Interbrew and Brazilian AmBev 2004 merger) Top Brewers in Canada #1: Molson Coors #2: Labatt #3: Sleeman Breweries Ltd. Profile • fifth largest in industry worldwide • founded in 1786, Molson is North America’s oldest beer brand • The Coors family owns 27% of shares; W. Leo Kielly III, CEO • Founded in 1847 • Rober Labatt, CEO • Acquired by Interbrew in 1995 • Founded in 1851 in Guelph, Ontario • John Sleeman, CEO Key Brands • Coors/Coors Light • Molson Canadian • Carling • Black Ice • Rickard’s • Bavaria • Labatt Blue • Alexander Keith’s • Blue Star • Kokanee • Club • Kootenay • Lucky • Oland • Schooner • Sleeman’s • Shaftebury • Upper Canada • Stroh • Okanagan Partnered with/ Distributes • Heineken • Miller • Foster’s • Corona • Budweiser/Bud Light • Guinness • PC Premium Draft • Bass • Beck’s • Cristall • Dos Equis • Löwenbräu • Stella Artois. • Grolsch • Pilsner Urquell • Samuel Adams • Sapporo • Scottish and Newcastle WINE Canadian Vintners Association Top Wineries #1: Vincor International #2: Andre’s Wines Ltd #3: Diageo Profile • Founded in 1961 • John Peller, President/ CEO • Formed in 1997 from Guinness and GrandMet merger • Lord (James) Blyth of Rowington, Chairman 462 Other independent microbreweries • Largest in Canada, fourth in N. America, 13th worldwide • Don Triggs, President/ CEO • Traces back to 1874 Niagara Wine Company • Owns The Wine Rack (Ontario) NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 Others: Mission Hill Maxxium Canada Key Brands SPIRITS • Inniskillin • Jackson-Triggs • Hogue • Sumac Ridge • Kumala • Goundrey • Cascadia • Thirsty Bench • Peller Estates • Hillebrand Estates • Domaine D’Or. • Red Rooster • Hochtaler • Beaulieu • Sterling Spirits Canada (aka Association of Canadian Distillers) International Ownership PERNOD RICARD S.A., the 2nd largest wine and spirits operator in the world (behind London’s Diageo), founded in 1975 by the merger of the two French companies. It acquired Seagram in 2001, and Allied Domecq in 2005 (who previously owned Hiram Walker). Sales in 2004/2005 approximately 5.8 billion€. Hiram Walker and Sons Ltd. Owns in excess of 51% shares of Corby Distilleries and sources 75% of Corby’s product requirements. Corby Distilleries Ltd. Corby owns or represents 8 of the top-selling 25 brands in Canada, and 16 of the top 50. Key Brands • Canadian Club • Lamb’s Rum • Seagram’s Coolers • Polar Ice Vodka • Wiser’s rye whiskies Represents/ distributes • Ballantine’s Scotch • Beefeater gin • Malibu rum • Kahlua liqueur • Chivas Regal • Havana Club rum Sources: Brewers of Canada: 2004 Annual Statistical Bulletin. [Online: http://www.brewers.ca/EN/index.htm] Molson Coors (Feb 9, 2005): Molson Coors Announces Results for Molson’s 3rd Quarter of Fiscal 2005. [Online: http://www. molsoncoors.com/press/02_09_05_molson.html] Maguire, B. (2006): The Battle of our Beers. The Dominion, January 26. [Online: http://dominionpaper.ca/business/2006/01/26/the_battle.html] Oligopoly Watch (Mar 3, 2004): Interbrew, AmBev plan to merge. [Online: http://oligopolywatch.com/2004/03/03.html] InBev (2006): About InBev > Our Company. [Online: http://www.inbev.com/about_inbev/1__1__0__ourcompany.cfm] Oligopoly Watch (July 22, 2004): Coors/Molson. [Online: http://www.oligopolywatch.com/2004/07/22.html] CNW Group (Feb 9, 2006): Corby Distilleries Limited announces stock split, dividend & earnings for four months ended December 31, 2005. [Online: http://www.newswire.ca/en/releases/archive/February2006/09/c0765.html] Wine Industry Report (Mar 8, 2006): Pernod Ricard & Corby Distilleries announce combined strategic approach to Canadian market. [Online: http://wineindustryreport.finewinepress.com/2006/03/08/pernod-ricard-corby-distilleries-announce-combined-strategic-approach-to-canadian-market/] Ryval, M. (2001): Glass Half Full. The Globe and Mail, September 28. [Online: http://www.theglobeandmail.com/series/wine/ glass.html] Paul, M.: Western Wines & the UK Wine Market. [Online: http://www.vincorinternational.com/download/InvDay.pdf] Vincor International (Oct 9, 2002): Vincor International announces agreement to acquire Australia’s groundrey wines. [Online: http://www.vincorinternational.com/base-module/companynewsreleases.cfm?newsID=1585&companyID=49&maintitle= Media] Canadian Shareowner (Sep/Oct 2004): Vincor International Inc.: Good For You Too. [Online: http://www.findarticles.com/p/articles/mi_qa4037/is_200409/ai_n9409482#continue] NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 463 Canada Appendix II. Collaboration of the Alcohol Producers and Alcohol Retailers on Prevention Initiatives & Campaigns – Examples from Canada Brewers of Canada • Media campaigns on radio, television, and outdoor advertising to remind Canadians not to drink and drive; with Canada Safety Council, Ontario Community Council on Impaired Driving, Student Life Education Company and the Traffic Injury Research Foundation. • Support alcohol ignition interlock devices. • Motherrisk program of the Hospital for Sick Children in Toronto, supported by Brewers of Canada (BAC). • Alcohol Risk Assessment and Intervention (ARAI) program with the College of Family Physicians of Canada. • FAS Resource Centre, with Health Canada, Association of Canadian Distillers and the Canadian Centre on Substance Abuse (CCSA). • Alcoholic Beverage Research Foundation (ABMRF), funded by brewers in Canada and US, provides grants for research on the prevention of harmful consumption of alcoholic beverages. • Program materials to reach audiences in the Native community; with Native Physicians’ Association in Canada. • Multimedia program for young teens to learn about alcohol; with educators and health and substance abuse professionals, piloted in New Brunswick. Now in the public domain the websites are currently hosted by Schoolnet, the Federal Government’s Internet server. • Labatt: Drive Home Safe Program in Atlantic Canada, and the Labatt Opération Nez Rouge in Quebec, where Labatt volunteers driver others who do not feel comfortable driving their own vehicles home. Labatt has partnered with local transit commissions to support New Year’s Eve Free Ride campaigns that provide passengers with free transit service all evening. First Canadian brewer to launch a moderation program and first to introduce a “near-zero” alcohol beer. Enlists major sports and entertainment figures in the fight against alcohol abuse. Know When to Draw the Line: Responsible consumption campaign by Labatt. Partner with Canadian Red Cross, Red Cross Swim and On Board to produce materials and programs to help boaters and swimmers remain safe and consume alcohol responsibly in and around the water. Partner with Canadian Avalanche Association on education on avalanche preparedness, safety and resources to avoid accidents. • Molson: Launched responsible use program with regard to impaired driving, including 1-888 TAXIGUY/ TAXI SVP. This program provides consumers with a safe, viable and convenient alternative to drinking and driving. Includes a network of over 425 partner cab companies, TAXIGUY services are now available in over 700 Canadian cities and towns, including all major urban centres. Over 150,000 calls made to date. Molson promotes the Don’t Drink and Drive message at many sports and entertainment events across Canada. “When we invite people to enjoy a Molson event, we remind them to plan an alternative to getting behind the wheel.” • Brewers state that “no other industry matches the human financial resources committed by the Canadian brewers in promoting further reduction in the already declining incidence of alcohol. We remain committed to what we see as both a corporate and social responsibility to promote responsible drinking.” • Over the past 10 years Canadian brewers have claimed to spend more than $100 million in funding for a number of activities, numerous partners including Health Canada: – targeted educational and intervention programs in partnership with health professionals and third party interest groups. – multimedia advertising responsible drinking campaigns. – support for medial and social-behavioural research. Sources: Brewers of Canada: Responsible Drinking. [Online: http://www.brewers.ca/EN/frames/enter_responsible.htm] Labatt: Responsible Use. [Online: http://www.labatts.com/english/lbc_responsible/lbc_main.htm] Brewers of Canada: Accountability means acting responsibly. [Online: http://www.brewers.ca/EN/responsible/index.htm] Brewers of Canada: What’s New: Brewers Remind Canadians Don’t Drink and Drive. [Online: http://www.brewers.ca/EN/whats_new/toronto_apr7_2004.htm] Molson: Molson in the Community. [Online: http://www.molson.com/community/ddad/index.php] 464 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6 Canada Association of Canadian Distillers (ACD) • Prevention of impaired driving programs, with Canada Safety Council (CSC). • Public service announcements against dangers of drinking and driving (regardless of beverage) with CSC. • SMASHED magazine with multiple collaborators. • Crime Stoppers Program – poster campaign with Liquor Control Board of Ontario, Ontario Provincial Police and the Royal Canadian Mounted Police (RCMP). • Fetal Alcohol Syndrome Information Service with Brewers Association of Canada and Health Canada. • Alcohol education and awareness programs and campaigns for post-secondary audience, with BACCHUS Canada. • Ontario Licence Plate Program illustrating a Don’t Drink and Drive symbol, with Ontario Ministry of Transportation. • Of 18 groups/campaigns listed on their website, 13 had to do with impaired driving. • ACD supports and participates in alcohol awareness programs that promote responsible consumption, collaborate with governments, public health agencies, law enforcement agencies, research groups and other stakeholders across the country. Sources: Association of Canadian Distillers: Programs and Campaigns. [Online: http://www.canadiandistillers.com/eng/ ResponsibleUse/programs.htm] Vintners • Web site of the Canadian Vintners Association provides links to numerous organizations involved in alcohol policy issues, including various councils, research institutions as well as social aspects organizations, e.g. Portman Group. • Other web sites links focus on: e.g., drinking and driving, fetal syndrome/fetal alcohol effects, government organizations, nutrition, moderate wine consumption and the benefits to health, and national and prevention organizations. • The Canadian Vintners Association “supports the responsible and moderate consumption of wine, but does not advocate non-drinkers begin drinking for the health benefits associated with wine. The abuse or over-consumption of wine or any other alcoholic beverage increases the risk of short or long term harm to health and should be avoided. Please enjoy our product in moderation and drink responsibly.” • The Wine Council of Ontario (January 11, 2005) welcomed Ontario’s Provincial Review of the Beverage Alcohol Business and supported the five principles that will guide the expert review panel in their work: – Promotion of on Ontario’s products – Safeguarding socially responsible consumption, storage, distribution and sale of beverage alcohol – Convenience, variety and competititive prices for consumers – Maximizing value to taxpayers – Ensuring responsible reuse and recycling practices Sources: Canadian Vintners Associaton [Online: http://www.canadianvintners.com/health/links.htm] Wine Council of Ontario [Online: www.winesofontario.org/PDFs/WCO&ProvincialReviewofBeverageAlcoholBusiness.pdf ] NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 23. 2006 . 6 465 Canada Liquor Control Board of Ontario • Partners with numerous groups to promote social responsibility and raise awareness of important alcohol-related issues, such as drinking and driving and responsible personal consumption. • Partners include: social and health agencies, social responsibility groups, community organizations, police agencies, educational agencies, beverage alcohol suppliers, the hospitality industry, and government. • “Since 1995, the LCBO has used TV, radio, print, cinema and billboard ads to bring our social responsibility messages to Ontario communities. Research has shown that public recall of these ad campaigns is high and that most respondents who’ve seen the ads would think twice about drinking and driving – and feel their family and friends would too”. • “Selling liquor responsibly is a public trust the LCBO has taken very seriously since 1927. We consider social responsibility as important as our mandate to provide a high level of customer service and maximize dividends for the provincial government.” LCBO programs include: – Information campaigns aimed at teenagers, such as the Safe Prom Campaign, which includes posters, teachers’ educational materials and tips for both parents and teens. [Online: http://www. lcbo.com/prom] – Talk to Your Kids about Alcohol. [Online: http:// www.talktokidsaboutalcohol.ca] – Staff training to prevent the sale of alcohol to minors, and to persons who are intoxicated, e.g. SMAART Training for Staff, Challenge and Refusal Program. – Television commercials in partnership with MADD Canada. – Responsible Host Tips and Good Host kits for overnight guests. Good Host Kit was developed by LCBO in partnership with Shoppers Drug Mart. It facilitates hosts of holiday celebrations to take action to deter drinking and driving. It includes everything a host would need for unexpected overnight guests. Plans are underway for a summer version of Good Host Kit. – Programs in partnership with other organizations, e.g., R.I.D.E. (in association with the Ontario Association of Chiefs of Police). – Collaborated with Mothers Against Drunk Driving (MADD Canada) on seven TV campaigns, which helped raise $400,000. LCBO also collaborated with MADD on the holiday season Project Red Ribbon campaign. Sources: Liquor Control Board of Ontario: Social Responsibility. [Online: http://www.lcbo.com/socialresponsibility/ourcommitment.shtml] Liquor Control Board of Ontario: Media Center. [Online: http://www.lcbo.com/aboutlcbo/media_centre/faq.shtml] Mothers Against Drunk Driving: Madd Canada News. [Online: http://www.madd.ca/english/news/pr/p05apr14.htm] 466 NORDIC STUDIES ON ALCOHOL AND DRUGS V O L . 2 3. 2 0 0 6 . 6