Dysfunctional Behavior in Organisations

advertisement

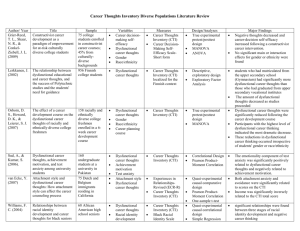

Dysfunctional Behavior in Organisations: Can HRD reduce the impact of dysfunctional organizational behavior – A Review and Conceptual Model Keywords: DYSFUNCTIONAL ORGANIZATIONAL BEHAVIOR, S/HRD, MULTI-LEVEL ANALYSIS Clíodhna MacKenzie, University of Limerick Thomas N. Garavan, University of Limerick Ronan Carbery, University of Limerick Abstract This article provides a review of the literature on dysfunctional organizational behavior and its relationship with human resource development (HRD) interventions. This paper will firstly, define dysfunctional organizational behavior, secondly, describe environmental factors argued to influence dysfunctional organizational behavior and finally provide insight on the negative impact of dysfunctional organizational behavior at an individual, organization and societal level. Applying the current financial crisis as the context of this paper, we argue that dysfunctional organizational behavior has the capacity to negatively affect not just the stability of the firm but society and the larger economic community. In this paper we propose a reconceptualization of the HRD framework through a dysfunctional behavior lens using a multilevel analysis (individual, organizational and societal) and argue that dysfunctional behavior has the potential for significantly negative societal impact that HRD academics and practitioners will need to address in a new economic landscape. We conclude that HRD may not be able to fully prevent dysfunctional organizational behavior; however, through thoroughly understanding antecedents that influence dysfunctional behavior the capacity exists to reduce the potential for dysfunctional behavior and minimize the impact at an individual, organization, institutional and societal level. Finally, we propose a new organizational governance and agency mediation control role in the new post economic landscape. The creation of this role may be the difference between history repeating itself and HRD becoming a credible organizational partner, not just to the business but to society. Analysis of the global economic crisis that has adversely affected almost every country in the world illustrates the societal impact of organizational behavior that was neither safe nor sound (Honohan 2010). In terms of impact felt at a societal level, the International Monetary Fund (IMF) estimated that banking losses in Ireland [2010] alone may be as high as €35 billion with a contraction of 14 per cent of Ireland‟s GDP (Mody 2009), that figure revised to €73 billion (Oliver 2010; Barrett et al. 2010) in order to ensure the survival of the Irish banking system and solvency of the country. The US bank bailout is expected to exceed US$11 trillion with US$3 trillion already committed (Goldman 2009), the knock-on effect on the US economy is the worst since the Great Depression in the 1930‟s. Andrew Haldane of the Bank of England estimates the global loss of economic output from the financial crisis may be as high as US$200 trillion (Hannon 2010). An ex-post analysis points to a number of causes for the international financial & banking failure: regulatory enforcement not equipped to deal with complexity of the market; socially harmful risk-taking behavior (Honohan 2009); failure of governance, knowledge and cognition (Power 2009); and macroeconomic policy ill-equipped to deal with innovation and systemic risk in the financial system (Blanchard, Caruana, and Moghadam 2009). The agreed consensus within the financial community is that the systemic, or “macro-prudential” interconnectedness (Federal Reserve System 2010) of the global financial & banking system was improperly regulated and as a result of this “light touch” regulation, excessively-risky investment strategies in terms of securitized products, sub-prime mortgage exposure, commercial property investment strategies coupled with and historically low interest rates and access to a cheap money supply culminated in events over the past 24 months. There are lessons to be learned in terms of ensuring organizations have sufficiently robust risk-management & assessment apparatus in place to mitigate the risk of a repeat of the current financial crisis; however, a more thorough understanding of the dysfunctional dimensions of organizational behavior is an imperative for organizations and more crucially, for HRD. Contemporary organizations are a complex and multi-dimensional construct in which members share an organizational identity, broadly defined as a process of interaction between organizational members and senior management that serves to affirm who or what the organization is and the individuals’ self-identification (Chreim 2002; Cornelissen, Haslam, and Balmer 2007; Hatch and Schultz 2002; Herrbach 2006) that is influenced by the organization’s social construct of values, norms and beliefs – its culture (Denison and Mishra 1995; Hatch 1993; Schein 2004; Zheng, Qu, and Yang 2009). Hatch and Schultz (2002) argued that “knowing how organizational identity dynamics works helps organizations to avoid organizational dysfunction” (p.1014) with Zheng et al., (2009) positing that organizational culture exerts its influence through “shaping the behavior” of its members (p.3). These arguments are quite salient if it is contextualized in terms of the international financial crisis that has impacted societies across the globe. The concept of dysfunctional organizational behavior is not a contemporary phenomenon, it has been examined and analysed from multiple perspectives over the past decade (see Balthazard, Cooke, and Potter 2006; Bennett and Robinson 2000; Dellaportas, Cooper, and Braica 2007; Duffy, Ganster et al. 2006; Kets de Vries and Miller 1984; Lawrence and Robinson 2007). Whilst the capacity for dysfunctional behavior among individuals/teams or within organizations is a concern for most senior management teams, the institutional / community / societal impact of the behavior has far wider reaching consequences. The Enron collapse is perhaps the most cited and easily recognizable in terms of organizational failure as a result of dysfunctional behavior. In the case of Enron, both agency issues and unethical / corrupt business practices were linked to the collapse of the company cited six times in Fortune magazine as “innovative company of the year” (Stein 2007). Levine (2005) provides insight into how unethical and corrupt behavior was viewed by one of the executives at Enron, stating they viewed “rules differently than other people” (p.727), this acceptance of rule bending became an organizational norm, embedding in the organizational orthodoxy whereby organizational members derived a certain pride in “getting around the rules”. Enron is a classic example of dysfunctional behavior that led to the collapse of an organization; however, it is also perhaps a very good example of how social contagion can spread from individual to team and become deleterious to organizational performance, development and survival. Mid-level managers, traders and professionals comprised the core of Enron (Werther 2003) and proclaimed themselves to be the smartest guys in the room. Kets der Vries and Miller (1984) provided some insight on organizational neuroticism that reflects the inner workings of Enron, they argued “….the prevailing neurotic style can give rise to shared fantasies and permeate all levels of the organization” (p.22). In the aftermath of the Enron collapse the public outcry for more stringent and robustly enforced regulations led to the creation of The Sarbanes-Oxley Act (2002), a riskaversion intervention aimed at ensuring no repeat of the Enron story – recent events illustrate that symptomatic responses are limited in their effect. Regulations, rules and societal norms do not insure against dysfunctional organizational behavior that has the capacity for institutional / societal reach, indeed as Werther (2003) argued, in light of organizational failure, perhaps it is time to “supplement legal and regulatory rules with insights from organization theory and research” (p.571). There is a significant opportunity for HRD to contribute to the management of dysfunctional organizational behavior by examining the antecedents, influences, motivational dimensions and impact at individuals, organization, institutional and societal levels. It is unlikely that HRD interventions will remove dysfunctional behavior from the organization; however, it can potentially reduce the risk of dysfunctional organizational behavior occurring and minimize the impact at an individual, organization and institutional level and negative outcome at a societal level when it does occur. The global effect of the financial & banking crisis provides a rare opportunity of HRD scholars and practitioners to address the crisis by focusing on the four primary practice areas of HRD: Organizational Development (OD), Career Development, Learning and Development (L&D) and Performance Management (Garavan 2007; Peterson 2008; Ulrich and Brockbank 2005) in pursuit of developing new theories that result in a more robust application of HRD interventions aimed at minimizing dysfunctional organizational behavior. The development of an organizational level governance role that will augment the four key practice areas of HRD in ensuring socially responsible behavior is the organizational rule rather than exception. The purpose of this paper is to examine how SHRD can minimize the impact of antecedents that have the capacity to influence, motivate and facilitate dysfunctional organizational behaviour. Whilst the literature on both SHRD and dysfunctional organizational behaviour is vast and diverse in terms of definitions and context of the phenomenon being examined, this paper aims to provide a narrow focus using a multi-level analysis (Garavan, McGuire, and O'Donnell 2004) of the relationship between SHRD and organizational antecedents that can influence dysfunctional organizational behaviour. This paper will examine and define recent instances of dysfunctional organizational behavior in the context of the international financial and banking crisis, examine implications for individuals, organizations and society and reconceptualise the HRD framework through a dysfunctional organizational behavior lens. Context: The intellectual failure some argue is central to the global economic crisis (FSA 2009; Power 2009) may have a noticeable impact on how future risk-management interventions are deployed and managed within the organization. The impact of the crisis is highlighted by McSweeney (2009) who argues that “extensive financial market failure precipitated and continues to perpetuate widescale economic and social problems”(p.844) arguably, the dysfunctional behavior may have been influenced by environmental factors as Kish-Gepart‟s (2010) research suggest, “antecedents in an individual‟s workplace environment…had simultaneous and significant unique impacts on either unethical intention or unethical behavior” (p.15). The capacity of human resources to add to the sustained competitive advantage of the organization is accepted; however, paradoxically, human resources are also capable of counterproductive work behavior (Levine 2010) which can have the opposite effect – organizational/institutional failure. In the context of the current international financial & banking crisis, property lending teams [in Irish banks] were anecdotally guilty of reckless lending practices (Honohan 2009) despite economic indicators of a „property bubble‟. Between 2003 and 2007 Irish banks “increased their borrowings from abroad by 50 per cent of annual GDP” (Honohan 2008:3) in an effort to compete with one another, loan to value (LTV‟s) ratios were increased, lending standards and stress testing of loans were relaxed and the reckless lending practices became the modus operandi de jour. The procyclicality of bank lending behavior is well accepted (Berger and Udell 2004) but the excessively risky strategies were as Honohan (2010) argues, “neither safe nor sound” and described as “socially harmful risk-taking behavior”. The lending practices engaged in by Irish banks were potentially hazardous to the organization but as the evidence shows, detrimental to the Irish economy as a whole. At an individual level, the leadership in many of Ireland‟s previously well respected banks had engaged in “egregious” activities that resulted in the majority of those banks becoming nationalized (NAMA 2010). The behavior of senior management in the Irish banks prior to their collapse is now viewed as ethically questionable and was not in acting in the best interest of any of the stakeholders, indeed, the office of the director for corporate enforcement (ODCE) is pursuing legal advice and may prefer criminal charges against many of the senior management in Irish banks. Leaders have a central role in developing and influencing organizational culture (Schein 2004), this was reflective of many of the Irish banks who engaged in excessively risky strategies in pursuit of profits, Berson et al., (2008) argued that organizations that emphasize “risk-taking” and advantage taking behavior do so even at the risk of stability and growth. This risk-taking strategy became a normative value with the banking culture, not just in Ireland but in many of the banks prior to the collapse. If taking a risk is viewed as a cultural value, excess risk taking may override „rational‟ decision making in what Schein refers to as the cultural amplifier hypothesis (Schein 1994: 168). In both the UK and US, dysfunctional organizational behavior may have contributed to the failure of notable commercial/investment banks and insurance giant AIG; however, the dysfunctional behavior may have been more on the deviant scale as incentive structures may have motivated individual and team investment strategies that were “socially irresponsible” (Levine 2010) and may have existed within a culture or subculture that facilitated the behavior. Hackman (cited in Felps, Mitchell, and Byington 2006) elucidated group (team) members “co-regulate” their behavior through “ambient” and “discretionary” stimuli to elicit “group uniformity”, this insight may illustrate how collective thought processes may have rationalized excessively risky lending practices in Ireland and ignored sound economic data in the US. The financial collapse in 2008 of Lehman Brothers, AIG, Bear Sterns, Citigroup, Freddie Mac and Fannie May highlights a number of common dimensions. Firstly, there was an overreliance on complex financial models to reduce risk exposure (an intellectual and learning & development failure), secondly, there was a degree of hubris among the senior management of many of these groups (a failure in leadership development), finally, there may have been an excessive success culture (Probst and Raisch 2005) which exacerbated the failures (a cultural and organizational development failure). The incentive structures at the time of the collapse almost certainly contributed to the excessively risky strategies and highlights agency issues prevalent in many organizations. In recent days, the announcement by the SEC (2010) that it intends bringing a charge of fraud against Goldman Sachs and one of its vice presidents citing it acted “deceptively” and in a “conflict of interest” with its clients relating to a collateralized debt obligation (CDO) related to subprime mortgages again illustrates failings at a leadership and organizational level. The charges by the SEC highlight agency or moral hazard issues many claim were central to how senior management, traders and brokers in US banks operated prior to the crisis; this was also a common feature among senior management in Irish banks. These practices, if found to be true in a court of law are on the upper scale of dysfunctional organizational behavior defined as unethical or corrupt (KishGepart, Harrison, and Trevino 2010). The failure of the Icelandic banking systems was in many ways similar to that of Ireland, the three main banks accounting for approximately 85 per cent of the banking system (Thomsen 2008) collapsed in quick succession. The highly leveraged banks engaged in a “foreign-funded boom” to expand abroad and accumulated assets of almost 900 per cent of GDP by end of 2007, this was similar to the Irish banking failure, although not as exposed, the Irish banks engaged in a property speculative business model that was also negatively impacted by the global financial crisis. The negative impact on both the Icelandic and Irish economies was also quite similar; both countries have experienced a dramatic decrease in the standard of living with Iceland going from being one of the “lowest indebted countries in Europe, to one of the must indebted advanced countries in Europe (IMF 2008). Similarly, Ireland is experiencing a decreased standard of living as a result of the bank lending behavior and lax regulatory enforcement (Barrett et al. 2010). The dysfunctional behavior of senior leadership may have been in line with organizational objectives; however, the negative impact in terms of loss of output (GDP) and rising unemployment highlights the central role HRD must play in developing tomorrow‟s leaders and organizations to ensure their behavior does not become socially irresponsible. It is important to illuminate how individual and collective dysfunctional contagion can spread within the organization negatively impacting an organizations‟ ability to achieve its goals and objectives. In notable cases of dysfunctional organizational behavior involving the banking & financial sector over the past decade, there is evidence that dysfunctional behavior can and does result in fundamental damage to the organization or its failure. The Société Générale Fraud (Allen 2008) highlighted the fraudulent and deviant behavior by Jerome Kerviel which resulted in losses of $7.2 billion (€4.9 billion). The Lehman Brothers collapse was argued to be the result of a culture of hubris, “imprudence”, “corruption” and “fraudulent behavior” (Gaffney 2009; Jameson 2009), the knock-on effect of the Lehman Brothers failure was at an institutional level that generated a contagion effect impacting other banking institutions. Schlich and Prybylski (2009) argue for the adoption of “risk awareness culture” in US banks in the aftermath of the financial collapse, this argument was echoed by Professor Patrick Honohan (2009) who calls for banks [Irish] to “renew and reform” business models and their culture. Dysfunctional behavior in Irish banks is not a recent phenomenon, with reported cases of “corruption” and “unethical behavior” (Knights and O'Leary 2005) that existed within a “culture of unacceptable behavior and practices” (IFSA 2004) and most recently Irish bank failures have been blamed on lending behavior that was questionably ethical and socially irresponsible. These examples of dysfunctional behavior in the financial & banking sectors provide a solid basis with which to pose the question – can anything be done to reduce the impact of this behavior? The recent economic crisis demonstrates that dysfunctional organizational behavior has the capacity for systemic failure that extends beyond the individual and organization and into the larger societal landscape (Ely 2009; Federal Reserve System 2010; FSA 2009; Honohan 2009; IMF 2008; Power 2009). Kulik (2005) argued, “agency culture” was potentially as detrimental to corporate America as it was to Enron (p.358), a wake-up call that may have been ignored by organizational theorists. The question now remains – can HRD interventions do anything to minimize dysfunctional organizational behavior in the post economic crisis landscape? Literature Review: The concept of dysfunctional organizational behavior provides for a multitude of descriptors, many of which are beyond the scope of this paper. The search criteria included but was not limited to: Organizational Dysfunction, Dysfunctional Organizational Behaviour, Counterproductive Work Patterns, Dysfunctional Ethical Behaviour, Team Dysfunction, Management Dysfunction, Financial Collapse, Banking Failure and Workplace Deviant Behavior using standard academic databases such as: Business Source Premier, Academic Source Premier, Econlit, Web of Science and Web of Knowledge. From the results of the searches a number of distinct themes emerged such as: Anti-Social Behaviour, Socially-Undermining Behavior, Ethics, Corruption, Deviant Behavior and Dysfunctional Behavior. The search criteria was not confined to S/HRD results, dysfunctional organizational behavior is present at individual, team, organizational and institutional levels and the search criteria was designed to capture this. Within this paper, the term dysfunctional organizational behavior will refer to any behavior that is counterproductive to organizational performance, development or long-term viability. Defining Dysfunctional Organizational Behavior: Dysfunctional organizational behavior is observable on a number of levels, it exists at the individual, organizational and institutional level and the impact of dysfunctional behavior can range from a mere annoyance to organizational destruction. Individual / Team Level Dysfunctional Behavior At the individual/team level of analysis, a number of notable papers identify the negative role anti-social behavior, socially-undermining behaviour, deviant behavior, abusive supervision and unethical behavior can have on the organization. There is however, some overlap in terms of dysfunctional behavior that resides within all levels of analysis, e.g. morally questionable behavior and unethical intention / behavior (Kish-Gepart, Harrison, and Trevino 2010) and organizational wrongdoing (Palmer 2008). While the definitions are diverse, there are more similarities than differences (see Duffy, Ganster et al. 2006; Griffin and Lopez 2005; Mitchell and Ambrose 2007). Griffin and Lopez (2005) defined bad behavior as “any form of intentional behavior that is potentially injurious to the organization and/or individuals within the organization” (p.988) with Duffy et al., (2006) arguing that socially-undermining behavior is intended to “hinder over time” an organizational members ability to maintain a “positive and successful work-related reputation”. Individual behavior is reflective of “organizational cues” and the behavior of other colleagues and supervisors could arguably indicate a cultural or subculture environmental influencing force. In their study of the negative consequences of abusive supervision, Tepper et al., (2008) found that workplace norms play a “moderating” role in organizational deviance (p. 729). They argued that abused subordinates withdraw and should “experience less affective commitment to the organization” (p.722). The impact of withdrawal and reduced commitment to the organization in terms of positive organizational citizenship behavior (OCB) can have a bottom-line affect on organizational efficiency, productivity and development. Cole et al., (2008) posited dysfunctional team behavior is “any observable, motivated behavior by an employee or group of employees that is intended to impair team functioning” (p.945) with Litzky et al., (2006) identifying “social pressures to conform” (p.94) as antecedents of dysfunctional behavior. The darker side of leadership behavior (Resick et al. 2009) illuminates a narcissistic personality characteristic that has the capacity through “pervasive” patterns of “grandiosity”, to spread throughout the organization and influence organizational cultural norms and behavior. Indeed, there are examples of narcissistic behavior in some of the banking collapses and near collapses. The former head of Allied Irish Banks plc (AIB) Eugene Sheehy was famously quoted as saying [AIB] “would rather die than raise equity”, this comment was in relation to AIB‟s solvency - this statement was reversed within weeks with the Irish government now a majority shareholder in the bank. Within the literature on counterproductive organizational behavior, Levine (2010) succinctly illuminates the negative effect of counterproductive behavior on the organization [Arthur Andersen], he argued “counterproductive behavior by the individual” was a critical dimension of organizational success or failure, more importantly however, were his remarks about counterproductive behavior being “permitted” or “encouraged” by the organization (p. 4). Levine defined counterproductive work behavior (CWB) as actions or behavior taken by a “substantial number of organizational members” through policies or norms that the organization either “intentionally overlooked or implicitly or explicitly encouraged” that adversely affected “customers, competitors, government agencies and entire nations” (p.6). The influential role of leadership should not be underestimated when examining dysfunctional behavior, as Prati et al., (2009) posit “leaders develop quality relationships” with organizational members and can influence “norms and guide behavior” (p.411). It is this dysfunctional behavior that may have metastasized into organizational level and institutional level dysfunction. The failure of Freddie Mac and Fannie May in the US was predicated on a “destructive race” (Timiraos 2010) to lower lending standards in an attempt to compete with Wall Street banks. Ultimately, poor management and lax regulation were identified as central to the failure of these banking institutions; this was also true of the banking crisis in both the UK and Ireland. Organizational Level Dysfunctional Behavior There are numerous definitions of dysfunctional behavior at an organizational level within the literature with Lange (2008) defining organizational corruption as the “pursuit of individual interest by one or more organizational actors” through “intentional misdirection” of organizational resources or “perversion of organizational routines”. Levine (2005) however argues that corruption entails a “higher end”, something more than increasing ones personal wealth, there must be a “perversion of public trust”. In examination of the current crisis, it is apparent, that Levine‟s proposition holds true. Indeed, there are striking similarities between the collapse of Enron in 2001 and events that led up to the current financial crisis. Deregulation in the energy market led to an “elimination of norms” in terms of “legally imposed limits”, there was, as Levine argues, a general acceptance of treating accounting practices (in the case of Enron) as rules to get around. During the current economic crisis, a similar organizational culture emerged, one of engaging in unethical behavior (Kish-Gepart, Harrison, and Trevino 2010) not at an individual level but at an organizational level. In terms of the current economic crisis, this behavior could be categorized as counterproductive to organizational survival. At an organizational level, Levine (2010) defined counterproductive behavior as “actions” taken by a “substantial number of organizational members” that adversely affects “customers, competitors, government agencies and even entire nations”. In light of the global economic crisis and financial cost, counterproductive behavior at an organizational level may have had an impact at an institutional and macro-institutional level. Investment teams within US banks dealing with subprime mortgages and securitized products such as CDO‟s knowingly and intentionally labelled high-risk investment products as low-risk products with the aid of ratings agencies such as Moody‟s and Standard & Poor‟s who colluded in the deceptive practices. The proclivity of banks to engage in risky strategies that were unsound and in contravention of their fiduciary responsibilities highlights what Palmer (2008) refers to as collective wrongdoing, defined as “behavior perpetrated by organizational officials (i.e., directors, managers, and / or employees) in the course of fulfilling their organizational roles judged by social control agents to be illegal, unethical or socially irresponsible” (p.107)”. Corrupt organizational behavior Pinto et al., (2008) posit, is when a “group of employees” carries out corrupt behaviors “on behalf of the organization”, this is primarily a “top-down phenomenon” (p.689) that benefits both the organization and the “dominant coalition”. It is important to note that external environmental factors such as regulations, shareholder pressure and analysts expectations may have influenced the collective dysfunctional behavior in US, UK and Irish banks. The violation of organizational rules such as prudent risk assessment and loan stress testing may have been in pursuit organizational goals and as Lehman and Ramanujam (2009) argue, rule violation is higher when the expectation that “regulatory enforcement” is low. Initial evidence from the current financial crisis would support this position. What led so many financial and banking institutions to engage in this type of dysfunctional behavior? The procyclicality of bank lending behavior (Berger and Udell 2004) explains only the mechanics behind lending practices in the banking industry and its relationship to the business cycle – it does not fully explain the irrational behavior of banks at an organizational level or institutional level. Rational behavior gave way to irrational exuberance and overreliance on complex risk models, there was as Krugman (2009) argues, a “romanticized” and “sanitized” view of the economy that led economists to ignore bubbles and bust cycles, this myopic perspective spread to the financial & banking institutions with devastating consequences. What is interesting about the current economic crisis is the institutional level of dysfunction which was not contained within the financial & banking institutions but existed on a macro level and included government and the regulators. Institutional Level Dysfunctional Behavior The benefit of the institutional level of analysis is that it takes a systemic or aggregate perspective of organizations, i.e.: financial & banking organizations, insurance organizations, accountancy & auditing practice and their interaction with for example: government agencies, financial regulators, auditing firms. This level of analysis according to Dimaggio and Powell (1983) is that it “directs our attention” to not just the inter-organizational interaction but to the “totality of relevant actors” (p.148). In examination of the current economic crisis, it would seem an appropriate level of analysis to view dysfunctional behavior on a macro scale given the mimetic isomorphic pressure on banking institutions to seek legitimacy among other banking institutions in what became a race to the bottom in terms of lending behavior and investment strategies. Institutional level dysfunction has been defined by Misangyi, Weaver, and Elms (2008) as “misuse of a position of authority for private or personal benefit” with Venard and Hanafi (2008) arguing that corruption in financial institutions “relies” on “transgressions of legal norms”. Both of these definitions provide insight into corruption as a dysfunctional behavior that can be applied at an institutional level; however does not fully capture the macro dimensions that typify the current financial crisis. Nielsen‟s (2003) definition on the other hand, illustrates the macro dimensional reach of institutional corruption that was evident in the international financial & banking crisis. Nielsen argued corruption at an institutional level was characterized as “subsystems of corruption that extend beyond geographic, socio-political and political-economic systems”. This is perhaps the most accurate description of institutional level corruption that applies to the current economic crisis. The macro-prudential interconnectedness of the global financial system manifested in a contagion effect that spread from bank to bank as they questioned their exposure to the subprime market following the collapse of Lehman Brothers in September 2008. What is interesting from a HRD perspective is the herding behavior that senior management engaged in at the largest US commercial and investment banks. Rajan (2005) argued that because [investment] managers compensation relates to returns, there is a “greater incentive to take risks” (p.316). The behavior of their peers was also cited as a dimension that provided insurance against “underperformance” – an institutional culture influence of sorts? This prescient argument resonates in the most visceral way in light of the US banking collapse in 2008-2009. When Lehman Brothers collapsed it started a contagion effect among US investment banks which then spread globally, severely impacting and prolonging recovery from the recession. It also highlights how bank behavior is sometimes not based on sound business decisions but those of the „herd‟. In the case of the Irish bank AIB, aggressive lending practices by a competitor Anglo Irish Bank “pushed” AIB to “relax its lending standards” (Kenna 2010). Levinson (2009) provided some insight into how senior executives in US banks made decision on their investment strategies, Chuck Prince ex-CEO of Citigroup was quoted by the Financial Times as saying “when the music stops” in terms of liquidity “things will be complicated but as long as the music keeps playing, we have to dance”. The admission by the ex-CEO of one of the largest banks that collapsed in the crisis provides a stark reminder that despite evidence to the contrary, their decision making can be based on little more than neuroticism (Kets de Vries and Miller 1984). Venard and Hanafi (2008) illustrate the isomorphic nature of organizations at an institutional level, they argue that “similarity is the result of organizations‟ quest to attain legitimacy within their environment”(p.484). This institutional level dysfunction is evident in the financial and banking institutions affected by the current economic crisis. Competitive isomorphism within the financial and banking sector illustrates the pressure toward similarity resulting from market competition; an example of this was the practice of a large portion of US banks to engage in the business of selling securitized products brought about by pressure from their competitors. The inability or complacency of the financial regulator in the US, UK or Ireland to enforce financial regulations may have stemmed from not wanting to “alienate powerful constituencies in the process of rule enforcement” (Lehman and Ramanujam 2009: 649). In Ireland, there was a similar mindset in operation, however, the focus was on the property market and not securitized products. Competition among banks in the commercial property market may have fuelled their risk appetite to a point where their lending decisions exposed them to potential failure Canoy et al., 2001 (cited in O' Sullivan and Kennedy 2007). This embedded risk culture may have prevented banks from recognizing or understanding their overexposure, this type of behavior was, with hindsight, injurious to the organization (Griffin and Lopez 2005) but more crucially, injurious at an institutional level. In both the Irish case and internationally, regulatory bodies were operating in a “complacent and permissive” way with a “light touch” regulatory approach (Honohan 2009), the UK was no different, in the UK the Financial Services Authority (FSA) concluded that there were “deficiencies in supervision” and an opaque understanding of the macro-prudential characteristics of the financial and banking sector (FSA 2009) that contributed to the banking failure there. Nielsen (2003) argued that corrupt sub-systems quite often choose to ignore the dysfunctional behavior because of their “compromised” positions. An example of this in the Irish context is the close relationship between senior management in Irish banks and the regulators office in which annual growth of 36 per cent in Anglo Irish Bank failed to attract the attention of the regulators office, Central Bank or Department of Finance (O'Halloran 2010). This socially irresponsible behavior has had a detrimentally negative effect on society and illustrates the very worst outcome as a result dysfunctional organizational behavior. In monetary terms, the dysfunctional organizational behavior is expected to be in the region of $11 trillion US and the impact on the Irish economy is thought to be in the region of €75 - €80 billion with a global loss in economic output estimated at US$200 trillion (Hannon 2010). The human costs are much higher with organizations failing or significantly reducing their workforces as a result of the dysfunctional behavior. Unemployment levels globally have risen sharply resulting in emigration from the worst affected economies with the knock-on effect of prolonged recovery that may last for a number of years. The announcement by the SEC of pursuing Goldman Sachs and one of its vice presidents on a charge of fraud illustrates the institutional effect of dysfunctional behavior. Following the announcement, Goldman shares plummeted 13% wiping out US$12 billion in shareholder wealth with a knock-on effect in other major banks such as JPMorgan Chase, Morgan Stanley and Citigroup who lost between 3% - 5%. In the context of this paper, we define dysfunctional organizational behavior as being behavior that has the capacity to negatively affect the well-being of the individual, team and/or organization in terms of psychological safety, positive affective organizational commitment and organizational development and has potential for organizational, institutional and/or societal reach that is potentially harmful. Author Dysfunctional Behavior (Individual / Team Level) Duffy et al. (2002); Duffy et al. (2006a); Duffy et al.( 2006b); Berry et al. (2007); Brown and Trevino (2006); Diefendorff and Mehta (2007); Dunlop and Lee (2004); Flemming and Zyglidopoulos (2007); Glomb and Liao (2003); Griffin and Lopez (2005); Judge et al. (2006); Lawrence & Robinson (2007); Litzkey et al. (2006); Robinson & Bennett (1995); Palmer (2008) Tepper et al. 2008 “Social Undermining” Cole et al. 2008; Felps et al. (2006) “Dysfunctional Team Behavior” Author (Bad Behavior) Deviant behavior; Aggressive behavior; Anti-social behavior 2 Organizational Wrongdoing” “Negative effect of Abusive Supervision” Dysfunctional Behavior (Organizational Level) Levine (2010) “Counterproductive organizational behavior” Ashforth et al. (2008); Kish-Gephart et al. (2010); Pinto et al. (2008); Pfarrer et al. (2008) “1Unethical intention” – “2Unethical Behavior” / “3Corrupt Behavior” Van Fleet and Griffin (2006); Guerra et al. (2005); Lehman and Ramanujam (2009) “Dysfunctional Organizational Culture” Lange (2008) “Organizational Corruption” Author Dysfunctional Behavior (Institutional Level) Definition “…behavior intended to hinder, over time, a worker’s ability to establish and maintain positive interpersonal relationships…favourable reputations” “...any form of intentional behavior that is potentially injurious to the organization and/or individuals within the organization” “…voluntary behavior that violates organizational norms…threatening the wellbeing of the organization or its members” “…2behavior perpetrated by organizational officials (i.e., directors, managers, and / or employees) in the course of fulfilling their organizational roles judged by social control agents to be illegal, unethical or socially irresponsible” “.. organizational members will experience less affective commitment to the organization” (p.722) “…any observable, motivated behavior by an employee or group of employees that is intended to impair team functioning” (p.945) Definition “…actions that adversely affect customers, competitors, government agencies, even entire nations taken by a substantial number of organizational members, and the organization through its policies or norms permits, intentionally overlooks or encourages such actions either explicitly or implicitly” “…1the expression of one’s willingness or commitment to engage in an unethical behavior” “…2any organizational member action that violates widely accepted (societal) moral norms” (p.2) “…3in which a group of employees carries out corrupt behaviors on behalf of the organization” “..one that constrains or limits individual or group-level capabilities or that actually encourages and rewards mediocre individual- and group-level performance”(p.699) “…the pursuit of individual interest by one or more organizational actors through the intentional misdirection of organizational resources or perversion of organizational routines” Definition Misangyi et al. (2008) “Institutional Corruption” “…misuse of a position of authority for private or personal benefit” Venard and Hanafi (2008) “Corruption in Financial Institutions” Neilsen (2003) “Corrupt Networks” “….relying on transgression of legal norms”1 “….behavior by public officials that deviates from accepted moral standards” 2 “….systemic sub-systems of corruption that extend beyond geographic regions and socio-political and political-economic systems” 1 2 Nye (1967) Brooks (1970) Re-conceptualizing the strategic HRD framework Over the past number of years strategic HRD has been extensively examined and conceptualized (see Ardichvili and Jondle 2009; Budhwar and Sparrow 2002; Garavan 2007; Garavan and McCarthy 2008; Garavan, McGuire, and O'Donnell 2004; Lengnick-Hall et al. 2009; McGuire et al. 2007; O'Donnell et al. 2007; Peterson 2008), with the focus being on presenting models or frameworks that depict how various interventions provides for positive impact and potentially contribute to sustained competitive advantage through utilization of the organizations human intellectual capital. There has been little by way of examining HRD dimensions / interventions through a dysfunctional organizational behavior lens. The proposed framework illustrates organizational capacity for dysfunctional behavior through HRD interventions, the behavior may be the bi-product of environmental and socio-environmental conditions and in examination of these potentially negatively impacting organizational behaviors. The authors have provided linkages illustrating the negative impact on and influence of HRD interventions as well as indicating the degree of impact using the levels of analysis approach. The framework proposes a new level of HRD intervention primarily aimed at acting as a safeguard for the organization. In the new economic environment, HRD will need to adopt the role of organizational governance and agency mediation control to ensure agency culture (Kulik, O'Fallon, and Salimath 2008; Kulik 2005) does not result in negative organizational and societal impact but also to ensure the organizational culture remains a positive dimension and does not turn toxic or dysfunctional. The framework provides an analysis of how HRD interventions have a potentially negative impact on organizational behavior which has a resultant knock-on effect / impact on SHRD goals & objectives. The conceptual framework highlights areas for further study in terms of how SHRD interventions influence dysfunctional organizational behavior. At level 1 of the proposed conceptual model, the primary unit of analysis is on individual dysfunctional behavior that is influenced by HRD interventions and/or has a negative impact on HRD interventions. „Bad‟ behavior and socially-undermining behavior (Duffy, Ganster, and Pagon 2002; Duffy, Ganster et al. 2006; Duffy, Shaw et al. 2006; Griffin and Lopez 2005) could potentially be influenced by organizational culture/subculture. Griffin and Lopez (2005) argue that a once “talented” and “hardworking” employee may engage in activities deemed to be bad or dysfunctional if he / she were moved to a new group / team whose norms were incongruent to his/her own, that employee may engage in dysfunctional behavior directed at the new team members or may embrace the team behavior and engage in dysfunctional behavior toward the organization. Eden and Spender (1998) provide a rich analysis of the tension between the social and systemic dimensions of cognition and the individual who acts within that social context, eventually becoming an autonomous member whose actions reflect the “reality” of that universe (p.33), this cultural backdrop has the ability to influence not just the cognition of the individual but that of the collective. When we examine the impact of this behavior on HRD interventions, it is reasonable to argue that this type of dysfunctional behavior can have a negative impact on HRD interventions such as: building organizational trust, open communications, psychologically safe environment and commitment to perform. If dysfunctional organizational behavior such as abusive supervision (Mitchell and Ambrose 2007; Tepper et al. 2008) is ignored by senior management because organizational goals and objectives are being met, it may create hostility and result in what Mitchell and Ambrose refer to as “displaced” deviant behavior directed at the organization, in turn the behavior may negatively affect how other employees perceive the psychologically safe environment and also have a negatively impact both OCB and organizational performance & development. Concepts such as a culture of learning and organizational culture have the potential to influence dysfunctional behavior such as have been described at an individual level. This behavior can then snowball and infect the team or organization (Ashforth et al. 2008). In the proposed model we illustrate the potentially influencing relationships through a dysfunctional lens identifying how the behavior may manifest and the impact of that behavior on HRD interventions such as those described in Figure 1. Providing interventions that address how dysfunctional behavior is influenced, motivated and facilitated at an individual level is a critical first step in addressing how dysfunctional behavior can embed and spread at an organizational and institutional level. Werbel and Balkin (2009) argued that at an organizational level, performance rewards aimed at employees who achieve and exceed goals and objectives through “misconduct” sends a clear “symbolic” message, it legitimizes the behavior. Further, employees engage in a process of rational choices where the employees weigh up the opportunity gain from the reward/incentive against the “fear of being caught” (performance assessment). The thrust of the paper illuminated how HR practices can potentially influence misbehaviour from an individual bottom-up perspective; it does not address the behavior from a systemic perspective. Ashforth et al., (2008) contend that corruption as a dysfunctional behavior is both a “state” and a “process”, engaging in a symptomatic response is limited as it fails to address the complexity of the interconnections, furthermore, in their analysis of organizational corruption they argued that the corrupt behavior of the individual can spread like a “virus” (p.671). Moreover, if the actions of the individual are left unchecked they can “spread to other individuals and magnify in scope and audacity”, potentially impacting at an organizational and institutional level. What is clear from the research is that individual actions of dysfunctional behavior are rarely contained and can influence the behavior of others, organizational learning and socialization is particularly susceptible in acting as a conduit for this behavior to be transmitted throughout the organization. If one examines how new Enron employees were socialized into its culture it becomes clear that the processes of socialization of corrupt and unethical work practices were an organizational norm that was the vision or organizational identity developed by senior leadership. Level 2 / Level 3 of the proposed conceptual model examine the organizational / institutional level and antecedents of influence on dysfunctional behavior. Arguably, SHRD input variables such as: alignment with organizational goals, commitment to improving performance and capacity for strategic engagement (Garavan 2007; O'Donnell et al. 2007; Peterson 2008) are essential dimensions that potentially facilitate sustained competitive advantage. These interventions however, can also influence dysfunctional behavior, a point illustrated by Palmer (2008) who suggested “subtle rewards and punishments, moulded attitudes and behaviors defined the situation” (p.122), perhaps an indication of how influential cultural, social and environmental cues are in dysfunctional organizational behavior. Dysfunctional behavior is not confined to individual or teams, it has also been shown to originate in organizational leadership (Van Fleet and Griffin 2006) and become “contagious” (Godkin and Allcorn 2009), “toxic” (Goldman 2006) and “counterproductive” (Harvey and Martinko 2006). In the future organizational landscape, strategic HRD may need to assume a more moderating role, one that recognizes that forming and maintaining strategic partnerships and capacity for strategic engagement should be in the best interest of not just the organization but society as well. Alignment with organizational goals/objectives and a strategic perspective may be linked to dysfunctional behavior that is “symbolically” accepted by the organization (Werbel and Balkin 2009). These objectives can be a moderator in dysfunctional team behavior and deviant workplace behavior which can negatively impact HRD interventions such as commitment to perform, capacity for trust and organizational learning & socialization. This level has the capacity to reinforce individual level dysfunction but also infect a supra-organization level (societal) that has the potential to have detrimental impact at an institutional and societal level. Environmental factors both internal and external have been shown to influence dysfunctional behavior within the organization (see Balthazard, Cooke, and Potter 2006; Gelfand, Leslie, and Keller 2008; Goncalo and Duguid 2008; Harrison, Ashforth, and Corley 2009; Linnenluecke and Griffiths 2009), a point clearly made by Chreim 2002 cited in (Prati, McMillan-Capehart, and Karriker 2009) arguing, the more a member views the organization as the embodiment of his or her own self, the “stronger the identification and higher the cognitive, emotional and behavioral components” (p.411). It is difficult to divorce dysfunctional behavior from organizational culture as individuals behave in ways that are consistent with group norms, values and beliefs, there are as Gregory et al., (2009) argue, “behavioral expectancies that dictate the way employees behave consistent with their cultural beliefs” (p. 674). In a similar tone, Gelfand et al., (2008) posited that “dominating conflict cultures will be more prevalent in highly competitive industries” whereby the highest value is placed on “coming out ahead or beating the competition” (p.149). This type of cultural backdrop reflects an environment that is neither conducive to nor facilitative of an operationally sound organization. Moreover, HRD interventions in terms of creating and maintaining strategic alliances with all organizational stakeholders and managing organizational knowledge and a culture of learning is paramount as a first step in ensuring organizational capability does not become organizational incapacity. This level of analysis is perhaps the most critically important, although organizational culture may influence individual behavior, as Ashforth et al (2008) alluded to, “people can engage in [dysfunctional] practices as a result of “immersion in, and socialization into the social and cultural environment of a corrupt organization”. In examination of the institutional and societal impact of the global financial crisis 2008-2009, there are indications that incentive structures may have influenced some of the reckless behavior, both in Ireland, UK and US (Levinson 2009; McSweeney 2009; Schlich and Prybylski 2009; Federal Reserve System 2010; Greenfield 2010; Honohan 2010). There are also indications that organizational leadership was highly influential in infecting the behavior of organizational members at a toxic and disruptive capacity and further indications that reckless lending practices and investment strategies existed within an agency culture (Kulik, O'Fallon, and Salimath 2008) that contributed to the collapse of so many well respected organizations. We propose a new role for HRD in light of the global financial & banking crisis. In this new role, HRD will assume an Organizational Governance and Agency Mediation Control mandate. This responsibility should be to sit at board level and provide insight to senior management and executive level personnel on organizational dimensions that are not visible but can have a significantly negative impact on organizational development and survival – culture & socialization. This new role will also provide HRD with a place at the table and a more influential position in developing organizational goals and objectives rather than implementing them through the organizations human intellectual capital. The desire for HRD to become strategic partners to the business and aligned with organizational goals/objectives can potentially lead to instances of dysfunctional organizational behavior in pursuit of profit. The impact on HRD is a potential reduction in organizational trust, questionable contribution to stakeholder value and short-term performance gain at the expense of long-term viability. Table 4: SHRD perspectives with negative effect and levels of analysis impact Author SHRD Intervention Ulrich 1998 Strategic partner with management Employee Champion Business Acumen Facilitate organizational transformation Help shape organizational goals & objectives Formulate HRD plans & policies Partnership with management & HRM Influence culture Environment scanning Developers of Business Strategy Embedded with senior management Human capital developers / Strategic partners / Functional Experts Impact / Effectiveness / Efficiency Talent pools / Manage resources & processes / Sustainable strategic success Human intellectual capital (capacity) McCracken & Wallace 2000 Ulrich & Brockbank 2005 Boudreau & Ramstad 2007 Garavan 2007 Peterson 2008 Strategic Orientation SHRD Strategies, Systems & Practices Understand / Manage firm culture Strategic partnership with senior management Climate of support Culture of Learning Capacity for Strategy / commitment to perform Aligned with Mission / Leadership Business acumen / strategic perspective Forge relationships / create HPWS / develop accountability Negative Effect of Interventions (Dysfunctional Behavior) Levels of Analysis Impact Socially-Undermining Behavior Individual / Team Dysfunctional Organizational Culture Abusive Supervision / Workplace Deviance Counterproductive organizational behavior Unethical Behavior / Organizational wrongdoing Individual / Organization / Institutional Individual / Organization Organization / Institutional / Dysfunctional team behavior / Dysfunctional culture Workplace deviance / Dysfunctional culture Unethical Behavior / Dysfunctional culture / Organizational wrongdoing Organization / Institutional Abusive supervision / Workplace deviance / Dysfunctional team behavior / Dysfunctional Culture Dependent Organization Disorder / Dysfunctional Culture Workplace deviance / Dysfunctional team behavior Workplace deviance / Dysfunctional team behavior Counterproductive / Unethical behavior / Organizational Wrongdoing Workplace deviance Organization / Institutional Dysfunctional team behavior Dysfunctional organizational culture Counterproductive organizational Organizational wrongdoing Organization Organization Organization / Institutional Organization / Institutional behavior / Individual / Organization / Institutional Organization / Institutional Individual / Organization Individual / Organization Individual / Organization / Institutional Organization / Institutional Individual / Organization Figure 1: Implications for Theory The academic community have contributed significantly to understanding dysfunctional organizational behavior from multiple perspectives. Analyzing dysfunctional organizational behavior using a multi-level perspective provides a micro, meso-macro, macro analysis of the impact of this behavior. The proposed model allows for analysis of HRD interventions through a dysfunctional behavior lens illustrating the impact at a multi-level perspective that includes institutional and societal impact. As the study of HRD is concerned with systems, processes and procedures that utilize human intellectual capital in pursuit of organization goals/objectives with the ultimate aim of achieving sustained competitive advantage, it is in imperative that as scholars, we understand the systemic nature of dysfunctional organizational behavior and the toxicity in which many organizations immerse themselves. There are divergent thoughts on where the role of HRD lies; is it confined to primarily organizational level interventions or is it responsible at all levels up to, and including national level. The events of the past 24 months should illustrate that HRD interventions and the study of HRD should be focused at the organizational level with an understanding of the institutional and societal impact of those interventions. This multi-stakeholder perspective provides the contextual basis for future abstractions of HRD interventions that may ensure against future organizational failures of the magnitude witnessed in the international financial & banking crisis. Future study of S/HRD should perhaps look beyond the systems thinking that seems to be pervasive in the research and look to analysis through a behavioral or rational choice theory lens in conjunction with the resource-based view (RBV) of the firm when considering future developments in S/HRD. It is an imperative to understand the behavioral and cognitive dimensions of organizational behavior as the recurrent them in organizational dysfunctional behavior is not the systems, process or procedures – it is the human element. Implications for Practice The role of HRD professionals in the organization is a multifaceted and multidimensional role that interfaces with senior management, middle management and team leader / line mangers as well as organizational members on a daily basis. The ability to be cognizant of, and address the needs of organizational stakeholders is a daunting task. As credible partners in the business, HRD is expected to provide a role of consultancy to senior management, balance realistic expectations of stakeholders, implement strategies aimed at achieving organizational goals and objectives, be positive change agents, develop management and leadership skills, provide career development interventions, manage organizational culture and ensure organizational development remains a core function. This is a tough job. In light of the current financial & banking crisis, the role of HRD will now need to shift somewhat, it will need to take a more proactive role in the development, implementation and management of the new mandate of corporate social responsibility agents. In the proposed model, we argue that the creation of an Organizational Governance & Agency Mediation Control role is an imperative in fully addressing the short-comings that were present in the current economic crisis. This new role will see HRD take an active role at board level acting in an advisory capacity to the board, providing insight into cultural dimensions of the organization, this role will also allow the professional body tasked with developing the organizations human resources to act as an objective intermediary between senior management and the organization to ensure corporate social responsibility is a key feature and applied in practice not just theory. The impact of the international financial & banking crisis has had a significantly negative impact on many organizations and society. In the new ear, HRD professionals will need to expand their role beyond traditional dimensions of organizational development, career development, learning & development and performance management to consider the wider impact human resources have on the organization and society. At a strategic level, HRD will need to fully understand the implications and impact (positive & negative) of organizational goals and objectives and may need to develop the ability to say no, when and where required. The development of trust and credibility of HRD will have a much wider focus in future with institutional and societal measurements of delivery. Conclusion: This paper adds to current theory in a number of ways. Firstly, the paper provides an analysis of HRD interventions through a dysfunctional organizational behavior lens, to the best of our knowledge; this has not yet been done. Secondly, it proposes a conceptual framework of HRD interventions that have the capacity to influence dysfunctional organizational behavior and finally, suggests a new mediating role for strategic HRD in a new economic landscape that will act as organizational level governance interventions aimed at averting socially irresponsible behavior from impacting at an organizational, institutional and societal level. Ulrich and Brockbank (2005) apply a metaphor to highlight the strategic role of HRD in the organization suggesting that HR should be “in the game” not just at the game; however, this allegory may need to be re-conceptualized as being in the game may increase the risk of social contagion in terms of dysfunctional organizational behavior which may have been a contributory factor in the failure of the international financial and banking sectors. Godkin and Allcorn (2009) argued that a “contagion perspective speaks to unconscious but shared interpersonal and group dynamics” (p.485) so arguably then, strategic HRD will need to become referees of the game, acting impartially in the best interest of all organizational stakeholders whilst also ensuring strategic disengagement from management ideology or organizational orthodoxy if it is required, in order to act in the best interest of the stakeholders at an organizational, institutional and societal level. The role of architects now takes on a new perspective for HRD in the post economic crisis landscape – as theorists the objective is in analyzing how HRD interventions may have facilitated the failures and as practitioners, the focus is on looking to rebuilding organizational capacity, human intellectual capability and perhaps most importantly - trust and credibility. The proposed organizational governance and agency mediation control dimension of HRD may provide a foundation in restoring credibility and trust of all stakeholders, internal to the organization and also externally. The macro-dimensional reach of dysfunctional organizational behavior extends beyond the firm as failures of large organizations have a knock-on societal affect. If leadership sets the behavioral tone of organizational behavior as Godkin and Allcorn (2009) argue, then HRD will need to help set a new organizational tune. The global financial crisis has implications for how HRD evolves and positions itself in a new economic reality. If HRD are to become strategic agents for the organization in the new global environment, HRD will need to recognize potentially disruptive dysfunctional organizational behavior antecedents, implement interventions aimed at minimizing the impact on the individual, organization & society and build organizational trust and credibility by adopting a new Organizational Governance & Agency Mediation Control mandate. HRD will need to become more than strategic in thought and rhetoric; HRD will have to become strategic in its delivery. The requirement for the organization to conform to societal and legal norms should not result in a “check-list” approach to adherence, the development of an embedded organizational culture that is risk-aware and cognizant of the potential for negative societal impact from dysfunctional organizational behavior should not be “window dressing” but should be interwoven into the very fabric of how the organization operates (Ashforth et al. 2008). As HRD scholars and practitioners it is our responsibility to ensure socially responsible behavior is the outcome of our interventions and not dysfunctional organizational behavior. Trust and credibility should be the mantra and guiding principle of HRD interventions is the new post-crisis economic landscape. References Allen, S. 2008. Control Lessons from the Société Générale Fraud. Bank Accounting & Finance OctoberNovember 2008. Ardichvili, A., and D. Jondle. 2009. Ethical Business Cultures: A Literature Review and Implications for HRD. Human Resource Development Review 8 (2):21. Ashforth, B. E., D. A. Gioia, S. L. Robinson, and L. K. TreviÑO. 2008. Re-viewing Organizational Corruption. Academy of Management Review 33 (3):670-684. Balthazard, P. A., R. A. Cooke, and R. E. Potter. 2006. Dysfunctional culture, dysfunctional organization: Capturing the behavioral norms that form organizational culture and drive performance. Journal of Managerial Psychology 21 (8):23. Barrett, A., I. Kearney, J Goggin, and T. Conefrey. Quarterly Economic Commentary, Spring 2010 2010. Available from http://www.esri.ie/news_events/latest_press_releases/quarterly_economic_commen_7/index.x ml. Bennett, Rebecca J., and Sandra L. Robinson. 2000. Development of a Measure of Workplace Deviance. In Journal of Applied Psychology. Berger, A. N., and G. F. Udell. 2004. The instutional memory hypothesis and the procyclicality of bank lending behavior. Journal of Financial Intermediation 13 (4):37. Berson, Y., S. Oreg, and T. Dvir. 2008. CEO values, organizational culture and firm outcomes. Journal of Organizational Behavior 29 18. Blanchard, O., J. Caruana, and R. Moghadam. 2009. International Monetary Fund: Initial Lessons of the Crisis. Budhwar, P. S., and P. R. Sparrow. 2002. Strategic HRM through the Cultural Looking Glass: Mapping the Cognition of British and Indian Managers. Chreim, S. 2002. Influencing Organizational Identification During Major Change: A Communiction-Based Perspective. Human Relations 55 (9). Cole, M. S., F. Walter, and H. Bruch. 2008. Affective Mechanisms Linking Dysfunctional Behavior to Performance in Work Teams: A Moderated Mediation Study. Journal of Applied Psychology 93 (5):13. Cornelissen, J. P. , S. A. Haslam, and J. M. T. Balmer. 2007. Social Identity, Organizational Identity and Corporate Identity: Towards an Integrated Understanding of Processes, Patternings and Products. British Journal of Management 18:15. Dellaportas, S., B. J. Cooper, and P. Braica. 2007. Leadership, Culture and Employee Deceit: the case of the National Australia Bank. Corporate Governance 15 (6). Denison, D. R., and A. K. Mishra. 1995. Toward a Theory of Organizational Culture and Effectiveness. Organizational Science 6 (2):19. Dimaggio, P. J., and W. W. Powell. 1983. The Iron Cage Revisited - Institutional Isomorphism and Collective Rationality in Organizational Fields. American Sociological Review 48 (2):147-160. Duffy, Michelle K., Daniel C. Ganster, and Milan Pagon. 2002. Social Undermining in the Workplace. Academy of Management Journal 45 (2):331-351. Duffy, Michelle K., Daniel C. Ganster, Jason D. Shaw, Jonathan L. Johnson, and Milan Pagon. 2006. The social context of undermining behavior at work. Organizational Behavior and Human Decision Processes 101 (1):105-126. Duffy, Michelle K., Jason D. Shaw, Kristin L. Scott, and Bennett J. Tepper. 2006. The Moderating Roles of Self-Esteem and Neuroticism in the Relationship Between Group and Individual Undermining Behavior. In Journal of Applied Psychology. Eden, C., and J. C. Spender. 1998. Managerial and Orgnaizational Cognition: Theory, Methods and Research. London: Sage. Ely, B. 2009. Bad Rules Produce Bad Outomces: Underlying Public-Policy Causes of the U.S. Financial Crisis. Cato Journal (29):1. Federal Reserve System, Board of Governors. 2010. The Public Policy Case for a Role for the Federal Reserve in Bank Supervision and Regulation. edited by B. o. Governors. New York. Felps, W., T. R. Mitchell, and E. Byington. 2006. How, When, and Why Bad Apples Spoil The Barrell: Negative Group Members and Dysfunctional Groups. In Research in Organizational Behavior, Vol 27. FSA. 2009. Business Plan 2009/2010. Gaffney, M. 2009. Money, Credit and Crisis. American Journal of Economics and Sociology 68 (4):55. Garavan, T. N. . 2007. A Strategic Perspective on Human Resource Development. Advances in Developing Human Resources 9 (1). Garavan, T. N., and A. McCarthy. 2008. Collective Learning Processes and Human Resource Development. Advances in Developing Human Resources 10 (4):20. Garavan, T. N., D. McGuire, and D. O'Donnell. 2004. Exploring Human Resource Development: A Levels of Analysis Approach. Human Resource Development Review 3 (4):24. Gelfand, M. J., L. M. Leslie, and K. M. Keller. 2008. On the etiology of conflict cultures. Research in Organizational Behavior 28:29. Godkin, L., and S. Allcorn. 2009. Dependent Narcissism, Organizational Learning, and Human Resource Development. Human Resource Development Review 8 (4):21. Goldman, A. 2006. High toxicity leadership: Borderline personality disorder and the dysfunctional organization. Journal of Managerial Psychology 21 (8):13. Goldman, D. 2009. Troubled Asset Relief Program. http://money.cnn.com/news/storysupplement/economy/bailouttracker/index.html. Goncalo, J. A., and M. M. Duguid. 2008. Hidden consequences of the group-serving bias: Causal attributions and the quality of group decision making. Organizational Behavior and Human Decision Processes 107:14. Greenfield, Hope. 2010. The decline of the best: An insider's lessons from Lehman Brothers. Leader to Leader 2010 (55):30-36. Gregory, B. T., S. G. Harris, A. A. Armenakis, and C. L. Shook. 2009. Organizational culture and effectiveness: A study of values, attitudes, and organizational outcomes. Journal of Business Research 62:6. Griffin, Ricky W., and Yvette P. Lopez. 2005. "Bad Behavior" in Organizations: A Review and Typology for Future Research. Journal of Management 31 (6):988-1005. Hannon, P. . 2010. Economic Hit from Crisis: A Very Big Number. The Wall Street Journal. Harrison, S. H., B. E. Ashforth, and K. G. Corley. 2009. Organizational sacralization and sacrilege. Research in Organizational Behavior 29:29. Harvey, P., and M. J. Martinko. 2006. Causal reasoning in dysfunctional leader-member interactions. Journal of Managerial Psychology 21 (8):15. Hatch, M. J. 1993. The Dynamics of Organizational Culture. Academy of Management Review 18 (4):36. Hatch, M.J., and M. Schultz. 2002. The dynamics of organizational identity. Human Relations 55 (8):29. Herrbach, O. 2006. A matter of feeling? The affective tone of organizational commitment and identification. Journal of Organizational Behavior 27. Honohan, P. The Financial Crisis: Ireland and the World 2008. Available from http://www.tcd.ie/Economics/staff/phonohan/Littleton%20lecture.pdf. ———. Tools for systemic risk assessment in Europe - The Parameters of the International Financial Architecture Post Crisis 2009. Available from http://www.centralbank.ie/frame_main.asp?pg=nws%5Farticle%2Easp%3Fid%3D484&nv=nws_n av.asp. ———. What went wrong in Ireland? 2009. Available from http://www.tcd.ie/Economics/staff/phonohan/What%20went%20wrong.pdf. Honohan, P. 2010. Introductory Statement by Patrick Honohan, Governor of the Central Bank of Ireland to the Joint Oireachtas Committees on Finance and the Public Service. IFSA. 2004. Investigations in AIB Group on Foreign Exchange and Other Charging Issues & Deal Allocation and Associated Issues. edited by F. S. Regulator. Dublin: Financial Services Authority. IMF. Iceland Gets Help to Recover From Historic Crisis 2008. Available from http://www.imf.org/external/pubs/ft/survey/so/2008/INT111908A.htm. Jameson, D. A. 2009. Economic Crises and Financial Disasters: The Role of Business Communications. Journal of Business Communications 46 (4). Kenna, C. 2010. Sorry Saga of Ruinous Management. Irish Times. Kets de Vries, M. F. R., and D Miller. 1984. The Neurotic Organization. San Francisco: Jossey-Bass. Kish-Gepart, J. J., D. A. Harrison, and L. K. Trevino. 2010. Bad Apples, Bad Cases, and Bad Barrels: MetaAnalytic Evidence About Sources of Unethical Decisions at Work. Journal of Applied Psychology 95 (1):30. Knights, D., and M. O'Leary. 2005. Reflecting on corporate scandals: the failure of ethical leadership. Business Ethics: A European Review. Krugman, P. 2009. How Did Economists Get It So Wrong? New York Times. Kulik, B., M. O'Fallon, and M. Salimath. 2008. Do Competitive Environments Lead to the Rise and Spread of Unethical Behavior? Parallels from Enron. Journal of Business Ethics 83 (4):703-723. Kulik, B. W. 2005. Agency theory, reasoning and culture at Enron: In search of a solution. Journal of Business Ethics 59 (4):347-360. Lange, D. 2008. A multidimensional conceptualization of organizational corruption control. Academy of Management Review 33 (3):710-729. Lawrence, Thomas B., and Sandra L. Robinson. 2007. Ain't Misbehavin: Workplace Deviance as Organizational Resistance. In Journal of Management. Lehman, D. W., and R. Ramanujam. 2009. Selectivity in Organaizational Rule Violations. Academy of Management Review 34 (4):643-657. Lengnick-Hall, M. L., C. A. Lengnick-Hall, L. S. Andrade, and B. Drake. 2009. Strategic human resource management: The evolution of the field. Human Resource Management Review 19:21. Levine, D. P. 2005. The Corrupt Organization. Human Relations 58 (6):17. Levine, E. L. . 2010. Emotion and power (as social influence): Their impact on organizational citizenship and counterproductive individual and organizational behavior. Human Resource Management Review 20:13. Levinson, Mark. 2009. The Economic Collapse. Dissent (00123846) 56 (1):61-66. Linnenluecke, M. K., and A. Griffiths. 2009. Corporate sustainability and organizational culture. Journal of World Business. Litzky, B. E., K. A. Eddleston, and D. L. Kidder. 2006. The Good, the Bad, and the Misguided: How Managers Inadvertently Encourage Deviant Behaviors. Academy of Management Perspectives:12. McGuire, D., T. N. Garavan, D. O'Donnell, and S. Watson. 2007. Metaperspectives and HRD: Lessons for Research and Practice. Advances in Developing Human Resources 9 (1):19. McSweeney, Brendan. 2009. The roles of financial asset market failure denial and the economic crisis: Reflections on accounting and financial theories and practices. Accounting, Organizations and Society 34 (6-7):835-848. Misangyi, Vilmos F., Gary R. Weaver, and Heather Elms. 2008. Ending Corruption: The Interplay Among Instutional Logics, Resources, And, Entrepreneurs. Academy of Management Review 33 (3):750770. Mitchell, Marie S., and Maureen L. Ambrose. 2007. Abusive Supervision and Workplace Deviance and the Moderating Effects of Negative Reciprocity Beliefs. In Journal of Applied Psychology. Mody, A. 2009. IMF Outlook for Ireland. NAMA. 2010. Minister for Finance Statement on Banking Supplementary Documentation. edited by D. o. Finance. Nielsen, Richard P. 2003. "Corruption Networks and Implications for Ethical Corruption Reform". Journal of Business Ethics 42 (2):125-149. O' Sullivan, K. P. V., and T. Kennedy. 2007. A Model for Regulatory Intervention in Ireland. Journal of Banking Regulation 8 (2):17. O'Donnell, D., C. Gubbins, D. McGuire, K. M. Jorgensen, L. B. Henriksen, and T. N. Garavan. 2007. Social Capital and HRD: Provocative Insights From Critical Management Studies. Advances in Developing Human Resources 9 (3):22. O'Halloran, M. 2010. Noonan Calls for Clean Out of "Tainted" Senior Bankers. Irish Times. Oliver, E. 2010. Bank bailout cost of €73 bn manageable, says ESRI. Irish Independent. Palmer, D. 2008. Extending the process model of collective corruption. Research in Organizational Behavior 28:28. Peterson, S. L. 2008. Creating and Sustaining A Strategic Partnership: A Model for Human Resource Development. Journal of Leadership Studies 2 (2):14. Pinto, Jonathan, Carrie R. Leana, and Frits K. Pil. 2008. Corrupt Organizations or Organizations of Corrupt Individuals? Two Types of Organizational Level Corruption. Academy of Management Review 33 (3):685-709. Power, M. . 2009. The Risk Management of Nothing. Accounting, Organizations and Society 34:6. Prati, L. M. , A. McMillan-Capehart, and J. H. Karriker. 2009. Affecting Organizational Identity: A Manager's Influence. Journal of Leadership & Organizational Studies 15 (4):11. Probst, G., and S. Raisch. 2005. Organizational crisis: The logic of failure. Academy of Management Executive 19 (1):15. Rajan, R. G. 2005. Has Financial Development Made the World Riskier? : Federal Reserve Bank of Kansas City. Resick, C. J., D. S. Whitman, S. M. Weingarden, and N. J. Hiller. 2009. The Bright-Side and the Dark-Side of CEO Personality: Examining Core Self-Evaluations, Narcissism, Transformational Leadership, and Strategic Influence. Journal of Applied Psychology 94 (6):16. Schein, E. H. 1994. Organizational Psychology. 3rd ed. New Jersey: Prentice-Hall. ———. 2004. Organizational Culture and Leadership. 3rd ed. San Francsisco: Jossey-Bass. Schlich, B., and H. Prybylski. 2009. Crisis Changes View of Risk Management: Risk Governance. Bank Accounting & Finance August-September:3. SEC. SEC Charges Goldman Sachs With Fruad in Structuring and Marketing of CDO Tied to Subprime Mortgages 2010. Available from http://www.sec.gov/news/press/2010/2010-59.htm. Stein, M. 2007. Oedipus Rex at Enron: Leadership, Oedipal struggles, and organizational collapse. Human Relations 60 (9). Tepper, Bennett J., Christine A. Henle, Lisa Schurer Lambert, Robert A. Giacalone, and Michelle K. Duffy. 2008. Abusive Supervision and Subordinates' Organization Deviance. In Journal of Applied Psychology. Thomsen, P. IMF Executive Board Approves US$ 2.1 Billion Stand-By Arrangement for Iceland 2008. Available from http://www.imf.org/external/np/sec/pr/2008/pr08296.htm. Timiraos, N. 2010. Treasury Officials Says Housing Goals Not to Blame for Fannie, Freddie Failures. The Wall Street Journal. Ulrich, D., and W. Brockbank. 2005. HR The Value Proposition. Boston: Harvard Business School Press. Van Fleet, D. D., and R. W. Griffin. 2006. Dysfunctional organization culture: The role of leadership in motivating dysfunctional work behaviors. Journal of Managerial Psychology 21 (8):10. Venard, B., and M. Hanafi. 2008. Organizational isomorphism and corruption in financial institutions: Empirical research in emerging countries. Journal of Business Ethics 81 (2):481-498. Werbel, J., and D. B. Balkin. 2009. Are human resource practices linked to employee misconduct? Human Resource Management Review. Werther, W. B. Jr. 2003. Enron: The Forgotten Middle. Organization 10 (3). Zheng, W., Q. Qu, and B. Yang. 2009. Towards a Theory of Organizational Culture Evolution. Human Resource Development Review 8 (2):22.