Notes - Ceat

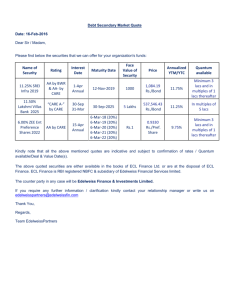

advertisement