Executive Summary

advertisement

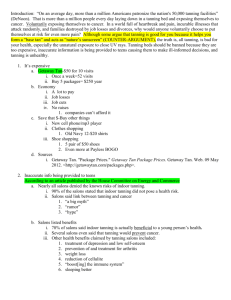

Executive Summary November LOREM IPSUM 2010 | i The Economic Gains From a Nebraska Sales Tax Exemption on Tanning Salon Services The accompanying table shows the economic impacts A provision of the 2010 Health Reform Bill placed a derived from a state sales tax exemption on tanning 10 percent tax on the gross revenues of indoor tanning salon services. services at tanning salons. For tanning salons located in most portions of Nebraska, this means a total 17 Total impact from Nebraska Sales Tax Exemption percent tax on gross revenues. Sales and employment in the tanning salon industry are likely to be responsive to changes in taxation on indoor tanning services at tanning salons and the negative response would be significant from a new targeted federal tax. Total Impact (added sales) $3,229,865 Added wages and salaries $1,096,794 The results of the new tax on tanning salons are: Gain in property tax collections Added Nebraska employment Gain in income tax collections Loss in state and local sales tax collections The combined federal and state sales tax places a significant tax burden on consumers of tanning services. • Many of these consumers also face increases in the cost of traveling further to patronize tanning salons as the industry contracts in reaction to the tax. • Reduces or eliminates the use of indoor tanning services distorting consumer choice. Given the responsiveness of consumers to price changes for this product, many operators of tanning salons will need to contract and/or be pushed into financial insolvency due to reduced consumer demand and efforts to absorb a portion of the tax without passing it onto consumers. • In response to the new tax burden, many tanning salon operators will either dissolve or cut back operations in towns, cities, and villages across Nebraska. • This will reduce state and local tax collections, shifting a portion of the burden of funding the health reform on to state and local taxpayers. • These losses imply that even those who do not patronize tanning salons will effectively pay a portion of this amount as the 10 percent federal tax reduces taxable economic activity in each state. A Study Produced By: Grand Island Center Stage closed its doors in August of 2010. $35,000 A significant fiscal burden placed on states and localities across the nation. Acute losses within the indoor tanning salon industry. • $29,000 $1,183,000 Source: Implan Multiplier System Negative impact to consumers. • 58.3