The Tragedy of the Commons?

advertisement

The Tragedy of the Commons?

Author(s): Prajit K. Dutta and Rangarajan K. Sundaram

Source: Economic Theory, Vol. 3, No. 3 (Jul., 1993), pp. 413-426

Published by: Springer

Stable URL: http://www.jstor.org/stable/25054712

Accessed: 21/10/2010 13:56

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at

http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless

you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you

may use content in the JSTOR archive only for your personal, non-commercial use.

Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at

http://www.jstor.org/action/showPublisher?publisherCode=springer.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed

page of such transmission.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Springer is collaborating with JSTOR to digitize, preserve and extend access to Economic Theory.

http://www.jstor.org

Econ. Theory 3,413-426

(1993) "^ ?

Economic

Theory 1993

?

Springer-Verlag

The tragedy of the commons?*

Prajit K. Dutta1

1

2

Department

Department

November

Received:

K. Sundaram2

and Rangarajan

of Economics,

of Economics,

22,1991;

New York, NY

10027, USA

University,

NY

of Rochester,

14627, USA

Rochester,

Columbia

University

revised

version March

16,1992

of the set of Markov-Perfect

provide a complete characterization

resource

of

games a la Levhari and

(MPE)

Equilibria

dynamic common-property

We

MPE

Mirman

find

all

of

exhibit

that

such

games

(1980).

remarkably regular

Summary.

We

nature,

however, and despite their memoryless

dynamic behavior. Surprisingly,

MPE need not result in a "tragedy of the commons",

of the

i.e., overexploitation

resource relative to the first-best solutions. We show through an example that MPE

of underexploitation

of the resource.

could, in fact, lead to the reverse phenomenon

we

are

demonstrate

Nonetheless,

that, in payoff space, MPE

always suboptimal.

1 Introduction

It is commonly

that when

several agents simultaneously

believed

exploit a

resource, the resulting externality will lead to overuse

productive common-property

or overexploitation

of the resource relative to the first-best situation, a phenomenon

the tragedy of the commons. The object of this paper is to

sense, if any, this view may be considered valid.

At least implicitly, the reasoning behind the existence of a "tragedy" involves an

to enforce

that players are not using history-dependent

strategies

assumption

is a phenomenon

"good" outcomes. In game-theoretic

terminology, overexploitation

to be associated with Markov-Perfect

of common-property

Equilibria or MPE

resource games. If players are conditioning

their equilibrium behavior solely on the

that has been

termed

in what

examine

current "state" of the game, but not on the history

*

The

first

University;

was a graduate

Sundaram

student at Cornell

when

this paper was written

was

the California

when

he was visiting

Institute

of

version

completed

to

in

are grateful

like

to many

and

would

for

their

thank,

advice,

particular,

people

version

the

that led to that state, the intuition

of

current

We

Technology.

and Karl Shell. We

Andreu Mas-Colell,

Mukul Majumdar,

Tapan Mitra, Debraj Ray, Aldo Rustichini,

at presentations

of participants

in Columbia

from the comments

also benefitted

(Fall 1988)

University

Partial support for this project was provided

and Caltech

by

(Spring 1990), and at various conferences.

the NSF

under Grant

86-06944

(principal

investigator:

Karl

Shell).

414

P. K. Dutta

and R. K. Sundaram

this reasoning appears compelling. Yet we show in this paper that, sur

prisingly, it is also false.

in a slight variant of the Levhari

In Sect. 3 of this paper, we derive an MPE

War"

Mirman

"Fish

in

which

of the resource

(1980)

example,

underexploitation

occurs from an interval of initial states. No nonconvexities

or pathological properties

the construction

is based on a simple point whose

drive this example. Rather,

behind

resource

importance may extend beyond the current context. Common-property

as

are

indeed

all

stochastic

from

games,

games,

distinguished

repeated games by the

a

state

asset - that moves

of

variable

in

this

the

stock

of

the

case,

presence

through time in response to the players' actions. The last property indicates the use

of the state as a proxy for history, albeit a limited one. In turn, this enables indirect

on history even under Markovian

behavior,

although direct con

conditioning

ditioning may be precluded.1

Details of the formalization

of these ideas may be found in Sect. 3. Here, we will

content ourselves with the observation

that this construction

appears to extend

we

shown

have

that under

similar

using

quite generally. Elsewhere,

techniques

resource

MPE

exist

in

all

games in which

symmetric common-property

exploitation

not

do

discount

the

future.2

players

If a "tragedy" (which is a positive feature of equilibrium play) need not occur

under MPE,

the question naturally arises if, normatively

speaking at least, MPE

are suboptimal. We turn to this and related questions

in Sect. 4, where we provide

an exhaustive

resource

in general common-property

characterization

of MPE

games, without any functional form restrictions.

exploitation

Briefly put, our findings are the following. Under nothing more than the usual

restrictions, all MPE exhibit remarkably well-behaved

convexity

dynamics, with

state trajectories from any initial state eventually becoming monotone

(Theorem 1).

If the state trajectory meets a certain "asymptotic

criterion, then it

convegence"

must lead to a "tragedy" (Theorem 2). While a "tragedy" may, or may not, occur

true that in payoff space all MPE are strictly sub

it is, nonetheless

optimal (Theorem 3). Indeed, Theorem 3 is an immediate consequence of Theorem 2

and the properties of the first-best solutions.

As a final question, we examine why the many

that have been

examples

studied in the literature3 have, by and large, tended to "confirm" the presence of a

tragedy. We show that general sufficient conditions on MPE

strategies exist that

always lead to a "tragedy" (Theorem 4). Many examples in the literature satisfy at

under MPE,

least one, and typically more, of these conditions.

resource games.

Section 2 presents a general framework of common-property

of the Levhari-Mirman

Section 3 is concerned with our modification

example.

1

our work was independent, we discovered

that this idea was not altogether

original. A similar

Although

the arguments

in Fudenberg

idea motivates

and Tir?le

(1983).

2

the arguments

and Sundaram

makes

See Dutta

(1992b). The absence of discounting

considerably

simpler, since any finite number of periods are irrelevant under the long-run average criterion.

3

and Lewis (1985),

See, e.g., Lancaster

(1979), Levhari and Mirman

(1980), Easwaran

(1973), Mirman

or Reinganum

and Radner

and Stokey

(1985). See also Benhabib

(1990), who characterize

equilibria

when

players

have

linear utilities.

The

415

of the commons?

tragedy

Section 4 presents

the Appendix.

the remaining

results

listed above. All proofs

are to be found

in

2 The framework

2.1 The dynamic

resource game

we consider

The model

here is closely

related

to those in Lancaster

(1973), Levhari

and Mirman (1980),Reinganum and Stokey (1985),Amir (1987),Benhabib and

and Sundaram

Radner

(1988), Dutta

(1992a, b), and Sundaram

(1989), among

others. There is a single good, the "resource", which may be consumed or invested.

Conversion

of investment to output takes one period and is accomplished

through

a production function f: R + -? R +. In each period t of an infinite horizon, two4 agents

observe the available stock yt ^ 0 of the good, and independently and simultaneously

decide upon their consumption

denote player

plans for the period. Let aite[0,yj

i's planned period-i consumption.

If plans are collectively

feasible (au + a2t ^ y\

then they are carried out, and player i's (actual) consumption

cit equals his planned

infeasible (au + a2t > yt\ then we simply

ait. If plans are collectively

consumption

assume that each player receives half the available stock.5 The amount x,e[0,)>f]

left over after consumption

by the players forms the investment or savings in period

t and is transformed to the period-(i + 1) available stock yt+1 as yt+ x=f(xt). There

entire process now repeats itself the new stock level yt+x. Player i's utility in period

t is a function only of his own consumption

cit in the period, and is given by wf(cir).

Both players discount future utilities by the factor <5e(0,1), and attempt tomaximize

total discounted utility over the infinite duration of the game.

on the functions involved.

We make the usual neoclassical

assumptions

1. f

Assumption

is differentiable

/

is continuous,

on R++,

with

increasing

lim/'(x)

>

and strictly

concave

on R+; /(0) = 0;

= 0

l/<5, lim f'(x)

x|0

jc?oo

are continuous,

2. The functions nf:R+-^R

Assumption

concave on R+, and continuously

differentiable on R++,

increasing

i= 1,2.

and

strictly

that by the assumptions

of/, there is a unique stock level x > 0 such that

x

x

x ??x. Therefore, / maps S = [0, x] into itself,

x

x

for

and

for

^

f(x) ^

f(x) ^

loss of generality, restrict analysis to S. We also refer to S as

and we may, without

the state space of the game and to a generic element yeS as a state.

The tuple {S,fu1,u29?}

completely

specifies the dynamic resource game. We

Note

proceed

4

to define

strategies,

payoffs,

and MPE

to this game.

case purely for notational

to the two-player

simplicity.

As the reader may readily check, none of our general

of this rule is of no significance.

are instead determined

state y, allocations

if, in the event of infeasible plans (al,a2)ata

analysis changes

=

that satisfy 0^hl{y,alya2)^hl{yialia2)-\-h2(y,al,a2)

y. Indeed,

(hlth2)

by any pair of functions

For instance,

is never an equilibrium

possibility.

(hx, h2) may also be chosen to ensure that infeasibility

=

i^j, i,j = 1,2.

whenever

+ a2\

ax + a2 > y, let ht(y, a1,a2)

a,y/[ai

5

We

restrict

The

specificity

attention

416

P. K. Dutta

2.2 Markov-Perfect

and R. K. Sundaram

in the game

equilibria

In general, a strategy for a player i specifies a (planned) consumption

level for ?after

since our interest in the sequel is solely

each possible history of the game. However,

to

inMarkovian

strategies, we avoid spurious generality, and restrict definitions

case.

no

this

Standard dynamic programming

loss in strategic

arguments show that

to a Markovian

flexibility results, since a player responding

strategy will always

have a Markovian

best-response,

if at all any best-response

A (stationary) Markovian

Definition.

that satisfies g(y)e[0,y~\

for all yeS.

strategy

exists.

for either player

is a function g:S-+S

A player's Markovian

at any state

strategy g specifies his planned consumption

yeS, as g(y), regardless of when, or how, y was reached. Let T be the set of all

Markovian

indices to distinguish

strategies. Henceforth, we will use player-specific

strategies.

A pair of Markovian

strategies (gx, g2) defines in the obvious manner, from any

?

initial state yeS, a unique history of t

th period stock levels, and period-i rewards

=

i

for

1,2.

Hence,

player

(gX9g2)

uniquely defines the total discounted

u\(gx,g2)(y)ao

for player i.Denote

this total reward by Wi(gx,g2)(y).

reward

?f= ?tu\(gx,g2)(y)

0

Definition.

The strategy g\sT

is player

l's best-response

(BR) to player 2's strategy

02erif:

Wx(gx*,g2)(y)^

A BR of player 2 to gxeT

is similarly defined.

A Markov-Perfect

>

such

that for i,j =1,2,

(91 Qi)

Definition.

Wx(gx,g2)(y)VyeS,Vgxer.

Equilibrium (MPE) is a pair of Markovian

and ?#;, gt is a BR to gy

Remark. The phrase "Markov-Perfect"

arises from the simple observation

Nash equilibria inMarkovian

strategies are also subgame-perfect.

strategies

that all

If an MPE

(gx,g2) satisfies the condition gx(y) + g2(y) ^ y for all yeS, we will

as

an

to

interior MPE. Dutta and Sundaram (1992a), and Sundaram (1989),

refer

it

=

have shown that under the additional

of "symmetry"

(ux u2), an

assumption

interior symmetric MPE

(g,g) always exists if utility functions obey the Inada

condition. Surprisingly, no one has yet (to the best of our knowledge)

established

a corresponding

result for the asymmetric game, although the examples of Levhari

and Mirman

(1973) admit such equilibria without

(1980) and Lancaster

imposing

are trivial to

player-symmetric

preferences. Of course, non-interior

equilibria

=

=

an MPE).

construct

In any

y for all yeS constitutes

(for example, gx(y)

g2(y)

event, the results of this paper hold for interior and non-interior

equilibria alike, so

this is not an important issue.

2.3 The first-best

solutions

From any initial state yeS, the set of all first-best payoffs that can be achieved are

those arising from a solution to the following problem as a varies between 0 and 1:

The

tragedy

417

of the commons?

Maximize l<*Wl(gl9g2)(y)+ (1- a)W2(gug2){y)l

(01.02)

is a well-understood

we

problem in neoclassical growth theory. Consequently,

confine ourselves to stating, without proof, its relevant characteristics.

For each ae[0,1],

there is a unique pair of Markovian

strategies (gla,g2a) that

solves this problem from each 0 < yeS. The resulting sequence of states {y*} from

for all t or y*+ ?^ yf?^ y for all

y under this solution ismonotone

(i.e., y*+i^y\^y

a

to

state

and

This

the so-called "golden rule",

converges

r),

steady

steady-state,

j?.

is independent of the choice of y and a, and is the unique solution to f(x*) = y*9

where <5/'(x*) = 1. Finally, if y # y*9 then we also have y* # y* for any i, that is {y*}

converges to y* only "asymptotically".

This

2.4 The "tragedy of the commons" defined

Fix a discount factor <5e(0,1). Since the golden-rule depends only on S (and /), but

not on a or the initial state y9 obvious definitions

of "overexploitation"

and a

and the

"tragedy" suggest themselves. Let (gl9g2) denote an arbitrary MPE,

sequence of stock levels generated from an initial state yeS under (gl9 g2) be denoted

by {yt(y)Y

Definition.

The MPE

The MPE

Definition.

from all y > 0.

(gx, g2) leads to a "tragedy"

(gug2)

from y if limsup yt(y) < y%.

t-+oo

leads to a "tragedy"

if (gi9g2)

leads to a "tragedy"

occurs from y if the sequence of states from y under

overexploitation

some

(gug2) is, beyond

point, strictly bounded below y$; and a "tragedy of the

commons" occurs if overexploitation

results from each initial state.

In words,

3 An example

This section presents an example of an interior MPE which sustains a steady-state

z lying strictly above the golden-rule. Our example is based on a modification

of

=

=

=

assume

and

who

that

Levhari and Mirman

x", ae(0,1);

ux (c) u2(c)

(1980),

f(x)

that we may take the state space S to be [0,1].

loge. Observe

Levhari and Mirman

show that there is a symmetric interior MPE

(g9g) to this

?

?

=

=

game in linear strategies specified by g(y)

olS).

(1 a<5)/(2

ky for yeS, where k

to which all

The unique non-zero steady-state of the game under this equilibrium,

stock sequences

converge,

is given by

W

?= ?-A

The "golden

rule" j?, in this case is

tf

It is readily

golden-rule

=

(a<5)a/1-a. (2)

that y*>y?For later use, we note

=

aa/1 "a.

y* is given by lim y?

checked

that the undiscounted

418

P. K. Dutta

and R. K. Sundaram

informal comments on the procedure we employ may be useful. The idea

is one of players getting "locked" into a steady-state

underlying our construction

a discontinuity

This

in equilibrium

results

from

y'>y*.

locking

strategies at /:to

the left of y', the strategies specify consumption

levels well above those required to

maintain

over the

If either player increases his consumption

y' as a steady-state.

Some

levels at /, this results in a lower stock level, a sharp increase

proposed steady-state

in consumption

at the new stock, and consequently

rapidly declining stocks. This

an

makes deviation from the proposed

unattractive

steady-state

option when ? is

high enough.

The feasibility of this procedure

in a truncated version of the

is demonstrated

Levhari-Mirman

note

We

that

the

truncation does not affect y%which

example.

remains the unique steady-state of the first-best solutions. The reader is urged to

consult the accompanying

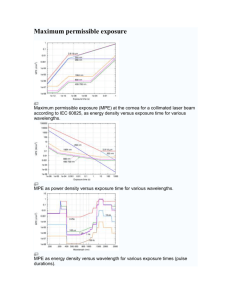

Fig. 1when going through this section.

To begin with, let / be given by

Since >? ? y* as ? ?1, and a(2

Consider

the truncation f(x)

game continues to have y$ as

Let

converge asymptotically.

(3)

'-(2=;)

a) < Ifor ae(0,1), we have y'>y*>

y% for all <5e(0,1).

=

y' for all x = (/)1/flt. For all <5e(0,1), this truncated

the unique steady state to which all first-best solutions

c' be half the consumption

that permits

regeneration

of/:

c'=

\1/1-a

=1 1/1

(1~a)' (4)

2{y'~{y)ll*) 2\2^~J

Now define themodified strategies (?,?) by

=

0()>) Ay,)>G[O,/)

=

+ 2c'y2,ye[y'M

l(y-y')

shows that, for any initial state y > y', these strategies ensure

Simple calculation

that the game moves

to y' in one step. We will now show that (?,?) is an MPE of

this game.6 Observe

that by construction / is a steady-state of this MPE

that lies

above the "golden-rule" y*.

take

Suppose the initial state is ye[0, y'). Given ?, neither player can unilaterally

the stock to y' in a finite number of periods. For, even with zero consumption/oreuer,

player

i faces a net production function

f(y)

=

y*(\-ky

?

sustainable

stock is [2

can have no effect

ye [0, y'), the modification

a best-response

to itself for all initial states

stock

Thus, if the game starts in [0,/),

whose maximum

6

The

obvious

modification

of the Levhari-Mirman

"a/1 "a <

<x<5]

/. Hence, for initial states

on the game, and consequently

# forms

in this segment.

levels eventually converge, under (?,?\

strategies

is another

MPE.

The

tragedy

419

of the commons?

. y=x

=

=

= Investment

of unique steady-state

(a

3/4; ?

20/21). A x

Fig. 1A, B. The Levhari-Mirman

example

of the game; x* = investment at unique steady-state

of first-best solution; x = investment at undiscounted

= investment

= Same as in

levels at the low and high steady-states

A; x and x'

golden rule. B x* and x

of the game

of the game, respectively; / = stock level at high steady-state

420

P. K. Dutta

to y?, where

approaches

the associated

consumption

the limiting value c, given by

and R. K. Sundaram

level cx? = c2?( = c?) = ?y?. As

c6

?jl,

(5)

a^-^-ar^-^l-a)

can be taken as an approximation

to c? for "high" ?.

it

is

that

for high a, c' > cb whenever \ > aa/1 "a,

and

evident

(4)

(5),

Comparing

the proposed steady-state

which is satisfied for an interval of values of a. Therefore,

a

has

level

than

the

/

strictly greater consumption

steady-state y?. If the game ever

which

enters [0, /), then under the strategy profile (0, ?) there is a finite number of periods

is

T, independent of S and the starting state in [0,/), beyond which consumption

over

For

less

than

d.

all

the

T

first

gains

uniformly strictly

sufficiently high ?,

periods

are swamped by the strictly smaller consumption

thereafter.7 For high 6, therefore,

either player is, given 0, better off also adopting ?jwhen the initial state is in [/, 1].

to itself on all of S.

Summing up, ? is a best-response

a stationary MPE

We have thus demonstrated

in which there is a steady-state

lying strictly above

4 A characterization

the "golden-rule."8

of MPE

We now turn to a characterization

of the properties of MPE of general dynamic

resource games. Throughout

the rest of this paper (gX9g2) will denote an arbitrary,

but fixed, MPE; oe(0,1) will be a fixed discount factor; y will denote a non-zero

initial state in S; the sequence of states from y under (gx,g2) will be denoted

will be denoted by Vi9 i=1,2;

by {)>,()>)}; the payoff functions Wi(gx,g2):S->R

=

the

under

function"

and, finally,

(gl9g2) will be denoted

\?/9i.e., i?/(y)

"savings

m*x{09y-gx(y)-g2(y)}.

state paths - is an important one

Our first result

the monotonicity

of MPE

in the sequel. Among other things, it enables

for it simplifies analysis considerably

us to replace the "limsup" in the definition of a "tragedy" with a plain "limit".

Theorem

monotone

1. For all y>09

there is an integer T(y) such that the sequence {yt(y)}

either yt+x(y)^yt(y)

i.e.,

for t^T(y),

for t= T(y), or yt+x(y)^yt(y)for

is

t^T(y).

Remark. We

note

that the convexity

of /

is not needed

for this result.

there is a unique element

1, for each yeS,

By Theorem

set

Let

Z

the

such limit points:

denote

of

all

yt(y)-+y(y)'

Z = {yeS\y

=

y(y)

=

y(y)eS

such

that

Mmyt(y) for some yeS}.

7

An alternative, more

intuitive, way to think about this is to note that as ?j 1, players care only about

c' > c, and c is larger than

their eventual

levels for each a; by construction

(i.e., steady state) consumption

the steady-state

that results from initial states in [0,/)

for any ? < 1.

consumption

8

to those we use in this section can also be employed

to support a

We suspect that similar methods

host of other points as steady-states

of (discontinuous)

at any rate, appears roughly the same as used here.

MPE,

for instance

points

ze(y?, y*). The

intuition,

The

tragedy

421

of the commons?

For notational

convenience, we will sometimes denote a generic element of Z by z

rather than y(y). The occurrence of a "tragedy" now reduces to examining whether

z < y* for all zeZ. Our main result on this question - that, as the example of the

cannot be strenthened

is that only a partial result

previous section demonstrates,

along these lines is valid:

Theorem

2. Let zeZ.

If there is yeS

such that yt(y)^>z9 but yt(y) ^ zfor any t, then

z<y*.

2 implies, almost immediately,

is strictly suboptimal

that any MPE

Theorem

from all initial states except, possibly, yj. For, recall that from any initial state

y?^y*, the sequence of stocks in any first-best solution converges asymptotically

some initial

to the golden-rule

y%. If (gi9g2) is to generate optimal payoffs from

state y #)>*, then the sequence {yt(y)} will have to coincide with the sequence of

2 shows that this is not

states from y in some first-best solution. But Theorem

to their limits would

if

then

the

did

coincide,

convergence

sequences

possible. For,

be only asymptotic. By Theorem

must be strictly below y%9while

It immediately follows that:

Theorem

3. The MPE

except, possibly,

2, this implies that the limit of the sequence

the first-best sequence, of course, converges

(gl9g2) generates

suboptimal payoffs from

{yt(y)}

to >?.

all initial states y

y%.

As a final question, we examine general conditions on the equilibrium strategies

for this question

(0i ?g 2) under which a "tragedy" is inevitable. Part of the motivation

in

to understand why constructed

in the Introduction,

is, as explained

equilibria

We

show

that:

exhibit

the

literature

in

studied

overexploitation.

always

examples

4. Suppose (gl9g2) is interior, and satisfies one of thefollowing:

2.

g

(i) i is continuously differentiable onS9i=l9

on

is

i.

S

both

g{

increasing

(ii)

for

(iii) i//(y) is strictly increasing on S.

Then (gl9 g2) leads to a "tragedy" from all y>0.

Theorem

Appendix

The proof of the results are derived

as consequences

of various

lemmata. We

begin

by defining

S(l)

=

=

> 0}.

{$eS\ j> yt(y) for some yeS9 and \?/($)

That is, S(l) is the set of states that (i) can be "reached" from some state in S under

for the game. Clearly,

the MPE

(gl9g2)> and (ii) ensure a non-trivial continuation

S(l) is the relevant set for dynamic analysis of (gx, g2):\? $tS(\)9 then either $ cannot

be reached from any other state and is therefore irrelevant after period 1, or $ can

be reached but the continuation

from p is trivial.

Lemma

1. On S(l),

thefollowing

(i) y'<y

(ii) Fl?O<Fl(y)

(iii)?-gjt/)<y-gj{y).

conditions

are equivalent:

422

P. K. Dutta

each of these implies \j/(y)^ ^(/).

Further,

and R. K. Sundaram

If the last inequality holds strictly,

then

(i)-(iii)must hold.

Proof (ii)=>(i) Suppose fory, y'eS(l) we had V^y)> V^y')but y < y'.Then / could

not be in S(l): for, player iwould prefer to go to y which can be achieved through

a unilateral increase in consumption

over the level required to reach / (thus gaining

in immediate

and

in the

with

reward),

V^y) > V^y'), i does

strictly better

continuation

also.

i's optimal actions at these

(i) => (iii) Suppose y, y' eS( 1) and y > y'. By hypothesis,

?

states do not terminate

set of

If / ?

the game.

g}(y') ^ y

gj(y), then the

at

at

is

in

that

Thus

the

actions

contained

continuation

from

y

non-terminating

y'.

as

as

to

at

least

is

the

But

continuation

from

reach

rather

than

y.

y'

y'

(for i)

good

a

or

a

current

current

in

unilateral

increase

y requires only

greater

by i,

consumption

reward. This implies that y$S(\), a contradiction.

actions at y contains those at y', and by

(iii)=>(ii) The set of non-terminating

sets

these

the

contain

hypothesis,

optimal actions.

from a standard argument

in intertemporal

This

follows

(m)=>il/(y)^\j/(y')

of

that

the

allocation

strict

ut. See, e.g., Sundaram

theory

concavity

exploits

converse

Lemma

The

is

the

for

established

details.

(1989,

II.4)

by reversing

argument.

QED

Proof of Theorem

Define

T=

1

inf{i|>^f(jv)

=

follows, we suppress

0}. In what

the argument

y.

for all t^ 1. Suppose for some t, we had

(?) T= oo. By hypothesis

yteS(l)

=

all

then

then by Lemma

for

+

1,

yt i?yt

yt

fe^O. If yt+i>y9

clearly yt+k

>

turn

in

the

that

monotonicity

off,

i?/(yt+J ^ \l/(yt) or, by

Vi(yt+1)

^?(.Vr) implying

that yt+2 ^ yt+1. Thus j;t+1^}'(=>)'f+2^};f+1.An

analogous argument establishes

for

that whenever yt+1 ^ yt, we must have yt+2 = yt+i' Therefore, yt ismonotone

t^ 1, and T(y) = 1 suffices.

Case

Case (ii) T is finite. In this case, yt(y) = 0 for all t^ T, so that T(y) = T obviously

satisfies Theorem

1. QED

Proof of Theorem

2

For ease of notation,

Lemma

2. 3ci9c2

we suppress

such that c?=

the dependence

on the initial state y.

lim gi(yt).

f-?oo

Proof. For convenience, we prove the lemma for the case yt > yt+x > y, yt[y. The

other case yt+i < yt < y, yt]y9 is handled analogously.

Suppose for some i, there

were subsequences

t

of

that

such

tk91?

lim gAyJ = at >bt=

Pick a subsequence

lim g^yj.

?f(k)of t such that i/(k)> tk for all k. For all i, yteS(l)9

and for

The

of the commons?

tragedy

423

each k

yt,w<ytk

Therefore,

yt,(k)-g?yt,(k))<ytk-gAytk)

by Lemma

?

or ?biS

limits as k-> oo now yields

- lim

lim

y

S y

gi(ytk)

k-?oo gi(ytak))

k-*oo

1.Taking

at; a contradiction

establishing

the lemma.

QED

Now definefa :S- S byfa( y) = #?(y) for >>

/ ? fa( y) = c{.Recall thatf(x) = y, and

note

?

that

y

?

cx

c2

=

x.

Define

=

W?(*) "<(* ^ *) + &*i(/W ?j(f(x)) x)

W\(x)

=

ut(yt

-

-

?j(yt)

x) + ?Wi(/(x)

-

-

^.(/(x))

xt+J,

are taken to be such that the implied consumptions

are

the domains

since x and xt are respectively

in the

(The domains are non-empty

non-negative.

domains of W? and W\.) The two objectives are nothing but the returns to two period

deviations which leave the evolution of the game unchanged after these two periods.

We now prove,

where

is T such that (i) x, (respectively x) is a feasible deviation at y

t

(respectively yt), ^ T, and (ii)W?(x) ?>Wf(xf) (respectively, W\(xt) ^ W\(x))91 ^ T.

=

=

1,2, whenever y > 0. (if y

0, Theorem 2

Proof We begin by showing that c?> 0, i

is trivial, so we ignore this case.) Since player i always has the option of making

the

?

in

it

for

feasible consumption

follows

that

all

r,

f,

yt

period

gj(yt)

Lemma

3. There

Vt(yt) = ut(yt

-

gj(yt)) + iM|(0)/[l

-

?].

^uf(xf) + aM0)/[l-<5].

1, {xj is a monotone

sequence for t^ 1, and since y > 0, x > 0. Let

By Lemma

0 = inf xt = min {xx, x}. Then, 0 > 0, so we have for all i,

?

r?fo) ^ M0) + ?Wf(0)/[1 ?] > ?W?(0)/[1 <5].

If &&)

-

0> then for all e > 0, there is 7(e)

(A.1)

such that for ?^ TOO,

K^XMeVCi-?].

a

-a],

(A.l) implies that there is rj>0 such that for all r, Vt{yt)^wf(^)/[l

This proves that Cj, c2 > 0.

contradiction.

?

Since yt9 gj(yt) converge to y, c, as ?- oo, it is now immediate that yt ? gj(yt)

?

?

x > 0 and j> c,

x, > 0 for t sufficiently large. This proves (i).

Observe

in

that,

fact, xt is a feasible deviation at yt for t sufficiently large, since

But

in period

xt is optimal

By hypothesis,

- oo establishes

t

as

the

second

limits

Taking

xt-+x.

i, so W](xf)^ W\(xT) for all such t.

inequality in (ii). The first inequality

424

P. K. Dutta

in a similar fashion:

may be established

have

ifwe had Wi(xt) > W{(x)

and R. K. Sundaram

then we must

also

0;O>t) *t) + aut(yt + ! gj(yt +1)-xt+1)

> Ui(yt *t+1)

xt) + ?M,(yt+1

ty(y.+i)

g?{yt)

"i^t

-

the optimality

since yt, 0/O\), xt->j>, c,-, x, respectively, as t-> oo. This contradicts

to g}) in period t. QED

of xt (in i's best-response

=

=

1,2. We shall show that

Next, let fcj [?i &(}>,)]/[}>

yj, for i

?

=

Lemma 4. <5/'(x) (1

1,2.

limsup k\) ^ 1,;

From Lemma

Proo/.

By the Mean

3,

?

?

?

?

there is y'te(y,

x? y,

x) such that

g?(yt)

g?{yt)

x)

u?(yt g?(yt)

xt)

_

9j(yt)

Value Theorem

t*i(yt

?

x,

there is ?|e(/(x)

Also,

x

)- xt +1) and x,e(x,xt)

-Cj-xt+1,yl+1-g?(yt+1

JM)Wi-3j(>Wi)-*,+i)-?

' '

L

L *r * J

*,-*

(/(*)-?j-*,+i)l

Cj

xt-x

y,+i~y

So for all large t, ?f'(xt_ t)(l - *})? ?'?(yp'W

But y[, ?j -* y

')

x as t-* oo, so the RHS goes

J

to 1 as t -* oo. Taking

<5/'(x) 1 lim supfc' ^ 1.(A.2)

k})^

For

the case yt\y, we use from Lemma

Identical

Lemma

as above

arguments

5. /'(x)(l

-

3 the fact that for all large i,

then yield (A.2).

? lim

lim sup k\

sup k'2)^

t

t

QED

1.

=

LetH{y,)

yt+1-yrThen,atheTH{yt)<0,H(yt)-*0,orH{yt)>0,H{yt)^0.

?

?

=

0, we have, in either case,

y

cl?c2)

Defining H(y) =f(y

Proof.

^-"^P

yt-y

such that

for all,

limits

The

tragedy

425

of the commons?

or, for all t:

yt~$

f(yt-gi(y?)-Qiiyt))-f(y-?i-?2)

Therefore,

rewriting

this inequality, we obtain

if(xt)-fix)\/

and taking

Write

k{

=

gx(yt)-cx

g2(yt)-c2\

yt-y

yt-y

xt-x A

\

<0

yt-y

yt-y

limits as t -

oo yields

lim sup k\. By Lemmas

t

the lemma.

^ {

)

QED

4 and 5, the following

inequalities

hold

?ff(x)(\-kx)^f\x)(\-kx-k2)

?f(m-k2)^ff(x)(l-kx-k2).

can hold simultaneously

only if kt > 0 for some iwhich implies that Sf'(x) >

therefore x < x* by the concavity of/, proving Theorem 2. QED

These

Proof

of Theorem

1,

4

Suppose g{ isC1 on S. Let y > 0. By hypothesis ^(y) > 0. Let P=f(\?f(y)) > 0. Since

g i is a best-response

to gi9 so ^(y) solves

max {uj(y- gt(y)- x) + ?Uj(f(x) - gt(f(x)) - <A(j>))}.

X

Since

this is an interior maximum,

the first-order

ufjigj(y)i=Mjtijmri'Hyn

Clearly

We

(A.3) holds

now prove

=

Hy) W\

conditions

a mi

=

1,2, for all y > 0 where j)=/#()>)).

for;

that i// is strictly increasing on S. Suppose

Then, j)=/(^(y))=/(^(/))

=

f,

imply

(A-3)

for y9 y'eS we had

so the RHS's of (A.3) coincide.

=

this implies y = y'. Therefore, ^

Since \j/(y)= ^(/),

Therefore, g^y)

gj(y')9j =1,2.

on

S. Since g{ is differentiable

for both i, so is ^, therefore, ^' ^ 0 or

is one-to-one

=

> 0 for y > 0, so ^'(y) = 0 for all y = 0. Since

^ ^ 0 on S. Since ^(0) 0 and \?/(y)

so i?/ is strictly increasing on 5.

^' = 0 and ^ is one-to-one,

So (i) is a sufficient condition for (iii). Although

(i)may now be proved directly

of \j/,we give a unified proof for (i) and (iii) that only

using the differentiability

uses (iii).

Note that if \?tis strictly increasing on S, then we must have y>y'=>

\?f(y)'> \?f(y')9

so that yt(y) > yt(y')9 and y(y) _ y(y'). Further, it is clear that if an initial state y is

not itself a steady state, then yt(y) must be a strictly monotone

sequence, so finite

to show that y(y) < y*

of yt(y) to a limit is ruled out. Therefore,

time convergence

for all yeS9 it now suffices to show that there is no steady state y > y*.

=

Recall

So let z* be the sup over all steady-states,

i.e., z*

sup{z|z =f(\//(z))}.

we must have

then for ye(z*,x],

of S. If z*<x,

that x is the upper-endpoint

to y(y) only

But since yt(y) can converge

for all t, so y(y)^z*.

yt(y)e(z*,x]9

>

we

This

3.2.

Theorem

must

have

also

implies that

y(y)

by

y*

asymptotically,

426

and R. K. Sundaram

P. K. Dutta

= x. But this is absurd since we must now have

y* > z*. The only other case is z*

= O for i=

1,2. Clearly, either player could deviate unilterally and assure

0f(z*)

himself of positive consumption

in at least one period. This completes the proof for

(i)and (iii).

The argument for hypothesis

(ii) is in two steps. Let y be any steady state of the

is interior, there is a left neighborhood

of {?/(y)which

game. Since the equilibrium

is a feasible deviation at y9 i.e., x in (\?/(y)? e9 \j/(y)) for some e > 0, such that x ^ 0

?

? x and

?

?

and implied consumptions:

y

f(x)

\j/(y)9are also non

gj(y)

gj(f(x))

negative. The last claim uses the fact that g}(f(x)) ^ g}(y).

_ x)= yt ] y.

The second step is almost identical to Lemma 4.We have xt | \?/(y)9

f(xt

=

=

Write, as before, k\

1,2.

[cf &()>,)]/[)>

yt\ i

?

?

?

?

Repeated use of the Mean Value Theorem, yields r\\?(y

Cj x.y

Cj x^J

?

?

?

?

and X\e(y

x) such that

c, x, yt

gj(yt)

(A.4)

Sf'^W-k^uWIu'W

-?

-? c' ^ c?. Hence,

r?\ ch and k\

taking limits in (A.4)

Sf'mi-hmsapknzi.

The

H(y,)

remainder

=

yt+l-y,

of the proof

to get

f'(x)(

and hence

the theorem.

is identical

to that of Lemma

4, using

the function

1- lim supk?- limsup it,2 ^ 1

)

QED

References

existence

games of resource extraction:

Amir, R.: Sequential

Discussion

Paper No. 825,1987

Working

of productive

R.: Joint exploitation

J., Radner,

Benhabib,

of Nash

asset:

Foundation

Cowles

equilibrium

a game-theoretic

Econ.

approach.

Theory 2,155-190(1992)

Dutta,

P.K.,

theorems

Dutta,

R.K.:

Sundaram,

P.K.,

M.,

How

in Markov-perfect

underconsumption

Easwaran,

existence

in a class of stochastic

games:

Equilibrium

Econ. Theory

models.

2,197-214

(1992)

and

can strategic models

be? Nonexistence,

different

chaos,

R. K.: Markovian

Sundaram,

and undiscounted

for discounted

Lewis,

T.: Appropriability

J. Econ. Theory,

equilibria.

of

the extraction

and

forthcoming

a common

property

resource.

to deter mobility.

J. Econ.

Econ?mica 51, 393-400 (1985)

Fudenberg,

D.,

Tir?le,

J.: Capital

as commitment:

strategic

investment

Theory 31, 227-256 (1983)

Lancaster,

K.: The

dynamic

L.: The

Levhari, D., Mirman,

J. Econ. 11,322-334(1980)

models

L.: Dynamic

Mirman,

theory

Reinganum,

period

Sundaram,

in mathematical

J.F., Stokey,

of commitment

R.: Perfect

153-177(1989)

J. Pol. Econ. 81,1098-1109

(1973)

inefficiency of capitalism.

a dynamic Cournot-Nash

great fish war: an example using

In: Liu, P.T., Sutinen

of fishing: a heuristic

approach.

1979

economics,

pp. 39-73. New York: Decker

resource:

of a natural

extraction

N.L.: Oligopolistic

in dynamic

equilibrium

games. Int. Econ. Rev. 26,161-174

in a class of symmetric

dynamic

Bell

solution.

J.G. (eds.) Control

importance

of

the

(1985)

games.

J. Econ.

Theory

47,