Labor&Cost Quantity Unit Cost&Per&Unit Total&Cost Prep%Beds

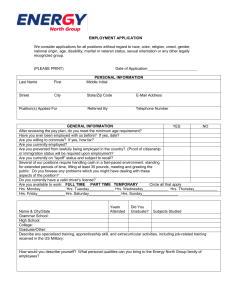

advertisement

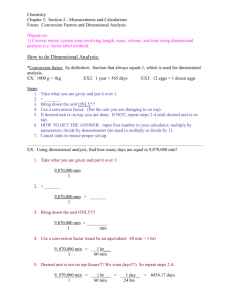

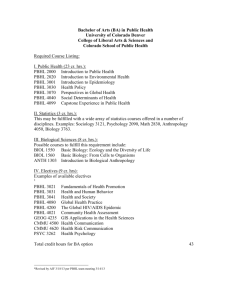

Cost Accounting Steps Green&Bean&Production&Costs Labor&Cost Quantity Unit Cost&Per&Unit Total&Cost Prep%Beds 0.2 Hrs Spread%Amendments 0.1 Hrs Seed 0.15 Hrs Water 0.25 Hrs Weed 2 Hrs Total&Labor Hours $%%%%%%%%%%%%10.00 Input%Cost Quantity Unit Cost&Per&Unit Total&Cost Seed 2 Lbs $%%%%%%%%%%%%10.00 Amendments 6 Lbs $%%%%%%%%%%%%%%0.10 Total&Input Machinary&Cost Quantity Unit Cost&Per&Unit Total&Cost Total&Machinery&Use 0.45 Hrs $%%%%%%%%%%%%10.00 Total&Cost&Per&Bed Quantity Unit Cost&Per&Unit Total&Cost Yield&Per&Bed 120 Lbs Steps to calculate the production cost per unit: 1. Track all the work (in total hours) that went into growing one bed of a crop. 2. Multiply by the hourly wage. 3. This is your labor cost per bed. 4. Track all the inputs that went into one bed. 5. Multiply by the costs associated with each input. 6. Add these together. 7. This is your total input cost per bed. 8. Track all the machinery hours that went into one bed. 9. Multiply by the machinery cost per hour. 10. This is your total machinery cost per bed. 11. Add together labor cost, input cost, machinery cost. 12. This is your total production cost per bed. 13. Divide by the yield (number of units) per bed. This is your production cost per unit. Green&Bean&Harvest&Costs Labor&Cost Quantity Unit Cost&Per&Unit Total&Cost Harvest 5 Hrs $-----------10.00 Quantity Unit Cost&Per&Unit Total&Cost Quantity&Harvested 30 Lbs Steps to calculate the harvest cost per unit: 1. Track the harvest labor hours and quantity harvested. 2. Multiply the harvest labor hours by the hourly rate. 3. This is your total harvest labor cost. 4. Divide by the number of units harvested. This is your harvest labor cost per unit. Labor&Cost Phone&Calls&to&Chefs Invoicing Delivery Bookkeeping Total&Labor Input&Cost Wax&Boxes Total&Input Vehicle&Cost Total&Channel&Sales Green&Bean&Marketing&Costs Quantity Unit Cost&Per&Unit Total&Cost 0.2 Hrs 0.1 Hrs 0.5 Hrs 0.25 Hrs 1.05 Hours $&&&&&&&&&&&&&&&&&10.00 $&&&&&&&&10.50 Quantity Unit Cost&Per&Unit Total&Cost 5 Ea $&&&&&&&&&&&&&&&&&&&0.75 $&&&&&&&&&&3.75 Quantity Unit 3 Miles $138.00 Cost&Per&Unit Total&Cost $&&&&&&&&&&&&&&&&&&&0.75 $&&&&&&&&&&2.25 Cost&Per&$/Sales Total&Cost $&&&&&&&&16.50 Steps to calculate the marketing cost per unit: 1. Track marketing labor (in total hours) for a marketing channel for one week. 2. Multiply by the hourly wage. 3. This is your total marketing labor cost for this channel, for this week. 4. Track other marketing input costs for this channel, for this week. 5. Add these together. 6. This is your total marketing input cost for this channel, for this week. 7. Track all vehicle miles for this channel, for this week. 8. Multiply by the vehicle cost per mile. 9. Add together labor cost, input cost, vehicle cost. 10. This is your total marketing cost for this channel, for this week. 11. Divide by the total sales for this marketing channel, for this week. 12. This is your marketing cost per dollar of sales. 13. Multiply the cost per dollar of sales by the price of your crop. This is your marketing cost per unit. Item Rent Insurance Phone Conferences Total Total)Farm)Sales Cost)Per)$/Sales Farm)Overhead)Costs Total)Cost $+++++++++++++++++++++++++++++++++++++ 1,200.00 $++++++++++++++++++++++++++++++++++++++++ 960.00 $++++++++++++++++++++++++++++++++++++++++ 900.00 $++++++++++++++++++++++++++++++++++++++++ 400.00 $+++++++++++++++++++++++++++++++++++++ 3,460.00 $+++++++++++++++++++++++++++++++++++ 33,000.00 Steps to calculate the overhead cost per unit: 1. Track your overhead costs for your farm for a period of time (one season, ideally). 2. Total your overhead costs for this time period. 3. Divide total overhead costs by the total sales for the same period of time. 4. This is your overhead cost per dollar of sales. 5. Multiply the cost per dollar of sales by the price of your crop. This is your overhead cost per unit. Comparing Price to Cost Crop: Price Per Unit Unit minus Production Cost Per Unit Harvest Cost Per Unit Marketing Cost Dollar of Sales Overhead Cost Per Dollar of Sales equals Profit (Loss) ü There are many different ways to allocate indirect costs and no “right” way. Experiment with different allocation bases and consider the impact of each of them on your assessment of the costs and profitability. Recommended References: Fearless Farm Finances: Farm Financial Management Demystified published by Midwest Organic and Sustainable Education Service 2012 The Organic Farmers Business Handbook by Richard Wiswall Growing For Market articles by Chris Blanchard o “Determine your labor costs and use the information wisely” May 2014 o “Identifying your biggest money-­‐making crops” January 2013 o “Setting-­‐prices-­‐for-­‐maximum-­‐profit” June/July 2012 Questions? Contact Us: http://centerforsmallfarms.oregonstate.edu/ Center for Small Farms & Community Food Systems 107 Crop Science Building, Oregon State University, Corvallis, OR 97331