SONIC MEDIA PLANNING CASE STUDY

advertisement

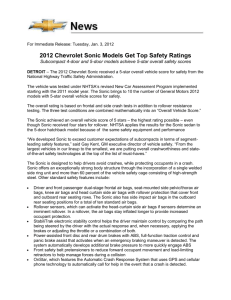

SONIC MEDIA PLANNING CASE STUDY Mary Ergul, Blair Siegler, Miranda Andersson, Rebekah White, Vanessa Rutters, Carter Barnett TABLE OF CONTENTS Executive Summary……………………………………………………….…………………………...3 Situation Analysis…………………………………………………………………….………………..5 Market Information……………………………………………………………………………...…..….5 Industry Sales……………………………………………………………………………………….…..5 Creative Background…………………………………………………………………………….……..5 Sonic Sales……………………………………………………………………………………….……..6 Pricing…………………………………………………………………………………………….….…6 Product Positioning……………………………………………………………………………….….…6 Target Audience ………………………………………………………………………………….….…7 Category Competitors……………………………………………………………………………...…...7 Share of Voice…………………..………………………………………………………………....……9 Creative and Media Background………………………………………………………………....……10 Seasonality…………………………………………………………………………………….……….13 Geography…………...………………………………………………………………………..…….….13 Promotions…………………………………………………………………………………..………....16 Budget……………………………………………………………………………………...…………..17 Advertising Season ………………………………………………………………………..…………..17 SWOT Analysis………………………………………………………………………………………..18 Objectives…………………………………………………………………………………………..…19 Marketing Objectives………………………………………………………………………………….19 Advertising Objectives………………………………………………………………………………...19 Media Objectives……………………………………………………………………………………....20 Creative Brief…………………………………………………………………………………...……..22 Media Strategy………………………………………………………………………………………..23 Television……………………………………………………………………………………..………..23 Radio…………………………………………………………………………………………….……..24 Magazines………………………………………………………………………………….…………..25 Outdoor…………………………………………………………………………………….…………..26 Internet………………………………………………………………………………..………………..27 Non­Traditional Media………………………………………………….……………………………..28 Evaluation……………………………………………………………………………………...……..30 EXECUTIVE SUMMARY Sonic Drive­In serves as one of the most unique fast­food restaurants of all time. Designed to differentiate from other competitors, Sonic emphasizes high quality menu items and skating carhops used to personalize users’ experience. With its commitment to customer service and signature drinks, such as cherry limeades and slushies, it’s no surprise that Sonic is one of the top sixteen fast food hamburger chains in the US. Sonic’s menu stretches far beyond the average chain, offering a wide variety of food including sandwiches, hamburgers, onion rings, salads, wraps, and breakfast items. Its success and growth is a result of its customer loyalty. Though Sonic experienced an economic slump in 2008, they are looking to capitalize on the rebounding fast food business in the coming years. Sonic has previously been best known in the south, but they have started making a northern presence in the past five years. Within the past fiscal year, Sonic opened 85 new Drive­In stores, 80 of which are franchises. Because Sonic competes in the “Quick Serve Restaurant Industry,” they compete highly with other business, such as McDonald’s, Arby’s, Wendy’s, Burger King, and Dairy Queen. Sonic has established itself as a well­known chain in the US, but there are still goals to be met. Our challenge is for Sonic to maintain or become a leading fast food restaurant operator in all of its markets by the fiscal year of 2016. It is also our goal that Sonic become a top five fast food restaurant in all high BDI markets. Our marketing challenge is to increase sales among 18­24 year olds by 5% within the 2014­2015 fiscal year. Five million of the $60 million total budget must be allocated to the 32 new markets of last year. With a fiscal year running from July 1, 2014­ June 30, 2015, Sonic will spread awareness as a desirable chain in the new locations, while also maintaining a strong presence in its already existing areas. We hope that by emphasizing reach and frequency, Sonic will be able to achieve its goals for the fiscal year. With traditional media, we plan to heavy­up on radio, outdoor, and magazines, while giving less attention to TV. Radio will serve as an effective vehicle for casual dining due to its ability to reach potential consumers in their cars. Our target audience will be more likely to make a stop at Sonic when they are already in a car. Because Sonic serves food for all meals, people will be receptive to the message at any time of the day. Outdoor ads will be an effective vehicle for the same reasons. Because the media will be in close proximity to the Sonic establishment, travelers will be reminded of the chain and make the rash decision to go there. Sonic’s target audience are considered heavy magazine users, so we will use this medium to pull in new customers. Most of our magazine budget will be targeted towards men due to their low presence at Sonic. Our goal is to increase awareness to men to bring new business to Sonic. Because Sonic’s target audience are not heavy TV users, less emphasis will be given to this medium. We will focus on daytime parts within network and spot television to spread awareness in the new locations, while also maintaining a competitive stance in previously existing areas. We will use the internet to provide most of our supplemental reach and frequency by targeting social media sites, such as Facebook, Twitter, and YouTube. We will emphasize the summer months by increasing spending on key word search and targeted site advertising. With non­traditional media, we will use a “Slushy Truck” at college campuses in our target regions. The truck will serve to increase sales and will be our main source of earned media. We hope that it will amplify popularity and frequencies among the younger generation with minimal cost. Using different data, such as Kantar, Nielson, and MRI, we are confident that our media plan will accomplish Sonic’s marketing objectives. By focusing on reach and frequency, Sonic will be able to create a strong presence in the new locations, while maintaining brand loyalty in already­existing areas. Within the 2014­2015 fiscal year, Sonic will increase its sales among 18­24 year olds by 5% and become a leading fast­food restaurant operator in all of its markets. SITUATION ANALYSIS Market Information Our primary geographic markets to promote our brand are the Northwest and Midwest regions of the US, because the majority of Sonic’s sales revenues are generated from the Southeast, Southwest and Northeast regions in the US. Bigger cities, such as Houston, Los Angeles, New York City, and Tampa Bay are some of the highest percentages in the US for Sonic fast food consumption. However, the Northwest and Midwest areas are lagging behind in popularity of Sonic’s Brand Development Index. McDonalds, In­and­Out Burger, Burger King, and Jack in the Box are one of the few other fast food burger companies that are the most threatening competitors towards Sonic. Industry Sales According to the Sales Estimates Data, there is an estimated revenue of 151453.1 million dollars in fast food sales. There is more data on specific fast food brands and Sonic’s contribution later in the report. Creative Background Overall, Sonic’s most successful creative strategies have involved two pals whose relationship is based on finding fault with one another. The main thing that made these commercials successful, whether people knew it or not, was that they were improvised. The genuine tone connected with consumers in a way that benefitted Sonic. Another scene involves the same improvising, but with a married couple instead. They made an effort to show just as much about the domestic condition as they did about Sonic’s fabulous menu. These two commercials ran starting in 2004, when Sonic became more widely known nationally. Going back to the beginning, one of Sonic’s most memorable advertising campaigns came from 1987­1993, in which they showcased a Brown Bag Special through Frankie Avalon. This particular campaign focused more on great value rather than entertainment. Sonic has also taken part in sponsorship for Nascar during the years of 2000­2003. Sonic has used various slogans over the years, but perhaps the most recognized is “It’s Not Just Good. It’s Sonic Good.” The majority of Sonic’s print ads showcase images of the food or the roller­skate feature of the chain. All in all, Sonic has completed several campaigns that show the restaurant in some way, while adding a touch of humor. Sources: http://adage.com/article/ad­review/sonic­great­actors­great­ads/119271/ http://en.wikipedia.org/wiki/Sonic_Drive­In#Advertising Sonic Sales According to the Sales Estimates Data, Sonic generates an estimated 3693.3 million dollars in revenue with the highest revenue in Texas locations. Pricing Sonic is relatively inexpensive. The priciest item is the SuperSONIC Bacon Double Cheeseburger ­ Combo at over 7 dollars, but the other burgers average less than 5 dollars depending on the number of ingredients. The drinks are all less than 2 dollars minus gallon sizes. The frozen treats average around 3 dollars. Product Positioning Sonic is very unique in the type of food they serve and how they serve it. They offer a variety of savory fast food including breakfast options served in a “old school” manner with waiters skating food to the cars as well as a drive thru option. Sonic is unique in the number of drinks and desserts, particularly ice cream, they offer. Target Audience MRI data states that the majority of current Sonic customers are female from the ages 25­54. Most of the customers are employed full­time, middle class, and married, but the majority do not have children living in their household. The median income of Sonic consumers is $65,186. The overwhelming race of Sonic customers are white consumers, so it might be a good idea to try to appeal to other races in our plan. Most of the current customers own their home and most live in the southwest and southeast. However, our target audience is adults, ages 18­24 years since we are trying to increase sales amongst this group by 5%. They are youngest age group that frequents Sonic. They also remain in one of the youngest age groups to frequent all fast food restaurants, and are among the highest consumers of fast food. Young females in college are going to be the audience we want to aim our advertising at. The average consumer is a female college student that most likely came from a middle class or an upper middle class family. She lives in a larger, southeastern or southwestern city. She likes the food that Sonic has to offer, and her schedule keeps her busy, so she especially appreciates the convenience of it. The primary ways to reach her are magazines, outdoor, and radio, but she is a very heavy user of the internet. Category Competitors The following brand name fast foods were chosen to be studied because they resemble Sonic in the type of food they serve such as hamburgers and ice cream and atmosphere they provide. Sonic has the least number of store counts compared to the other three according to Raphael Bryon. McDonald’s An obvious and recognized brand in the fast food industry is The Golden Arches. Although their drink and dessert menu doesn’t have as many options as Sonic, they serve breakfast and are known for their ice cream treats called McFlurry’s. Arguably the biggest name in fast food, it comes as no surprise that they spend the most on advertising for total media ­ 882.232.3 million dollars. Noticeably McDonald’s also spends way more n magazines than any of the other competitors. According to Raphael Bryon as of 2011 there were 14,000 store counts. Mickie D’s overall has phenomenal sales and only seem to be doing noticeably worse the month of October. Dairy Queen Probably the most similar to Sonic, Dairy Queen is also known for their frozen treats referred to as Blizzards but also serves a variety of non­regional fast food such as chicken fingers and fries. Although they do not have car hops, DQ has a similar outdoor patio environment with no advertising characters unlike Ronald McDonald and BK’s King. According to Raphael Bryon as of 2011 there were 5,050 store counts. These stores experience the highest sales during late spring early summer probably because this is when people really want ice cream. Burger King BK most resembles McDonald’s in this mix of competitors. Not maybe the first place one goes for ice cream, this establishment is known for their burgers including a veggie burger, chicken options, and sides such as onion rings. Burger King spends 304,743.2 million dollars on total media. According to Raphael Bryon as of 2011 there were 7,750 store counts. These stores experience the highest sales during winter especially around holiday season ­ maybe the turkey is too dry and the kids are whining too much so BK experiences these high volume sales. Wendy’s This establishment is similar to McDonald’s and Burger King. Known for their burgers and ice cream Frosty’s, Wendy’s is a big competitor in the fast food industry. They spend 287656.7 million dollars total on media. Share of Voice Although Sonic is within the top 16 fast food hamburger chains in the USA, we used Kantar data to look at how much they spend in different category mediums in comparison to the top five hamburger chains. We felt that looking at the top 5 chains would give us a clear interpretation of Sonic’s strengths and weaknesses. We compared the serious competitors­ McDonald’s, Burker King, Wendy’s, Arby’s, and Dairy Queen­ to Sonic when a potential consumer is faced with alternative hamburger choices. Though Sonic’s total advertising spending is greater than Arby’s and Dairy Queen, it is far from that of McDonald’s, Burger King, and Wendy’s. Sonic represents about 3.4% of all advertising sales among the top 6 hamburger chains. McDonald’s dominates the market by far and is followed, though not closely, by Burger King and Wendy’s. Given that Sonic is faced with a smaller budget, this obviously significant difference in market spending presents a problem for Sonic as the brand tries to differentiate itself. Sonic is not a major player in most media, but they do, however, have a stronger presence in the Spot TV category, coming in at 5.9% share of voice versus some of their competitors that come in around 1­3% share of voice. They also show a stronger presence in the magazine and local radio categories. Sonic’s advertising expenditure poses a problem in that it has a larger budget than Arby’s and Dairy Queen, yet it still falls below them in rank. This chart displays the share of voice using Kantar competitive data of brands expenditure on media. Creative and Media Background Media Mix This Media Mix looks at the way media dollars are allocated for Sonic. The proportion of advertising dollars spent in each media class is calculated to show where Sonic spends most of its budget. The huge majority of Sonic’s advertising money is spent on Spot TV, followed by Cable TV. Other categories with significant spending include Network and SLN TV. Sonic fails to advertise in several categories, including syndication, Sunday magazines, local magazines, Hispanic magazines, B to B, national newspapers, Hispanic newspapers, and network radio. Because of this, we feel that Sonic has a great opportunity to expand its horizons and introduce itself to new markets, like magazines and radio. Media Habits 79.9% of heavy fast food consumers have internet access, and households that have access to internet via computer is 73.3%. Sonic customers have slightly higher numbers, with 81.9% internet access and 76.5% internet via computer. Computer usage and internet activity is fairly high; they are very heavy users. 77.5% of all Sonic customers have visited a chat room, 45.3% have used email, 46.4% have paid bills online, and 51.5% have obtained the latest news or current events online. Since their internet activity is reasonably high, it would be useful to reach our market through the internet. Non­Traditional Media We have chosen to attract a younger audience by creating the “Slushi Truck” at college campuses in our target regions. They will be situated in the hub of each campus so that students will have the opportunity to purchase a refreshing drink/slushi on their way to class during the warmer seasons. Alongside with college student promotion, Sonic will be featured on football gamedays by selling their signature food items to fans. This will hopefully generate a large popularity among young adults and alumni who are seeking flavorful, American grub. Seasonality Sales are generally lower during Sonic’s second fiscal quarter (the months of December, January and February) compared to the other three quarters. This is because of the lower temperatures in the northern climate which tend to reduce customer visits to those drive­ins. Geography As of August 31, 2010, the Company had 3,572 Sonic Drive­Ins in operation from coast to coast, consisting of 455 Company owned and 3,117 Franchise Owned. Sonic is best known and strongest in the southern United States. DMA Name %U.S. Minneapolis­St. 1.52 Est FF Est Sonic BDI (% Sales % Sales % Sonic (BDI x Sales/% .30/CDI x U.S.) .7) 1.36 1.66 109 CDI 89 Weighted 52 Paul, MN Portland, OR 1.04 Seattle­Tacoma, 1.64 .99 1.01 97 95 44 1.42 1.64 100 87 49 WA Lansing, MI .22 .21 .21 95 95 42 Milwaukee, WI .78 .90 .78 100 115 37 Medford et al, .15 .14 .15 100 93 46 Flint­Saginaw et .39 .37 .44 112 95 51 .64 .67 .64 100 104 41 Eugene, OR .21 .20 .21 100 95 45 Yakima et al, .20 .18 .20 100 90 48 Bend, OR .06 .05 .06 100 83 52 Spokane, WA .37 .33 .37 100 89 48 OR al, MI Grand Rapids et al, MI WA Sioux Falls et .23 .21 .23 100 91 47 Madison, WI .33 .28 .34 103 85 52 Wausau­Rhinel .16 .14 .15 94 88 46 Butte­Bozeman, .06 .05 .06 100 83 52 .05 .05 84 83 43 al, SD ander, WI MT Great Falls, MT .06 The following graph shows 15 of our 32 new target markets. There is at least one DMA representing its respective state. Because of the 32 new Sonic stores opening, we want to focus more on CDI due to the potential of low market sales in the fast food category. Thus, we give more weight to CDI (70%) than BDI (30%) when weighting their indexes. The category is not strong in these markets, but the brand, a big fish in a small pond, does comparatively well. These DMA’s are probably good areas in which to maintain existing promotion, but sales trends should be closely monitored to gauge the markets’ continuing value. At glance, the BDI looks higher than the CDI in most of these markets. Grand Rapids, MI and Milwaukee, WI, for example, are markets that show lower BDI than CDI, meaning that the product category, fast food, has great/better sales than the brand, Sonic, itself. In the instance such as this one, there is room for the Sonic brand to grow. In the other markets that show higher BDI than CDI, Sonic seems to be doing well, while the product category of Fast Food seems to be showing low potential. This is a situation where reasons for the poor showing of the category must be investigated. If the Fast Food category has been showing continuous decline, then it might be doing well. However, if research shows that the product category itself can be potentially rejuvenated then advertising for the brand might be worth the investment. Although the message might have to encourage Fast Food consumption rather than just Sonic Drive­In consumption exclusively. Another important factor that should be taken into account is our target audience: the 18­24 year old market. This specific age group is known to be more prone to eating fast food. Thus, category development in this case would not need much emphasis. Rather, focusing on brand development and how we get Sonic in the hearts, minds, and mouths of our target market is what’s most important. Promotions Sonic has a fun interactive feature on their website where people can upload pictures of themselves at / with Sonic onto the website. Budget Our total budget is 60 million dollars, 5 million we must allocate to the 32 markets that were new last year. Another 5 million will be for advertising and promotions in non­traditional media. We are thinking of football and holiday promotions and contests. This media will serve as a call to action for consumers. We have also allocated $10,000,000 to national contingency and $5,000,000 to spot contingency. Advertising Season Our twelve month campaign will begin July 1st 2014. Rather than trying to boost sales the second fiscal quarter (which typically has the lowest sales due to climate) we will boost our reach and frequency during the months leading up to summer (when sales are typically the highest) SWOT Analysis Strengths: Drive in, drive thru and patio seating options Full menu served all day Culture is unique­ skating carhops Customer loyalty is among the strongest in the food industry Impressive marketing program Made­to­order food Weaknesses: Not as strong or well­known in the north Not popular in winter months Not a lot of advertising contributions by the franchisees Opportunities: Capitalize in coming years with rebounding economy Advertise more about unique drive in concept Expansion of Sonic Drive­Ins within the U.S. Threats: Cost of credit and less availability have caused fewer new franchise stores to open Consumer spending patterns Concerns about nutritional content of quick­serve food High level of fast food competition OBJECTIVES Marketing Objectives To maintain as leading (top ten) fast food restaurant operator in all of their markets by fiscal 2016. Sonic currently holds the place in the top 16 fast food hamburger chains in the USA based on number of locations. The goal is to keep Sonic in the top ten of all fast food restaurants. To maintain as a top five fast food restaurant in all high BDI markets by fiscal 2016. We are currently number five, and we want to maintain our spot amongst the competition. We plan to keep the advertising heavy in the peak months to keep sales and awareness up. Keeping the advertising and sales high will keep us where we want to be. To increase sales at Sonic restaurants among 18­24 year olds by 5% within fiscal year 2014­2015. Our primary target market for Sonic is adults, 18­24 years old. We want to market the brand as fast, inexpensive, quality food to experience in the unique atmosphere of Sonic. Advertising Objectives Increase Brand Awareness The goal is to increase brand awareness in certain areas of the country that are obtaining new Sonics in the year of 2015. We want to put extra emphasis on areas that have never had a Sonic in their area before. Emphasize Uniqueness Sonic has many characteristics, such as their high­quality distinctive made­to­order menu items and their personalized service featuring skating carhops, that make them unique among other competitors. These characteristics make Sonic separate from competitors such as McDonald’s, Burger King, and Wendy’s and will make consumers more likely to choose Sonic. Media Objectives National Plan The Sonic brand itself and the fast food category need a very high level of reach since the objective is to make all potential buyers aware of the new entry in these 32 new markets. Our media objectives are based on a national campaign with a standard message, while also putting extra emphasis on the 32 new markets. In order to do this, we need to increase our reach and frequency in these spot markets, in addition to funneling our advertising dollars into cable television, radio, and internet keyword search. The primary selling months for Sonic are March, June, July and September. Our method of advertising will be accomplished through a pulsing schedule, maintaining continuity but increasing advertising exposure at certain periods, such as the months of March, June, July and September. During these months, we intend to create high amounts of reach and frequency. However, we intend to generate most of our awareness through high levels of reach and frequency during those months that lead into sales. In the months of December, January and February, the months with little propensity to consume Sonic food due to the climate change, we decrease our numbers greatly in order to make the most of our budget. $5,000,000 of our $60,000,000 budget will be used for non­traditional media, such as a Sonic mobile (similar to the Oscar Meyer), Youtube promotions, Facebook, Twitter, and other social media platforms. Because the 18­24 year old market is heavily reliant on Social Media, we hope this will allow us to gain additional frequency to increase our overall average frequency in order to reach our goals established for each month. Although these platforms are difficult to measure ROI, we hope the success of each in the promotion of our brand will be reflected in our overall sales and goals set for each month. Creative Brief Client: Sonic Key Fact: Sonic is a fast food restaurant that offers a unique experience paired with several different menu options available throughout the day, but Sonic’s popularity is limited outside of the southeastern and southwestern U.S. Problem: Sonic is not very popular outside of the southeastern U.S. and several restaurants are being launched in new locations, and more 18­24 year olds need to be aware of the brand. Objective: To increase awareness of the brand and the sales of Sonic by 5% among 18­24 year olds within the fiscal year of 2014­2015. Target: Young adult females from middle class/upper middle class homes, typically residing in a larger urban area. They are usually kept busy with their college courses or new career, so Sonic offers them a quick and cheap solution for a snack or meal. Insight: Target market enjoys the unique atmosphere but also the convenience, variety, and quality food that Sonic has to offer. Promise: Sonic will provide an assortment of quality food items at a reasonable price. Sonic’s customer loyalty is strong, so once the new customers are drawn in and satisfied, they will continue to come back. Support: The menu at Sonic includes many different items – there is something to satisfy everyone. Brand loyalty among current Sonic customers is high, so once new customers are brought in, they will remain supportive of the brand. Mandatories: Brand name, logo MEDIA STRATEGY Television MRI Media Data suggests that the Sonic Drive­In users watch a minimal amount of television. Media data reveals through quintiles that our target audience is not a heavy user of prime television, daytime television, or of television as a whole. MRI Media Data also revealed that other fast food and drive­in restaurant users do not watch heavy amounts of television either. Using this data, we felt that television should be of lower emphasis in our media plan. Because television spots are expensive, we did allocate a fair amount of money to the medium, but we decided to minimize reach and frequency. As a result, spending is significant, yet GRPs is low. Within our television buys, it was decided to focus on daytime parts. Our reasoning behind this was gathered through MRI demographics and our target audience. MRI demos showed that the majority of Sonic Drive­In users are in the age group of 18­24. It was concluded that the majority of people in this age group are at home more during the day than the age group below and above them. To save money and reach our target audience better, we decided to only use daytime parts. Kantar Competitive Data revealed that top competitors were allocating much more towards Network Television than Sonic. It also revealed that Sonic was spending much more on Spot TV than top competitors. Because we are targeting new locations, we kept Spot TV buys comparable to Network TV buys to spread awareness. We did not allocate any money towards Spot TV in the months of December to February due to the decreased demand in fast food and cold Sonic beverages. We did spend minimal amounts in Network TV for the months of December­February to maintain awareness and keep Sonic in the mind of the consumers when making decisions against competitors. Radio We chose the medium radio to focus on because it a smart medium for casual dining. Because Sonic offers food for all meals of the day, morning, daytime, and evening, we think this will be an effective strategy because the majority of time people listen to the radio is in their cars. Audience that listen to advertisement for Sonic in their cars are more likely to make a stop at Sonic. We would adapt our well known commercials into radio. Because the commercials focus on two people’s funny conversation about Sonic rather than visuals, this will be beyond easy to adapt into a dialogue for radio. We picked most months to focus on but severely lessen December, January, and February because we do so poorly in those months (we attribute to lack of those who crave ice cream when it’s snowing outside) that we would rather focus on the months that make us more money. We still have spots in those time periods because we believe a year long radio presence will keep us in the minds of consumers. Based on the Kantar Data, we do however spend less than Burger King. We spend the majority of our radio budget for morning drive and daytime time slots. We believe when the target demographic is driving to school or work, they can be influenced to go to Sonic for breakfast or be enticed to get Sonic for lunch so our radio spots reflect auditory messages highlighting our mouthwatering breakfast and lunch specials. Daytime spots are important to us for the same reason because we believe our target audience will be driving from school or picking up kids from work and may be influenced to stop for a snack so for net radio morning drive we spend $17,666,000 (297 GRPs) and day time we spend $1,392,000 (297 GRPs). We spend significantly more on net but still spend a little on spot just at a smaller ratio with the same pattern of lower spending during the colder months and evening spots so for spot radio morning drive we spend $3,363,000 thousand (380 GRPs) and spot radio daytime we spend $3,276,000 (307 GRPs). As you can see, although it seems like we spend less in spot radio, we still have maintained our objective of increasing GRPs at a low cost. Because many Sonic stores have early closing hours in smaller or more conservative towns, we chose not to spend nearly as much with evening parts. We do also make sure to spend a little for spot radio and evening, because we believe a radio presence will impact our brand positively. Radio: Quintile 1: 105 Quintile 2: 104 Quintile 3: 113 Quintile 4: 98 Quintile 5: 81 These quintiles of our target market indicate that the heavy users (lower numbers) are heavy users of radio so our decision to use radio is intelligent and well thought out. I would like to spend more on radio. Magazines Sonic’s magazine presence is heavy. Quintiles one and two are the heaviest consumers of magazines, so we dedicated a good amount of our budget to magazines. Since our target market is 18­24 year olds, this is a prime medium to reach them. Overall, we allocated $13,255,000 to magazines throughout the year. The primary selling months for Sonic are June, July, and August, so we increased our budget for magazines in the months prior to those – March, April, and May. For this, we used full­page color ads. This is the prime time to pull in new customers, so we want the ads to grab their attention so they keep in mind that Sonic is an available fast food choice. Sonic sells the least in the months of December, January, and February. We kept some ads in general interest magazines, but we kept the budget for these months very low. Since these are the least active months for Sonic, we decided to only place ads in general interest magazines, and pulled all ads from men’s and women’s magazines. We used a combination of full­page color and full­page black and white ads during these months. We didn’t want to completely drop all magazine ads, so we used just enough to remind the consumers about Sonic. In June, we increased the budget for men’s magazines. Since the primary customers at Sonic are women, we wanted to increase awareness amongst men. We also allocated $250,000 more to men’s magazines than to women’s in the overall campaign. We are hoping that this will increase awareness amongst men, and they will bring their business to Sonic. We used full­page color ads to draw them in and grab their attention, but we also want them to get the information about the restaurant to get them to go. Outdoor For the same reason as radio, we believe outdoor media will be an effective vehicle as people see outdoor media when they are driving. Outdoor is a “go­to” for fast food restaurants for a reason because the media is typically located close to the establishment so it reminds someone of the location or informs travelers about a quick place to grab food on long drives unfamiliar with the area. We have been using clever wordplay and large appetizing pictures on our billboards to make audience enticed by the picture and humored by the text. For instance, one billboard reads “Let’s propose a toast” displayed with a mouthwatering picture of a sandwich in between two pieces of Texas toast. Because outdoor media can be so cheap and we really believe in our other vehicles, we chose to spend a little less. We picked most months to focus on but forgo December, January, and February because we do so poorly in those months (we attribute to lack of those who crave ice cream when it’s snowing outside) that we would rather focus on the months that make us more money. We believe our outdoor presence during this time will reach the people driving by to see signs and want to pull over for a snack whilst on the road. We spend 3070.9 thousand dollars for outdoor. Outdoor Quintiles: Quintile 1: 122 Quintile 2: 112 Quintile 3: 109 Quintile 4: 91 Quintile 5: 66 These quintiles of the target market show that the quintiles with less numbers are heavy users of outdoor media so our decision to buy more outdoor media is a smart one. Internet Internet will provide most of our supplemental reach and frequency from media such as Facebook, Twitter and YouTube promotions. Many people in our target audience of 18­24 year olds are heavily involved with social media according to the Sonic quintiles. This would allow us to gain additional frequency, especially since 90% of online users have a Facebook or Twitter account. The Internet will allow us to better compete with our competitors since they are also advertising on social media. Sonic is spending $6,030,800 in key word search advertising and $6,054,400 for targeted site advertising with much more concentration in the summer months. With June being the month we should spend the most in ($946,000), July and August are also months where we should invest high amounts of money with $709,500 in July and $827,800 in August. The summer months are the best to invest in because the target audience of 18­24 year olds will be attracted to the cool drink and slush selections as well as the ice cream and milkshake specials during the summer. The months we should spend the least in Internet advertising is in December, January and February where December is only $165,600 and January and February are $236,500. The rest of the middle months should have a steady amount of internet advertising in key word search and targeted sites around $400,000­$500,000 to keep internet users aware of seasonal offers. With keyword search, we would use the popular search engines like Google.com, which is highly visited by the target audience of 18­24 year olds. Buying keywords on websites would allow the target market to be reached whenever they type Sonic related words into a search engine, which would make our campaign goals easier to reach. Examples of key words that would direct consumers to Sonic’s website would be “Sonic” “Drive­In” “Slushes” “happy hour” “fast food” “pretzel dog” “sonic menu” “sonic locations” “ice cream” and many more. Since focus on the targeted sites is continues year round, the presence of the Sonic brand will constantly be available for the public to see on the Internet. Compared to our top competitors like McDonalds, Burger King, and Wendy’s, Sonic is spending less on Internet advertising so our increase in total spending and GRPs should help our market position. Non­Traditional Media We have chosen to attract a younger audience by creating the “Slushy Truck” at college campuses in our target regions. They will be situated in the hub of each campus so that students will have the opportunity to purchase a refreshing drink/slushy on their way to class during the warmer seasons. We are expecting a large increase in sales within college communities, and on social media. Sonic will have earned media from students through Twitter, Facebook, and FourSquare, which will allow us to view their opinions about flavor choices and the brand. These social medias will be the sole source of Sonic’s earned media for the entire campaign, because it will reach more spot markets than any other form of traditional media. The truck will primarily be located in the centers of campuses, but its mobility will be convenient enough to reach other parts of the college towns. The Sonic mobile device applications will be able to notify students about its current location and flavors each week. There are seasonal flavors, such as pink lemonade or blue raspberry that will be heavily promoted during the first semester, or third quarter, of every year. Students will be looking forward to a refreshing slushy on their way to class when the weather is warm between the months of April and September. We initially want to begin this campaign in the midwestern schools, because they are located in the strongest market for Sonic. If the outcome of this marketing technique is extremely effective, then we will further expand the idea into the Northwestern region cities. Alongside with college student promotion, Sonic will be featured on football game days by selling their signature food items to fans. The Island Fire Cheeseburger, SuperSonic Bacon Double, Original Pretzel Dog, and Foot Long Quarter Pound Coney will be the top featured items on the menu every game day. The truck will have a limited menu, because these food items are recently new additions to the Sonic drive thru menu. The result of this idea will ultimately increase sales at Sonic drive thru venues so that consumers can experience the whole menu options. Overall, the Slushy and Game­Day trucks will cover a vast range of ages between 18 year­old college students to 50 year­old alumni, and amplify the popularity among the younger generation. In addition, these strategies will increase our frequencies without increasing a large amount of the budget. EVALUATION Budget Evaluation Size of Budget: $60,000,000 Amount Allocated to National Contingency: $10,000,000 Amount Allocated to Spot Contingency: $5,000,000 Amount Allocated to Non­Traditional Media: $5,000,000 Our two biggest medium expenditures of this media plan went towards Internet and radio. We feel as though we spent the budget wisely because we were able to achieve high reach and high frequency. With our primary focus on reach, in order to launch the Sonic brand to our 32 new markets, we feel as though our message has been heard by the target market of young adults age 18­24 a sufficient number of times. We also included buys in Men’s, Women’s and General Interest Magazines, as well as Outdoor and Television to ensure recency of our brand’s message. Spending a sufficient amount on radio, mainly morning and dayparts, proves to be another way to achieve effective reach for our brand. Using Ostrow’s Model we calculated our goal frequency at roughly 3.5; due to our limited budget towards our 32 new spot markets we feel as though we have achieved the necessary frequency through the help of radio reinforcement and nontraditional promotions via Facebook, Twitter, and of course our Sonic Mobile. We chose to utilize the internet advertising available because our target market of 18­24 year olds is known to show heavy internet usage and are a tech­savvy generation. As well, the generations to follow are also very connected to the internet as a first reference for information. Social media is a huge market as well, connecting our target audience in an authentic way that also foster participation and interaction with the Sonic brand. And because the Oscar Meyer mobile is actually proven to be a hit with the young­adult crowd, we decided to utilize our non­traditional media budget in this way. Our distribution of the budget is a little bit different for each month. We increase the reach, frequency and thus our budget in the months prior to our biggest selling months. During the months of December, January and February, we cut our budget drastically due to a decrease in sales. Still, we retain a decent amount of reach and frequency to keep our brand in the minds of consumers. We anticipate enough carry­over sales during these months due to our heavy advertising campaign in the months prior to March, June, July and September. We feel as though the recency of our message would carry over into the three slow months enough to sustain an adequate income for the brand. We would also continue the Facebook/Twitter promotions during these three months because they are at no cost to the company. In addition, because we maintained to stay within our budget each month at no expense to our GRPs, reach and frequency, we did not need to allocate any more money from our contingency budget. Because of this, we can allocate some of this money more towards non­traditional media to promote more earned media. Sonic Media Plan Flowchart