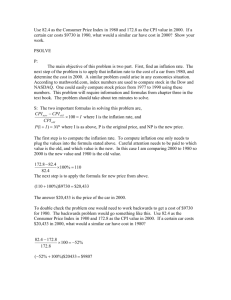

Credit Controls - Federal Reserve Bank of Richmond

advertisement