PUAD 662 – NATIONAL BUDGETING

advertisement

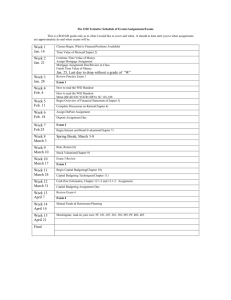

PUAD 662 – NATIONAL BUDGETING, SPRING 2014 Professor Paul L. Posner 703-371-1343 – cell 703-993-3957 – office 703-631-1445 – home pposner@gmu.edu Office hours: Tuesday, Metropolitan Building, 530-700 pm Course Description This course will focus on how the national government raises revenue and spends it. That sounds simple enough, just like your family budget! Except unlike your family budget, the participants don’t love each other. In fact, there are thousands of participants, each with differing interests and designs on scarce resources. The question of how much of the economy to devote to government through taxes and how to allocate those revenues is the most important annual decision that political leaders at all levels of government must make. They can decide to avoid some tough choices – reforming immigration and social security are two recent major policy reforms that leaders ducked for fear of the political consequences. Unlike these other areas, decisionmakers must decide the size and distribution of the pie every year, whether they like it or not. Budgetary choices have large economic and political stakes. From an economic perspective, the federal budget bottom line constitutes fiscal policy – a primary level for federal elected officials to manage the economy and deliver on campaign promises to create full employment with low inflation. The debates over the budget’s bottom line – how much deficit or surplus should have both now and in the future – have important consequences for the growth of the economy and for the distribution of economic resources among various interests. Individual budgetary decisions also have important economic implications – the decision to invest public resources in a particular area can have profound effects on private investments. For instance, the decision to provide federally subsidized flood insurance has set in motion the settlement of beaches and other low lying flood plains throughout the country, as home owners, realtors and developers are indemnified from risk by federal insurance payouts. While economically relevant, the budget is at its heart a political document. Whether officials try to hide it or not, the budget reveals their underlying priorities about two important values – how much government should extract from the economy and which claimants deserve more or less from the scarce resources that are raised. To make matters more tense, not only are resources limited for public programs, but needs are virtually infinite. Generals can testify about the woeful state of military armaments and readiness with as much earnesty and drama as highway engineers can attest to the many bridges about to collapse – and both can cite figures denominated in trillions of dollars to make the necessary investments to mitigate the risks to the public and the republic. Making tradeoffs among competing claims for limited resources is an inherently political process. No one has figured out a magic analytic formula for deciding how to determine the relative merit of these competing claims and groups. Thus, budgeting is at its heart a political process. But it is also a technical and managerial process. Managing the choice making requires seemingly mind numbing processes to create a common way to measure claims and ensure all the numbers add up. The technical jargon and cost accounting involved with budgeting at times seems to mask the underlying political stakes involved. But the manipulation of budget concepts, accounting and processes is as much a political process as the direct choices that are made. Savvy interest groups have their own litany of budget process reforms which, while always argued as saving the republic from imminent harm, have the fortunate side effect of just happening to benefit the interests of the group advocating that particular process reform. Thus, it is no surprise that highway lobby organizations advocate a capital budget – a budget structure designed to highlight and presumably more fully fund the vast inventory of unmet needs in this area. Budget processes are not just about how we make choices, but also about how we track and implement those choices. Legislators and Presidents alike are held accountable not just for the choices they make but for the results of the programs and operations they fund. Budget execution phases of budgeting are important to understand since these are the processes that determine how agencies, the President and the Congress ensure that actual spending is effective, efficient and, above all else, legal. This course will help you better understand how budget systems address these political, economic and managerial issues. We will work together to explore the following major areas: --The conceptual basis for the government’s role in the economy and the society --The economic rationale and implications of national budgeting decisions --The political processes shaping budgetary choices --The role played by various institutions in federal budgeting --The design and implementation of the budget formulation and execution process at the federal level --The various reforms proposed for changing the budgetary process Course Expectations Students will be expected to gain a conceptual understanding of the budget process in general as well as a familiarity with key features of budget formulation and execution. Students will deal with these issues through a combination of readings, class discussion, group projects and exams. A series of short two page essays will be required periodically to test students’ mastery of readings and concepts. A midterm and final take home exam will be administered. Students will be responsible for leading discussion of course readings each week. In addition, students will form groups in class to do the following projects: --Budget trends analysis – students will report to class on trends in key policy areas --Reports on key budget policy issues – groups will be responsible for presenting case studies to illustrate the issues discussed in class to be determined. Issues to be discussed will include the budget implications of social security, health care reform, infrastructure investment, the Obama stimulus and the states, value added taxation and extraordinary budget process reforms. --Deficit reduction exercise – students will form teams to play the role of various actors in the U.S. Senate assigned with the task of reducing the federal budget deficit by $1 trillion over 5 years.. Teams will play the following actors: President Obama, Senate Majority Leader Reid, Senate Minority Leader McConnell, Senator Olympia Snowe as leader of Republican moderates and Senator Ben Nelson as leader of Democratic moderates. Grading will follow these weights: Final exam – 35% Two pagers – 25% Class presentations – 25% General oral participation – 15% Two basic text books will be assigned: Allen Schick, Federal Budget: Policy, Politics and Process 3rd edition (Washington, D.C.: Brookings, 2007) Jay Eungha Ryu, The Public Budgeting and Finance Primer Considerable reliance will be placed on budget documents and reports issued by the U.S. Office of Management and Budget, the Congressional Budget Office and the U.S. Government Accountability Office which can be accessed on line at those agencies web sites (omb.gov; cbo.gov; gao.gov) In addition, various handouts will be provided through the University Library’s e-reserve and a password will be announced in class for students to access these materials. Three particularly useful documents are --The GAO’s budget glossary that provides a handy definition of budgetary terms you may not be familiar with. (U.S. Government Accountability Office, A Glossary of Terms Used in the Federal Budget Process (GAO-05-734SP) www;gao.gov --The CBO’s annual Budget and Economic Outlook: An Update, August, 2011 (www.cbo.gov) --The OMB’s budget documents, particularly the Analytical Perspectives and the Historical Tables, FY2012 Budget Students should notify the instructor if they are unable to attend a particular class by email either before or immediately after class. Unexplained absences will be duly noted in determining the student’s grade. Students will be required to hand all assignments in on time. Should students be late, the grade will be lowered by one half of a grade in deference to those students who submitted work on time. Plagiarism: You are expected to adhere to the honor code of George Mason University. This includes the university’s policy on plagiarism. Using the words or ideas of anyone other than yourself, and pretending those words are your own, constitutes serious academic dishonesty and will not be tolerated. Any words or ideas presented in your paper which are not your own must be properly quoted and/or cited in your paper. To guard against plagiarism and to treat students equitably, written work may be checked against existing published materials or digital databases available through various plagiarism detection services. Accordingly electronic forms of submitted materials may be requested. The Honor Code policy endorsed by the members of the Department of Public and International Affairs relative to the types of academic work indicated below is set out in the appropriate paragraphs: 1. Quizzes, tests and examinations. No help may be given or received by students when taking quizzes, tests, or examinations, whatever the type or wherever taken, unless the instructor specifically permits deviation from this standard. 2. Course Requirements: All work submitted to fulfill course requirements is to be solely the product of the individual(s) whose name(s) appears on it. Except with permission of the instructor, no recourse is to be had to projects, papers, lab reports or any other written work previously prepared by another student, and except with permission of the instructor no paper or work of any type submitted in partial fulfillment of the requirements of another course may be used a second time to satisfy a requirement of any course in the Department of Public and International Affairs. No assistance is to be obtained from commercial organizations which sell or lease research help or written papers. With respect to all written work as appropriate, proper footnotes and attribution are required. January 21– What is a budget anyway? This session will discuss the overview of the course. criteria for shaping the government’s role in the national economy and society. Public finance and public choice literatures will be discussed as well as historical data comparing U.S. experience with other OECD nations. We will discuss the differences between budgeting for federal government, states, private firms and the family. Allen Schick, The Federal Budget: Politics, Policy and Process – Chapters 1 and 2. PBS Frontline http://www.pbs.org/wgbh/pages/frontline/cliffhanger/ ASSIGNMENT due on January 28: Students will each play a game on budgetary choices to familiarize ourselves with federal budget choices. http://crfb.org/stabilizethedebt/ Each student will write a two pager discussing the three new things you learned about what it will take to close the fiscal gap. January 28– Macrobudgeting: The Economic role of the federal budget Discussion will place the economic role of the federal budget in perspective. Primer on macroeconomics and the role of fiscal policy in influencing macroeconomic trends. Recent historical experiences and projected long term models for future economic outcomes will also be discussed. Van Doorn Ooms et. al., The Federal Budget and Economic Management – handout CBO, Macroeconomic Effects of Alternative Budget Paths, pp. 1-12 IMF, Fiscal Monitor, October 2013, Chapter 1 Paul Krugman http://www.nytimes.com/2013/12/30/opinion/krugman-fiscal-feverbreaks.html?ref=paulkrugman http://www.nytimes.com/2013/10/18/opinion/krugman-the-damagedone.html?ref=paulkrugman Committee for Responsible Federal Budget, http://crfb.org/blogs/reinhart-and-rogoff Reinhart and Rogoff, Growth in a Time of Debt – handout Suggested reading: Alan Auerbach, American Fiscal History in the Post-War Era: An Interpretative History – handout Benjamin Friedman, Deficits and Debt in the Short and Long Run – handout GAO, Federal Debt: Frequently Asked Questions http://www.gao.gov/special.pubs/longterm/debt/index.html ASSIGNMENT due on February 4 : Krugman has called those concerned about rising debt deficit scowls while Reinhart and Rogoff worry about the consequences of rising debt. What would you tell a member of Congress to do in the next few years about – continue to curb the deficit, worry about the economy’s growth instead? Or a combination? February 4 – The crucible of politics Assessment of the political underpinnings for budgeting by exploring political trends in national government institutions, political parties, interest groups, media, cultural and social divisions. The results of these trends will be linked to pressures being brought to bear on the federal budget. Models will also be presented that seek to link dimensions of political debates and interests with policy outcomes. David Weimer and Aidin Vining, Policy Analysis in Representative Democracy handout Hugh Heclo, Hyperdemocracy – handout Anthony Downs, Why the Government Budget is Too Small in a Democracy – handout James Buchanan, “Why Does Government Grow?” – handout Tim Conlan and Paul Posner, Pathways to Power, Chapters 1 and 7 Suggested Readings: Committee for a Responsible Federal Budget, “Deficit Reduction: Lessons From Around the World,” (Washington, D.C., September, 2009). Jens Henriksson, Ten Lessons About Budget Consolidation (Brussels: Bruegel Essay and Lecture Series, 2007). February 11 – Does it take a crisis? Ryu, Chapter 7 Paul Posner, The Politics of Fiscal Austerity Paul Posner, Will It Take A Crisis” Pew Foundation, March, 2011. Standard and Poor’s downgrading of U.S. Treasuries from AAA to AA+ http://www.standardandpoors.com/ratings/articles/en/us/?assetID=1245316529563 GMU Centers on Public Service, The 1990 Budget Summit Suggested Readings: CRS report on government shutdown - handout Phil Joyce, The Costs of Budget Uncertainty – handout Leonard Burman, et. al. “Catastrophic Budget Failure” paper presented to the Conference on America’s Looking Fiscal Crisis, Los Angeles, Ca., January 15, 2010 R. Kent Weaver, “The Politics of Blame Avoidance” Journal of Public Policy (1986), 6: 371-398 Assignment: Write a two page blog giving your Vegas betting odds on reaching agreement on the following before 2016 elections: (1) debt ceiling increase (2) new budget and appropriations for the next three years (3) social security reform and (4) tax reform. What do you deduce are the major factors governing the probability of action or stalemate across these cases. February 11 and 18 – Microbudgeting: the structure of the federal budget process Discussion will focus on the concepts underlying the preparation of the federal budget, including budget baselines, budget accounts, functions, character class codes and object classes. The basic fundamentals about tracking federal expenditures through the process will be covered. Various kinds of budget authorities will be covered, including discretionary, mandatory, contract. Trust funds and federal funds will also be covered. U.S. GAO, A Glossary of Terms Used in the Federal Budget Process (GAO-05-734SP) – read appendices U.S. OMB, Historical Tables, FY 2012 Budget Allen Schick, Federal Budget, Chapters 3 and 4. ASSIGNMENT due on February 18: Different students will be asked to make presentations in class interpreting trends in the following areas: --Revenues over the past 50 years --Defense spending over the past 50 years --Health care spending over the past 50 years --Federal investment spending over the past 50 years --Grants to state and local governments over past 50 years --Income Security over past 50 years --Federal civil servants pay and benefits over past 50 years Using the OMB Historical Tables, groups of students will explain for the class the trends in nominal and real numbers as well as provide other perspectives helping to explain reasons for the trends. February 25 and March 4– The politics of budget formulation: The Executive Branch We will focus on the process of budget formulation – from both agency and central budget office perspectives. Discussion will first center on the role and nature of the formal institutions involved with budget formulation, including processes, requirements and submissions. Students will become familiar with the OMB Circular A-11 – the basic guidance to agencies to formulate their requests. The discussion will then proceed to explore the politics behind the process – what are the incentives faced by the various players in the process and what are some of the strategies they pursue? Ryu, Chapters 13-16 Allen Schick, Federal Budget – Chapter 5 Aaron Wildavsky, “Calculations” - handout Joseph White, Budgeting for Entitlements – handout Roy Meyers, Strategic Budgeting – handout Suggested readings: Barry White, Examining Budgets for Chief Executives – handout Charles Lindblom, The science of muddling through, Public Administration Review, 1959 James True, Frank Baumgartner and Bryan Jones, Policy Punctuations: U.S. Budget Authority, 1947-1995 – handout Charles Levine, Organizational Decline and Cutback Management, Public Administration Review Lynn on Niskanen - handout ASSIGNMENT due on March 4 : Students will make presentations in groups focused on specific agencies. In this case, students will be asked to assess the following kinds of budget cuts for the specific federal agency to be determined : (1) across the board cuts (2) cuts in employee pay and pensions (3) cuts in capital investment and maintenance and (4) cuts in grants and other benefit payments. Students will evaluate the short and long term financial costs/benefits, the social costs/benefits and the political costs/benefits. March 18 – The role of the Congress (Presentation by guest lecturer) Discussion will focus on the Congressional budget and appropriations processes. How does Congress formulate its own budget goals and how do the various institutions within Congress work to either support or undermine the process? The discussion will focus on appropriations committees and their roles in the process, as well as on authorization committees. Allen Schick, Federal Budget, Chapters 6, 8 and 9 Jonathan Rauch, “Divided We Thrive,” New York Times November 14, 2010. Diana Evans, Congressional Appropriations –handout Suggested Readings: James Saturno, Points of Order in the Congressional Budget Process - handout Steven Smith, “Congressional Trends”, – handout Philip Joyce, Congressional budget reform: The unanticipated implications for federal policy making Public Administration Review. Washington: Jul/Aug 1996. Vol. 56, Iss. 4; March 25 – Performance budgeting and accountability Discussion will focus on how budgets impact performance and implementation of programs. Discuss approaches over the years to introduce performance assessments and measures into budgeting. Discuss how agencies manage funds after appropriations are enacted. Oversight, audit and evaluation will also be addressed. Ryu,, Chapters 8-12 Allen Schick, Federal Budget, Chapter 10 Paul Posner and Denise Fantone, Performance Budgeting: Improving Prospects for Sustainability – handout Suggested readings: CBO, Comparing Budget and Accounting Measures of the Federal Government’s Financial Condition, Dec, 2006 Allen Schick, The Road to PPB: Stages of Budget Reform – article in Public Administration Review, December, 1966 OMB, Analytical Perspectives, FY 2012, Chapter 31 GAO, Understanding the Primary Components of the U.S. Government Financial Statements http://www.gao.gov/assets/80/76924.pdf ASSIGNMENT due on April 1: For class discussion, go to web site expectmore.gov which lists ratings done by Bush administration on the performance of all major federal programs. Read ratings for two of the programs rated “effective” – National Highway Traffic Safety Grans and Federal Transit Administration Formula Grants. And then read ratings for two “ineffective” programs – Amtrak and Essential Air Service (rated results not demonstrated which is even worse than ineffective). Be prepared to discuss the implications of these ratings in class. April 1 - The politics and process of taxation Discussion will focus on the composition of revenues, the implications of tax policy for economic outcomes and for budgetary choices. Tax expenditures are among the issues that will be considered Allen Schick, Federal Budget – Chapter 7 GAO report on tax policy - handout Sheldon Pollack, The Politics of Taxation – handout Suggested readings: U.S. GAO, Government Performance and Accountability: Tax Expenditures Represent a Substantial Federal Commitment and Need to be Reexamined, (GAO-05-690) Jonathan Baron and Edward J. McCaffery, “Starving the Beast: The Political Psychology of Budget Deficits” – handout April 8 - All Money is not Green: Capital budgeting, earmarked revenues and user fees We will learn about the special challenges associated with budgeting for capital, fee funded programs and earmarked revenues. Advocates for these kinds of programs have perennially attempted to recognize the different character of these kinds of programs by providing for differential treatment in the budget process. This session will discuss the unique issues associated with each, and will explore the implications of such solutions as capital budgets, trust funds and offsetting collections for the politics and outcomes of budgeting. OMB, Analytical Perspectives, FY 2012, Chapters 16, 21 and 28 Suggested Readings: GAO, Executive Guide: Leading Practices in Capital Decision-Making. GAO/AIMD99-32. December 1998 President’s Commission to Study Capital Budgeting Report, 1999. Paul L. Posner, Public-Private Partnerships: The Relevance of Budgeting, paper presented at OECD Senior Budget Officers meeting, 2008 GAO, Federal User Fees: A Design Guide, 2008, GAO-08-386SP April 15 – Intergovernmental Fiscal Relationships Federal budgeting is not only about federal agencies and their employees but also entails a range of other subsidies and tools providing subsidies, grants and loans to state and local governments and other nonprofit and private for profit entitities. State and local and the national government often jointly participate in financing public services through grants, loans and tax expenditures as well as mandates. This discussion will examine federal budgeting for intergovernmental programs and understand the implications for federal and state and local finances and accountability to common taxpayers. We will assess whether the politics of federal budgeting varies significantly for different tools of governance and how this manifests itself in federal program design and implementation. Ryu, Chapters 21 and 22 Report of the State Budget Crisis Task Force . http://www.statebudgetcrisis.org/wpcms/wp-content/images/Report-of-the-State-BudgetCrisis-Task-Force-Full.pdf OMB Analytical Perspectives FY2013, Chapter 18 Suggested Reading: Timothy Conlan and Paul Posner, “Inflection Point: Federalism and the Obama Administration” April 22 – BUDGET PROCESS REFORMS When groups don’t like the outcomes of the budget process, they reach for budget process reforms to change the results. In this session, we will inventory the types of process reforms, understand their prospective impacts and explore the political prospects of serious reform to the budget system at the national level. Paul Posner, “Waiting for Godot” Public Administration Review, March/April, 2009 Aaron Wildavsky, The Political Implications of Budget Reform: A Retrospective – Handout Allen Schick, Federal Budget, Chapter 11 Getting Back to Black, Report of Pew-Peterson Commission on Budget Process Reform, November, 2010 Suggested Readings: Center for Budget and Policy Priorities, Budget Process Reform, 2007 – handout Heritage Foundation, 10 Elements of Comprehensive Budget process Reform, 2006 handout Philip Joyce and Robert Reischauer, The Federal Line Item Veto: What it is and what it will do, Public Administration Review Vol 57, No. 2 (March,April, 1997) Irene Rubin, The Great Unraveling: Federal Budgeting, 1998-2006, Public Administration Review, July/August, 2007, Vol 67, Issue 4 April 29– Assessing Long Term Commitments and Fiscal Risks Session will explore how to think about long term commitments in the federal budget. Long term budget models will be examined to ascertain the nature of the long term exposures in the federal budget. New approaches for measuring and presenting those commitments in federal budgeting will be assessed. Potential linkages between federal budgeting and accounting will be examined to test whether additional value could be realized from the integration of these two financial disciplines. GAO, Fiscal Exposures: Improving the Budgetary Focus on Long-Term Costs and Uncertainties, GAO-03-213 (Washington, D.C.: Jan. 24, 2003). Congressional Budget Office, The Long Term Budget Outlook, 2013 The National Commission on Fiscal Responsibility and Reform, Moment of Truth, December, 2010 Henry J. Aaron, “How to think about the U.S. Budget Challenge,” Journal of Policy Analysis and Management (2010). Suggested readings: GAO, Accrual Budgeting: Useful in Certain Areas But Does Not Provide Sufficient Information for Reporting on the Nation’s Long Term Fiscal Challenge, GAO-08-206, 2007. Alan M. Jacobs, “The Politics of When: Redistribution, Investment and Policy Making for the Long Term,” British Journal of Political Science 38 (2008), pp. 193-220. , R. Kent Weaver, ‘Insights from Social Security Reform Abroad” in iR. Douglas Arnold, Michael J. Graetz and Alicia H Munnel, eds. Framing the Social Security Debate (Washington, D.C.: National Academy of Social Insurance, 1998). John Myles, discussant on Weaver, “Instights from Social Secuity Abroad” in R. Douglas Arnold, Michael J. Graetz and Alicia H Munnel, eds. Framing the Social Security Debate (Washington, D.C.: National Academy of Social Insurance, 1998). Paul Posner and Irene Rubin, “Budgeting for the Long Term” May 6 – Final class discussion Wrap up of course and discussion of lessons learned about budgeting in preparation for final exam. ASSIGNMENT: Students will form groups to attempt to debate and pass a $1 trillion reduction in the deficit through the U.S. Senate. Students will join groups to play the following roles: President Obama, Senator Reid, Senator McConnell, Senator Snowe, Senator Nelson. Each group will have a predefined number of Senatorial votes; budget options will be provided to the groups as the basis for proposals. The simulation game will be played on December 2 or December 9. FINAL EXAM – SENT OUT May 6