2nd Presentation

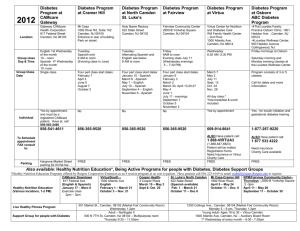

advertisement

1 9.16.15 RE3- Remediation + Redevelopment + Results Cooper’s Ferry Partnership CAMDEN 1957 Moving Camden Forward • Community Safety • Education • K-12 • Eds and Meds • Transportation • Development Moving Camden Forward Community Safety Moving Camden Forward Education Reform- K-12 Moving Camden Forward Education: Eds and Meds EDS & MEDS: • Rutgers University Camden • Cooper Medical School of Rowan University • Rowan University at Camden • Camden County College • Cooper University Hospital • MD Anderson Cancer Center • Virtua Hospital • Our Lady of Lourdes Over 12,000 Higher Ed Students (180+ Medical Students) Moving Camden Forward Transportation 8 Walter Rand Transportation Center RiverLink Ferry & Taxi Benjamin Franklin Bridge Walt Whitman Bridge Planned Glassboro-Camden Line GreenWay Trails Access to NJ Turnpike | 295 | 676 Rt. 30, 38, 42, 70, 168 15 mins to PHL airport 8 Camden Kroc Center 2008 Roberts Pavilion Rutgers Graduate Dormitory City Parks, Roads and Streetscape MD ANDERSON COOPER Cancer Center Cooper Medical School of Rowan University Setting The Stage For Private Investment 2008 – 2013 Over $750 Million New Jersey Economic Opportunity Act The Driving Force Rebuilding The City 10 1 YEAR - $1 BILLION Holtec International Cooper Hospital Lockheed Martin Webimax Diogenix Volunteers of America Subaru of America Broadway Associates $260,000,000.00 $40,000,000.00 $107,000,000.00 $12,800,000.00 $7,500,000.00 $6,300,000.00 $118,000,000.00 $13,500,000.00 Broadway Housing Partners PCM Contemporary Graphics Solutions American Water Works Co. Chef'd LLC Great Socks LLC EMR $6,100,000.00 $3,900,000.00 $34,000,000.00 $164,000,000.00 $19,000,000.00 $15,000,000.00 $253,000,000.00 More Announcements Within 90-Days New Jersey Economic Opportunity Act The Driving Force Rebuilding The City GROW: Job creation and job retention incentive program Provides corporate business & insurance premiums tax credits Min of 8 new or 19 retained full time employees Min capital investment of $15/sqft of gross leasable area Credits are material factor in decision Prove net positive benefit of 100% of tax credit amount • Stay for 1.5x length of credits (15 years) Business receives 1/10 of total credit each year for 10 years $35,000,000 maximum annual cap • • In Camden, additional awards if create > 35 jobs & make capital investment > $5 million Claw back if fall below 80% of certified employment level Applications due July 1, 2019 ERG: Key developer incentive program • Fills project financing gaps: insufficient revenues to support the project debt service under a standard financing scenario or a below market development margin or rate of return Incentive grant reimbursement = up to 40% of total project cost for commercial projects including retail, office and/or industrial uses for purchase or lease 20 year term Max of annual percentage amount of reimbursement < an average of 85% of the project's annual incremental revenues Applications due July 1, 2019 • No property tax on improvements for years 1-10; full tax rate phased in at 10%/year for years 11-20 (GROW and ERG) New Jersey Economic Opportunity Act Example: Company Relocation 150 Employees (Building 70k sq ft) OWN LEASE If lease 70,000 sq ft with 150 employees $13,000 per employee per year x 150 employees = $1,950,000 annual Rent= 70,000 sqft @ $30/sqft NNN $2,100,000/year = $2,100,000 (Market Rate Rent) $1,950,000 (Total Amount of Credits)= $150,000 Annual Rent 70,000sq ft - Class A /NNN (Turn Key Operation) If build 70,000 sq ft with 150 employees Up to $50million for 150 Employees Acquisition + All Development Cost (+expenses) = 70,000 sqft @ $500/sqft $35,000,000 (Development Cost) $35 Million All-in Development Cost- Up to $50 Million Tax Incentives= Free 70,000 sq ft – Class A Office Building Note* Calculations are made with the assumption that the EOA applicant keeps/uses the credits OTHER INCENTIVES No state sales tax on any item purchased in NJ (construction, office supplies, etc.) vehicles & gasoline are excluded No wage tax Employees pay income tax in state of residence New Market Tax Credits Historic Tax Credits Employees pay income tax in state of residence Any retail items sold in Camden are subject to ½ state sales tax (3.5%) Energy BPU Saving (Up to $1-Million) Future Development Sites Waterfront Sites 14 Admiral Wilson Blvd. Former Prison Development Opportunities Goldenberg Site- Admiral Wilson Blvd. 15 20 Acres Development Opportunities Gateway District (Campbell’s Soup, Subaru HQ) Conceptual Drawing 16 Gateway District Conceptual Drawings for Development • Brandywine Realty • Subaru HQ Campbell’s Soup HQ Existing Site Waterfront Opportunities Various Sites 17 Waterfront Opportunities AVAILABLE NOW 18 Ruby Match Factory- 300 N. Delaware (856) 234-9300 www.loft-offices.com 19 For More Information Anthony Perno- President & CEO 856. 757. 9154 perno@coopersferry.com 9.16.15 LIVE. WORK. INVEST. CAMDEN.