George R Anderson Jr Financial Disclosure Report

advertisement

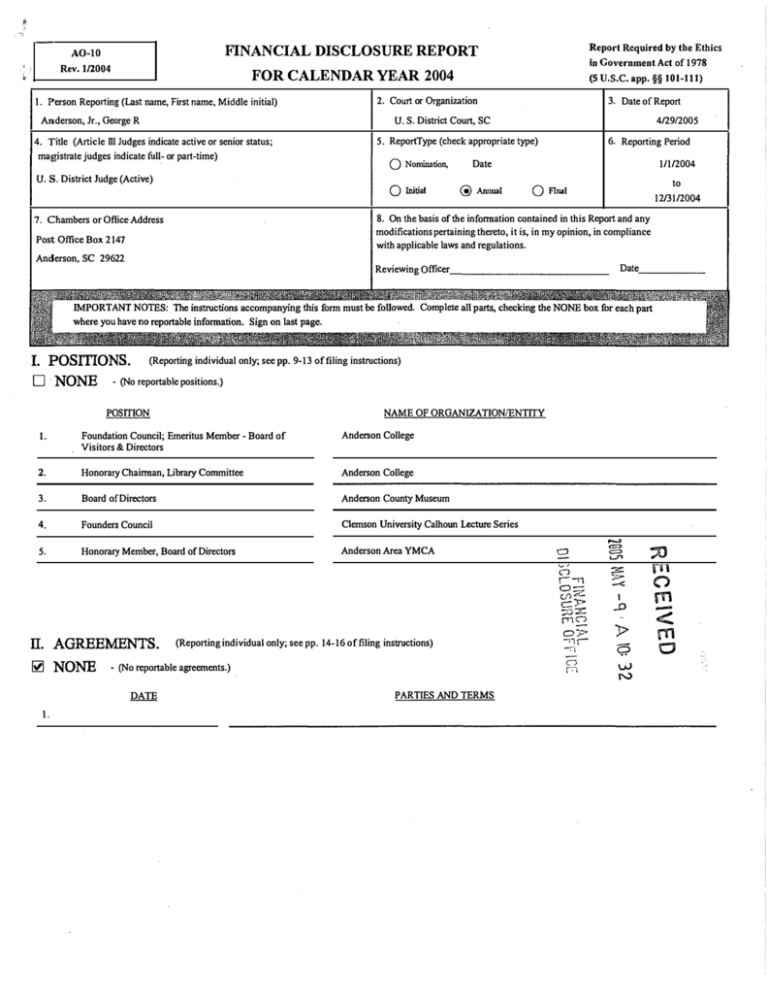

Report Required by the Ethics

FINANCIAL DISCLOSURE REPORT

A0-10

Rev.1/2004

in Government Act of 1978

FOR CALENDAR YEAR 2004

I. Person Reporting (Last name, First name, Middle initial)

(5 U.S.C. app. §§ 101-111)

2. Court or Organization

3. Date of Report

U. S. District Court, SC

Anderson, Jr., George R

4. Title (Article Ill Judges indicate active or senior status;

magistrate judges indicate full-or part-time)

U. S. District Judge (Active)

412912005

5. ReportType (check appropriate type)

Q

Nomination,

0

Initial

6. Reporting Period

Date

(!)

AI111ual

1/1/200 4

Q

to

Final

12/31/2004

8. On the basis of the information contained in this Report and any

7. Chambers or Office· Address

modifications pertaining thereto, it is, in my opinion, in compliance

Post Office Box 2147

with applicable laws and regulations.

Anderson, SC 29622

Reviewing Officer

_____________

I. POSffiONS.

D NONE

·

-

_

____

(Reporting individual only; see pp. 9-13 of filing instructions)

(No reportable positions.}

NAME OF ORGANIZATIONffiNTITY

POSITION

I.

Date.

Foundation Council; Emeritus Member - Board of

Anderson College

Visitors & Directors

2.

Honorary Chairman, Library Committee

Anderson College

3.

Board of Directors

Anderson County Museum

4.

Founders Council

Clemson University Calhoun Lecture Series

5.

Honorary Member, Board of Directors

Anderson Area YMCA

CJ

.....,

=

=

....,,

C)

::;;-::

,. _,,

o::;.;

C.f) tc::: )'::>'

::oz

rri::?,

II. AGREEMENTS.

NONE

-

(Reporting individual only; see pp. 14-16 of filing instructions)

c-i

C-)

(No reportable agreements.)

r7 1

PARTIES AND TERMS

I.

O'Y'

-nr

-

:;,=.-<

I

....0

)>

9

I.>)

N

;1J

('")

rn

-

<

rn

c

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting

Date of Report

4/29/2005

Anderson, Jr., George R

ill. NON-INVESTMENT INCOME.

A.

(Reporting individual and spouse; see PP· 11-24 of filing instructions)

Filer's Non-Investment Income

NONE

·

(No reportable non-investment income.)

SOURCE AND TYPE

GROSS INCOME

(yours, not spouse's)

1.

B.

Spouse's Non-Investment Income - (If you were married during any portion of the reporting year, please complete this section. Dollar amount

not required except for honoraria.)

NONE

- (No reportable non-investment income.)

SOURCE AND TYPE

l.

IV. REIMBURSEMENTS

--

transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children. See pp. 25-27 of instructions.)

0 NONE

-

(No such reportable reimbursements.)

SOURCE

DESCRIPTION

[.

SC Bar Association (Convention]

January 23-25, 2004, Charleston, SC [Hotel & Registration Fee]

2.

SC Bar Association [Seminar]

May 20-21, 2004, Charleston, SC (Hotel] [Seminar Speaker]

3.

SC Trial Lawyers Association [Convention]

August 4-7, 2004, Hilton Head, SC [Room, Registration Fee]

4.

Charleston School of Law [Opening Ceremony]

August 17-18, 2004, Charleston, SC [Room]

5.

SC Trial Lawyers Association [Convention]

December 2-5, 2004, Atlanta, GA (Room] [Convention Speaker]

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting

Anderson, Jr., George R

V. GIFTS.

NONE

Date of Report

4/29/2005

(Includes those to spouse and dependent children. See pp. 28-31 of instructions.)

-

(No such reportable gifts.)

SOURCE

DESCRIPTION

1.

VI. LIABILITIES.

NONE

-

CREDITOR

1.

(Includes those of spouse and dependent children. See pp. 32-34 of instructions.)

(No reportable liabilities.)

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT

Date of Report

Name of Person Reporting

:.---Page 1of5

Anderson, Jr., George R

. Vil. INVESTMENTS and TRUSTS

4/29/2005

-- income, value, trauscations (includes those of the spouse and dependent children.

Description of Assets

Transactions during reporting period

reporting period

(1)

(2)

(1)

D.

Gross value at end of

Income during

reporting period

(including trust assets)

.

c.

B.

A.

See pp. 34-57 of filing instructions )

If not exempt from disclosure

(1)

(2)

(3)

(2)

Place "(X)" afet r each asset exempt

from prior disclosure

Value

Type

Code I

(e.g.

div. rent or

Code2

(A-H)

int.)

(J-P)

Amount

Va lue

Method

Code 3

(Q-W)

DNONE

Type (e.g.

buy, sell,

Date:

merger,

Day

Month-

redemption)

(4)

Code2

buyer/seller

(J-P)

I

(ifpri•11te

(A-

transaction)

HI

(No reportable income, assets, or transactions)

I.

PROPERTY #1, ANDERSON, SC

2.

INSURED MUNICIPAL INCOME TRUST BOND

3.

COMMUNITY FIRST BANCORPORATION

None

J

w

A

Interest

J

T

A

Dividend

L

T

c

Interest

K

T

B

Interest

K

T

c

Interest

K

T

P.Redeem

1125

J

P.Redeem

Ill

J

A

7.

P. Redeem

7/1

J

A

8.

P.Redeem

9/1

J

A

4.

5.

6.

9.

10.

11.

(9.36%)

COMMON STOCK

SC RESOURCES AUTHORITY LOCAL

GOVERNMENT BOND

(7.2%)

CHARLESTON CO.SC HOSPITAL BOND

(5.625%)

SC STATE HOUSING AUTHORITY BOND

(6.45%)

CHARLESTON CO.SC HOSPITAL BOND

B

Interest

K

T

c

Interest

L

T

B

Interest

K

T

(5.625%)

DARLINGTON CO. SC BOND

(6.125%)

RICHLAND-LEXINGTON SC AIRPORT BOND

(6.125%)

12.

CHARLESTON CO.SC BOND

(5.5%)

c

Interest

K

T

13.

CHARLESTON CO. SC BOND

(5.5%)

D

Interest

M

T

B

Dividend

M

T

A

Dividend

K

T

None

L

w

D

Interest

L

T

c

Interest

K

T

14.

THE SOUTH FINANCIAL GROUP, INC.

COMMON STOCK

15.

COMMUNITY CAPITAL CORP. COMMON

16.

PROPERTY #2, ANDERSON, SC

17.

STOCK (BELTON BANK)

SPARTANBURG COUNTY SC HEALTH

SERVICES BOND

18.

I.

2.

(5)

ldentily of

Gain

Code

Value

(5.5%)

LEXINGTON CO. SC HOSPITAL BOND

(5.125%)

less

Iucome/Gain Codes:

A

= $1,000 or

B

= $1,001-$2,500

C

(See Columns Bl andD4)

F

= $50,001-$100,000

G

=$100,001-$1.000,000

HI =$1,000,001-$5,000.000

= $15,000 or less

K

, $15,001-$50,000

L

N = $250,000-$500,000

0

=$500,001-$1,000,000

Pl

Value Codes:

(See Columns

Cl and D3)

3. Value Method Codes

(See Column C2)

P3

=

$25,000,001-$50,000,000

Q

=

Appraisal

lJ =Book Value

,

=$2,501-$5,000

=

$50,001-$100,000

= $1,000,001-$5,000,000

P4

=

D

=

$5,001-$15, 000

H2 =More than$5,000,000

M

= $100.001-$250,000

P2

=

T

= CashiMarkel

$5,000.001-$25.000,000

$More than $50.000,000

R

= Cost (Real Eslate Only)

S

=

Assessment

V

=Other

W

=

Estimated

E

= $15,001-$50,000

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting

Page 2 of5

Anderson, Jr., George R

·vn. lNVESTMENTS and TRUSTS

Date of Report

4/29/2005

- income, value, transcations (includes those of the spouse and dependent children.

B.

A.

c.

Description of Assets

Transactions during reporting period

reporting period

reporting period

(I)

D.

Gross value at end of

Income during

(including trust assets)

See pp. 34-57 of filing instructions.)

(2)

(I)

(2)

If not exempt from disclosure

(1)

Place "(X)" after each asset exempt

from prior disclosure

Value

Code I

div.

Code2

(A-H)

int)

(e.g.

renL or

Value

Method

Code3

(Q-W)

(J-P)

D

Interest

M

T

SC PUBLIC SERVICE AUTHORITY BOND (5%)

B

Interest

K

T

BANK OF ANDERSON ACCOUNT,

A

Interest

L

T

A

Dividend

K

T

A

Dividend

L

T

RE G IONS FINANCIAL CORP. COMMON STOCK

c

Dividend

L

T

SC PUBLIC SERVICE AUTHORITY BOND

D

Interest

M

T

SPARTANBURG CO. SC HEALTH SERVICES

19.

Type

Amount

Type

(e.g.

buy, sell,

Date:

Month-

merger,

Day

redemption)

(4)

(3)

(2)

(5)

Value

Gain

Identity of

Code2

Code

buyer/seller

(J-P)

1

(if private

m

(A-

transaction)

BOND (5.125%)

20.

21.

ANDERSON, SC

GRANDSOUTH BANCORPORATION COMMON

22.

STOCK

PEOPLES BANCORPORATION, INC. COMMON

23.

STOCK

24.

25.

(5.125%)

26.

FLORENCE CO. HOSPITAL BOND (4.75%)

B

Interest

K

T

27.

HORRY CO. HOSPITAL BOND (5.00%)

B

Interest

K

T

28.

ORANGEBURG CO. SC BOND (5.70%)

D

Interest

M

T

29.

MSDWIRA#l

c

Dividend

K

T

30.

- MSDW AMERICAN OPPORTUNITIES B

31.

- MSDW DNIDEND GROWTH B MUTUAL

32.

MSDWIRA#2

A

Dividend

J

T

33.

- MSDW AMERICAN OPPORTUNITIES B

34.

- MSDW DNIDEND GROWTH B MUTUAL

B

Distribution

MUTUAL FUND

FUND

MUTUAL FUND

FUND

MANDATORYIRA DISTRIBUTION: MSDW IRA

35.

Distributio

#1

MSDW GROWTH SEC. B FUND (MUTUAL

36.

See Note#1 in

12115

n

F

N

Dividend

Part VIII

T

FUND)

1. Income/Gain Codes:

(See Columns BI and D4)

Colurrms Cl

and 03)

= $1,001-$2.500

c

D

=

$5,001-$15,000

G

= $100,001-$1.000,000

Hl = $1,000,001-$5,000.000

H2

=

More

= $15.000 or less

K

= $15,001-$50,000

L

= $50,001-$100.000

M

=

$100.001-$250,000

= $250,000-$500.000

0

= $500.001-$1,000.000

Pl

= $1,000,001-$5,000,000

P2 = $5,000.001-$25.0IJO,OOO

=Cost (Real Estate

= $1,000 or less

F

=

N

P3

=

2. Value Codes:

(See

B

A

$50,001-$100,000

$25,000,001-$50.000,000

= $2,501-$5.000

P4 =$More

.1. YalueMethodCodes

Q

=Appraisal

R

(See Column C2)

u

=Book Value

v

Other

Only)

than $5,000,000

than $50.000,000

s

=

w

=Estim1tcd

Assessment

T

= CaslvMarkel

E

=$15.001-SSO,OOO

FINANCIAL DISCLOSURE REPORT

.

.... Page3 of5

Anderson, Jr., George R

'VII. INVESTMENTS and TRUSTS

- income,

4/29/2005

value, transcations (includes those of the spouse and dependent children. See pp. 34-57 offiling instructions.)

c.

B.

A.

at end of

reporting period

(2)

(I)

Place "(X)" after each asset exempt

from prior disclosure

Amow1t

Code I

(A-H)

(2)

(I)

If not exempt from disclosure

(1)

(3)

(4)

Value

Code2

(J-P)

Gain

Cod e

I (A-

(2)

Value

Code2

(J-P)

Type (e.g.

div. rent. or

int.)

MSDW AMERICAN OPPORTUNITIES FUND B

D.

Transactions during reporting period

Gross value

Income dming

reporting period

Description of Assets

(including trust assets)

37.

Date of Report

Name of Person Reporting

.

Value

Method

Code3

(Q-W)

None

L

T

None

J

T

Type (e.g.

buy, sell,

merger,

red emption )

Date:

Month-

Day

HI

(5)

Identity of

buyer/seller

(if private

transaction)

(MUTUAL FUND)

MSDW CAPITAL OPPORTUNITIES FUND

38.

(MUTUAL FUND)

MANDATORY IRA DISTRIBUTION: MSDW IRA

39.

A

Distribution

Distributio

SC TRANSPORTATION INFRA-STRUCTURE

40.

12115

See Note #2 in

n

#2

D

Interest

N

T

B

Interest

K

T

Part VllI

BOND (5.375%)

HILTON HEAD ISLAND SC GEN. OBL. BOND

41.

(5.50%)

42.

UNIVERSITY OF SC BOND (5.75%)

c

Interest

K

T

43.

LEXINGTON CO. SC WATER & SEWER BOND

D

Interest

M

T

44.

GREENVILLE HOSPITAL SYSTEM BOND

c

Interest

L

T

45.

SC TRANSPORTATION INFRASTRUCTURE

c

Interest

K

T

THREE RIVERS SOLID WASTE BOND (5.30%)

D

Interest

M

T

GREENVILLE HOSPITAL SYSTEM BOND

D

Interest

M

T

c

Interest

K

T

c

Interest

L

T

None

K

T

c

Interest

L

T

A

Interest

J

T

B

Interest

K

T

D

Interest

M

T

(5.45%)

(5.25%)

BOND (5.25%)

46.

47.

P. Redeem

111

K

(5.00%)

SC PUBLIC SERVICE AUTHORITY BOND

48.

(5.125%)

GREENVILLE HOSPITAL SYSTEM BOND

49.

(5.00%)

MSDW AMERICAN GROWTH FUND OF

50.

AMERICA B MUTUAL FUND

BEAUFORT-JASPER SC WATER & SEWER

51.

BOND (5.00%)

SC STATE HOUSING DEVELOPMENT BOND

52.

(5.125%)

SC TRANSPORTATION INFRASTRUCTURE

53.

BOND (5.00%)

SPARTANBURG CO. SC HOSPITAL BOND

54.

(5.25%)

l. Income/Gain Codes:

(See

Colunms Bl and D4)

A

= $1,000 or less

B

= $1,001-$2,500

c

= $2,501-$5.000

D = $5,001-$15,000

F

= $50,001-$100.000

G

= $!00,001-$1.000,000

HI

= $1.000,001-$5,000.000

H2 =More

= $15.000 or less

K

= $15,001-$50,000

L

"' $50,001-SJOO.OOO

0

'

Pl

=

P4

=$More than $50.000,000

2. Value Codes:

(See

Columns Cl and D3)

3. Value Method Codes

(See

Colunm C2)

N

=

$250,000-$500.000

P3

=

$25,000.001-$50.000,000

Q

=Appraisal

lJ =Book Value

$500.001-$1,000,000

R

=Cost (Real

v

=Other

Estate Only)

$1,000,001-$5,000,000

s

= Assessment

w

=Estimated

than $5,000,000

M

= $100.001-$250,000

P2

=

$5,000.001-$25.000,000

T

=

CashiMarket

E

= $15,001-$50,000

FINANCIAL DISCLOSURE REPORT

Date of Report

Name of Person Reporting

Page4 of5

Anderson, Jr., George R

Vll. INVESTMENTS and TRUSTS

4/29/2005

-- income, value, transcations (includes those of the spouse and dependent children. See pp. 34-57 offiling instructions.)

c.

B.

A.

Description of Assets

(including trust assets)

D.

Income during

Gross value at end of

reporting period

reporting period

(1)

(2)

(l)

Transactions during reporting p eriod

(2)

If not exempt

(1)

Place "(X)" after each asset exempt

from prior disclosure

Type

Code I

div. rent. or

(A-H)

int.)

SC STATE PUBLIC SERVICE AUTHORITY

55.

Value

(e.g.

Amow1t

Value

Code2

Method

(J-P}

Code 3

(Q-W)

E

Interest

N

T

D

Interest

M

T

D

Interest

M

T

D

Interest

M

T

SC TRANSPORTATION INFRASTRUCTURE

LEXINGTON CO. SC WATER & SEWER BOND

SC STATE PUBLIC SERVICE AUTHORITY

59.

VAN KAMPEN COMSTOCK B MUTUAL FUND

A

Divided

L

T

60.

GREENVILLE CO. SC SCHOOL DISTRICT

D

Interest

M

T

D

Interest

M

T

GREENVILLE CO. SC SCHOOL DISTRICT

c

Interest

L

T

63.

SC TRANSPORTATION INFRA. BOND (5.10%)

c

Interest

L

T

SPARTANBURG CO. SC HEALTH SERVICES

c

Interest

L

T

D

Interest

M

T

A

Interest

J

T

c

Interest

K

T

c

Interest

L

T

B

Interest

K

T

c

Interest

L

T

B

Interest

K

T

B

Interest

K

T

64.

I.

J.f\

buyer/seller

(ifpm1ate

transaction)

HOSPITAL BOND (5.25%}

GREENVILLE CO. SC SCHOOL DISTRICT

65.

72.

I (A-

BOND (5.5%}

SC TRANSPORTATION INFRA. BOND (5%)

71.

Code

BOND (5.5%)

62.

70.

Code2

(J-P}

SANTEE COOPER BOND(5. l25%)

61.

69.

Day

Gain

(5.00%)

58.

68.

redemption}

Month-

(5)

Identity of

Value

BOND (5.10%)

57.

67.

merger,

Date:

SANTEE COOPER BOND(5.125%)

56.

66.

Type (e.g.

buy, sell,

from disclosure

(4)

(3)

(2)

BOND (5.5%)

GREENVILLE HOSPITAL SYSTEMS FACILITY

REV. BOND (4.6%)

SPARTANBURG CO. SC HEALTH SERVICES

HOSPITAL BOND (5.25%)

SPARTANBURG CO. SC HEALTH SERVICES

HOSPITAL BOND (5.25%)

SC STATE PUBLIC SERVICES AUTH. SANTEE

COOPER BOND (4.75%)

SC STATE PUBLIC SERVICES AUTH. SANTEE

COOPER BOND (4.75%)

BEAUFORT CO. SC TAX REVENUE BLUFFTON

BOND (5.00%)

SC STATE PUBLIC SERVICES AUTH. SANTEE

COOPER BOND (5.125%)

Income/Gain Codes:

A

=

$ ! ,000 or less

B

=$1,001-$2,500

C

=

$2,501-$5,000

D

(See Columns

F

=

$50,00 l-$100.000

G

=$100,001-$1,000,000

HI

=

$1.000,001-$5,000.000

H2 =More than $5,000,000

= $15 .000 orless

K

=

L

= $50,001-$100,000

N

=$250,000-$500.000

0

=$500,001-$1,000,000

Pl

"

P3

=-

Q

=Appraisal

R

=

V

=Other

BI and D4)

2. Value Codes:

(See Colunms Cl

3. Value

and 03)

Method Codes

(See Colunm C2)

$15,001-$50,000

$5,001-$15,000

M

= $100,001-$250,000

P2

=

$5,000,001-$25.000,000

P4 =$More than $50,000,000

$25,000,CIOl-$50.000,000

lJ =Book Value

$1,000,001-$5,000,000

=

Cost (Real Estate Only)

S

=

Assessment

W

=

Estimated

T

=Cash/Market

E

=

$15,001-$50,000

FINANCIAL DISCLOSURE REPORT

Date of Report

Name of Person Reporting

Page5 of5

Anderson, Jr., George R

VII. INVESTMENTS and TRUSTS

412912005

-- income, value, transcations (includes those of the spouse and dependent children. See pp. 34-57 of filing instructions.)

c.

Gross value at end of

reporting period

B.

Income during

reporting period

A.

Description of Assets

(inc luding trust assets)

(1)

Place "(X)" after each asset exempt

from prior disclosure

Amount

Code I

{A-H)

(2)

(1)

(2)

Value

Code2

(J-P)

Type (e.g.

div. rent or

int.)

D.

Transactions during reporting period

If not exempt from disclosure

(1)

Value

Method

Code 3

(Q-W)

Type (e.g.

buy. sell,

merger,

(2)

Date:

Month Day

redemption)

(3)

(4)

Value

Code2

(J-P)

Gain

Code

I (AHI

73.

MSDW JP MORGAN MID CAP VALUE B FUND

A

Dividend

K

T

Buy

2/25

K

74.

COLLEGE OF CHARLESTON BOND (5%)

c

Interest

L

T

·Buy

1/12

L

75.

BERKELEY CO. SC WATER & SEWER BOND

B

Interest

K

T

Buy

7/13

L

B

Interest

L

T

Buy

10/28

L

(5)

Identity of

buyer/seller

(ifprivate

transaction)

(5%)

GREENVILLE CO. SC SCHOOL DISTRICT

76.

BOND(5.5%)

l. Income/Gain Codes:

(See Columns

Bl and D4)

B

= $1,001-$2,500

c

G

= $!00,001-$1,000,000

HI = $1.000,001-$5,000.000

K

= $15,001-$50,000

L

0

=

Q =Appraisal

R

=Cost (Real Estate Only)

lJ '" Book Value

v

=

$1,000

F

=

$50,001-$100.000

=

$15,000 or

=

$250,000-$500,000

2. Value Codes:

(See

Columns Cl and DJ)

or less

A

N

less

$500,001-$1,000,000

Value Metliod Codes

(Sec

Column C2)

$2,501-$5.000

= $50,001-$100,000

Pl = $1,000,00J-$5,000,000

D

=

$5,001-$15,000

H2

=

More thau $5,000,000

M

=

$100.001-$250,000

E

= $15.001-SSO.OOO

P2 = $5,000.001-$25.000,000

l'4 =$More than $50.000,000

P3 = $25,000,001-$50.000,000

3.

=

'Other

s

=

w

- Estimated

Assessment

T

=

Cash/Markel

I

i

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting

Date of Report

Anderson, Jr., George R

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS

l) Part VII, page 2, line 35: 6th mandatory IRA withdrawal. IRA listed in Part VII, page 2, line 29.

2) Part VII, page 3, line 39: 5th mandatory IRA withdrawal. IRA listed in Part VII, page 2, line 32.

4/29/2005

(Indicate part of Report.)

FINANCIAL DISCLOSURE REPORT

Name of Person Reporting

Date of Report

Anderson, Jr., George R

4/29/2005

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if

any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported

was

withheld

because it met applicable statutory provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been

reported are in compliance with the provisions of 5 U.S.C. § 501 et. seq., 5 U.S.C. § 7353, and Judicial Conference regulations.

APRIL 29,

2005

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY

BE SUBJECT TO CML AND CRIMINAL SANCTIONS (5 U.S.C. app. § 104)

FILING INSTRUCTIONS

Mail signed original and 3 additional copies to:

Committee on Financial Disclosure

Administrative Office of the United States Courts

Suite 2-301

One Columbus Circle, N.E.

Washington, D.C. 20544