Automotive Industry Analysis - the Systems Realization Laboratory

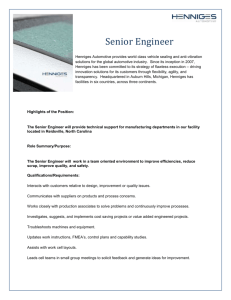

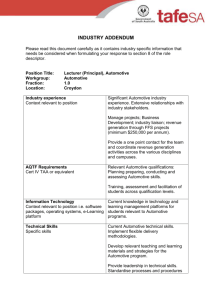

advertisement