KFC Killer: How Popeyes Reinvented Itself To Win The Fried

advertisement

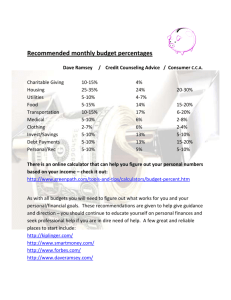

24 Daily THE DAILY LIST The World’s Most Powerful People BY FORBES STAFF SERGEI CHIRIKOV/AFP/GETTY IMAGES NAME AGE RESIDENCE / ORGANIZATION 1 VLADIMIR PUTIN RUSSIA / RUSSIA 62 2 BARACK OBAMA 53 UNITED STATES / UNITED STATES 3 XI JINPING CHINA / CHINA 61 4 POPE FRANCIS 77 VATICAN CITY STATE / ROMAN CATHOLIC CHURCH 5 ANGELA MERKEL GERMANY / GERMANY 60 6 JANET YELLEN 68 UNITED STATES / FEDERAL RESERVE 7 BILL GATES 59 UNITED STATES / BILL & MELINDA GATES FOUNDATION 8 MARIO DRAGHI 67 ITALY / EUROPEAN CENTRAL BANK 9 SERGEY BRIN 41 UNITED STATES / GOOGLE 9 LARRY PAGE 41 UNITED STATES / GOOGLE SEE THE FULL LIST AT www.forbes.com/powerful-people/list/#tab:overall THURSDAY | NOVEMBER 6, 2014 The world is moving so fast these days that the man who says it can’t be done is generally interrupted by someone doing it. -Elbert Hubbard KFC Killer: How Popeyes Reinvented Itself To Win The Fried Chicken War BY BRIAN SOLOMON, FORBES Popeyes is crushing rivals with a mix of upscale marketing and unapologetically greasy comfort food that customers—and investors— can’t resist. Cheryl Bachelder used to cringe driving past a Popeyes restaurant. “We looked like an old-fashioned chicken chain from the ’60s. Tired, dirty and slow,” she says. DAVID SMITH FOR FORBES Not anymore. Seven years after taking over as CEO, Bachelder Bachelder accepted the top job at Pophas proved that high-calorie greasy food eyes against the advice of friends. She incan still thrive in America. While the rest herited a mess. Founded in 1972 by Al Coof the fast-food industry sputters (even peland in a New Orleans suburb, Popeyes McDonald’s has been losing customers the went bankrupt 20 years later after it tried last two years), Bachelder has engineered to swallow larger competitor Church’s five straight years of juicy U.S. same-store Chicken. Reorganized as AFC Enterprises sales growth. The chain added 126 do(for “America’s Favorite Chicken”), the mestic restaurants in 2013 and is on track company added Cinnabon and Seattle’s to open up to 130 more this year (as rival Best Coffee. But the conglomerate days KFC suffers through its ninth straight year were short-lived after the Arthur Anderof declining store counts). Investor praise sen accounting scandal; AFC had to restate is fawning: Shares are up an eye-popping three years of earnings. The other brands 950% since the beginning of 2009. were sold off, leaving only Popeyes, long Her secret recipe? Turning a chain of overdue for a makeover. dingy chicken joints into restaurants modPopeyes still had loyal customers reciteled on “fast casual” darlings like Chipotle ing old commercial taglines—”Love That and Panera. Fried chicken may not be an Chicken!”—and singing the praises of the upscale product, but that doesn’t mean signature flaky buttermilk biscuits. Superyou can’t sell it like one. Also Inside : “Popeyes was going to go away,” says • AS OIL PLUNGES FURTHER, WHY IT Piper Jaffray analyst Nicole Miller Regan. MIGHT BE ‘GAME OVER’ FOR THE “But if you look today, it’s not even in FRACKING BOOM recovery anymore. It’s all about growth— • WILL YOUR FAVORITE TAX BREAK and that stems from Cheryl coming in and BE RESTORED? righting the ship.” © 2014 Forbes LLC 24 Daily fan Beyoncé reportedly served Popeyes at her wedding. But the business was a disaster, with declining customer counts in a shrinking backwater of the fast-food industry. The restaurants, shabbily adorned with touristy evocations of New Orleans, like street lamps and Mardi Gras beads, didn’t help. The first goal for Bachelder, an exmarketing chief at Domino’s Pizza and KFC, was to remove the cringe factor. But she hit a wall. Popeyes’ relationship with its franchisees had soured. When Bachelder showed the initial restaurant redesign, franchisees “said, essentially, ‘Hell no,’” she recalls. They complained about the “Salvador Dalí-esque” design and the projected costs. Bachelder admits she was naive to expect frustrated small-business owners to put hundreds of thousands of dollars into failing restaurants. It took two trying years of negotiations to win them over. In one meeting a veteran franchisee railed against a chicken special, yelling at Bachelder, “You nearly bankrupted the system!” Her counterpunch: data. With new accounting software in over 1,000 restaurants Bachelder could prove the promotion generated record operating profit. The system tracks restaurant profitability and delivers detailed quarterly reports comparing franchisee results against regional and national averages. Many chains don’t gather such data. “Popeyes is the true poster child for how collaboration produces for both parties,” says Aziz Hashim, a fast-food franchisee in Atlanta for 20 years, who sold off his other stores since coming to Popeyes in 2009. Patience—and a remodeling effort that topped out at $100,000 per location— paid off. Instead of lawyering up, Popeyes franchisees are upgrading at a rapid rate. The chain will have 80% under the new redesign by the end of this year. The company’s new name—Popeyes Louisiana Kitchen—and its new look embrace Cajun spices and classic Southern fare, a theme pounded home by Popeyes’ first national television ad campaign, which introduced spokes-character Annie, the straight-talkin’ African-American chef. 2 | FORBES DAILY THURSDAY | NOVEMBER 6, 2014 The tag trickles down to restaurants, where signs tout Louisiana’s “uniquely American cuisine” and glass jars filled with chili peppers decorate pantry racks. Bone-in chicken delivers 60% of Popeyes’ sales, while boneless is the choice of people under 30, the group Bachelder wants to woo for lunchtime visits. A recent success is tenders fried in waffle batter. Limited-time offers drive traffic—boneless chicken sales are up 100% since 2008, and a new fried seafood push is also performing well. So is the home office. It netted $35.4 million on $221.5 million in revenue over the most recent four quarters, compared with $33.6 million on $194.7 million a year earlier. One thing you won’t find in Popeyes’ new kitchen: salads. Bachelder thinks rivals promote health food for p.r. purposes. “I’m not trying to solve the world’s problems here,” she argues. Customers are just fine with that. Same-store sales in the U.S. have increased an average 4.5% in the last three years, and since 2008 average restaurant operating profit (before rent) has gone from 17.6% to 22%. Sales have risen quickly, with new freestanding locations averaging $1.6 million a year, up over 50% from the old model, and better development metrics have lowered the failure rate (once between 10% and 15%) to just a handful among the 644 openings in the last five years. Bachelder sees room to double the domestic store count, which would put the chain toe-to-toe with KFC in the drive-through-dominated suburbs. And investors are antsy to take advantage of the runway left overseas. Popeyes counts only 461 restaurants abroad, versus more than 9,400 for KFC. Andrew Skehan, COO for Popeyes’ international development, says success at home lets it attack from a position of strength. “We go up against global brands who are going outside the U.S. because they’re not competing here. They’re desperate,” he says. Bachelder can smile at that. Cringe-worthy fare is on someone else’s plate now. FD New from Forbes, an eye-opening report on the new American phenomenon of living car-lite, even car-free. All over the country, people are living car-lite — rethinking when and how they rely on cars. Some are even choosing to live car-free. It’s a shift that will have economic, environmental, political, and industrial implications for all of American society. Download this new eBook today. Signature Series eBook AVAILABLE ON FOLLOW BRIAN SOLOMON AT www.forbes.com/sites/briansolomon/ Ingram Creative Services www.ingramcs.com dwight@ingramcs.com 919.265.8605 Client: Project: Item: Copy: Art: Forbes Magazine Curbing Cars eBook Space Ad Ken Schneider Dwight Ingram Ad Size: Trim Size: Bleed: Colors: Filename: Date: 1/3 pg. Pag 2.33” x 10.5 No bleed 4 color CMY Forbes-eboo June 23, 20 24 Daily THURSDAY | NOVEMBER 6, 2014 As Oil Plunges Further, Why It Might Be ‘Game Over’ For The Fracking Boom BY CHRISTOPHER HELMAN, FORBES STAFF DAVID MCNEW/GETTY IMAGES The price of oil fell some more on Tuesday, down as low as $75.84 before closing at $77 a barrel. The decline is blamed on Saudi Arabia cutting prices rather than cutting output amid signs of global glut. That’s discouraging to America’s highly leveraged drillers, who had been hoping beyond hope that $80 would act as a floor on prices. If prices don’t recover soon this could be the beginning of the end of the Great American oil fracking boom. Already ConocoPhillips and Shell have announced a pullback in onshore investment. But the real pain will be felt by the army of smaller independent producers. There’s been a lot of talk about the breakeven prices per barrel needed to sustain drilling in various oil plays. Some say $80, others say $70. If you have acreage in a sweet spot you might be safe down to $50. But let’s get real—breakeven just isn’t good enough. Investors need returns on capital, not just returns of capital. And for myriad small drillers this fall in prices has virtually eliminated any possibility of turning real cash profits. Over the long run, a company that can’t generate a profit is worthless. Though oil prices are down “just” 30%, shares in some drillers with shaky balance sheets have plunged 60%. It is always the case that shares in leveraged commodity producers are more volatile than the underlying commodity. Equities are ultimately priced on a company’s ability to generate profit. Small moves in commodity prices have a huge impact on earnings. At $100 a barrel, the average oil company can generate net income on the order of $15 a barrel. But if prices fall 10% to $90, leaving a margin of $5, that means profits plunge 66%. At current prices, the average oil company isn’t profitable at all, and the weaker ones, loaded up with debt, are the walking dead. A perfect example is Goodrich Petroleum, which announced some big new discoveries in the Tuscaloosa Marine Shale. While the oil may be there, at current prices it is 3 | FORBES DAILY simply not economic to drill. Goodrich shares are down 70% in six months. The oil industry is a study in contrasts. When you look at the financial statements of Exxon Mobil, you see a fortress— the company generates more than enough cash to pay all its capital spending and still have $20 billion a year left over for dividends and buybacks. Exxon will survive the downdraft just fine—its shares are down just 7% this year. Contrast that with the small shale-only drillers, which have been borrowing like crazy to acquire acreage and deploy fleets of rigs. They may post net income every quarter, but their profitability is only an accounting illusion. Their capex has outstripped cashflow generation year in and year out. Without big borrowing (backed by rosy forecasts of future production growth) they are toast. So who’s in the worst shape? The companies with a combination of high debt, high costs and relatively poor acreage, like Goodrich. Another early casualty could be Swift Energy, which has piled up $1.2 billion in debt in recent years to drill high-cost wells on marginal acreage. Swift’s investors are clamoring for change as shares have plunged 50% this year. Swift’s net debt has climbed to more than three times estimated 2014 EBITDA, or more than 80% of enterprise value. According to data from U.S. Capital Advisors, other op- 24 Daily THURSDAY | NOVEMBER 6, 2014 erators with high leverage that are living well outside their means include SandRidge, which has debt of 2.6 times EBITDA and 51% of enterprise value; EXCO Resources with debt 4.3 times EBITDA and 83% of enterprise value; and Magnum Hunter Resources, with debt 4.8 times EBITDA and 38% of enterprise value. Contrast that, for example, with the fortress balance sheet of Occidental Petroleum, which has net debt of just .3 times EBITDA, a mere 9% of enterprise value. Investors smell the weakness; year to date SandRidge is down 42%, EXCO’s down 46% and Magnum Hunter’s off 43%. According to recent analysis by Credit Suisse, if oil prices fell and stayed $70 a barrel, Swift, Magnum Hunter and SandRidge would all see their net debt to EBITDA multiples rise to thoroughly unsustainable levels of more than 6x. Why do these multiples matter? Lenders like to see ample cash flow available to cover debt payments. It’s common for bond covenants to require companies to maintain a debt-toEBITDA ratio of no more than 4x. Get more leveraged than that and lenders will pressure companies to slash spending and sell assets—or entire operations. So why is it more likely that we’ll see a wave of consolidation in the oil patch this time around, when it didn’t happen back in 2009, when prices plunged from $147 to $35 a barrel? Because back then companies hadn’t gotten used to high prices and hadn’t yet begun to remake themselves wholly as onshore shale drillers. Their reserves were still structured for a world of sub-$50 oil. This time it is most assuredly different. Another word on those “breakeven” prices. In recent weeks we’ve seen lots of stories presuming to tally the breakeven oil prices that various OPEC states need in order to balance their budgets and keep their people placated with social programs. Ignore all of them, because those numbers are based on data at least several months old. What’s changed since then? The foreign exchange value of the U.S. dollar. Russia’s ruble has plunged 20% against the dollar this year to record lows. The Saudi riyal, ostensibly pegged to the dollar, still managed to “tumble” last week. Even the Canadian dollar has slumped against the greenback. This matters a lot. Oil trades in dollars, but the government budgets of oil exporters are denominated in their national currencies. So as the dollar strengthens, these countries, upon conversion, are left with considerably more riyals and rubles than a year ago. Even at a lower dollar-denominated oil price, their purchasing power per barrel sold hasn’t changed much at all. Thus the pain to OPEC from lower prices is minor; the pain to America’s marginal drillers will be severe. Lest we be too pessimistic, it’s worth giving the final word to an optimist. “A six-month decline in oil prices will not cause any producers to actually go bankrupt,” says Brian Bradshaw, a principal with BP Capital’s TwinLine mutual fund. “A lot of pain has already been felt. If you want to know the most likely bankruptcy candidate I think it is the entire country of Venezuela.” So maybe the fate of America’s small drillers won’t seem so bad after all. FD FOLLOW CHRISTOPHER HELMAN AT www.forbes.com/sites/christopherhelman/ Will Your Favorite Tax Break Be Restored? BY ASHLEA EBELING, FORBES STAFF Hoping for a big tax refund and one that’s on time? Call Congress. The fate of 50-plus tax breaks that expired at the end of December 2013 could determine when and how much you get as a tax refund when you file your 2014 tax return next spring. That’s because they include a bunch of individual breaks that help teachers, students, commuters, struggling homeowners, donors and conservationists. It could mean $250— or thousands—off your taxes. The problem is Congress let these 4 | FORBES DAILY tax breaks expire on Dec. 31, 2013, leaving taxpayers in limbo. “You don’t know what the rules are going to be,” says an exasperated Mel Schwarz, director of tax legislative affairs in Grant Thornton’s Washington, D.C. office, adding, “It cheapens the entire tax system.” While businesses are bemoaning the uncertainty around big-ticket breaks like the research and development tax credit and bonus depreciation, these are the major individual tax extenders at stake: • The deduction for state and local sales taxes. • Above-the-line deduction of up to $4,000 for higher education expenses. • Tax-free distributions from an Individual Retirement Account for charitable purposes (the IRA charitable tax rollover) for taxpayers over 70 ½. 24 Daily THURSDAY | NOVEMBER 6, 2014 ROY SCOTT/GETTY IMAGES • A $250 above-the-line deduction for school teachers for supplies. • Parity for employer-provided mass transit and parking benefits ($250 a month, up from $130 a month). • The ability to exclude a discharge of residential mortgage indebtedness from gross income. • The deduction for mortgage insurance premiums. • Enhanced rules for donating real property for conservation. It’s déjà vu. There have been five, soon to be six retroactive extensions of most of these tax breaks, Schwarz counts. Twice relief came in October, two times in December (December 17th and December 20th) and most recently, in January (of the year after the tax breaks expired). • The American Taxpayer Relief Act (ATRA) of 2012 was signed into law on Jan. 2, 2013. (The extenders were made retroactive to Jan. 1, 2012 and good through Dec. 31, 2013.) 5 | FORBES DAILY • The Job Creation Act of 2010 was signed into law Dec. 17, 2010. (The extenders were made retroactive to Jan. 1, 2010, good through Dec. 31, 2011.) • Three acts designed to deal with the financial bailout during the great recession were signed into law on Oct. 3, 2008. (The extenders were made retroactive to Jan. 1, 2008, good through Dec. 31, 2009.) • The Tax Relief and Health Care Act of 2006 was signed into law Dec. 20, 2006. (The extenders were made retroactive to Jan. 1, 2006, good through Dec. 31, 2007.) • The Working Families Tax Relief Act of 2004 was signed into law Oct. 4, 2004. (The extenders were made retroactive to Jan. 1, 2004, good through Dec. 31, 2005.) One consequence of Congress’ faltering is that the 2015 tax filing season may not start on time, and that could mean delayed refunds. IRS Commissioner John Koskinen admonished Senate Finance Committee chairman Ron Wyden (D-Ore.) and his cohorts in a letter last week to take action on the extenders. “It would be detrimental to the entire 2015 tax filing season and to millions of taxpayers if Congress fails to provide a clear policy direction before the end of November.” Congress will address the extenders. “It’s just a question of when do the extenders get done,” Schwarz says. At this point, nothing is going to happen until after the November elections when Congress reconvenes in the lame duck session. One possibility would be for the extenders to be added to the federal budget continuing resolution. It’s also possible that they could move separately and maybe become a vehicle for other legislation. A combination of extenders and emergency spending is also a possibility. Expect to hear that there’s no time for picking and choosing which extenders to drop and which to make permanent. So that makes another temporary extension likely. My bet: another twoyear extension covering 2014 and 2015. That leaves room for serious tax reform in 2015. FD FOLLOW ASHLEA ABELING AT www.forbes.com/sites/ashleaebeling/ 24 Daily Published weekdays by Forbes LLC. 60 Fifth Avenue, New York, 10011 © 2014 Forbes LLC Miguel Morales, Editor Merrilee Barton, Photo Editor To distribute ForbesDaily at your organization or place of business e-mail: dlopenzina@forbes.com To order reprints of articles appearing in ForbesDaily e-mail: reprints@forbes.com To sponsor an issue of ForbesDaily e-mail: dlopenzina@forbes.com Douglas A. Lopenzina, Director, Content Sales & Licensing For more information about Forbes magazine, visit www.ForbesMagazine.com