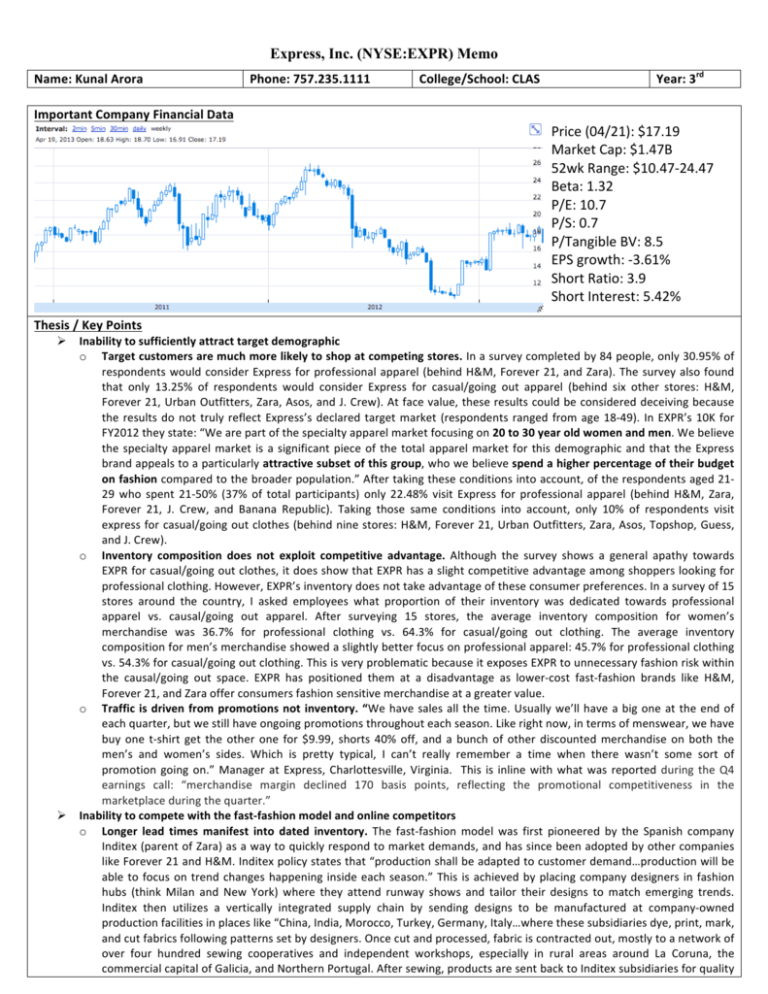

Express, Inc. (NYSE:EXPR) Memo Price (04/21): $17.19 Market Cap

advertisement

Express, Inc. (NYSE:EXPR) Memo

Name: Kunal Arora Important Company Financial Data Thesis / Key Points Ø

Ø

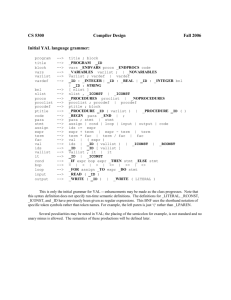

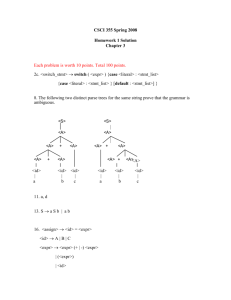

Phone: 757.235.1111 College/School: CLAS Year: 3rd Price (04/21): $17.19 Market Cap: $1.47B 52wk Range: $10.47-­‐24.47 Beta: 1.32 P/E: 10.7 P/S: 0.7 P/Tangible BV: 8.5 EPS growth: -­‐3.61% Short Ratio: 3.9 Short Interest: 5.42% Inability to sufficiently attract target demographic o Target customers are much more likely to shop at competing stores. In a survey completed by 84 people, only 30.95% of respondents would consider Express for professional apparel (behind H&M, Forever 21, and Zara). The survey also found that only 13.25% of respondents would consider Express for casual/going out apparel (behind six other stores: H&M, Forever 21, Urban Outfitters, Zara, Asos, and J. Crew). At face value, these results could be considered deceiving because the results do not truly reflect Express’s declared target market (respondents ranged from age 18-­‐49). In EXPR’s 10K for FY2012 they state: “We are part of the specialty apparel market focusing on 20 to 30 year old women and men. We believe the specialty apparel market is a significant piece of the total apparel market for this demographic and that the Express brand appeals to a particularly attractive subset of this group, who we believe spend a higher percentage of their budget on fashion compared to the broader population.” After taking these conditions into account, of the respondents aged 21-­‐

29 who spent 21-­‐50% (37% of total participants) only 22.48% visit Express for professional apparel (behind H&M, Zara, Forever 21, J. Crew, and Banana Republic). Taking those same conditions into account, only 10% of respondents visit express for casual/going out clothes (behind nine stores: H&M, Forever 21, Urban Outfitters, Zara, Asos, Topshop, Guess, and J. Crew). o Inventory composition does not exploit competitive advantage. Although the survey shows a general apathy towards EXPR for casual/going out clothes, it does show that EXPR has a slight competitive advantage among shoppers looking for professional clothing. However, EXPR’s inventory does not take advantage of these consumer preferences. In a survey of 15 stores around the country, I asked employees what proportion of their inventory was dedicated towards professional apparel vs. causal/going out apparel. After surveying 15 stores, the average inventory composition for women’s merchandise was 36.7% for professional clothing vs. 64.3% for casual/going out clothing. The average inventory composition for men’s merchandise showed a slightly better focus on professional apparel: 45.7% for professional clothing vs. 54.3% for casual/going out clothing. This is very problematic because it exposes EXPR to unnecessary fashion risk within the causal/going out space. EXPR has positioned them at a disadvantage as lower-­‐cost fast-­‐fashion brands like H&M, Forever 21, and Zara offer consumers fashion sensitive merchandise at a greater value. o Traffic is driven from promotions not inventory. “We have sales all the time. Usually we’ll have a big one at the end of each quarter, but we still have ongoing promotions throughout each season. Like right now, in terms of menswear, we have buy one t-­‐shirt get the other one for $9.99, shorts 40% off, and a bunch of other discounted merchandise on both the men’s and women’s sides. Which is pretty typical, I can’t really remember a time when there wasn’t some sort of promotion going on.” Manager at Express, Charlottesville, Virginia. This is inline with what was reported during the Q4 earnings call: “merchandise margin declined 170 basis points, reflecting the promotional competitiveness in the marketplace during the quarter.” Inability to compete with the fast-­‐fashion model and online competitors o Longer lead times manifest into dated inventory. The fast-­‐fashion model was first pioneered by the Spanish company Inditex (parent of Zara) as a way to quickly respond to market demands, and has since been adopted by other companies like Forever 21 and H&M. Inditex policy states that “production shall be adapted to customer demand…production will be able to focus on trend changes happening inside each season.” This is achieved by placing company designers in fashion hubs (think Milan and New York) where they attend runway shows and tailor their designs to match emerging trends. Inditex then utilizes a vertically integrated supply chain by sending designs to be manufactured at company-­‐owned production facilities in places like “China, India, Morocco, Turkey, Germany, Italy…where these subsidiaries dye, print, mark, and cut fabrics following patterns set by designers. Once cut and processed, fabric is contracted out, mostly to a network of over four hundred sewing cooperatives and independent workshops, especially in rural areas around La Coruna, the commercial capital of Galicia, and Northern Portugal. After sewing, products are sent back to Inditex subsidiaries for quality Express, Inc. (NYSE:EXPR) Memo

Ø

control, finishing, and packaging.” This at odds with traditional fashion firms like EXPR who “combine design and sales but outsource manufacturing, often to low-­‐wage subcontractors in East Asia and elsewhere. Searching for cheap labor, companies use networks of subcontractors that may embroider, and sew fabric each in a different country.” Express’s horizontal supply chain means their “seasonal design process begins approximately 45 weeks (lead time) in advance of store delivery (2013 10K),” which forces them to manufacture “nearly 80 percent” of their inventory by the start of each season. Whereas fast-­‐fashion companies can leverage their vertically integration and shorter lead times (as short as 15 days in Zara’s case) to only commit “50 to 60 percent of their lines by the start of the season, meaning that up to 50 percent of their clothes are designed and manufactured smack in the middle of the season.” Thus, fast-­‐fashion companies can limit fashion risk by taking advantage of new trends, while EXPR is left with dated inventory that can only be moved through promotional means. o International expansion likely to disappoint. International expansion is one of EXPR’s focal points in their four-­‐pillar growth strategy. Currently, expansion is being targeted in the Middle East and Latin America, but these are markets that are already dominated by fast-­‐fashion competitors like H&M and Zara. Given EXPR’s inability to attract customers in their current markets, it’s unlikely that they will thrive in markets where fast-­‐fashion companies already have a stronger foothold than they do in the US. o E-­‐Commerce is a current bright spot, but growth is unsustainable. EXPR’s e-­‐commerce growth has covered much of EXPR’s strategic missteps in their brick-­‐and-­‐motor locations: “The flat comparable sales resulted from decreases in both transactions and average dollar sales, was offset by growth in e-­‐commerce sales. We attribute the decrease in transactions to lower traffic in our stores and a lesser acceptance of product in certain women's categories during the second and third quarters (10K 2013).” In 2012, sales increased 32% over 2011, representing 13% of net sales. However, the majority of this growth has been driven by increased investment in the e-­‐commerce platform and a significant amount of catch-­‐up compared to their peers. Once the novelty wears off, the e-­‐commerce division will suffer from the same pressures of dated inventory and fast-­‐fashion competition that their brick-­‐and-­‐motor stores have already encountered. Financials confirm these underlying trends (refer to exhibits) o Slow FCF/square foot growth and decreasing same-­‐store comps o Lowest margins among peer group Misperception “Express represents one of the few names with a low bar to beat.” Simeon Siegel, Analyst, J.P. Morgan. Currently, analyst lump EXPR within the specialty retail industry against companies like The Limited, The Gap, Abercrombie & Fitch, Zumiez, etc. This is a fundamental mistake, although EXPR follows a similar “retail-­‐to-­‐market” strategy, there target market (fashion-­‐forward 20-­‐30 year olds) put them in direct competition with fast-­‐fashion companies. So, although the bar may be low, it should be even lower if EXPR is pitted against the likes of H&M, Forever 21, and Zara. Ø “Forever 21 and H&M are cheaper than Express, but the clothes at Express are cheaper than Zara.” Survey Respondent. Refer to exhibits. VAR. Refer to exhibits. Ø

How It Plays Out Ø

Ø

Ø

Declining same-­‐store comps are indicative of EXPR’s structural decline. This trend will continue as customer appeal for EXPR’s “value proposition” continues to lose out to fast-­‐fashion brands, especially as they expand into the US market (Zara). Continued discounting and promotions to move inventory will eventually signal the market. As EXPR ups their promotional schemes, market participants will begin to take EXPR’s inability to understand fashion trends much more seriously. E-­‐commerce division will lose steam and fail to hold up topline growth. Once the novelty of EXPR’s online platform wears off and e-­‐commerce catch up transitions into a more mature division, growth will slow and failure at the brick-­‐and-­‐motor level will be more evident. Risks / What Signs Would Indicate We Are Wrong? Ø

Ø

If management recognizes their inability to manage fashion risk and begin to act accordingly: by shortening lead times. If the new outlet concept actually holds up topline growth, so far its just in the concept stage. Signposts / Follow-­‐Up Ø

Ø

Ø

Ø

Ø

Gross Margins E-­‐commerce sales Promotions and discounting Lead times Net income is expected to be in the range of $29.5 million to $32.5 million, or $0.34 to $0.38 per diluted share for Q1. Company Description EXPR is a specialty apparel and accessory retailer offering both women's and men's merchandise. The Company operates in brick and mortar retail stores and the express.com e-­‐commerce Website. The Company offers its customers an assortment of fashionable apparel and accessories to address fashion needs across multiple aspects of their lifestyles, including work, casual, jeanswear, and going-­‐out occasions. During the fiscal year ended January 28, 2012 (fiscal 2011), the Company opened its stores in Canada. As of January 28, 2012, it operated 609 stores in 47 states across the United States, as well as in the District of Columbia, Puerto Rico, and two provinces in Canada. These include 576 dual-­‐gender stores, 20 women's stores, and 13 men's stores. Express, Inc. (NYSE:EXPR) Memo

This survey was conducted through SurveyMonkey.com and was completed by 84 respondents from the greater Richmond area, greater New York area, greater Atlanta area, Hampton Roads, Dallas, Austin, and Charlottesville. http://www.surveymonkey.com/s/DLY2WFF !"#$"%&

!"#$

!"#$!%&

$(#)(&'

'(#)(%&

!"#$%&'

*#)+&'

*+,-.&

/-.&

"*,!-'

!",!%'

!#)"&'

+-,+%'

+-,)%'

!"#$%&'()*+,"'

!"#$$%&'()*+,-+&./(

"'#!$%&

!"#$%&'

((#)(%&

!*#+'%&

!"#!$%&

!"#!$%&

$%#*"&'

$(#))&'

$+#"!&'

,#)$&'

,-./&0&1//2&

(3"&45/6&0&

57-89&

,-./&0&57-89& ,-./&/:/;<&"&

57-896&

,-./&/:/;<&)&

57-896&

-+.*!/%%%'

-*(/+++.!%/%%%'

-(+/+++.0!/%%%'

-0(/+++.%%/%%%'

-$++/+++.$*!/%%%'

*#!$&'

-$*(/+++.$!%/%%%'

!"#$#%&'(#)*+),%$*-#)./#%&)*%)0'123*%)

!(#"!%&

!"#$"%&

!"#$"%&

!+#,!%&

!'#($%&

(#)*%&

*#!'%&

'."%&

*.!'%&

!!.!"%&

!*.-'%&

-!.-"%&

-*.+'%&

-#,,%&

-#,,%&

+!.+"%&

+*.,'%&

+#**%&

,!.,"%&

,*."'%&

Express, Inc. (NYSE:EXPR) Memo

()*+,'-+,.,+,/0,1'.*+'-+*.,112*/34'5663+,4'

!"#$!%&

'$#$(%&

)$#(*%&

!"#$%&'

+"#)$%&

+"#)$%&

+)#$(%&

(!#!"%&

./0&

1234543&+(&

6737&

89:34;;&

<#&=34>&

?7@7@7&

A4:BCDEF&

GHI43&

J3C7@&

GBKEL43;&

('#+,%&

M;2;&

((#,*%&

(*#"(%&

,#-+%&

N4>&O23P&/&

=2Q:7@R&

S2:;I2:&

TB4;;&

()*+,'-+,.,+,/0,1'.*+'23143567*8/9':4)';<<3+,5'

!"#$%&'

()#!(&'

**#+!&'

)*#,*&'

%-#(,&'

%"#*!&'

-!#"$&'

!"#$%&'

,#(*&'

,#(*&'

$#%)&'

-#%"&'

./0'

1234543'%-'

63789'

:;<=>43?'

@838'

:AB43'

C?2?'

D#'E34F'

GHI34??'

J2I?B2I'

K89898'

L4I;7M=N'

O;4??'

P4F'Q23R'/'

E2SI89T'

Express, Inc. (NYSE:EXPR) Memo

!"#$$%&'"()*%+#"%,-./0.%

!"!#$%&'()*!++,*

!"#!$%&

!"#-%))!!

'(#)!%&

!"#$%&'!!

!"#$%))!!

!"#(%()!!

!"#(%))!!

!"#'%(,!!

!"#)%))!!

*'#"$%&

!"(&%))!!

!"(-%))!!

!"(*%+'!!

!"($%))!!

!"((%))!!

!"()%))!!

()),!

()')!

()''!

()'(!

+,-&

./01234&

5678&

!"#$%!&'($)!"*$+),-./*01-.2)$%/'##$(/$3)

!"#$

!'#$

%#$

%#$

(#$

&#$

(#$

&#$

"#$

!#$

*!$+'!'$

*+$+'!'$

*,$+'!'$

*"$+'!'$

*!$+'!!$

*+$+'!!$

*,$+'!!$

*"$+'!!$

*!$+'!+$

*+$+'!+$

*,$+'!+$

'#$

*"$+'!+$

)&#$

*This includes e-­‐commerce sales; the only data for SSS excluding e-­‐commerce is for Q4 2010 (7%), Q4 2011 (3%), Q4 2012 (-­‐3%) Black Blazer at Zara for $159

are a polyester and wool blend. Black Blazer at Express for $228; both blazers Express, Inc. (NYSE:EXPR) Memo

Express, Inc. (NYSE:EXPR) Memo

Ideas for the Club Portfolio: I believe we can begin to outperform the market if we amend the way we think about our portfolio. 1. Strategy. Just looking at the portfolio, it is hard to discern what strategy we are pursing. Since the central strategy of MII is focused on using VAR to gain an informational edge on the market, I think we should focus on stocks where gaining such an edge is possible. I don’t think that we are in a position to gain helpful VAR on an Apple or a Google that isn’t already being reflected in the price of their stocks. To use VAR to our advantage we should focus on smaller cap stocks with informational inefficiencies. 2. Composition. MII shouldn’t construct portfolios with second-­‐tier ideas. We should consider pushing our long positions towards the 10% level if we have particularly strong conviction. There is no need to hold a 2-­‐3% position if we truly believe we have an edge over the market. 3. Risk Control. We should consider pair trading to mitigate industry/market risk. Organizational Structure 1. Industry Groups. Associate groups should be created around industries. Associates can have the choice to work with a new industry group each semester. This will not only give members exposure to working with different industries, but also MII as a whole will benefit from associates who understand the industry as a whole and it’s implication on specific firms. Associate groups should meet weekly. 2. Company Experts. We should consider anyone who pitches a stock as that company’s expert and decisions to buy or sell should be run by that expert before any action is made. We should also consider their recommendations in a timely manner so we can catch movements associated with identified catalyst. 3. Transparency. Minutes should be distributed among the organization from both the associate and manager meetings.