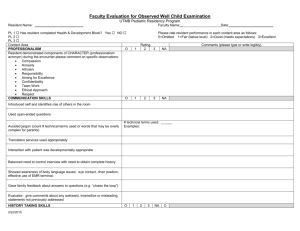

New balance of payments category codes

advertisement

Balance of Payments User Guide Think Corporate Banking. Think RMB. BopCUS 3 l 1 Index I BoPCUS 3 pg What is BoPCUS? Background 01 What is changing in BoPCUS 3 A. Updates to customer information 02 B. Changes to the BoP codes 03 C. Additional third party information required 04 BoPCUS Inflow Index 07 BoPCUS Outflow Index 27 Frequently asked questions 45 Balance of Payments Reporting (BoP Reporting for short) is an electronic message system used by Authorised Dealers (i.e. banks) to report cross-border transactions to the South African Reserve Bank (SARB). From 19 August 2013 there will be changes to the BoP reporting system. RMB employees assisting clients with cross-border transactions may be prompted to supply additional information or select new BoP codes to describe a client’s transaction. This guide summarises the changes that will be implemented. BopCus Version 3 What is BoPCUS? Background 1. International trade and other international transactions result in a flow of funds between South Africa and other countries. 2. To control, monitor and limit this outflow and inflow of capital, Exchange controls (Excon) are implemented in South Africa and other countries. In SA, Excon is the responsibility of the Treasury, which has largely delegated this authority to the South African Reserve Bank (SARB). 3. The Balance of Payments (BoP) is a systematic record of all economic transactions between the residents of the reporting country (e.g. South Africa) and the rest of the world in a specific period (usually quarterly or yearly). The SARB is officially responsible for the compilation of South Africa's BoP statistics. 4. All transactions relating to the flow of goods, services and funds across national boundaries are recorded in the BoP of South Africa and the countries involved in the transaction or trade. This determines how much money is going in and out of a country. 5. Flows reflected in the BoP affect the total economy’s activities associated with production, generation and distribution of income, consumption, and accumulation activities e.g. credit and debit entries for goods and services in BoP accounts are equivalent to flows of exports and imports of goods and services. 6. These flows are reflected in the economy’s account for goods and services and consequently affect the measurement of gross domestic product (GDP) and its composition in terms of final demand components e.g. final consumption, gross capital formation, etc. 7. Data for these transactions are obtained from various sources, including the South African Revenue Service (SARS), government departments, public corporations, and the private banking sector. 01 l BopCUS 3 From the Rulings “The objective of the Reporting System is to ensure accurate and comprehensive reporting of all data by Authorised Dealers on crossborder transactions for compilation of: −− Balance of payments statistics by the Research Department of the South African Reserve Bank −− Foreign debt statistics and repayment profiles to support monetary policy decisions −− Statistical information relating to the nature, volume and values of the various crossborder flows and provide the appropriate information for economic and financial management decisions, as well as planning and policy formulation.” Excerpt from SA Reserve Bank Rulings, Ruling J What is changing in BoPCUS 3? During the first phase of BoPCUS 3, the following changes will be implemented: A A. Updates to customer information B Changes to the BoP codes B. CC Third party information required* *SA resident information will be required based on the relevant BoP code A Updates to clients’ information Clients must provide additional information to the bank from 19 August 2013. Additional personal information fields are mandatory for the completion of foreign exchange transactions. From Entities: −− Trading name, if applicable −− Institutional sector (The main institutional sector of each entity: Financial Corporate / Non-financial Corporate / general Government / Household such as partnerships, trusts and one man businesses) −− Industrial classification (The main production activity of each entity: Agriculture, Mining, Transport, Construction, etc.) −− Loan tenor and interest rate (in the case of repayment of foreign loans) −− Transport document number (in the case of the importation of goods) −− Sub BoP category* −− Third party details* −− Additional import related data** From Individuals: −− Gender −− Date of birth −− Foreign ID number * −− Tax clearance certificate reference (in the case of individual foreign investment allowances) −− Loan tenor and interest rate (in the case of foreign loans) −− Transport document number (in the case of the importation of goods) −− Sub BoP category* −− Third party details* For example: −− A customer visits a branch to make an outward payment to pay for imported goods. While completing the transaction, the system will require additional information for the transaction to complete successfully. −− A customer wants to complete a MoneyGram transaction on a cellphone. The customer will receive an error message directing them to a branch to update their personal profile with the additional details like the province in which they reside. Thereafter the transaction can be completed. The impact −− Relevant to all transactions. −− Without the additional information, transaction will not be successful. −− When completing transactions on systems like Karabo or Vantage, the system will prompt users to supply additional mandatory information. −− Customers may have to be redirected to a branch customer representative to update their personal / entity profile on Hogan. *Where applicable **The SARB Import Verification System (IVS) is used by the bank to authenticate customs notification by the importer BopCUS 3 l 02 B Changes to the BoP codes The codes that are used to report the nature of foreign exchange transactions will change. The BoP Code informs the SARB of the type of payment the client is making or receiving. The client is fully accountable for supplying the correct and accurate BoP Category or transaction description. Categories are completely different For example: Sub-categories are applicable in some instances For example: −− Current category for gift payments is: 501 −− As from 19 August 2013, the BoP Category for gifts will be: 401 2 BOP 3 −− Current category for freight payments is: 301 −− As from 19 August 2013, the BoP Categories for freight will be as follows: Payment for passenger services- road Payment for passenger services- rail Payment for passenger services- sea Payment for passenger services- air Payment for freight services- road Payment for freight services- rail Payment for freight services- sea Payment for freight services- air The impact −− Relevant to all transactions −− When completing a transaction, the system will provide a list of the new BoP codes. Select the new code from the list that corresponds to the reason for the transaction. −− Using the old, familiar codes will result in incorrect reporting to the SARB. 03 l BopCUS 3 270/01 270/02 270/03 270/04 271/01 271/02 271/03 271/04 C Additional information required when doing a transaction on behalf of another party (third party) When doing a foreign exchange transaction on behalf of a third party, a customer is required to provide information about the third party. Third party transactions are transactions made by an RMB account holder, on behalf of another person or entity, who is not the holder of the transacting account. For example: −− Where the father is paying for the travel on behalf of a family, the details of the wife and children must be provided as third party details. −− Where an agent is making an import or export payment on behalf of various South African entities, details of the entities must be provided. −− Where the financial institution is making payment in respect of foreign investments of various SA parties, the details of the SA parties must be supplied. The impact −− Relevant only to certain transactions. −− When customers do transactions on behalf of other parties, select the option on the system and complete the additional information required as prompted by the system. −− Third party information is mandatory for certain BoP codes, but can be captured for other codes. BopCUS 3 l 04 Index I Inflow A B C D 05 l BopCus 3 pg Merchandise Transaction adjustments 07 Exports: Advance payments 07 Exports 07 Exports: Other 08 Intellectual property and other services Transaction adjustments 10 Charges for the use of intellectual property 10 Disposal of intellectual property (Excluding computer related and audiovisual) 10 Research and Development 10 Audiovisual and related items 10 Computer software and related items 11 Technical related services 11 Travel services for non-residents 12 Travel services for residents 12 Travel services in respect of third parties 12 Telecommunication and information services 12 Financial services 13 Construction services 13 Government services 13 Study related services 13 Other business services rendered 13 Transactions relating to income and yields on financial assets Transaction adjustments 14 Income receipts 14 Transfers of a current nature Transaction adjustments 16 Current payments 16 E Transfers of a capital nature Capital transfers and immigrants Transaction adjustments 18 Capital transfers relating to government / corporate entities (excluding loans) 18 Capital transfers by non-resident individuals 18 Disinvestment of capital 18 Capital transfers by South African resident individuals Disinvestment of capital to a resident Foreign Currency Account 20 Disinvestment of capital 20 Immigrants 20 Financial investments / disinvestments and prudential investments Transaction adjustments 20 Financial investments / disinvestments (excluding local institutional investors) 20 Investment by a non-resident 20 Disinvestment by a resident corporate entity 20 Inward listed investments 21 Prudential investments (institutional investors and banks) 21 Derivatives F Transaction adjustments 22 Derivatives (excluding inward listed) 22 Loan and miscellaneous payments Transaction adjustments 24 Loans (capital portion) 24 Loans granted to residents 24 Loans repaid by resident temporarily abroad 24 Loans repaid by non-residents 24 Miscellaneous payments 24 BopCus 3 l 06 Inflow A. Merchandise Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds applicable to merchandise 100 100 / 950 Exports: Advance payments Export advance payment (excluding capital goods, gold, platinum, 101 crude oil, refined petroleum products, diamonds, steel, coal, iron ore and goods exported via the South African Post Office) 01 101 Export advance payment - capital goods 101 02 101 Export advance payment - gold 101 03 101 Export advance payment - platinum 101 04 101 Export advance payment - crude oil 101 05 101 Export advance payment - refined petroleum products 101 06 101 Export advance payment - diamonds 101 07 101 Export advance payment - steel 101 08 101 Export advance payment - coal 101 09 101 Export advance payment - iron ore 101 10 101 Export advance payment - goods exported via the South African Post Office 101 11 101 Export payments (excluding capital goods, gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal, iron ore and goods exported via the South African Post Office) 103 01 102 / 103 Export payment - capital goods 103 02 102 / 103 Export payment - gold 103 03 201 Export payment - platinum 103 04 102 / 103 Export payment - crude oil 103 05 102 / 103 Export payment - refined petroleum products 103 06 102 / 103 Export payment - diamonds 103 07 114 Export payment - steel 103 08 102 / 103 Export payment - coal 103 09 102 / 103 Export payment - iron ore 103 10 102 / 103 Exports 07 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 2 Export payment - goods exported via the South African Post Office 103 11 113 Exports: Other Consumables acquired in port 105 105 Trade finance repayments in respect of exports 106 407 Export proceeds where the Customs value of the shipment is less 107 than R500 112 Export payments where goods were declared as part of passenger 108 baggage and no UCR is available 102 / 103 / 112 Proceeds for goods purchased by non-residents where no physical 109 export will take place, excluding gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal and iron ore as well as merchanting transactions 01 116 Proceeds for gold purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 02 116 Proceeds for platinum purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 03 116 Proceeds for crude oil purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 04 116 Proceeds for refined petroleum purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 05 116 Proceeds for diamonds purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 06 116 Proceeds for steel purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 07 116 Proceeds for coal purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 08 116 Proceeds for iron ore purchased by non-residents where no physical export will take place, excluding merchanting transactions 109 09 116 Merchanting transaction 110 315 BopCUS 3 l 08 09 l BopCUS 3 B. Intellectual property and other services Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds applicable to intellectual property and service related items 200 902 / 950 Rights assigned for licenses to reproduce and/or distribute 201 312 / 313 / 605 Rights assigned for using patents and inventions (licensing) 202 312 / 605 Rights assigned for using patterns and designs (including industrial processes) 203 312 Rights assigned for using copyrights 204 312 / 313 / 605 Rights assigned for using franchises and trademarks 205 605 Disposal of patents and inventions 210 312 / 605 Disposal of patterns and designs (including industrial processes) 211 312 / 605 Disposal of copyrights 212 312 / 313 / 605 Disposal of franchises and trademarks 213 312/ 605 Proceeds received for research and development services 220 319 Funding received for research and development 221 504 Sales of original manuscripts, sound recordings and films 225 323 Receipt of funds relating to the production of motion pictures, radio and television programs and musical recordings 226 323 Charges for the use of intellectual property Disposal of intellectual property (excluding computer related and audiovisual) Research and development Audiovisual and related items BopCUS 3 l 10 Description BoPCUS 3 Sub-Cat BoPCUS 2 Computer software and related items The outright selling of ownership rights of software 230 111 / 112 312 605 Computer-related services including maintenance, repair and consultancy 231 104 / 312 / 319 Commercial sales of customised software and related licences for 232 use by customers 101 / 102 / 103 / 112 / 113 / 312 Commercial sales of non-customised software on physical media with periodic licence to use 233 101 / 102 / 103 / 112 / 113 / 312 Commercial sales of non-customised software provided on physical media with right to perpetual (ongoing) use 234 101 / 102 / 103 / 112 / 113 / 312 Commercial sales of non-customised software provided for 235 downloading or electronically made available with periodic licence 111 / 312 Commercial sales of non-customised software provided for 236 downloading or electronically made available with single payment 111 / 312 Technical related services Fees for processing - processing done on materials (excluding 240 gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal and iron ore) 01 320 / 321 Fees for processing - processing done on gold 240 02 321 Fees for processing - processing done on platinum 240 03 321 Fees for processing - processing done on crude oil 240 04 321 Fees for processing - processing done on refined petroleum products 240 05 321 Fees for processing - processing done on diamonds 240 06 321 Fees for processing - processing done on steel 240 07 321 Fees for processing - processing done on coal 240 08 321 Fees for processing - processing done on iron ore 240 09 321 Repairs and maintenance on machinery and equipment 241 104 Architectural, engineering and other technical services 242 320 Agricultural, mining, waste treatment and depollution services 243 321 11 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 2 Travel services for non-residents Travel services for non-residents - business travel 250 253 Travel services for non-residents - holiday travel 251 254 Foreign exchange accepted by residents from non-residents 252 255 Travel services for residents - business travel 255 303 Travel services for residents - holiday travel 256 304 Proceeds for travel services in respect of third parties - business travel 260 260 Proceeds for travel services in respect of third parties - holiday travel 261 260 Proceeds for telecommunication services 265 307 Proceeds for information services including data, news-related and news agency fees 266 313 / 314 Travel services for residents Travel services in respect of third parties Telecommunication and information services Transportation services Proceeds for passenger services - road 270 01 302 Proceeds for passenger services - rail 270 02 302 Proceeds for passenger services - sea 270 03 302 Proceeds for passenger services - air 270 04 302 Proceeds for freight services - road 271 01 301 Proceeds for freight services - rail 271 02 301 Proceeds for freight services - sea 271 03 301 Proceeds for freight services - air 271 04 301 Proceeds for other transport services - road 272 01 301 / 308 Proceeds for other transport services - rail 272 02 301 / 308 Proceeds for other transport services - sea 272 03 301 / 308 Proceeds for other transport services - air 272 04 301 / 308 Proceeds for postal and courier services - road 273 01 308 Proceeds for postal and courier services - rail 273 02 308 BopCUS 3 l 12 Description BoPCUS 3 Sub-Cat BoPCUS 2 Proceeds for postal and courier services - sea 273 03 308 Proceeds for postal and courier services - air 273 04 308 Financial services provided Commission and fees 275 311 Proceeds for financial services charged and advice provided 276 311 280 309 Proceeds for government services 281 325 / 901 Diplomatic transfers 282 325 285 305 Proceeds for legal services 287 317 Proceeds for accounting services 288 317 Proceeds for management consulting services 289 317 Proceeds for public relation services 290 317 Proceeds for advertising and market research services 291 318 Proceeds for managerial services 292 317 Proceeds for medical and dental services 293 326 Proceeds for educational services 294 319 Operational leasing 295 316 Proceeds for cultural and recreational services 296 324 Proceeds for other business services not included elsewhere 297 901 Construction services Proceeds for construction services Government services Study related services Tuition fees Other business services rendered 13 l BopCUS 3 C. Transactions relating to income and yields on financial assets Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds related to income and yields on 300 financial assets 902 / 950 Income receipts Dividends 301 401 Branch profits 302 403 Compensation paid by a non-resident to a resident employee temporarily abroad (excluding remittances) 303 404 Compensation paid by a non-resident to a non-resident employee 304 in South Africa (excluding remittances) 404 Compensation paid by a non-resident to a migrant worker employee (excluding remittances) 305 404 Compensation paid by a non-resident to a foreign national contract worker employee (excluding remittances) 306 404 Commission or brokerage 307 405 Rental 308 406 Interest received from a resident temporarily abroad in respect of 309 loans 01 407 Interest received from a non-resident in respect of individual loans 309 02 407 Interest received from a non-resident in respect of study loans 309 03 407 Interest received from a non-resident in respect of shareholders loans 309 04 407 Interest received from a non-resident in respect of third party loans 309 05 407 Interest received from a non-resident in respect of trade finance loans 309 06 407 Interest received from a non-resident in respect of a bond 309 07 407 Interest received not in respect of loans 309 08 402 Income in respect of inward listed securities equity individual 310 01 408 Income in respect of inward listed securities equity corporate 310 02 408 Income in respect of inward listed securities equity bank 310 03 408 BopCUS 3 l 14 Description BoPCUS 3 Sub-Cat BoPCUS 2 Income in respect of inward listed securities equity institution 310 04 408 Income in respect of inward listed securities debt individual 311 01 408 Income in respect of inward listed securities debt corporate 311 02 408 Income in respect of inward listed securities debt bank 311 03 408 Income in respect of inward listed securities debt institution 311 04 408 Income in respect of inward listed securities derivatives individual 312 01 408 Income in respect of inward listed securities derivatives corporate 312 02 408 Income in respect of inward listed securities derivatives bank 312 03 408 Income in respect of inward listed securities derivatives institution 312 04 408 Income earned abroad by a resident on an individual investment 15 l BopCUS 3 313 402 D. Transfers of a current nature Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds related to transfers of a current 400 nature 902 / 950 Current payments Gifts 401 501 Annual contributions 402 502 Contributions in respect of social security schemes 403 503 Contributions in respect of charitable, religious and cultural (excluding research and development) 404 504 Other donations / aid to Government (excluding research and development) 405 501 Other donations / aid to private sector (excluding research and development) 406 501 Pensions 407 505 Annuities (pension-related) 408 506 Inheritances 409 508 Alimony 410 509 Tax - Income Tax 411 01 510 Tax - VAT Refunds 411 02 510 Tax - Other 411 03 510 / 604 Insurance premiums (non life / short term) 412 511 Insurance claims (non life / short term) 413 512 Insurance premiums (life) 414 310 Insurance claims (life) 415 310 Migrant worker remittances (excluding compensation) 416 404 Foreign national contract worker remittances (excluding compensation) 417 404 BopCUS 3 l 16 17 l BopCUS 3 E. Transfers of a capital nature Description BoPCUS 3 Sub-Cat BoPCUS 2 Capital transfers and immigrants Transaction adjustments Adjustments / Reversals / Refunds related to capital transfers and 500 immigrants 902 / 950 Capital transfers relating to government / corporate entities (excluding loans) Donations to SA Government for fixed assets 501 601 Donations to corporate entities - fixed assets 502 603 Investment into property by a non-resident corporate entity 503 602 Disinvestment of property by a resident corporate entity 504 602 Capital transfers by non-resident individuals Investment into property by a non-resident individual 510 01 602 Investment by a non-resident individual - other 510 02 602 Disinvestment of capital by a resident individual - Shares 511 01 602 Disinvestment of capital by a resident individual - Bonds 511 02 602 Disinvestment of capital by a resident individual - Money market instruments 511 03 602 Disinvestment of capital by a resident individual - Deposits with a 511 foreign bank 04 602 Disinvestment of capital by a resident individual - Mutual funds / collective investment schemes 511 05 602 Disinvestment of capital by a resident individual - Property 511 06 602 Disinvestment of capital by a resident individual - Other 511 07 602 Disinvestment of capital (Note: Categories 511/01 to 511/07 above are preferred to the of categories 514/01 to 514/07 and 515/01 to 515/07, which will be discontinued in future) BopCUS 3 l 18 Description BoPCUS 3 Sub-Cat BoPCUS 2 Disinvestment of capital to a resident Foreign Currency Account (Note: Categories 511/01 to 511/07 above are preferred to the use of categories 514/01 to 514/07, which will be discontinued in future) Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Shares 514 01 602 Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Bonds 514 02 602 Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Money Market Instruments 514 03 602 Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Withdrawal from a foreign bank account 514 04 602 Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Mutual funds / collective investment schemes 514 05 602 Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Property 514 06 602 Disinvestment of capital by a resident individual in respect of cross-border flows originating from a foreign source into a foreign currency account held at an Authorised Dealer in South Africa - Other 514 07 602 Disinvestment of capital repatriated in respect of an individual investment - Shares 515 01 602 Disinvestment of capital repatriated in respect of an individual investment - Bonds 515 02 602 Disinvestment of capital repatriated in respect of an individual investment - Money market Instruments 515 03 602 Disinvestment of capital repatriated in respect of an individual investment - Deposits with a foreign bank 515 04 602 Disinvestment of capital (Note: Categories 511/01 to 511/07 above are preferred to the of use categories 514/01 to 514/07 and 515/01 to 515/07, which will be discontinued in future) 19 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 2 Disinvestment of capital repatriated in respect of an individual investment - Mutual funds / collective investment schemes 515 05 602 Disinvestment of capital repatriated in respect of an individual investment - Property 515 06 602 Disinvestment of capital repatriated in respect of an individual investment - Other 515 07 602 Repatriation of capital, on instruction by the Financial Surveillance 516 Department, of a foreign investment by a resident individual in respect of cross-border flows 606 Repatriation of capital, on instruction by the Financial Surveillance 517 Department, of a foreign investment by a resident individual originating from an account conducted in foreign currency held at an Authorised Dealer in South Africa 607 Immigrants Immigration 530 01 609 Transaction adjustments Adjustments / Reversals / Refunds related to financial investments 600 / Disinvestments and Prudential investments 902 / 950 Financial investments / disinvestments (excluding local institutional investors) Investment by a non-resident Investment in listed shares by a non-resident 601 01 701 Investment in non-listed shares by a non-resident 601 02 701 Investment into money market instruments by a non-resident 602 Investment into listed bonds by a non-resident (excluding loans) 603 01 702 Investment into non-listed bonds by a non-resident (excluding loans) 603 02 702 Disinvestment of shares by a resident - Agricultural, hunting, forestry and fishing 605 01 701 Disinvestment of shares by a resident - Mining, quarrying and exploration 605 02 701 Disinvestment of shares by a resident - Manufacturing 605 03 701 703 Disinvestment by a resident corporate entity BopCUS 3 l 20 Description BoPCUS 3 Sub-Cat BoPCUS 2 Disinvestment of shares by a resident - Electricity, gas and water supply 605 04 701 Disinvestment of shares by a resident - Construction 605 05 701 Disinvestment of shares by a resident - Wholesale, retail, repairs, hotel and restaurants 605 06 701 Disinvestment of shares by a resident - Transport and communication 605 07 701 Disinvestment of shares by a resident - Financial services 605 08 701 Disinvestment of shares by a resident - Community, social and personal services 605 09 701 Inward listed securities equity individual buy back 610 01 706 Inward listed securities equity corporate buy back 610 02 706 Inward listed securities equity bank buy back 610 03 706 Inward listed securities equity institution buy back 610 04 706 Inward listed securities debt individual redemption 611 01 706 Inward listed securities debt corporate redemption 611 02 706 Inward listed securities debt bank redemption 611 03 706 Inward listed securities debt institution redemption 611 04 706 Inward listed securities derivatives individual proceeds 612 01 706 Inward listed securities derivatives corporate proceeds 612 02 706 Inward listed securities derivatives bank proceeds 612 03 706 Inward listed securities derivatives institution proceeds 612 04 706 Disinvestment by resident institutional investor - Asset Manager 615 01 704 Disinvestment by resident institutional investor - Collective Investment Scheme 615 02 704 Disinvestment by resident institutional investor - Retirement Fund 615 03 704 Inward listed investments Prudential investments (Institutional Investors and Banks) 21 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 2 Disinvestment by resident institutional investor - Life Linked 615 04 704 Disinvestment by resident institutional investor - Life Non-Linked 615 05 704 Bank prudential disinvestment 616 Not allocated 617 Not allocated 618 705 Derivatives Transaction adjustments Adjustments / Reversals / Refunds related to derivatives 700 902 / 950 Derivatives (excluding inward listed) Options - listed 701 01 804 Options - unlisted 701 02 804 Futures - listed 702 01 805 Futures - unlisted 702 02 805 Warrants - listed 703 01 806 Warrants - unlisted 703 02 806 Gold hedging - listed 704 01 202 Gold hedging - unlisted 704 02 202 Derivative not specified above - listed 705 01 202 / 804 / 805 / 806 / 901 Derivative not specified above - unlisted 705 02 202 / 804 / 805 / 806 / 901 BopCUS 3 l 22 23 l BopCUS 3 F. Loan and miscellaneous payments Description BoPCUS 3 Sub-Cat BoPCUS 2 Loans (Capital portion) Loans granted to residents Trade finance loan drawn down in South Africa 801 999 International Bond drawn down 802 999 Loan made to a resident by a non-resident shareholder 803 999 Loan made to a resident by a non-resident third party 804 999 Loans repaid by residents temporarily abroad Repayment by a resident temporarily abroad of a loan granted by 810 a resident 306 / 901 / 998 Loans repaid by non-residents Repayment of individual loan to a resident 815 998 Repayment of a study loan to a resident 816 306 / 998 Repayment of a shareholders loan to a resident 817 998 Repayment of a third party loan to a resident (excluding shareholders) 818 998 Repayment of a trade finance loan to a resident 819 998 830 901 Rand drafts/cheques drawn on vostro accounts (Only applicable if 832 no description is available) 904 Credit/Debit card company settlement as well as money remitter settlements 901 Miscellaneous payments Details of payments not classified 833 BopCUS 3 l 24 Index I Outflow A B C 25 l BopCus 3 pg Merchandise Transaction adjustments 27 Imports: Advance payments not in terms of import undertaking 27 Imports: Advance payments in terms of import undertaking 27 Imports: Excluding advance payments and not in terms of import undertaking 28 Imports: Excluding advance payments but in terms of import undertaking 28 Imports: Other 29 Intellectual property and other services Transaction adjustments 30 Charges for the use of intellectual property 30 Acquisition of intellectual property (excluding computer related and audiovisual) 30 Research and development 30 Audiovisual and related items 30 Computer software and related items 31 Technical related services 31 Travel services for non-residents 31 Travel services for residents 31 Travel services in respect of third parties 32 Telecommunication and information services 32 Transportation services 32 Financial services obtained 32 Construction service 32 Government services 33 Study related services 33 Other business services 33 Transactions relating to income and yields on financial assets Transaction adjustments 34 Income payments 34 D E Transfers of a current nature Transaction adjustments 36 Current payments 36 Transfers of a capital nature Capital transfers and immigrants Transaction adjustments 38 Capital transfers relating to government / corporate entities (excluding loans) 38 Capital transfers by non-resident individuals 38 Capital transfers by South African resident individuals Investment not related to the investment allowance 38 Investment in terms of investment allowance 39 Investment from a resident Foreign Currency Account 40 Re-transfer of capital repatriated 40 Immigrants 40 Financial investments / disinvestments and prudential investments Transaction adjustments 41 Disinvestment by a non-resident 41 Investment by a resident corporate entity 41 Inward listed investments 42 Prudential investments (Institutional Investors and Banks) 42 Derivatives F Transaction adjustments 43 Derivatives (excluding inward listed) 43 Loan and miscellaneous payments Transaction adjustments 44 Loans (capital portion) 44 Loan repayments by residents 44 Loans granted to residents temporarily abroad 44 Loans granted to non-residents 44 Miscellaneous payments 44 BopCus 3 l 26 Outflow . A. Merchandise Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds applicable to merchandise 100 100 / 950 Imports: Advance payments (not in terms of import undertaking) Import advance payment (excluding capital goods, gold, 101 platinum, crude oil, refined petroleum products, diamonds, steel, coal, iron ore and goods imported via the South African Post Office) 01 101 Import advance payment - capital goods 101 02 101 Import advance payment - gold 101 03 101 Import advance payment - platinum 101 04 101 Import advance payment - crude oil 101 05 101 Import advance payment - refined petroleum products 101 06 101 Import advance payment - diamonds 101 07 101 Import advance payment - steel 101 08 101 Import advance payment - coal 101 09 101 Import advance payment - iron ore 101 10 101 Import advance payment - goods imported via the South African Post Office 101 11 101 Import advance payment (excluding capital goods, gold, 102 platinum, crude oil, refined petroleum products, diamonds, steel, coal, iron ore and goods imported via the South African Post Office) 01 108 Import advance payment - capital goods 102 02 108 Import advance payment - gold 102 03 108 Import advance payment - platinum 102 04 108 Import advance payment - crude oil 102 05 108 Import advance payment - refined petroleum products 102 06 108 Import advance payment - diamonds 102 07 115 Import advance payment - steel 102 08 108 Import advance payment - coal 102 09 108 Imports: Advance payments (in terms of import undertaking) 27 l BopCUS 3 Description BoPCUS 3 Sub- Cat BoPCUS 2 Import advance payment - iron ore 102 10 108 Import advance payment - goods imported via the South African Post Office 102 11 108 Import payment (excluding capital goods, gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal, iron ore and goods imported via the South African Post Office) 103 01 102 / 103 Import payment - capital goods 103 02 102 / 103 Import payment - gold 103 03 201 Import payment - platinum 103 04 102 / 103 Import payment - crude oil 103 05 102 / 103 Import payment - refined petroleum products 103 06 102 / 103 Import payment - diamonds 103 07 114 Import payment - steel 103 08 102 / 103 Import payment - coal 103 09 102 / 103 Import payment - iron ore 103 10 102 / 103 Import payment - goods imported via the South African Post Office 103 11 113 Import payment (excluding capital goods, gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal, iron ore and goods imported via the South African Post Office) 104 01 109 / 110 Import payment - capital goods 104 02 109 / 110 Import payment - gold 104 03 203 Import payment - platinum 104 04 109 / 110 Import payment - crude oil 104 05 109 / 110 Import payment - refined petroleum products 104 06 109 / 110 Import payment - diamonds 104 07 115 Import payment - steel 104 08 109 / 110 Import payment - coal 104 09 109 / 110 Import payment - iron ore 104 10 109 / 110 Import payment - goods imported via the South African Post Office 104 11 109 / 110 Imports: Excluding advance payments and not in terms of import undertaking Imports: Excluding advance payments but in terms of import undertaking BopCUS 3 l 28 Description BoPCUS 3 Sub- Cat BoPCUS 2 Imports: Other Consumables acquired in port 105 105 Repayment of trade finance for imports 106 107 Import payments where the customs value of the shipment is less 107 than R500 112 Import payments where goods were declared as part of passenger baggage and no MRN is available 102 / 103 / 112 108 Payments for goods purchased from non-residents in cases 109 where no physical import will take place, excluding gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal and iron ore as well as merchanting transactions 01 116 Payments for gold purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 02 116 Payments for platinum purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 03 Payments for crude oil purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 04 116 Payments for refined petroleum products purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 05 116 Payments for diamonds purchases from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 06 116 Payments for steel purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 07 116 Payments for coal purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 08 116 Payments for iron ore purchased from non-residents in cases where no physical import will take place, excluding merchanting transactions 109 09 116 Merchanting Transaction 110 29 l BopCUS 3 315 B. Intellectual property and other services Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds applicable to intellectual property and service related items 200 902 / 950 Rights obtained for licences to reproduce and/or distribute 201 312 / 313 / 605 Rights obtained for using patents and inventions (licencing) 202 312 / 605 Rights obtained for using patterns and designs (including industrial processes) 203 312 Rights obtained for using copyrights 204 312 / 313 / 605 Rights obtained for using franchises and trademarks 205 605 Acquisition of patents and inventions 210 312 / 605 Acquisition of patterns and designs (including industrial processes) 211 312 / 605 Acquisition of copyrights 212 312 / 313 / 605 Acquisition of franchises and trademarks 213 312 / 605 Payments for research and development services 220 319 Funding for research and development 221 504 225 323 Payment relating to the production of motion pictures, radio and 226 television programs and musical recordings 323 Charges for the use of intellectual property Acquisition of intellectual property (excluding computer related and audiovisual) Research and development Audiovisual and related items Acquisition of original manuscripts, sound recordings and films BopCUS 3 l 30 Description BoPCUS 3 Sub-Cat BoPCUS 3 Computer software and related items The outright purchasing of ownership rights of software 230 111 / 112 / 312 / 605 Computer-related services including maintenance, repair and consultancy 231 104 / 312 / 319 Commercial purchases of customised software and related licences to use 232 101 / 102 / 103 / 112 / 113 / 312 Commercial purchases of non-customised software provided on physical media with right to perpetual (ongoing) use 234 101 / 102 / 103 / 112 / 113 / 312 Commercial purchases of non-customised software downloaded or electronically acquired with periodic licence 235 111 / 312 Commercial purchases of non-customised software downloaded or electronically acquired with single payment 236 111 / 312 Technical related services Fees for processing - processing done on materials (excluding 240 gold, platinum, crude oil, refined petroleum products, diamonds, steel, coal and iron ore) 01 320 / 321 Fees for processing - processing done on gold 240 02 321 Fees for processing - processing done on platinum 240 03 321 Fees for processing - processing done on crude oil 240 04 321 05 321 Fees for processing - processing done on refined petroleum products Fees for processing - processing done on diamonds 240 06 321 Fees for processing - processing done on steel 240 07 321 Fees for processing - processing done on coal 240 08 321 Fees for processing - processing done on iron ore 240 09 321 Repairs and maintenance on machinery and equipment 241 104 Architectural, engineering and other technical services 242 320 Agricultural, mining, waste treatment and depollution services 243 321 Travel services for non-residents - business travel 250 253 Travel services for non-residents - holiday travel 251 254 Travel services for residents - business travel 255 303 Travel services for residents - holiday travel 256 304 Travel services for non-residents Travel services for residents 31 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 3 Travel services in respect of third parties Payment for travel services in respect of third parties - business travel 260 260 Payment for travel services in respect of third parties - holiday travel 261 260 Payment for telecommunication-services 265 307 Payment for information services including data, news related and news agency fees 266 313 / 314 Telecommunication and information services Transportation services Payment for passenger services - road 270 01 302 Payment for passenger services - rail 270 02 302 Payment for passenger services - sea 270 03 302 Payment for passenger services - air 270 04 302 Payment for freight services - road 271 01 301 Payment for freight services - rail 271 02 301 Payment for freight services - sea 271 03 301 Payment for freight services - air 271 04 301 Payment for other transport services - road 272 01 301 / 308 Payment for other transport services - rail 272 02 301 / 308 Payment for other transport services - sea 272 03 301 / 308 Payment for other transport services - air 272 04 301 / 308 Payment for postal and courier services - road 273 01 308 Payment for postal and courier services - rail 273 02 308 Payment for postal and courier services - sea 273 03 308 Payment for postal and courier services - air 273 04 308 Financial services obtained Commission and fees 275 311 Financial service fees charged for advice provided 276 311 280 309 Construction services Payment for construction services BopCUS 3 l 32 Description BoPCUS 3 Sub-Cat BoPCUS 2 Government services Payment for government services 281 325 / 901 Diplomatic transfers 282 325 285 305 Payment for legal services 287 317 Payment for accounting services 288 317 Payment for management consulting services 289 317 Payment for public relation services 290 317 Payment for advertising and market research services 291 318 Payment for managerial services 292 317 Payment for medical and dental services 293 326 Payment for educational services 294 319 Operational leasing 295 316 Payment for cultural and recreational services 296 324 Payment for other business services not included elsewhere 297 901 Study related services Tuition fees Other business services obtained 33 l BopCUS 3 C. Transactions relating to income and yields on financial assets Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds related to income and yields on financial assets 300 902 / 950 Dividends 301 401 Branch profits 302 403 Compensation paid by a resident to a resident employee temporarily abroad (excluding remittances) 303 404 Compensation paid by a resident to a non-resident employee (excluding remittances) 304 404 Compensation paid by a resident to a migrant worker employee (excluding remittances) 305 404 Compensation paid by a resident to a foreign national contract worker employee (excluding remittances) 306 404 Commission or brokerage 307 405 Rental 308 Interest paid to a non-resident in respect of shareholders loans 309 04 407 Interest paid to a non-resident in respect of third party loans 309 05 407 Interest paid to a non-resident in respect of trade finance loans 309 06 407 Interest paid to a non-resident in respect of a bond 309 07 407 Interest paid not in respect of loans 309 08 402 Fee in respect of inward listed securities derivatives individual 312 01 311 Fee in respect of inward listed securities derivatives corporate 312 02 311 Fee in respect of inward listed securities derivatives bank 312 03 311 Fee in respect of inward listed securities derivatives institution 312 04 311 Income payments 406 BopCUS 3 l 34 35 l BopCUS 3 D. Transfers of a current nature Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds related to transfers of a current 400 nature 902 / 950 Current payments Gifts 401 501 Annual contributions 402 502 Contributions in respect of social security schemes 403 503 Contributions in respect of foreign charitable, religious and cultural (excluding research and development) 404 504 Other donations / aid to a foreign Government (excluding research and development) 405 501 Other donations / aid to a foreign private sector (excluding research and development) 406 501 Pensions 407 505 Annuities (pension related) 408 506 Inheritances 409 508 Alimony 410 509 Tax - Income Tax 411 01 510 Tax - VAT Refunds 411 02 510 Tax - Other 411 03 510 / 604 Insurance premiums (non life / short term) 412 511 Insurance claims (non life / short term) 413 512 Insurance premiums (life) 414 310 Insurance claims (life) 415 310 Migrant worker remittances (excluding compensation) 416 404 Foreign national contract worker remittances (excluding compensation) 417 404 BopCUS 3 l 36 37 l BopCUS 3 E. Transfers of a capital nature Description BoPCUS 3 Sub-Cat BoPCUS 2 Capital transfers and emigrants Transaction adjustments Adjustments / Reversals / Refunds related to capital transfers and emigrants 500 902 / 950 Donations by SA Government fixed assets 501 601 Donations by corporate entities – fixed assets 502 603 Disinvestment of property by a non-resident corporate entity 503 602 Investment into property by a resident corporate entity 504 602 Capital transfers relating to government / corporate entities (excluding loans) Capital transfers by non-resident individuals Disinvestment of property by a non-resident individual 510 01 602 Disinvestment by a non-resident individual - other 510 02 602 Investment by a resident individual not related to the investment allowance - Shares 511 01 602 Investment by a resident individual not related to the investment allowance - Bonds 511 02 602 Investment by a resident individual not related to the investment allowance - Money market instruments 511 03 602 Investment by a resident individual not related to the investment allowance - Deposits with a foreign bank 511 04 602 Investment by a resident individual not related to the investment allowance - Mutual funds / collective investment schemes 511 05 602 Investment by a resident individual not related to the investment allowance - Property 511 06 602 Investment by a resident individual not related to the investment allowance - Other 511 07 602 Capital transfers by South African resident individuals Investment not related to the investment allowance (Note: Categories 511/01 to 511/07 are preferred to the use of categories 514/01 to 514/07 and 515/01 to 515/07, which will be discontinued in future) BopCUS 3 l 38 Description BoPCUS 3 Sub-Cat BoPCUS 2 Foreign investment by a resident individual in respect of the investment allowance - Shares 512 01 606 Foreign investment by a resident individual in respect of the investment allowance - Bonds 512 02 606 Foreign investment by a resident individual in respect of the investment allowance - Money market instruments 512 03 606 Foreign investment by a resident individual in respect of the investment allowance - Deposits with a foreign bank 512 04 606 Foreign investment by a resident individual in respect of the investment allowance - Mutual funds / collective investment schemes 512 05 606 Foreign investment by a resident individual in respect of the investment allowance - Property 512 06 606 Foreign investment by a resident individual in respect of the investment allowance - Other 512 07 606 Investment by a resident individual originating from a local source into an account conducted in foreign currency held at an Authorised Dealer in South Africa 513 Investment in terms of investment allowance 607 Investment from a resident Foreign Currency Account (Note: Categories 511/01 to 511/07 are preferred to the use of categories 514/01 to 514/07 and 515/01 to 515/07, which will be discontinued in future) Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Shares 514 01 608 Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Bonds 514 02 608 Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Money market instruments 514 03 608 Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Deposit into a foreign bank account 514 04 608 Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Mutual funds / collective investment schemes 514 05 608 Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Property 514 06 608 39 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 2 Foreign investment by a resident individual in respect of crossborder flows originating from a foreign currency account held at an Authorised Dealer in South Africa - Other 514 07 608 Re-transfer of capital repatriated in respect of an individual investment - Shares 515 01 602 Re-transfer of capital repatriated in respect of an individual investment - Bonds 515 02 602 Re-transfer of capital repatriated in respect of an individual investment - Money market Instruments 515 03 602 Re-transfer of capital repatriated in respect of an individual investment - Deposit with a foreign bank 515 04 602 Re-transfer of capital repatriated in respect of an individual investment - Mutual funds / collective investment schemes 515 05 602 Re-transfer of capital repatriated in respect of an individual investment - Property 515 06 602 Re-transfer of capital repatriated in respect of an individual investment - Other 515 07 602 Emigration foreign capital allowance - Fixed property 530 01 609 Emigration foreign capital allowance - Listed investments 530 02 609 Emigration foreign capital allowance - Unlisted investments 530 03 609 Emigration foreign capital allowance - Insurance policies 530 04 609 Emigration foreign capital allowance - Cash 530 05 609 Emigration foreign capital allowance - Debtors 530 06 609 Emigration foreign capital allowance - Capital distribution from trusts 530 07 609 Emigration foreign capital allowance - Other assets 530 08 609 Re-transfer of capital repatriated (Note: Categories 511/01 to 511/07 are preferred to the use of categories 514/01 to 514/07 and 515/01 to 515/07, which will be discontinued in future) Emigrants BopCUS 3 l 40 Description BoPCUS 3 Sub-Cat BoPCUS 2 Financial investments /disinvestments and prudential investments Transaction adjustments Adjustments / Reversals / Refunds related to financial investments 600 / disinvestments and prudential investments 902 / 950 Financial investments / disinvestments (excluding institutional investors) Disinvestment by a non-resident Listed shares - sale proceeds paid to a non-resident 601 01 701 Non-listed shares - sale proceeds paid to a non-resident 601 02 701 Disinvestment of money market instruments by a non-resident 602 703 Disinvestment of listed bonds by a non-resident (excluding loans) 603 01 702 Disinvestment of non-listed bonds by a non-resident (excluding loans) 603 02 702 Investment into shares by a resident entity - Agricultural, hunting, forestry and fishing 605 01 701 Investment into shares by a resident entity - Mining, quarrying and exploration 605 02 701 Investment into shares by a resident entity - Manufacturing 605 03 701 Investment into shares by a resident entity - Electricity, gas and water supply 605 04 701 Investment into shares by a resident entity - Construction 605 05 701 Investment into shares by a resident entity - Wholesale, retail, repairs, hotel and restaurants 605 06 701 Investment into shares by a resident entity - Transport and communication 605 07 701 Investment into shares by a resident entity - Financial services 605 08 701 Investment into shares by a resident entity - Community, social and personal services 605 09 701 Investment by a resident corporate entity 41 l BopCUS 3 Description BoPCUS 3 Sub-Cat BoPCUS 2 Inward listed securities equity - Individual 610 01 706 Inward listed securities equity - Corporate 610 02 706 Inward listed securities equity - Bank 610 03 706 Inward listed securities equity - Institution 610 04 706 Inward listed securities debt - Individual 611 01 706 Inward listed securities debt - Corporate 611 02 706 Inward listed securities debt - Bank 611 03 706 Inward listed securities debt - Institution 611 04 706 Inward listed securities derivatives - Individual 612 01 706 Inward listed securities derivatives - Corporate 612 02 706 Inward listed securities derivatives - Bank 612 03 706 Inward listed securities derivatives - Institution 612 04 706 Investment by resident institutional investor - Asset Manager 615 01 704 Investment by resident institutional investor - Collective Investment Scheme 615 02 704 Investment by resident institutional investor - Retirement Fund 615 03 704 Investment by resident institutional investor - Life Linked 615 04 704 Investment by resident institutional investor - Life Non-Linked 61 5 05 704 Bank prudential Investment 616 Inward listed investments Prudential investments (Institutional Investors and Banks) 705 BopCUS 3 l 42 Description BoPCUS 3 Sub-Cat BoPCUS 2 Derivatives Transaction adjustments Adjustments / Reversals / Refunds related to derivatives 700 902 / 950 Derivatives (excluding inward listed) Options - listed 701 01 804 Options - unlisted 701 02 804 Futures - listed 702 01 805 Futures - unlisted 702 02 805 Warrants - listed 703 01 806 Warrants - unlisted 703 02 806 Gold hedging - listed 704 01 202 Gold hedging - unlisted 704 02 202 Derivative not specified above - listed 705 01 202 / 804 / 805 / 806 / 901 Derivative not specified above - unlisted 705 02 202 / 804 / 805 / 806 / 901 43 l BopCUS 3 F. Loan and miscellaneous payments Description BoPCUS 3 Sub-Cat BoPCUS 2 Transaction adjustments Adjustments / Reversals / Refunds related to loan and miscellaneous payments 800 902 / 950 Repayment of trade finance drawn down in South Africa 801 999 Repayment of an international bond drawn down 802 999 Repayment by a resident of a loan received from a non-resident shareholder 803 999 Repayment by a resident of a loan received from a non-resident third party 804 999 810 306 / 901 / 998 Individual loan to a non-resident 815 998 Study loan to a non-resident 816 306 / 998 Shareholders loan to a non-resident 817 998 Third party loan to a non-resident (excluding shareholders) 818 998 Trade finance to a non-resident 819 998 Details of payments not classified 830 901 Rand collections for the credit of vostro accounts 831 903 Not allocated 832 Loans (Capital portion) Loan repayments by residents Loans granted to residents temporarily abroad Loan made by a resident to a resident temporarily abroad Loans granted to non-residents Miscellaneous payments Credit / Debit card company settlement as well as money remitter 833 settlements 901 BopCUS 3 l 44 ? Frequently asked questions Below you will find a list of frequently asked questions with answers which will assist in understanding the requirements for BoPCUS Version 3. ? 1. What is BoPCUS? ›› Balance of Payments Customer Transaction Report Message (BoPCUS) means an electronic data interchange which is the agreed message standard used by banks to send balance of payment messages in respect of customers to the South African Reserve Bank (SARB). ? 2. What is a cross-border foreign exchange transaction? ›› The purchase or sale of foreign exchange with or for Rands (flow of money between South Africa and other countries). ? 3. Why do we have to report Balance of Payment (BoP) details when transferring funds abroad or receiving funds from abroad? ›› The information is used by the South African Reserve Bank (SARB) to inform macro-economic decisions. ? 4. How does BoPCUS Version 3 impact me as a client? The changes include, but are not limited to: ›› Change in BoP category codes ›› Additional data to be provided for personal as well as payment details ›› Third party details to be provided where a resident third party is involved in a transaction ? 5. What is the target date for the implementation of the new BoP reporting requirements? ›› 19 August 2013 ? 6. What is the bank’s role in BoP Reporting? ›› We are an authorised dealer in foreign exchange. We report all cross-border transactions to the SARB for statistical, regulatory and information purposes. ? 7. Why is it mandatory to provide the information when making a payment abroad or receiving funds from abroad? ›› BoP data is most important for national and international policy formulation. The SARB uses the information to understand the factors that influence the BoP of South Africa ›› To be in compliance with the International Monetary Fund (IMF) standards ›› To comply with Financial Intelligence Act (FICA) requirements 45 l BopCUS 3 ? 8. Please provide more details on the change in BoP category codes The BoP codes will inform the SARB of the type of payment the client is making or receiving. The client is fully accountable for supplying the correct and accurate BoP category or BoP description. Changes to the current BOP codes: ›› Categories are completely different ›› Sub-categories are applicable in some instances Examples: 1. Current BoP category for freight payments is: 301 As from 19 August 2013, the BoP categories for freight will be as follows: ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› ›› 2. 270/01: Payment for passenger services – road 270/02: Payment for passenger services – rail 270/03: Payment for passenger services – sea 270/04: Payment for passenger services – air 271/01: Payment for freight services – road 271/02: Payment for freight services – rail 271/03: Payment for freight services – sea 271/04: Payment for freight services – air 272/01: Payment for other transport services – road 272/02: Payment for other transport services – rail 272/03: Payment for other transport services – sea 272/04: Payment for other transport services – air 272/04: Payment for other transport services – air 273/01: Payment for postal and courier services – road 273/02: Payment for postal and courier services – rail 273/03: Payment for postal and courier services – sea 273/04: Payment for postal and courier services - air Current BoP category for Gift payments is: 501 As from 19 August 2013, the BoP category for Gifts will be: 401 ? 9. Please provide more details on the third party details required Where a resident third party is involved in a transaction, their details must be provided. Examples: ›› Where the father is paying for the travel on behalf of the family, the details of the wife and children must be provided as third party details. ›› Where an agent is making an import or export payment on behalf of various South African entities, details of the SA entities must be provided. ›› Where a financial institution is making payment in respect of foreign investments for various South African parties, the details of the SA parties must be supplied. BopCUS 3 l 46 ? 10. Please provide more details on the additional information required Some additional information to be provided to your Bank as from 19 August 2013, is as follows: In the case of Entities: ›› Trading name, if applicable ›› Institutional sector (The main institutional sector of each entity: Financial Corporate / Non financial Corporate / general Government / Household such as partnerships, trusts and one man businesses) ›› Industrial classification (The main production activity of each entity: Agriculture, Mining, Transport, Construction, etc) ›› Loan tenor and interest rate (in the case of foreign loans) ›› Transport document number (in the case of the importation of goods) ›› Sub BoP category, where applicable ›› Third party details, where applicable In the case of Individuals: ›› Gender ›› Date of birth ›› Foreign ID number, where applicable ›› Tax clearance certificate reference (in the case of individual foreign investment allowances) ›› Loan tenor and interest rate (in the case of foreign loans) ›› Transport document number (in the case of the importation of goods) ›› Sub BoP category, where applicable ›› Third party details, where applicable ? 11. Will I need to provide all my information again? (Know Your Client (KYC) process) ›› No, but to enable us to keep your records accurate and updated, we need to be provided with any changes to your details (i.e. street and postal addresses, contact name and numbers, etc.). ? 12. Is there a change to the BoP rules that specify which transactions are reportable? ›› There is no change to the current reporting rules. The non resident reporting rules will change in phase 2 of the project which is to be implemented in 2014. ? 13.. Has BoPCUS version 3 introduced an impact or change to Exchange Control? ›› No, current Exchange Control rules and regulations remain the same. ? 14. Is there any additional documentation I need to provide? ›› The BoP details are required to be captured on an integrated form (paper-based or electronic or any other format approved by the SARB). The form will cater for all fields required by the SARB. The integrated form is a contract between the Bank and its customer and includes a declaration to the effect that the information provided is true and correct and that the information may be supplied to the SARB, SARS and FICA. 47 l BopCUS 3 ? 15. What about my privacy? ›› The data submitted is intended to satisfy regulatory SARB, SARS and FICA requirements. Data will not be divulged to other third parties. ? 16. What are the implications of not providing the information required by the SARB? ›› In accordance with our mandate as an Authorised Dealer, we will not be able to process a payment without the required information being supplied. BopCUS 3 l 48 49 l BopCus 3 BopCus 3 l 50 51 l BopCus 3