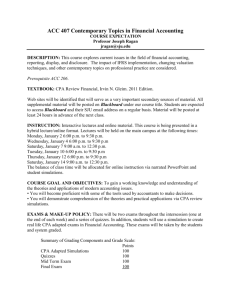

ASA - CPA Australia

advertisement

CPA AUSTRALIA Pathway to CPA Status CPA Australia is the sixth largest accounting body in the world with over 117,000 finance, accounting and business members in 100 countries across the globe. Different types of membership with CPA Australia Associate (ASA)- graduates who have completed a tertiary degree accredited by CPA Australia are eligible for non-voting status with CPA Australia. You must join CPA Australia as an ASA to be eligible to enrol in the CPA Program Certified Practicing Accountant (CPA) - have completed the CPA Program and Mentor program. This includes three compulsory and three elective segments, as well as three years mentored practical experience in finance, accounting or business advice Fellow (FCPA) - CPA who has at least 15 years experience in accounting, finance or both and at least five years experience in a responsible executive position relating to accounting or finance (or have been a full-time principal in a practice) Undergraduate Degree Non Accredited Accredited (12 core knowledge areas covered) Conversion Course (12 core knowledge areas covered) ASA ASA CPA Program and Mentor Program CPA Associate Membership Admission Requirements are: • A CPA Australia accredited Bachelor degree or a qualification completed through a Higher Education Provider assessed by CPA Australia as comparable to an Australian Bachelor degree, and • The content of the degree level studies must fulfil all of our 12 core knowledge areas Core Knowledge Areas • • • • • • • • • • • • Systems and Processes (Basic) Financial Accounting (Financial and Corporate) Management Accounting Accounting Theory Commercial Law (Introductory, including contracts) Information Systems Design and Development Quantitative Methods Finance (Corporate) Economics Company Law Auditing Taxation Law CPA Program Compulsory segments •Reporting and Professional Practice •Corporate Governance and Accountability •Business Strategy and Leadership Elective segments •Assurance Services and Auditing •Contemporary Issues in Financial Accounting •Financial Reporting and Disclosure •Financial Risk Management •Insolvency and Reconstruction •Knowledge Management •Personal Financial Planning and Superannuation •Strategic Management Accounting •Taxation •International Business Mentor Program • The three year Practical Experience Mentor Program provides a framework for developing and demonstrating practical workplace skills at a professional level, in the areas of accounting and/or finance, while being mentored by an approved mentor and documenting what they do at work • The Mentor Program is designed to align with CPA Program studies and further develop an Associate members work in a professional accounting or finance role Advancement to CPA Status • Complete the six segment CPA Program and, • 3 year Mentor Program • you have 6 years to advance from Associate membership to CPA status Further Information Corporate Website: cpaaustralia.com.au Student Website: .cpacareers.com.au Phone: 1300 73 73 73